Peer-to-peer (P2P) exchanges provide an alternative way to buy Bitcoin and other cryptocurrencies. Buyers and sellers trade using local currencies and payment methods, and an escrow system helps ensure both parties remain safe.

This guide explains how P2P platforms work, how they compare with traditional exchanges, and what best practices to follow. It also ranks and reviews the best P2P crypto exchanges in 2025 for trading fees, safety, liquidity, and other important factors.

The Top 7 P2P Crypto Exchanges in 2025

These are the best P2P crypto exchanges to consider:

- Best Wallet — Non-custodial wallet with a built-in exchange supporting anonymous fiat payments

- MEXC — A great option to buy small amounts of crypto at competitive exchange rates

- OKX — Global P2P platform with 900+ payment methods in 100+ countries

- Binance — The best P2P platform for buying large amounts close to the spot price

- Bybit — Buy crypto quickly via P2P to access perpetual futures markets with 200x leverage

- BingX — Get top-tier rates on USDT purchases with some merchants selling below the market rate

- KuCoin — Safety-first P2P exchange with identity verification and advanced seller metrics

The 7 Best Peer-to-Peer Cryptocurrency Exchanges Reviewed

Learn more about the top peer-to-peer cryptocurrency exchange platforms listed above. Read on to pick the right provider for you.

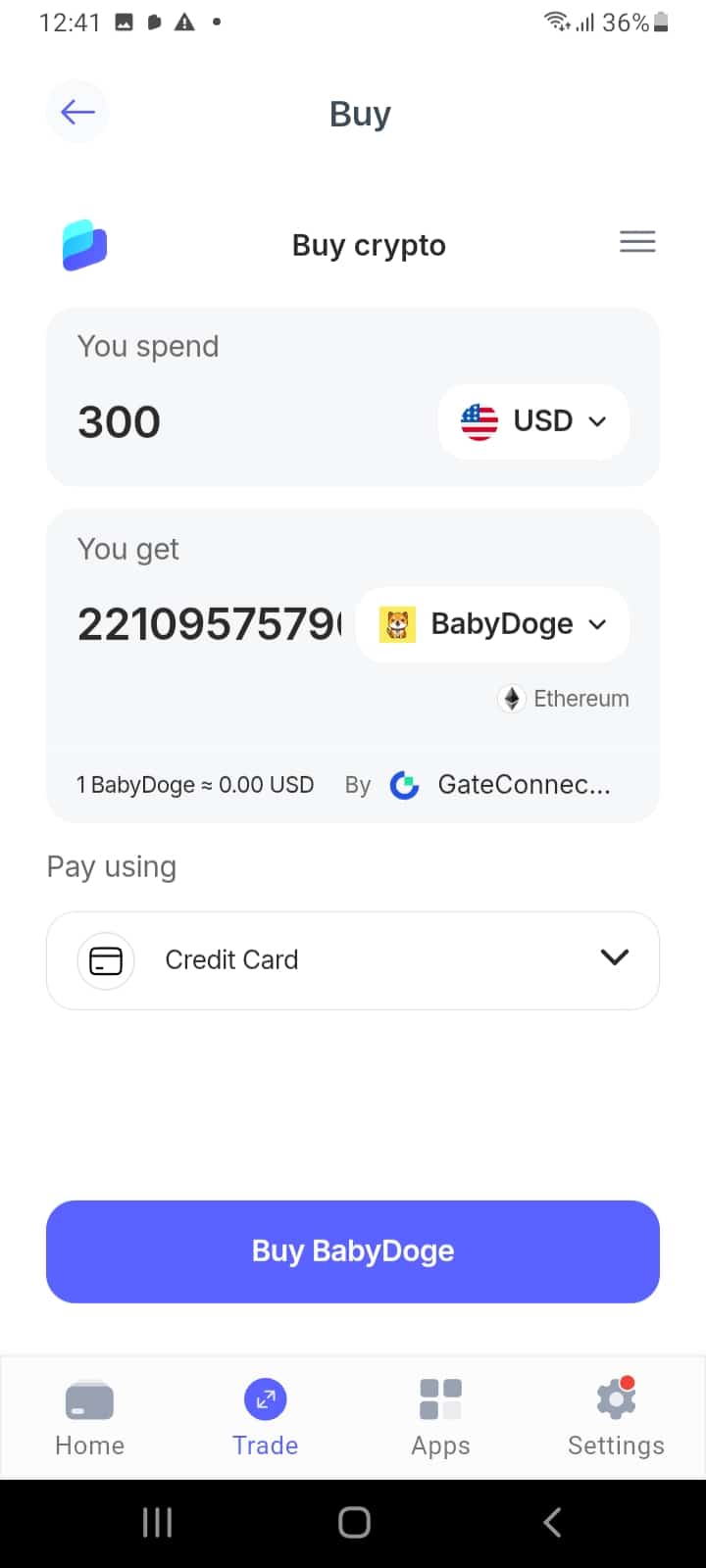

1. Best Wallet — The Overall Best Place to Buy and Sell Crypto With Local Payment Methods

Best Wallet is a non-custodial wallet that offers a user-friendly interface and a built-in exchange — enabling users to buy and sell cryptocurrencies without relying on centralized exchanges. The exchange supports dozens of currencies and over 100 payment methods, from local bank account transfers and credit cards to Neteller, PayPal, and Skrill.

As a non-custodial provider, Best Wallet lets users trade without using centralized platforms, and the purchased digital assets appear instantly in the wallet balance. The Best Wallet app also supports decentralized token swaps across 60+ networks, including Ethereum, Solana, and BNB Chain. Users can access Launchpad projects, too—these are new cryptocurrencies that raise funds before they debut on exchanges.

Pros:

- The overall best P2P crypto exchange platform in 2025

- Supports thousands of digital assets from the top blockchain ecosystems

- Purchase methods include local bank transfers, e-wallets, and debit/credit cards

- Offers an average trade completion time of under five minutes

- Available as a mobile app with a great user interface for iOS and Android

- The app is also a non-custodial wallet with robust security measures

Cons:

- Transaction fees vary depending on liquidity providers

- The in-app staking feature is in development

|

Supported Coins |

1,000+ |

|

Payment Methods |

100+ |

|

Fiat Currencies |

30+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Backed by a non-custodial wallet. Supports thousands of digital assets. No KYC requirements. |

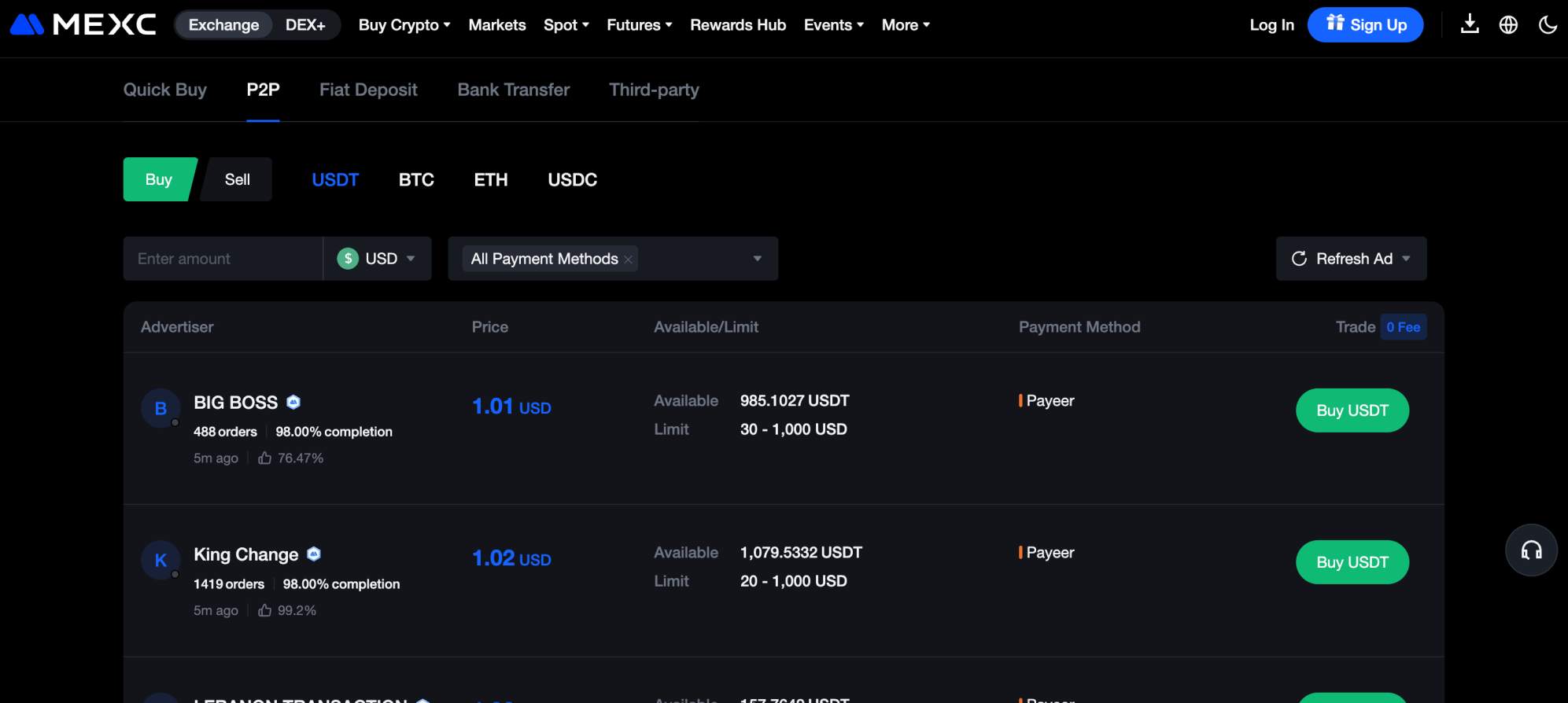

2. MEXC — Tier-One P2P Exchange Supporting 25+ Local Currencies With Competitive Rates

MEXC is a popular crypto exchange with over 36 million users and several billion dollars in daily trading volume.

While the main platform supports debit/credit cards, MEXC also offers a P2P exchange with a wider range of local payment methods. It supports 25+ currencies, including RUB, VND, and BRL, and exchange rates are competitive when buying smaller amounts. Rates become less favorable on larger purchases, as most P2P users are casual traders.

Although MEXC allows buyers and sellers to avoid KYC requirements, the P2P framework uses an escrow system to ensure safety. The P2P platform supports just four cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin(USDC). Once the P2P trade is complete, users can access over 4,000 spot and futures markets.

Pros:

- Supports 25+ local currencies and a wide selection of payment methods

- An escrow system protects buyers and sellers from fraud

- Competitive P2P rates on small purchases

- The main exchange supports over 4,000 markets

- Used by over 36 million crypto investors globally

Cons:

- Limited liquidity to cover large P2P trades

- The peer-to-peer exchange supports just four cryptocurrencies

|

Supported Coins |

4 |

|

Payment Methods |

100+ |

|

Fiat Currencies |

25+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Top exchange rates on small P2P trades. Uses an escrow system to protect buyers and sellers. The main exchange offers thousands of spot and futures pairs. |

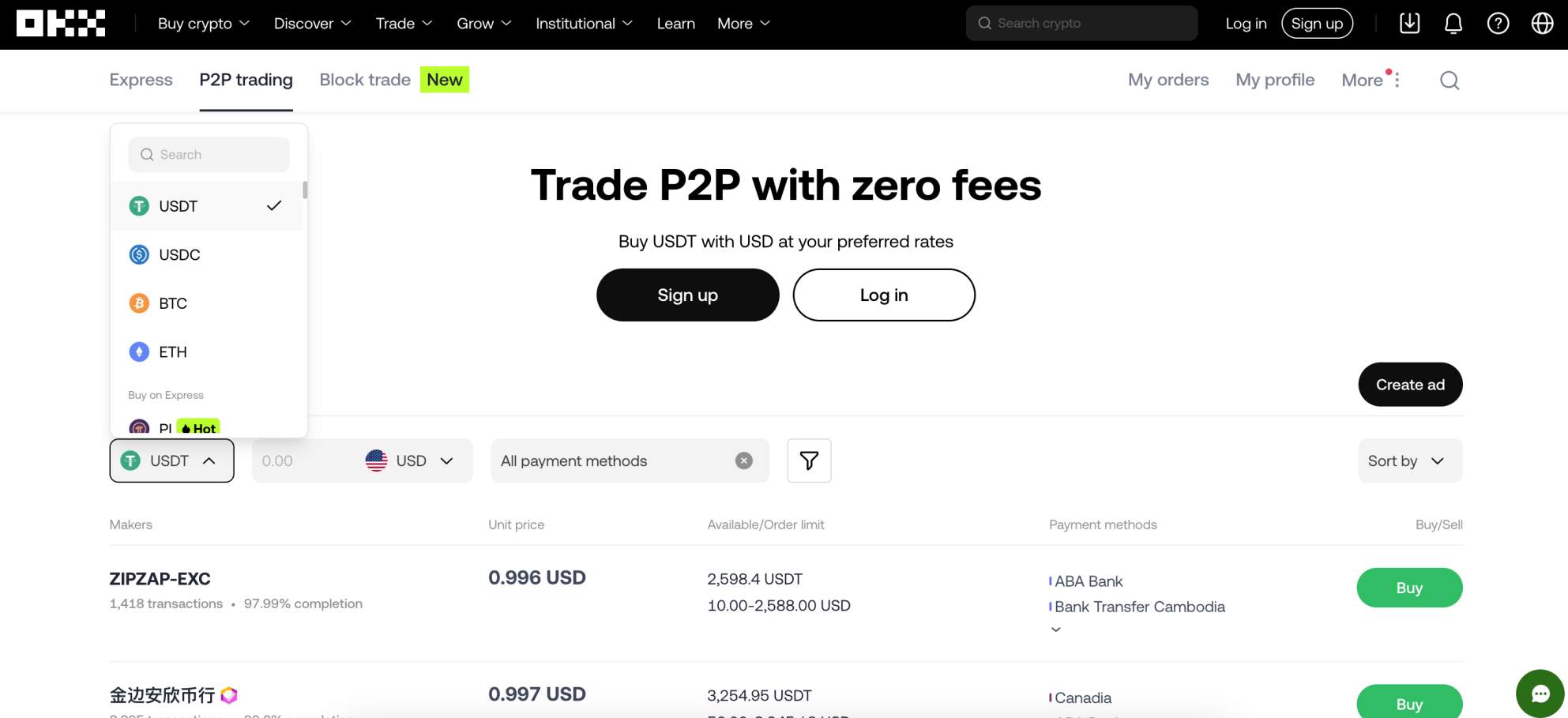

3. OKX — Buy Digital Assets With 900+ P2P Payment Methods

OKX is another top crypto exchange that offers a P2P platform. It supports 100+ fiat currencies and 900+ payment methods, including mobile payments, local transfers, and e-wallets like Skrill and Neteller.

The user-friendly dashboard lets buyers enter their preferences and displays suitable sellers by the exchange rate. While P2P sellers set rates, OKX charges no additional trading fees, so buyers pay exactly what’s quoted.

Escrow wallets protect users in terms of safety, although it’s best to stick with OKX Verified sellers, as they’ve completed a KYC process. OKX supports four cryptocurrencies for P2P trades: BTC, ETH, USDT, and USDC. The primary OKX exchange offers hundreds of additional digital assets, including the best altcoins to buy.

Pros:

- A top peer-to-peer Bitcoin exchange with 900+ payment methods

- Buy and sell Bitcoin and other cryptocurrencies with 100+ local currencies

- Many sellers have completed KYC for additional security

- The exchange doesn’t charge additional fees on P2P trades

Cons:

- P2P trading only supports BTC, ETH, USDT, and USDC

- Some sellers set fees at over 10% above the spot price

|

Supported Coins |

4 |

|

Payment Methods |

900+ |

|

Fiat Currencies |

100+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Buy digital assets with 900+ payment types. The user-friendly P2P dashboard is ideal for beginners. The primary exchange offers exposure to hundreds of additional markets. |

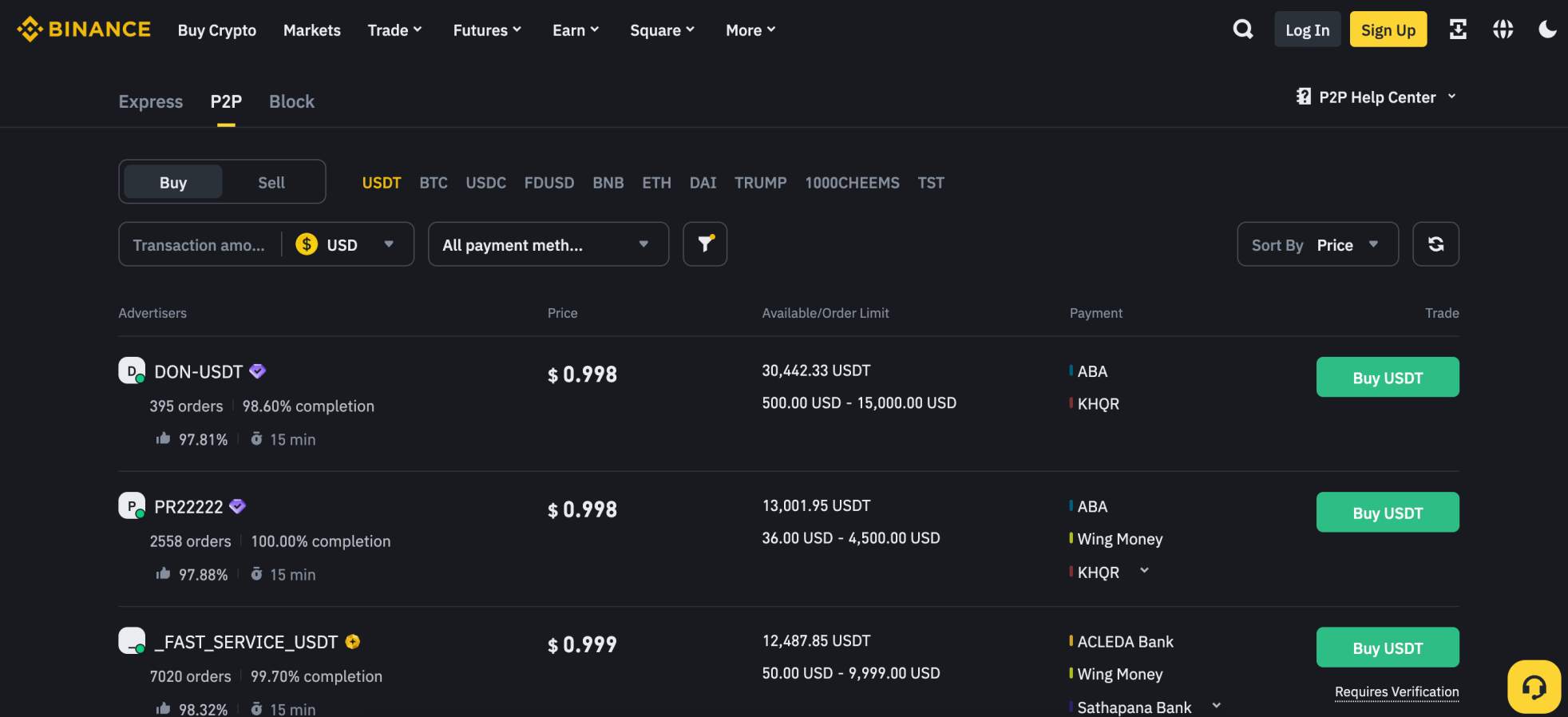

4. Binance — Top P2P Crypto Platform to Purchase Large Amounts at Low Fees

While Binance is the world’s largest spot trading exchange, it’s also a great option for buying and selling cryptocurrencies via the P2P system.

Binance offers deep liquidity across 100+ fiat currencies, including USD, EUR, and AED, which makes Binance P2P a top choice for large investments, especially when buying stablecoins like USDT.

Currently, one seller offers up to $4.5 million worth of USDT at $0.998 — just below the global spot price.

Other P2P cryptocurrencies include BTC, USDC, ETH, Dai (DAI), and OFFICIAL TRUMP (TRUMP). The platform supports over 800 payment methods, although most relate to local bank accounts. Both buyers and sellers must complete KYC verification before trading, which might not suit some users.

Note: Binance is also the best P2P crypto lending site for trading collateral. Users can repay their loans at any time without additional fees.

Pros:

- One of the best P2P crypto exchanges for deep liquidity

- Some stablecoin sellers offer below-market rates

- The platform supports 10 P2P cryptocurrencies

- Choose from over 800 payment types

Cons:

- Supports TRUMP but not established meme coins like Dogecoin (DOGE)

- All P2P users must complete KYC verification

- Some Binance products (e.g, perpetual futures) are banned in some countries

|

Supported Coins |

10 |

|

Payment Methods |

800+ |

|

Fiat Currencies |

100+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Buy large amounts of cryptocurrencies at industry-leading rates (often below the spot price). The average trade time is just 15 minutes. Offers an express feature to streamline purchases. |

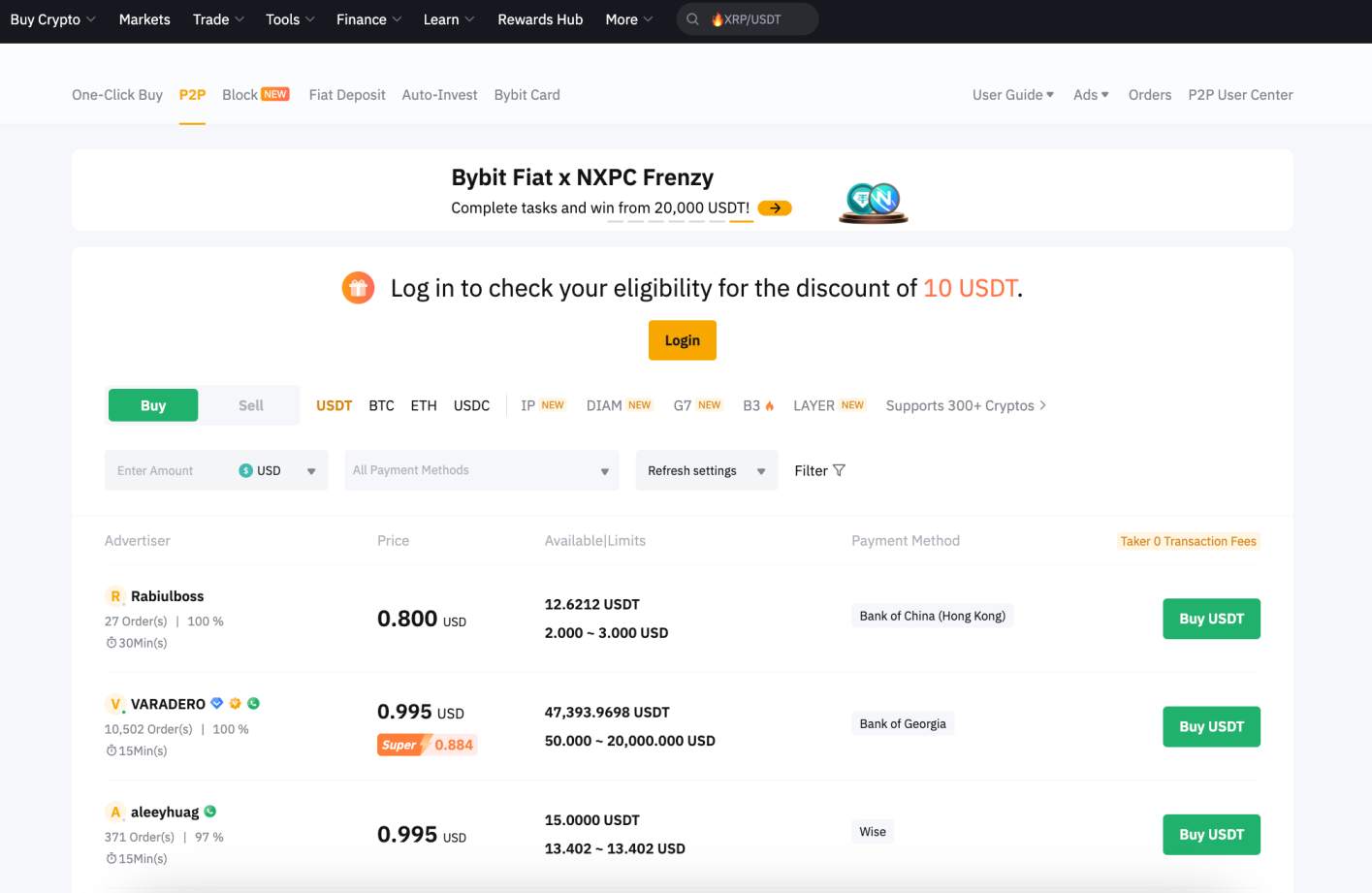

5. Bybit — The Best P2P Exchange to Trade Crypto Futures With High Leverage

Bybit is a tier-one exchange with average daily trading volumes of $36 billion, making it the second-largest platform after Binance. Its growing P2P ecosystem offers access to the crypto derivative markets, with perpetual futures like BTC and ETH offering leverage of up to 200x.

Bybit derivatives support thousands of pairs, provide industry-leading spreads, and allow traders to go long or short.

The peer-to-peer crypto exchange supports USDT, BTC, ETH, and USDC—these virtual currencies serve as collateral when trading derivative products. Users can buy digital assets with 60+ currencies and 600+ payment methods, including local and international wires, Cash App, and Revolut. P2P buyers can claim “Super Deal” promotions from select sellers, which reduce fees by up to 99 USDT.

Pros:

- Buy cryptocurrencies via P2P to access derivative products

- Trade perpetual futures with 200x leverage

- Choose from 600+ P2P payment methods and 60+ currencies

- Super Deal promotions offer discounts of up to 99 USDT

Cons:

- The P2P exchange doesn’t support meme coins

- Purchase limits vary widely depending on the currency

- KYC verification is mandatory, unlike the primary Bybit exchange

|

Supported Coins |

4 |

|

Payment Methods |

600+ |

|

Fiat Currencies |

600+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Trade crypto futures with a 0.5% margin after completing the P2P trade. Supports challenger banking apps like Revolut and Cash App. Buyers receive discount vouchers from select sellers. |

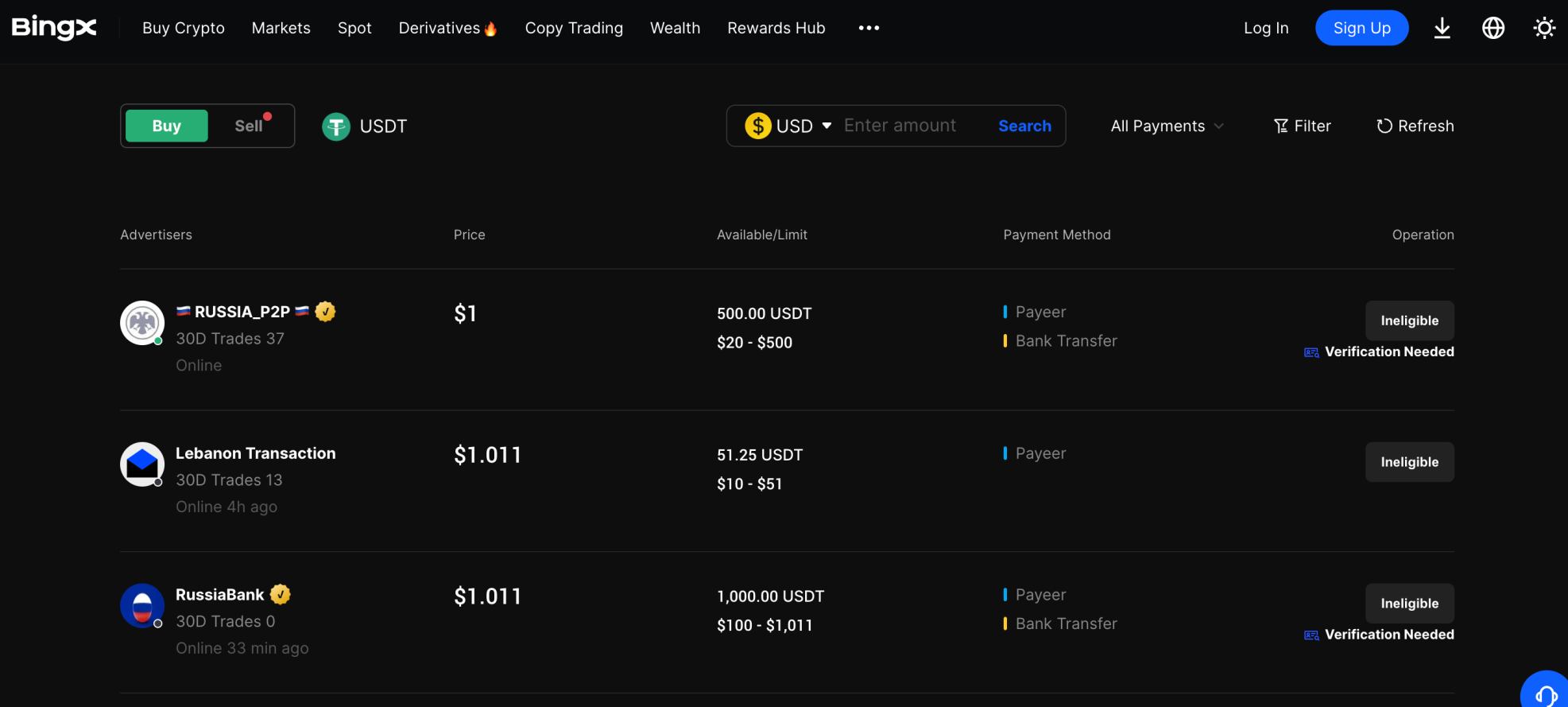

6. BingX — Popular Trading Platform and App With Favorable P2P Rates on USDT Purchases

BingX is a diverse trading exchange that supports hundreds of pairs across a wide range of products, from spot markets and perpetual futures to copy trading and automated bots. Its P2P crypto marketplace offers various payment methods and one of the fastest ways to deposit fiat money — successful trades are completed in minutes.

While the platform only supports USDT for trading crypto, the stablecoin is the primary quote currency for most BingX markets and its trading partners.

Approximately 65 fiat currencies are supported, and sellers accept local bank account transfers, Advcash, Payeer, Wise, and other convenient methods. Some merchants offer exchange rates marginally below the spot price, so buyers can often get a better deal compared to traditional exchanges.

Pros:

- Offers market-leading rates on USDT purchases

- Sellers accept over 65 local currencies

- Some merchants allow no-KYC purchases

Cons:

- The P2P department supports just one digital asset

- PayPal can’t be used as a payment method

- Uses third-party providers to settle P2P transactions

|

Supported Coins |

1 |

|

Payment Methods |

300+ |

|

Fiat Currencies |

65+ |

|

Mobile App |

Yes |

|

Top 3 Features |

Accessible via desktop browsers and a native P2P app for iOS and Android. Some sellers accept buyers without KYC verification. Exchange features include copy trading, automated bots, and derivatives. |

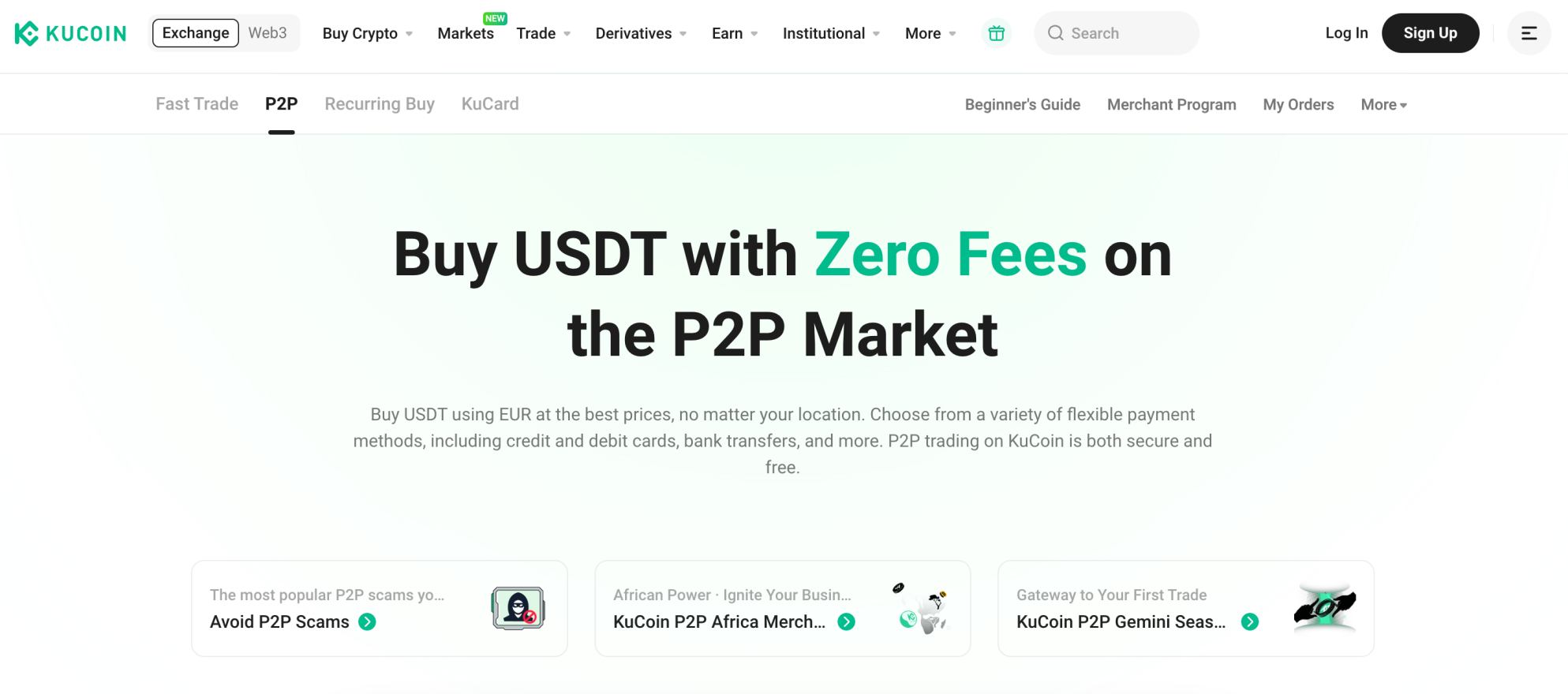

7. KuCoin — Buy Crypto From Verified P2P Sellers With a Strong Trading History

KuCoin is a security-first exchange that ensures a safe trading experience. All P2P sellers complete advanced ID verification, and the public rating system helps buyers choose a suitable merchant.

Advanced data metrics include total trades, average settlement time, and total completion rates. KuCoin guides buyers through the escrow process, ensuring they only send funds once the seller has completed the transfer.

Buyers have 100+ payment methods to choose from, although fiat currencies support is limited to about 30+. KuCoin doesn’t charge P2P fees, but seller exchange rates are often sub-par.

Five cryptocurrencies are available when using the P2P platform: BTC, ETH, USDC, USDT, and KuCoin Token (KCS). KuCoin’s primary spot exchange has over 900 markets, including the best gaming coins to buy.

Pros:

- The best P2P cryptocurrency exchange for safety

- The platform requires all sellers to complete KYC

- Advanced data metrics to assess merchant reliability

Cons:

- Some P2P currencies have limited liquidity

- Supports just 30+ fiat currencies

- Most merchants sell Bitcoin and other digital assets above the global spot price

|

Supported Coins |

5 |

|

Payment Methods |

100+ |

|

Fiat Currencies |

30+ |

|

Mobile App |

Yes |

|

Top 3 Features |

No additional fees to trade on the P2P marketplace. One of the few P2P platforms to accept debit/credit cards. All sellers are verified to ensure safety. |

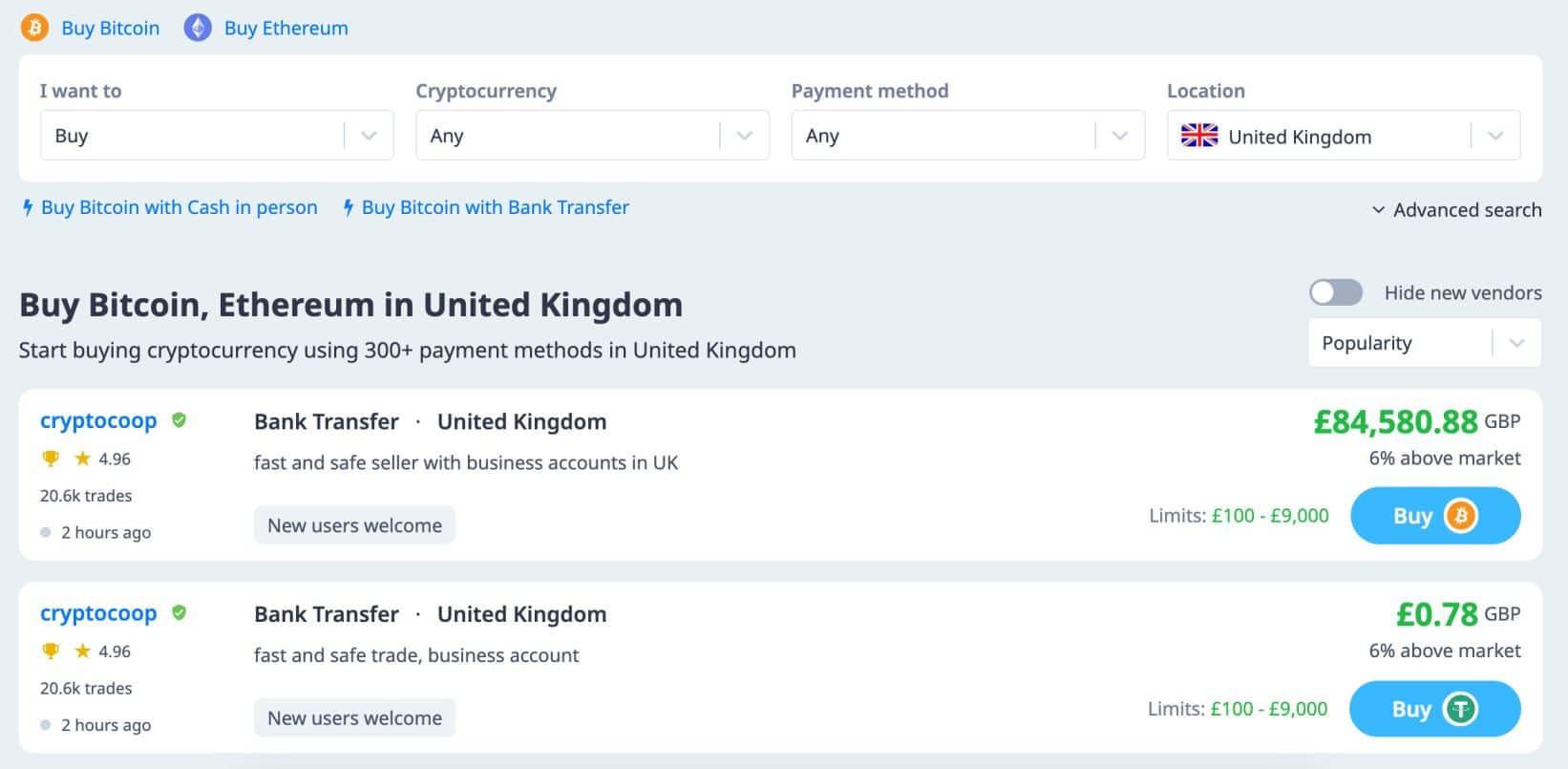

What are P2P Crypto Exchanges?

Peer-to-peer crypto exchanges, or simply “P2P”, are crypto platforms that connect buyers and sellers, enabling participants to trade without intermediaries.

While P2P exchanges are typically global, most buyers purchase cryptocurrencies from sellers based in the same country. This lets users transact their preferred currency, reducing fees and settlement times. P2P traders use local payment methods, too, from bank wires and domestic e-wallets to mobile transfers.

Peer-to-peer transactions eliminate third parties, yet P2P providers play a central role in ensuring safety. Platforms provide an escrow system, where the seller deposits the exact amount of cryptocurrencies into the exchange’s wallet. The cryptocurrencies stay locked in the wallet until the buyer completes the payment — the digital currencies are released once the seller confirms they’ve received the funds.

The best P2P crypto exchanges offer a fee-free service, which means they don’t charge additional commissions. Sellers set their own exchange rates, often a few percent above the global spot price for the respective cryptocurrency.

How Peer-to-Peer Bitcoin Exchanges Work

Once you’ve registered with a P2P exchange, the platform requires the trade parameters, including:

- Digital asset: The cryptocurrency you want to buy

- Currency: The local payment currency, such as USD or GBP

- Payment method: The preferred payment type, such as local bank account, Cash App, or PayPal

- Purchase amount: The total purchase requirement, stated in the chosen fiat currency

The exchange then provides a list of sellers that align with the trade requirements, often sorted by the most competitive exchange rate. You can usually view eBay-style stats about each seller, such as their rating, whether they’re KYC verified (not all exchanges need to be), how many trades they’ve completed, and the average trade duration.

P2P platforms display seller rates in the local currency, which is almost always above the global spot price. These higher prices can be offset when using local methods, as buyers avoid foreign exchange fees and transaction charges.

Once the buyer chooses a merchant and confirms the stated rates and terms, the seller deposits the exact amount of cryptocurrencies in the exchange’s escrow wallet. Waiting for the exchange to confirm the completed escrow transfer is crucial to avoid scams.

The buyer then transfers funds and waits for the seller to mark the payment as complete — the top merchants do this almost immediately. Finally, the P2P exchange releases the purchased cryptocurrencies from the escrow account, and the buyer withdraws the assets to a private wallet.

P2P Crypto Exchanges Versus Standard Exchanges

Here are the core benefits of P2P trading compared to traditional crypto exchanges.

Local Currencies and Payment Methods

P2P exchanges accept a much wider range of fiat currencies, particularly those from non-major economies. Consider an investor from South Africa — they can buy Bitcoin on Coinbase, but ZAR isn’t directly accepted, so they must incur foreign exchange fees. That same investor can use ZAR on a P2P platform to reduce transaction costs.

The best P2P crypto exchanges typically support hundreds of local payment methods, too. Best Wallet, for instance, supports QR code payments in Thailand. This system is widely used throughout the country, as payments happen instantly and at no cost. The same method isn’t accepted on traditional crypto exchanges, which typically focus on major debit/credit cards.

Market Prices

The best crypto exchanges offer spot trading markets, so prices reflect global rates — the price difference between major exchanges is marginal.

P2P platforms let sellers choose their own market prices. Rates tend to be above the spot price, often by a few percent, but sometimes rise significantly depending on the payment method and currency. In some cases, P2P buyers pay below the spot price, potentially because the seller requires a fast sale.

Liquidity

Liquidity is one of the biggest drawbacks of using peer-to-peer exchanges, as casual traders typically use platforms. Sellers often have a few hundred dollars worth of cryptocurrencies to sell, so if buyers require a higher amount, they need to complete multiple P2P trades.

Traditional spot exchanges, especially tier-one platforms like Binance and Bybit, attract billions of dollars in daily trading volume. Exchange users can buy large amounts without significantly impacting the market price or experiencing unfavorable slippage.

Available Assets

P2P exchanges typically support 4-7 major cryptocurrencies, including BTC, ETH, USDT, and USDC. They provide a gateway to the broader markets, as most centralized exchanges offer USDT-denominated pairs like XRP/USDT and DOGE/USDT.

Standard exchanges offer substantially more markets — MEXC supports over 4,000 pairs, including spot trading and perpetual futures.

Benefits of Using P2P Exchanges vs OTC Exchanges

Most P2P exchanges are aimed at casual investors who want to buy or sell Bitcoin and altcoins in small amounts. They connect traders directly, so digital currencies are bought and sold without third-party intermediaries.

The best P2P Bitcoin exchange platforms also support various fiat currencies and local payment methods, allowing traders to carry out secure transactions quickly and cost-effectively. They also support anonymous accounts, although some sellers request government-issued ID to ensure regulatory compliance.

Over-the-counter (OTC) exchanges, on the other hand, are aimed at large-scale investors with significant purchase requirements, often at least $50,000. These amounts are too much for P2P exchanges, so OTC providers help investors source cryptocurrencies at the best market price.

OTC brokers lock in the sourced price before payment to reduce volatility, and they provide dedicated, one-on-one support throughout the transfer process. OTC buyers must complete enhanced customer due diligence (ECDD) due to the substantial transaction sizes involved.

Is P2P Crypto Trading Legit?

Peer-to-peer crypto trading is a legitimate alternative to centralized exchanges. While tier-one platforms often accept major currencies like USD and EUR, they lack support for minor and exotic currencies.

The best P2P Bitcoin exchanges solve this problem by supporting currencies from around the world, alongside payment methods that aren’t available on major exchanges, such as local QR and mobile transfers.

In general, P2P transactions are safe — the escrow system protects buyers and sellers from scams. However, like all online transactions, caution is advised — P2P buyers should avoid high-risk transfer methods like Western Union, MoneyGram, and in-person cash payments.

Always use verified sellers with positive reviews and sufficient trading history, and never send money until the escrow wallet is funded.

How to Get Started With a P2P Exchange

Follow these steps to buy cryptocurrencies on a P2P exchange in under five minutes. The walkthrough shows the process with Best Wallet, a non-custodial wallet and exchange that supports global currencies and payment methods without KYC requirements.

Step 1: Download the Best Wallet App

Visit the Best Wallet website and download the mobile app for iOS or Android.

Step 2: Complete Security Steps

Open the app to complete the security steps — you need to enter an email address, choose a PIN, and write down the secret passphrase.

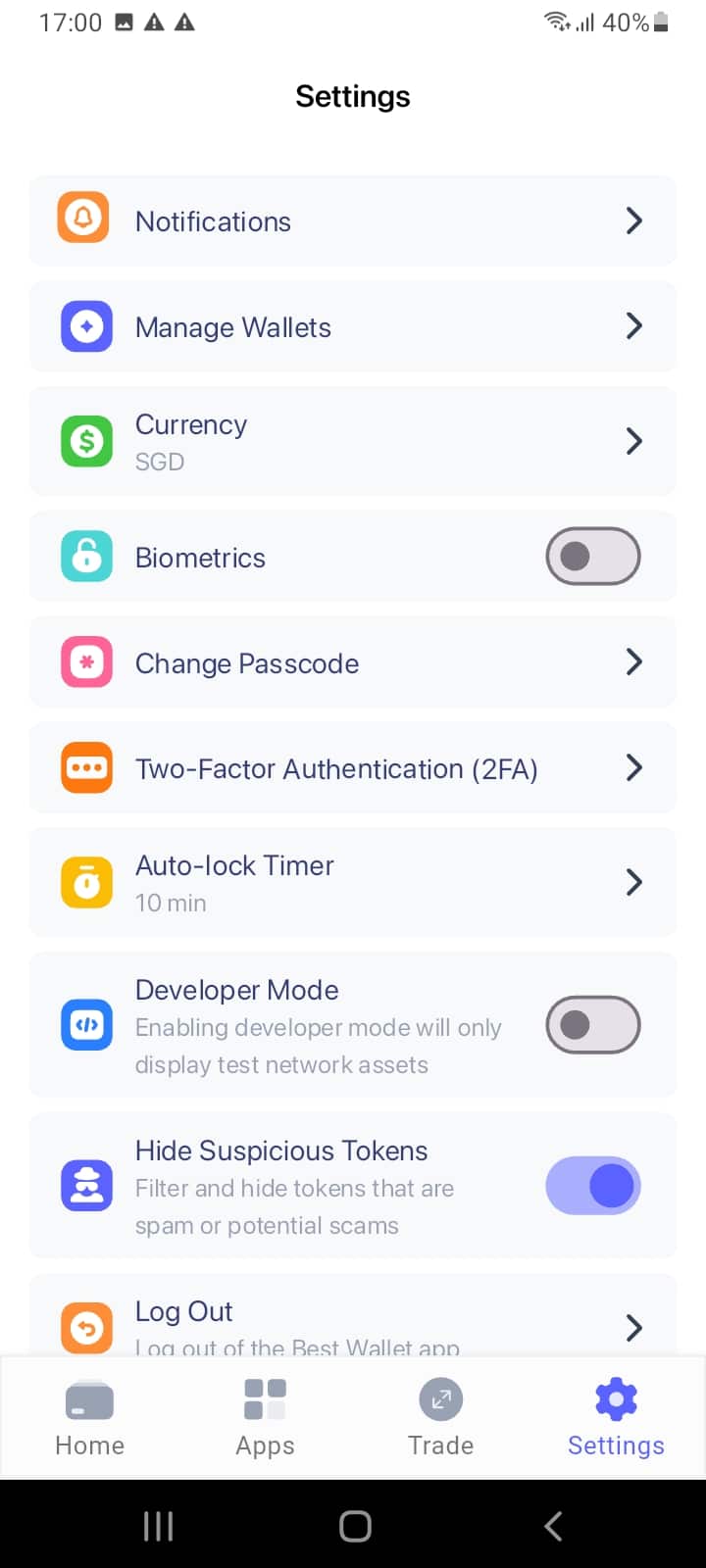

Best Wallet also supports two-factor authentication and biometrics. To activate these additional security features, click “Settings” and follow the on-screen instructions.

Step 3: Choose P2P Parameters

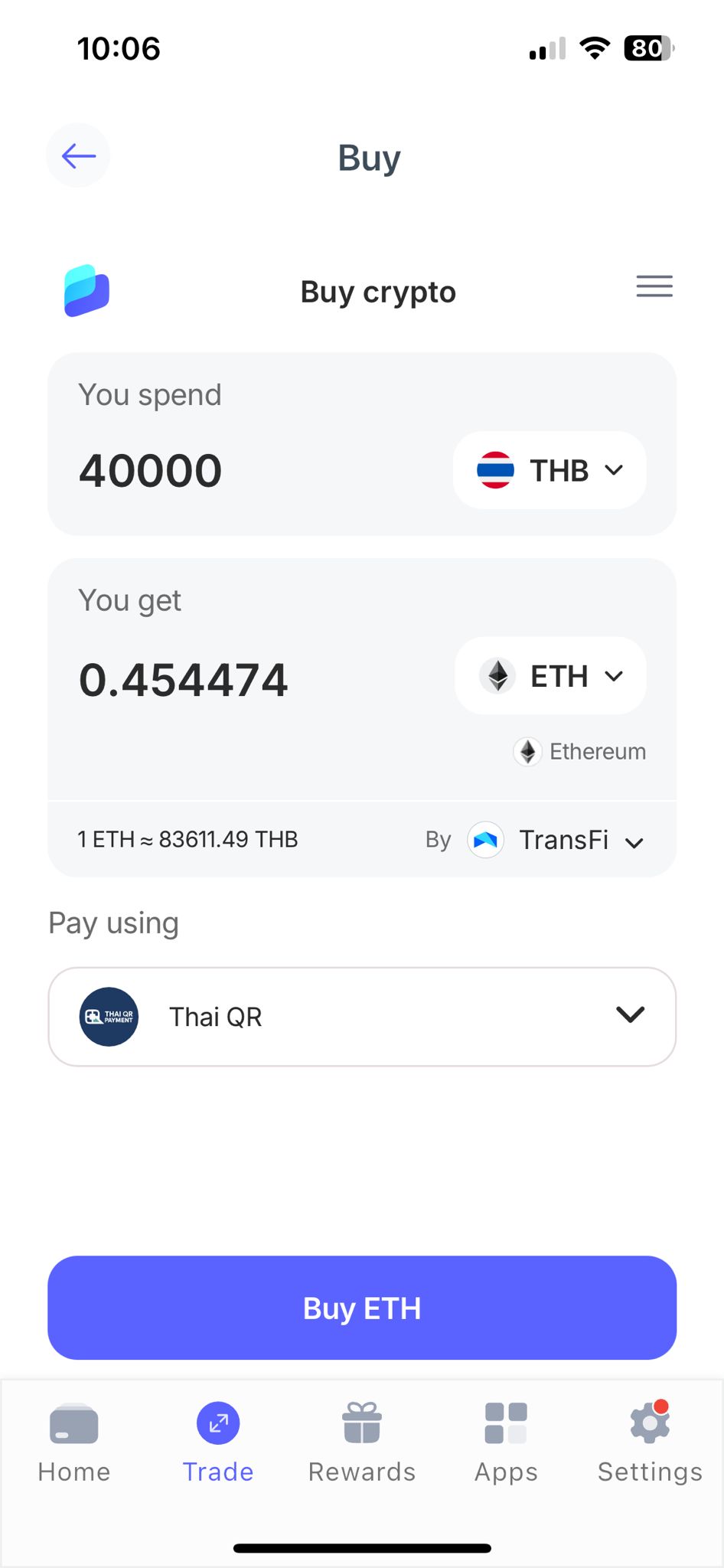

Now click “Trade” and “Buy”, and enter the digital asset you want to buy. Then select the preferred currency, purchase amount, and payment method. Best Wallet sources the best market price for your trade parameters and connects you with the respective payment gateway.

In this example, the user is buying 40,000 THB worth of Ethereum via a local Thailand QR payment.

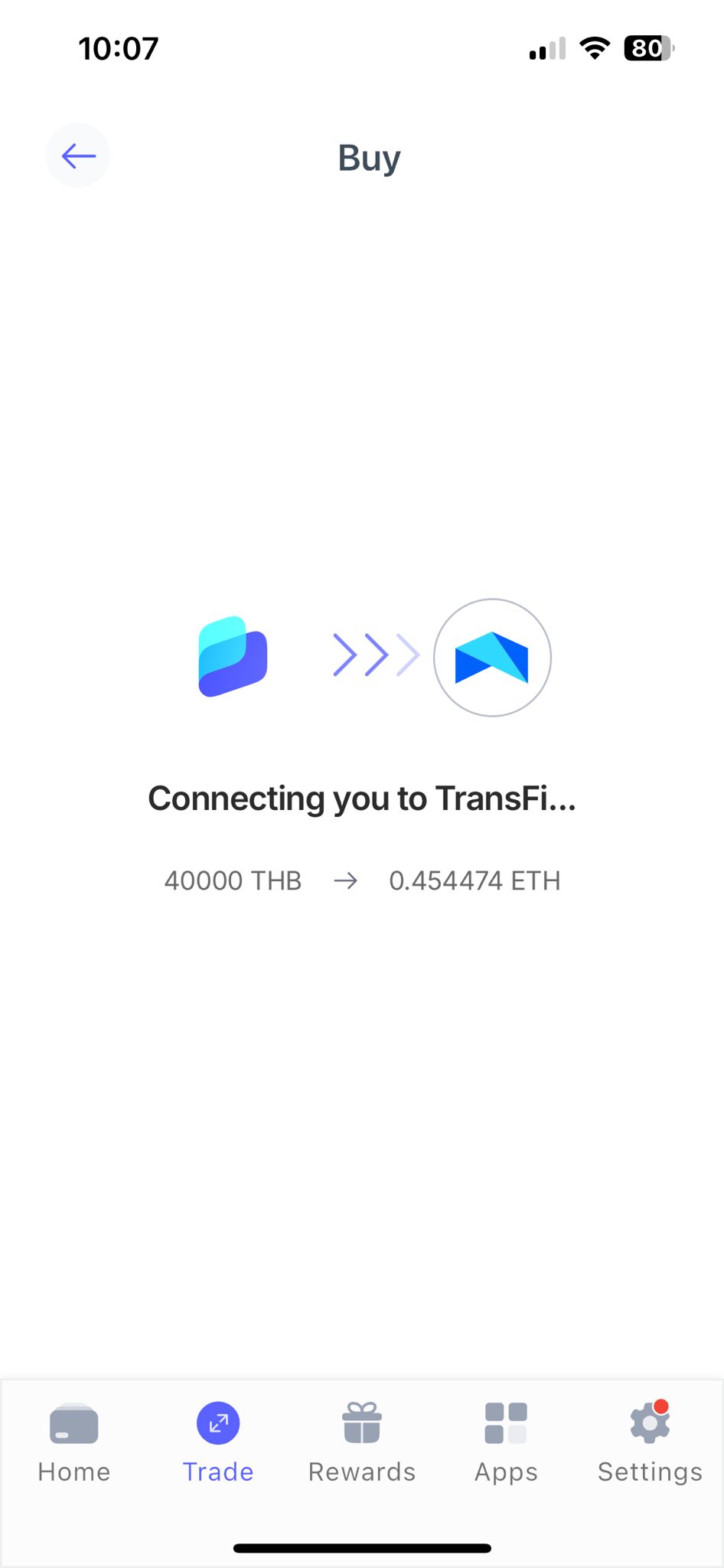

Step 4: Complete P2P Payment

The connected gateway now asks for the payment details — you can enter them securely, as the Best Wallet app is encrypted for user safety. The payment processes instantly, and Best Wallet adds the funds to your wallet balance a few seconds later.

As a non-custodial wallet, you can keep the purchased cryptocurrencies in Best Wallet until you’re ready to sell. The app also offers fiat off-ramp services, so you can cash out your cryptocurrencies back to the same currency and withdraw them to the preferred payment account.

Conclusion

The best P2P crypto exchanges reduce the reliance on centralized platforms — you buy digital currencies directly from local sellers with domestic currencies and payment types.

Our research shows that Best Wallet is the overall best option. The exchange supports thousands of cryptocurrencies at competitive fees, and there are no KYC requirements to use fiat money. Best Wallet doubles as a non-custodial wallet, so cryptocurrencies bought from its P2P exchange are safely stored.

References

- Bybit Launches 2025 Strategy to Empower Crypto Traders (Reuters)

- Crypto Peer-to-Peer Exchanges Grow in Popularity as Regulatory Scrutiny Rises (Bloomberg)

- What is OTC Trading? How to Trade Securities Over-the-Counter (Saxo Group)

- Enhanced Customer Due Diligence (ECDD) Program (Australian Transaction Reports and Analysis Centre)