Most blockchain networks don’t naturally talk to each other. Ethereum, Solana, BNB Chain, and other top blockchains each operate in their own walled gardens. This makes it harder to move assets and share information across separate blockchain networks. That’s where crypto bridges come in.

Also known as blockchain bridges, these protocols help connect different networks. They are the intermediaries that make blockchain networks interoperable with each other. By doing that, they make the entire ecosystem more flexible and more useful. Bridge protocols increase the flexibility and utility of digital assets, allowing users to use the unique features of different blockchains. However, they are also popular targets for malicious hacks, which is why it’s so important to use a trustworthy bridge.

In this guide, we’ll break down what crypto bridges are, how they work, and why they matter.

Key Takeaways

- Crypto bridges allow users to move assets between different blockchain networks (e.g., Ethereum to Solana), enabling ecosystem interoperability.

- Bridges often use “wrapped” tokens — locked on one chain and minted on another — to represent assets across networks.

- Bridges are common targets for hacks due to their complex architecture and central points of failure, making them one of the riskiest parts of the crypto ecosystem.

What Is a Crypto Bridge?

A crypto bridge, also known as a blockchain bridge, is a protocol that connects different blockchain networks and enables asset flow. Such interoperability is vital in blockchain technology since it allows us to access the unique benefits and features of diverse blockchains without being confined to only one.

For instance, bridges can facilitate the transfer of tokens from Ethereum to Solana or from Bitcoin to Avalanche, all while unlocking a broad range of decentralized apps and services. By doing this, blockchain bridges broaden access for users, create a more innovative crypto space, and boost liquidity across all of the top networks.

Crypto bridges enable transferring assets between different blockchains, even though the original tokens don’t technically leave their native network. Bridges operate by locking assets on one blockchain and minting equivalent “wrapped” tokens on the second one. By doing this, they allow users to use crypto assets across various blockchain ecosystems with ease.

The Lock and Mint Mechanism

Let’s say that you want to move assets between two different blockchain networks. This process would typically involve three main steps:

-

- Locking: Your asset is locked in a smart contract on the source blockchain

- Minting: An equivalent amount of wrapped tokens is minted on the second (destination) blockchain

- Redeeming: The wrapped tokens are now burned on the destination chain to return the assets, and the original tokens are unlocked on the source chain

Thanks to this three-step mechanism, the total supply of the assets can remain constant across different blockchains (barring hacks or exploits).

Complexity in Crypto Bridge Development

Building crypto bridges is complicated for several reasons, including:

Different Consensus Mechanisms

Different blockchains often use vastly different consensus protocols, such as Proof of Stake (PoS) or Proof of Work (PoW). This can make interoperability quite challenging.

Bridges that connect blockchains with different consensus mechanisms, such as PoW and PoS, require specialized protocols. For instance, the xDai Bridge connects Ethereum, which uses PoW, to Gnosis Chain, which uses PoS. It uses its own set of validators, different from those maintaining the Ethereum network. In this way, the bridge can create secure, efficient transfers between the two chains despite their differing consensus mechanisms.

Security Concerns

Bridges are frequent targets for attacks, and for good reason. The Ronin attack, one example of many, highlights the vulnerabilities present in such systems. The Ronin hack occurred in March 2022, when attackers stole $625 million from the Ronin Network, which underlies the game Axie Infinity. The hackers exploited vulnerabilities in the network’s bridge and gained control of five validator keys. This allowed them to approve fraudulent transactions and gave them access to funds in Ether and USDC. Their attack even went undetected for several days.

Smart Contract Compatibility

Developers need to create a sophisticated design and implement it accurately to ensure that smart contracts can communicate securely across blockchains. Even a tiny mistake could cost users millions of dollars in lost crypto.

Each blockchain may have its own way of structuring a smart contract. Ethereum, for example, uses the coding language Solidity, but Tezos uses Michelson. Ensuring these contracts can communicate with each other requires a specially designed bridge that can understand and interact with multiple contract structures, further increasing its complexity.

If the bridge is designed poorly, this can create vulnerabilities of various kinds, giving attackers easy access to locked funds. A single bug or gap in how contracts interpret data from different chains can easily lead to data corruption or fund theft.

Developers must enable smart contracts on different blockchains to send and receive data securely. In many cases, this involves the use of oracles or other middleware. This creates yet another potential attack vector, as oracles and similar tech can also be abused or exploited maliciously for profit.

Finally, different blockchains achieve transaction finality in different ways. Ethereum transactions, for instance, are considered final after a certain number of confirmations. Other blockchains use different mechanisms.

Types of Crypto Bridges Explained

Now that you know what a crypto bridge is and how it works, it’s time to discuss the different types of crypto bridges. There are many different blockchain bridges, as well as diverse classifications of them.

Keep in mind that a bridge can fall under more than one of these categories. For instance, a federated bridge can also be a partially decentralized bridge.

Crypto Bridge Control Models

Custodial Bridges (Trusted Bridges)

Custodial bridges are controlled by a trusted third party. The bridge operator will hold custody of the crypto assets during the transfer. If you choose this type of bridge, it means that you trust the operator to lock the assets on one blockchain and issue wrapped tokens on the other.

As you can imagine, custodial bridges are very simple to build and use. However, they come with the risk of centralization since you have to trust the bridge operator to protect your data and not misuse your funds. Such bridges are often criticized by crypto advocates because their reliance on centralized third parties is essentially antithetical to the ideals of the technology.

Non-Custodial Bridges (Trustless Bridges)

Non-custodial bridges, otherwise known as decentralized or trustless bridges, operate without a central authority. Instead, they use smart contracts and decentralized protocols to ensure the secure locking and transfer of crypto assets.

In this scenario, the user retains full control over their asset. The entire process is trustless, which makes it more complex and slower, but also reduces the risks of centralized points of failure. However, the increased complexity could make vulnerabilities and exploits more likely if it isn’t designed and audited carefully enough.

Federated Bridges

Federated bridges use a group of trusted operators/validators to control the bridge. The validators are responsible for validating transactions via the blockchains, as well as maintaining the bridge’s security.

Federated bridges aren’t fully decentralized, so they offer a fine balance between efficiency and security. They are faster compared to non-custodial bridges, but still require some level of trust in the validators.

Hybrid Bridges

Hybrid bridges are exactly what their name tells you – a combo of both custodial and non-custodial models. In this bridge, some of the transactions are managed by a central authority. The others are decentralized, which allows for a mix of security and speed. They simply offer the best of both worlds but still require some trust.

| Type | Control Mechanism | Trust Level | Pros | Cons | Examples |

|---|---|---|---|---|---|

| Custodial | Centralized (single operator) | High | Simple and fast | Centralized risk, less secure | Binance Bridge, Wormhole |

| Non-custodial | Smart contracts (fully on-chain) | Trustless | Decentralized and secure | Complex to use, slower | Thorchain, Polkadot |

| Federated | Group of validators | Moderate trust | Balanced and efficient | Still some centralization, moderate speed | xDai Bridge |

| Hybrid | Mix of centralized and decentralized | Moderate trust | Best of both worlds | Requires partial trust | Anyswap |

Levels of Decentralization and Security in Crypto Bridges

Fully Centralized Bridges (Low Trust Bridges)

This is when a single entity controls both the locking and minting of tokens. This type is the fastest but comes with high trust risks.

Partially Decentralized Bridges (Moderate Trust Bridges)

In this case, a few trusted validators control the process, which provides a balance between speed and trust.

Fully Decentralized Bridges (High Trust Bridges)

No central entity has control over fully decentralized bridges. The bridges operate entirely based on blockchain consensus, which offers high security (but at the cost of speed).

| Type | Who Controls It? | Speed | Trust Level | Examples |

|---|---|---|---|---|

| Fully centralized | One entity | Fastest | Low (high risk) | Binance Bridge |

| Partially decentralized | Few trusted validators | Medium | Moderate | xDai Bridge |

| Fully decentralized | Entirely on-chain | Slower | High (trustless) | Thorchain, Polkadot |

Cross-Consensus Crypto Bridges

Same Consensus Mechanism Bridges

These bridges connect blockchains that use the same consensus mechanisms, such as Proof of Work to Proof of Work.

Cross-Chain Bridges (Cross-Consensus Bridges)

Cross-chain bridges are specifically designed to facilitate the transfer of assets between different blockchain ecosystems with entirely different consensus mechanisms. These bridges use more advanced technology and protocols to ensure cross-chain communication.

| Type | Connected Blockchains | Complexity | Use Case | Example |

|---|---|---|---|---|

| Same consensus bridges | Same mechanism (PoW → PoW) | Lower | Native token transfers | Ethereum ↔ Ethereum |

| Cross-chain bridges | Different mechanisms (PoW → PoS) | Higher | Ecosystem interoperability | Cosmos, Polkadot |

Interoperable Token Bridges vs Wrapped Token Bridges

Interoperable Token Bridges (True Native Transfers)

Some blockchain ecosystems, such as Cosmos and Polkadot, support direct native token transfers because they were designed with cross-chain compatibility in mind. In these (rare) cases, native tokens can be transferred directly between compatible chains without wrapping.

Wrapped Token Bridges

Wrapped token bridges involve locking the original crypto on the source blockchain and creating a wrapped version of it on the destination chain. The vast majority of crypto bridges are wrapped token bridges.

Crypto Bridge Use Cases

DeFi Bridges

Decentralized finance (DeFi) bridges are designed to move assets between DeFi protocols, typically focusing on Ethereum-compatible blockchains.

NFT Bridges

NFT bridges focus on transferring non-fungible tokens between different blockchain platforms.

General Asset Bridges

General asset bridges are used to transfer regular assets like tokens between blockchains, without a focus on DeFi or NFTs.

| Type | Focus area | Assets transferred | Specialized for | Example |

| DeFi bridges | DeFi protocols | Fungible tokens (e.g., ERC-20) | Yield farming, staking | RenBridge |

| NFT bridges | Non-fungible tokens | ERC-721, other NFT formats | Cross-chain NFT ownership | Ethereum ↔ Solana NFT bridges |

| General asset | Regular tokens | Any crypto asset | General usage | Cosmos IBC, Polkadot’s XCMP |

Why You Might Need a Crypto Bridge

Crypto bridges exist because most blockchains aren’t interoperable, and there is tremendous value in being able to use your assets on multiple blockchains. If you hold Bitcoin but want to stake it in Ethereum’s DeFi ecosystem, you can’t do that directly. That’s when you need a bridge.

Think of blockchains like separate islands that don’t naturally talk to each other. They each have their own rules, ecosystems, and tokens. Bridges are your translators. They let you move tokens across without having to sell your assets.

Here are some of the most common reasons why people use crypto bridges:

Earn yield on your tokens across chains

Let’s say that you want to earn interest on your Bitcoin holdings through a lending protocol like Aave. Here comes the tricky part – Aave doesn’t support the Bitcoin blockchain. However, a bridge will let you lock your BTC on the Bitcoin network and receive a wrapped version, like wBTC on Ethereum. The token will behave like Bitcoin and track its price (barring a hack or exploit), but you can use it on Ethereum-based platforms – all thanks to the bridge.

Access to cheaper transaction fees

Ethereum is famous for its high gas fees, even after the many upgrades that were intended to pull them down. If you want to save money, you can move your assets to a lower-cost network like Optimism, Arbitrum, Avalanche, or Polygon. Many of the top DeFi apps also support these low-cost blockchains, allowing you to access much of the same functionality available on Ethereum.

A crypto bridge will make the migration simple. You’ll still own your assets, but using an environment where a transaction might cost a fraction of a cent instead of a few dollars.

Use dApps that only exist on certain blockchains

Some of the best dApps and protocols are chain-specific. Solana has its unique DeFi apps like Raydium and Ocra. BNB Chain has PancakeSwap. Avalanche has Trader Joe and Platypus Finance. If you want to use the apps but your funds are on Ethereum, a bridge is a great way to transfer them there.

NFT and gaming

Let’s say that you own an NFT on Ethereum, but a new game on Polygon supports it. Or, you earned altcoins on one chain but plan to trade them on a marketplace on another. How do you do this? Of course, the answer is a specialized crypto bridge that supports NFTs (ERC-721 and ERC-1155 tokens).

Arbitrage and liquidity opportunities

Sometimes, a single asset will be priced differently across different blockchains. If you are fast and careful enough, it’s possible to buy assets on one chain and bridge them to another before selling for a profit. However, you would likely need an advanced bot to achieve any real success, as other arbitrageurs are constantly looking for and taking advantage of these kinds of discrepancies.

Risk management and diversification

Holding assets across multiple blockchains can reduce your exposure to network-specific risks. Many opt for this option to diversify their portfolio and avoid risks. If Ethereum gets congested or suffers an issue, you will still have assets left and usable on other chains.

Risks of Crypto Bridges Explained

Crypto bridges are important tools for moving assets across blockchains, but they come with serious risks. But why are blockchain bridges so vulnerable?

Bridges often hold large amounts of funds in one central location. They keep it in a smart contract or with custodians. This makes them attractive targets to criminals. On top of that, many bridge designs are complex and still in an experimental phase, with unaudited (or poorly audited) code and unclear security models.

These issues have led to some major bridge hacks over the years, the Ronin Network attack being just one example. Some other examples include:

1. Orbit Chain Bridge Exploit – $81 Million (January 2024)

On December 31, 2023, hackers exploited Orbit Chain’s cross-chain bridge, resulting in the theft of approximately $81 million. The attackers compromised seven out of ten multisignature validators, enabling unauthorized withdrawals of assets including USDT, USDC, ETH, WBTC, and DAI.

2. ALEX Bridge Incident – $4.3 Million (May 2024)

In May 2024, ALEX, a decentralized finance platform, experienced suspicious withdrawals totaling $4.3 million following a contract upgrade. Security firm CertiK identified this as a possible private key compromise, suggesting that the deployer’s account may have been breached.

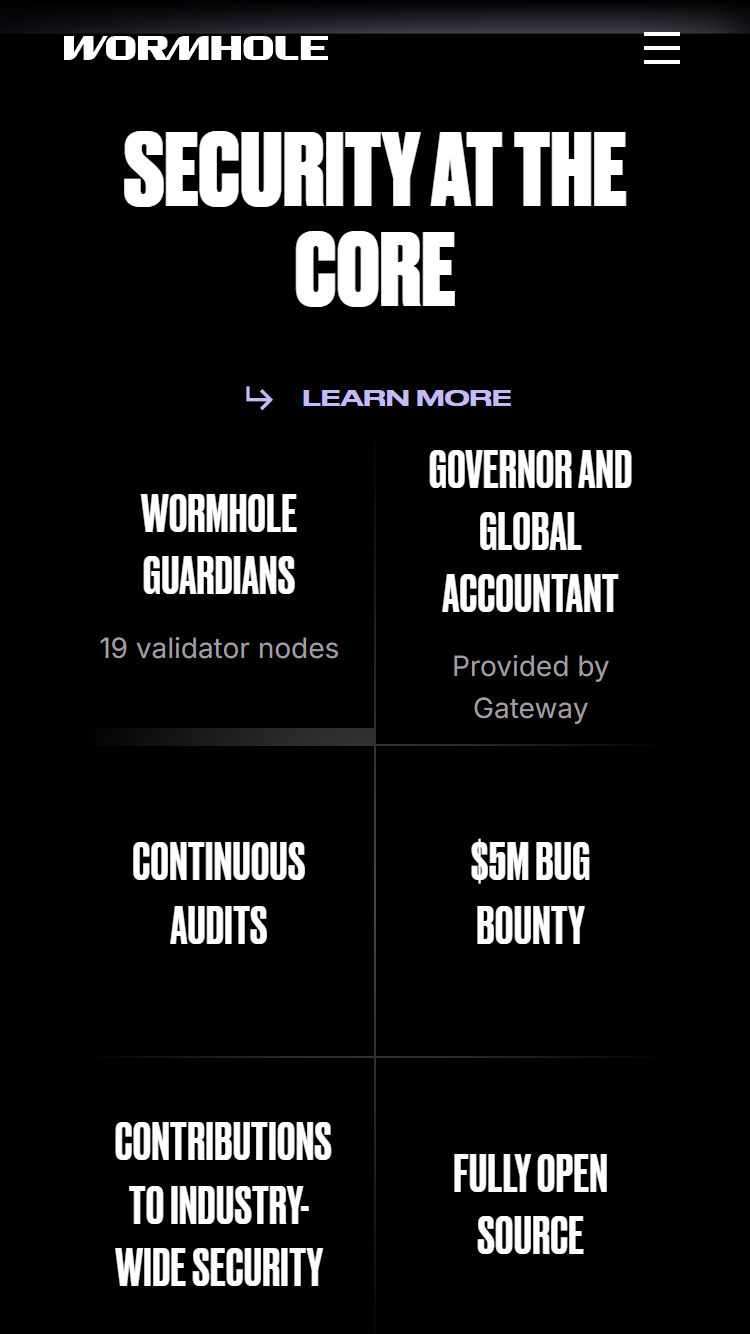

3. Wormhole Bridge Vulnerability – Potential $5 Million Loss Prevented (May 2024)

In May 2024, security firm CertiK detected and prevented a critical vulnerability in the Wormhole cross-chain bridge, which could have led to losses of up to $5 million. The flaw involved incorrect application of access modifiers in the smart contract code.

4. North Korean Cyberattacks – $1.3 Billion Stolen in 2024

According to Chainalysis, North Korean hacking groups, notably the Lazarus Group, stole approximately $1.3 billion in cryptocurrency through various cyberattacks in 2024. These attacks often targeted cross-chain bridges and exchanges, with the stolen funds reportedly used to finance the country’s missile and nuclear programs.

5. ByBit Exchange Hack – $1.5 Billion (February 2025)

In February 2025, the FBI attributed a $1.5 billion theft from the cryptocurrency exchange ByBit to North Korean hackers. This incident is considered one of the largest crypto heists to date, with the stolen assets laundered through various means.

Besides being targets, bridges are often used for laundering stolen funds. For instance, RenBridge has been used to launder over $540 million since 2020, including proceeds from ransomware and North Korean-linked hacks.

How to Stay Safe

If you decide to choose a blockchain bridge, you should consider these precautions:

-

-

- Use only well-audited bridges that have a strong track record for security

- Avoid bridges with centralized control if possible

- If the bridge has an unclear or poorly described validator structure, avoid it

- Use small amounts to test any new bridge you use

- Watch for red flags (like paused withdrawals, unverified smart contract changes, and more)

-

Bridges can be a handy and powerful tool, but it is important to remember that they are also high-risk. Always do your research before you trust a blockchain bridge with your assets.

How to Use a Crypto Bridge in 4 Steps

Cross-chain bridges can feel intimidating if you don’t have experience with them, but they are actually quite easy to use. With that in mind, we created a short guide to help you safely bridge crypto between blockchains.

Choose the Right Bridge Based on What You Need

Not all bridges work the same or support the same tokens. So, before you make an investment and give a bridge access to your assets, make sure to pick one that:

-

-

- Supports your source and destination blockchains

- Handles the tokens you wish to transfer

- Is known to be secure

-

Some popular examples of bridges you can use are:

| Synapse | Great for stablecoins across EVM chains |

| Stargate | Known for its deep liquidity and native token transfers |

| Portal by Wormhole | Supports Solana and Ethereum ecosystems |

| Celer cBridge | Good UX and broad token support |

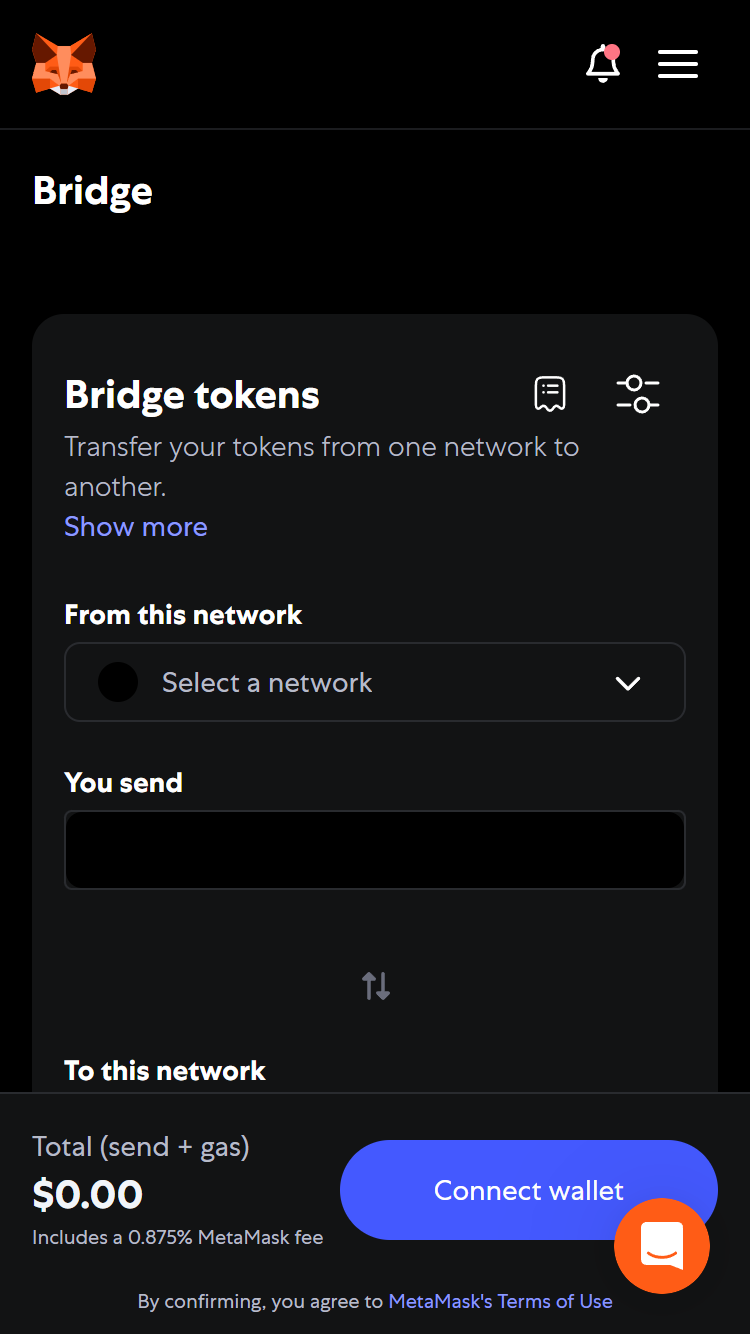

Connect Your Wallet

Next, you’ll need a non-custodial crypto wallet like MetaMask or TrustWallet. If you don’t have one, here is what you need to do:

-

-

- Choose the best crypto wallet for you

- Download MetaMask (or another non-custodial wallet)

- Create the wallet (save your seed phrase securely!)

- Fund the wallet with the token you wish to bridge + a little native token for gas (e.g., ETH for Ethereum, MATIC for Polygon, etc.)

- Go to the bridge’s website (and make sure you have the correct domain)

- Click “Connect Wallet”

- Approve the connection

-

To start, your wallet must be on the source chain. Most bridges will prompt you to switch. MetaMask has a great guide explaining how to add a new network to your wallet if you need help.

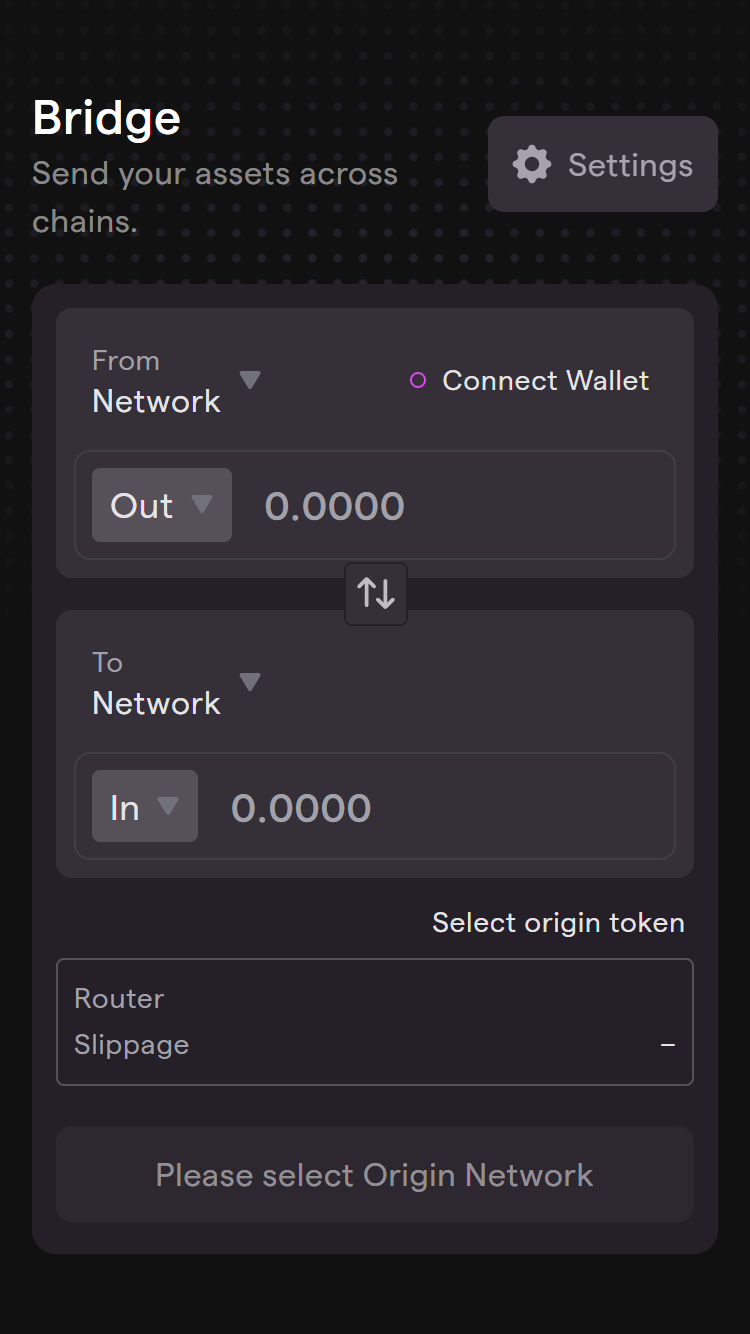

Select Your Asset and the Amount You Wish to Transfer

Now enter in the details of your asset, the destination blockchain, the amount, and so on. Once you filled all of the required details in, click “Bridge” or “Send” to confirm the transaction. The wallet will then ask you to approve a spending limit. Once it is improved, the bridging transaction will pop up for you to finalize.

Wait for Confirmation

After you approve the transaction, your tokens will be locked or swapped on the source chain. The wrapped or native tokens will then arrive on the destination chain.

Depending on the network congestion, the type of bridge you choose, and the chain speed, this can take a few minutes or significantly longer. Most bridges will show you a progress bar or a status tracker. If something goes wrong, you can find a support option or click “Retry” if the transaction fails.

Important tip: Be patient when you wait for confirmation. Don’t refresh the page during the transaction.

Popular Crypto Bridges

Cross-chain bridges are all around these days, but as in any market, only a few stand out in the crowd. Let’s take a look at the most popular crypto bridges you can consider for your asset transfers.

Wormhole

Best for Solana <–> Ethereum, plus Cosmos chains

What it does: Wormhole is one of the OGs of cross-chain bridging. It connects different ecosystems – Solana, Ethereum, BNB Chain, Polygon, and Cosmos-based chains. Wormhole uses a network of validators to verify the messages between chains. It was built by Jump Crypto and supports NFTs, tokens, and more.

Even though Wormhole was the subject of a major hack in 2022, it has bounced back stronger since.

Synapse Protocol

Best for: Fast stablecoin transfers across EVM chains

What it does: Synapse is a fast and simple bridge that supports many EVM-compatible chains. It supports Arbitrum, Optimism, and BNB, to mention a few. It doesn’t just lock tokens – it uses liquidity pools, which equals fast transactions and trustless smart contracts.

Synapse is often used to bridge stablecoins like USDC and DAI. It also has an excellent, easy-to-use UI that is perfect for beginners.

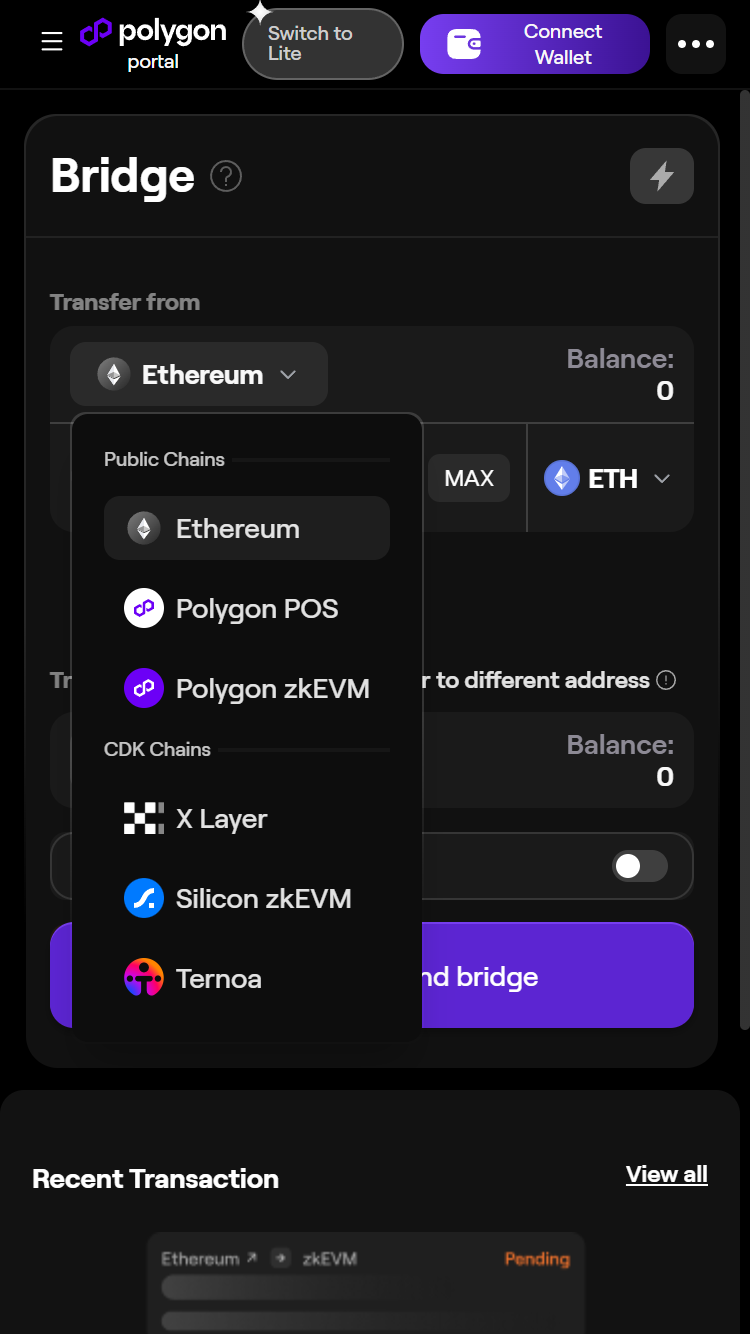

Polygon Bridge

Best for moving ETH or ERC-20 & ERC-721 tokens between Ethereum and Polygon

What it does: This is the official bridge of the Polygon network. It’s perfect if you want to save gas by transferring assets between Polygon and Ethereum. It’s built by the Polygon team and comes in two versions: PoS Bridge, which is faster, and Plasma Bridge, which is considered more secure.

The Polygon Bridge supports native ETH, ERC-20, and ERC-721 tokens.

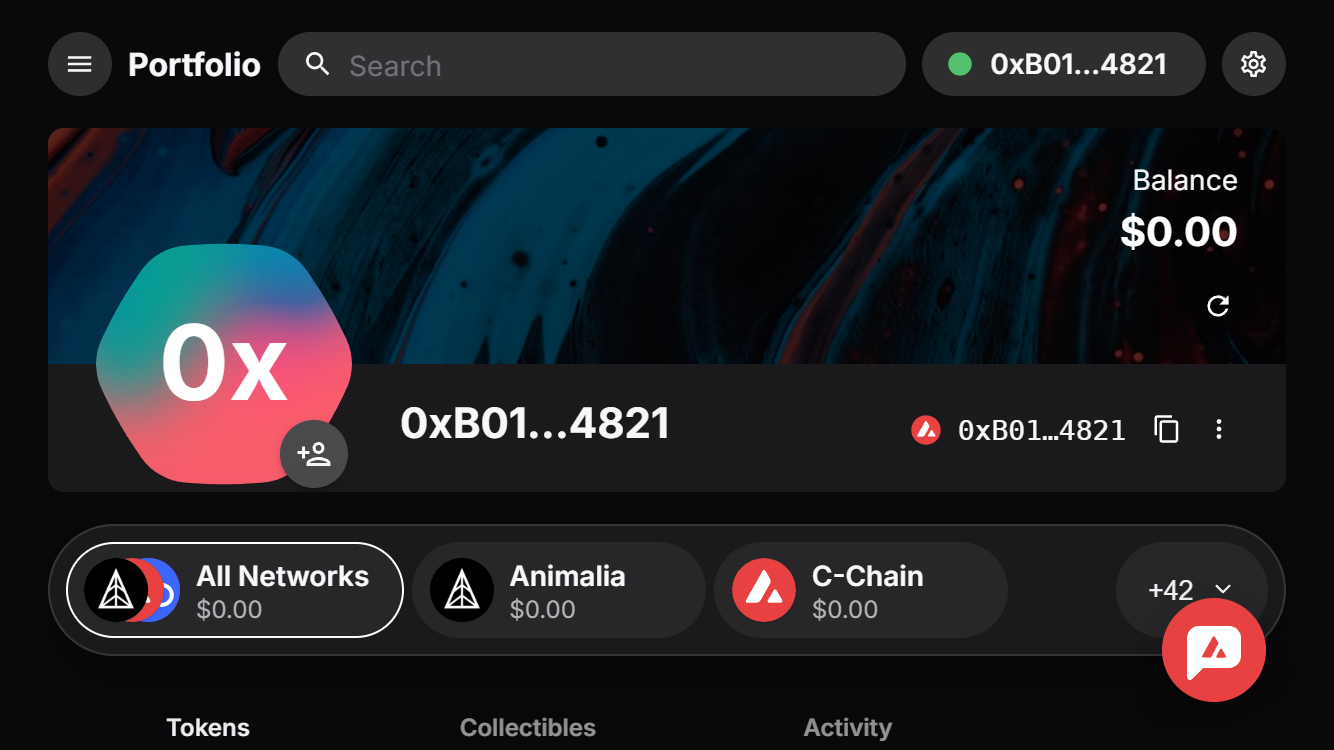

Avalanche Bridge

Best for: Ethereum <–> Avalanche C-Chain

What it does: The Avalanche bridge is very similar to the Polygon Bridge, but used to transfer assets between Ethereum and Avalanche. Avalanche is one of the fastest and most affordable blockchains available today, and many DeFi platforms support it, making it a popular choice for fee-conscious DeFi users. This bridge will allow you to move ETH and ERC-20 tokens from Ethereum into Avalanche’s C-Chain.

The Avalanche Bridge was built by Ava Labs and supports MetaMask, among other wallets. It uses Intel SGX, which is a secure enclave technology for extra protection.

Binance Bridge

Best for: ETH <–> BNB Smart Chain (BSC)

What it does: This is Binance’s official bridge between Ethereum and BNB Smart Chain. It has been around a while, but Binance has phased out direct support in selected regions. Still, it is a popular choice for those who love the Binance ecosystem.

The Binance Bridge is centralized (custodial), though Binance is more trustworthy to many crypto investors than most other crypto companies. It has a simple user interface if you are using the Binance wallet or exchange.

| Bridge | Chains Supported | Control Model | Asset Types | Speed | Ease of Use |

|---|---|---|---|---|---|

| Wormhole | Ethereum, Solana, BNB Chain, Polygon, Cosmos, Avalanche, and more | Federated | Tokens, NFTs, messages | Medium | Moderate |

| Synapse Protocol | Ethereum, Arbitrum, Optimism, Avalanche, BNB Chain, Polygon, many EVM chains | Non-custodial (DeFi) | Mostly stablecoins like USDC and DAI; tokens | Fast | Easy |

| Polygon Bridge | Ethereum ↔ Polygon | Semi-custodial (PoS), Optional Plasma | ETH, ERC-20, ERC-721 | Medium (Fast w/PoS) | Easy |

| Avalanche Bridge | Ethereum ↔ Avalanche (C-Chain) | Custodial | ETH, ERC-20 (wrapped) | Fast | Very easy |

| Binance Bridge | Ethereum ↔ BNB Smart Chain | Fully custodial | ETH, ERC-20, BEP-20 | Fast | Very easy if on Binance |

The Future of Blockchain Bridges

The future of crypto bridges is looking bright. It is mainly driven by technological and security advancements, and led by the growing need for interoperability across diverse blockchain networks. Below are some of the key trends that are shaping this space.

Enhanced Security Measures

Bulking up security remains the top priority for crypto bridges. We’ve seen numerous major breaches in recent years. In 2022 alone, bridge hacks resulted in billions in losses.

To address these challenges, bridge developers are working on further securing existing bridge mechanisms as well as implementing new advanced cryptographic techniques. These include, but are not limited to, zero-knowledge proofs, multi-signature protocols, and threshold encryption.

Additionally, extensive auditing and bug bounty programs are becoming more popular in the industry.

Integration of Artificial Intelligence

Artificial intelligence (AI) is playing a bigger and bigger role in optimizing the operations of bridges. AI algorithms have already proven to be very useful in dynamically adjusting transaction routes. This helps avoid a major challenge in bridging, which is network congestion.

AI can also be used to audit code, predict and prevent security breaches, and manage liquidity across multiple chains.

Cross-Chain Smart Contract Interoperability

Crypto bridges are facing the next frontier that goes beyond simple asset transfer. We are talking about enabling seamless transactions between smart contracts across different blockchains. Thanks to this development, decentralized applications (dApps) can finally use the unique features of different blockchains simultaneously.

Decentralized Insurance Protocols

When the value locked in a bridge grows, so does the need for better risk management solutions. This is why the market is focused on decentralized insurance protocols – to provide more coverage against potential bridge failures and smart contract vulnerabilities.

These protocols are becoming more and more popular to help users hedge against devastating hacks and exploits. They use smart contracts and decentralized governance to offer users and liquidity providers a better safety net.

Conclusion

Crypto bridges form some of the most important infrastructure that powers the multi-chain future of the industry. As the crypto ecosystem grows, the tools we use to exchange data and assets between chains become more and more important. Whether you want to earn yield on Bitcoin in Ethereum’s decentralized finance, transfer NFTs across chains, or simply find cheap alternatives to Ethereum, bridges are a powerful tool for all kinds of crypto investors.

Still, not all bridges are created equal. We have custodial, non-custodial, cross-chain, federated, hybrid bridges, and so on. Each of these comes with its own trade-offs in terms of speed, trust, and even security.

As time passes, innovation and tech advancements are driving the development of more secure, more advanced bridges. Still, we are far from making these perfect. This means that, in blockchain bridges, risks like hacks, bugs, and poor design are still a major issue.

Choosing the right bridge means that you must know where your priorities stand. Do you value decentralization? Speed? Lower fees? As always, it is important to do your research and, of course, don’t ever bridge more than you can afford to lose!

FAQ

Are crypto bridges safe?

Some crypto bridges are safer than others. Non-custodial bridges reduce trust risks, but no bridge is 100% secure. Hacks have happened with even the most popular bridges.

What is a wrapped token?

A wrapped token is a token that represents another asset from a different blockchain, such as Wrapped Bitcoin (WBTC) on Ethereum.

Why are bridges important?

Bridges connect isolated blockchains, therefore enabling better liquidity, more flexibility, and access to DeFi and dApps.

Can I use a bridge with any crypto?

Yes, but only if both blockchains and assets are supported by the bridge you choose.

Do I need a wallet to use a bridge?

Yes. You need a crypto wallet like MetaMask to send and receive bridged tokens.

Are there fees linked to bridges?

Yes. You’ll usually need to pay network gas fees and sometimes additional bridge fees.