By offering enhanced privacy and anonymity in trades, faster registration, wider availability, and, most importantly, greater freedom in the crypto realm, the best no-KYC crypto exchanges represent a compelling option for traders. One of the biggest advantages of these exchanges is that they stick to the founding principles of independence and decentralization that started with the first cryptocurrency, Bitcoin.

In this article, you’ll learn about our top picks for the best no-KYC crypto exchange and read their quick yet comprehensive reviews, which should help you pick the one best suited for you. You’ll also learn about what these exchanges are and how they function, touching upon the key differences and benefits, and find out how to start using one.

Ranking No KYC Crypto Exchanges

Before describing and reviewing the core features of each no-KYC crypto exchange we’ve picked, here’s a brief summary of them all so you get a concise overview:

- Best Wallet — Non-custodial wallet with the overall best cryptocurrency exchange without KYC

- Margex — Exchange with no mandatory KYC and 100x leverage futures trading

- BloFin — Tiered KYC crypto exchange with a high security focus

- KCEX — Innovative exchange with a flexible KYC policy and minimal fees

- BingX — Over 1,000 cryptocurrencies and a robust set of features

- Bitunix — Sign up for up to 8,000 USDT in bonuses and trade without KYC

- WEEX — No KYC exchange with a daily check-in and 30,000 USDT welcome bonus

Reviewing the Best Crypto Exchanges Without KYC

To help you find an exchange that’s just right for you, we’ve prepared short yet detailed reviews of our top picks. You’ll learn about the best features of each exchange, as well as some crucial info like the number of tradable cryptos, leverage on crypto futures, trading fees, and more. Let’s take a look.

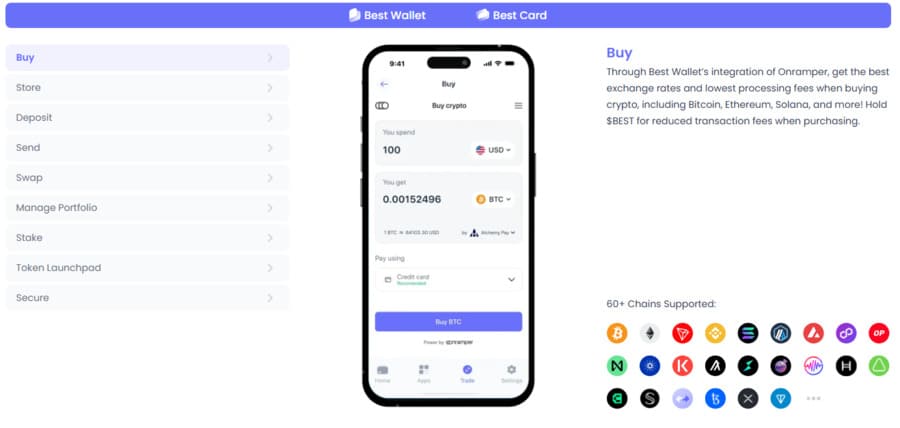

1. Best Wallet — Crypto Wallet With the Overall Best No-KYC Exchange

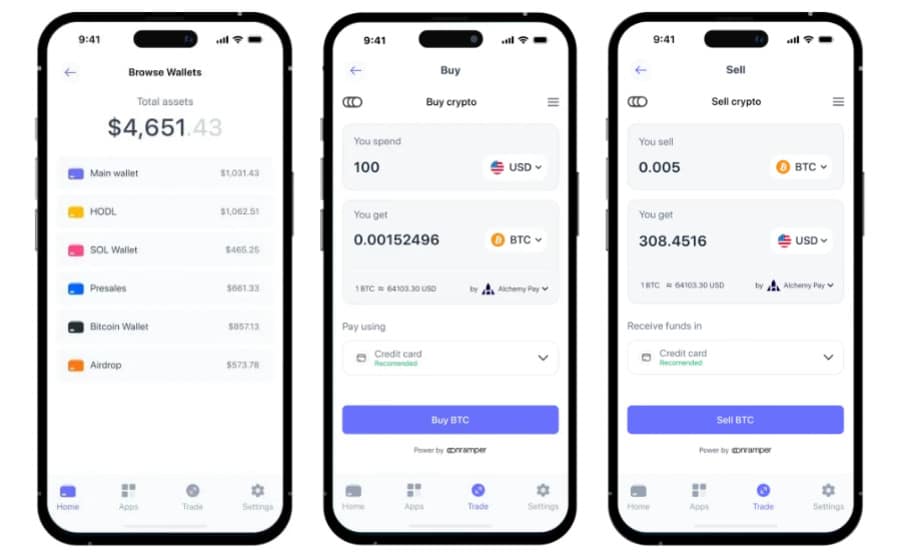

Best Wallet is a non-custodial mobile crypto wallet that allows you to trade without providing an ID or completing the standard Know Your Customer (KYC) procedure. It’s often referred to as one of the top Web3 wallets on the market.

But why is it on this list, let alone at the top? It’s simply because it features an embedded DEX with all the functionalities that the best no-KYC crypto exchanges have. Here, you’ll find a bunch of altcoins as well as new tokens that are just hitting the market, which makes it a great place to be for the incoming altcoin season.

We find it is the best no-KYC crypto exchange, as its platform supports thousands of cryptocurrencies and tokens, and is compatible with over 60 chains, including popular ones like Ethereum, Polygon, and Binance Smart Chain. It offers low trading fees, mostly associated with third-party services, like Onramper, which lets you buy crypto for fiat.

Best Wallet’s Best Features

- Trade crypto: With 60+ chains supported and the option to buy and sell crypto, you have plenty of opportunities for trading.

- Swapping crypto: You can swap crypto directly in the wallet, as well as through the Best DEX. Cross chains are also supported.

- BEST token: The crypto wallet project has a native token you can trade and hold for added benefits like lower or zero fees and occasional airdrops. It’s currently in presale.

2. Margex — Exchange Without KYC and Futures With 100x Leverage

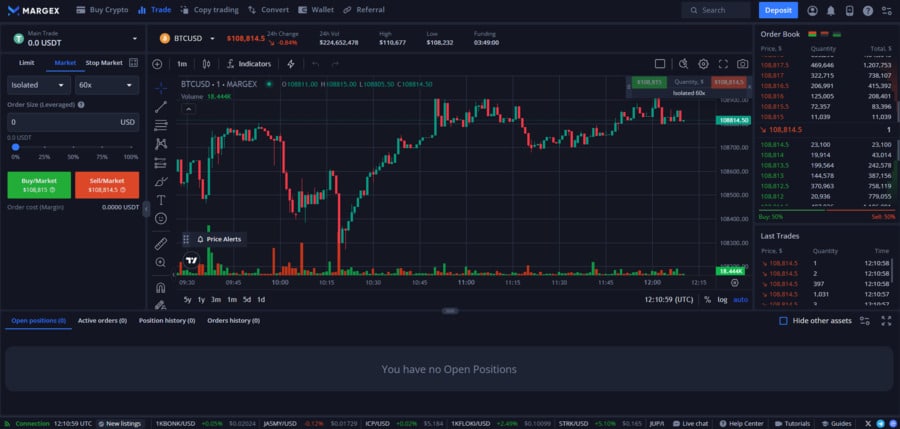

Margex is one of the best no-KYC crypto exchanges, available in more than 150 countries. It boasts more than half a million registered users, and one of the main reasons for this is its no-KYC policy. The process is not mandatory when you start trading, but it is required if you want to deposit fiat.

Margex is known for its derivatives trading offerings, where perpetual futures can be traded with up to 100x leverage on top pairs, like BTC/USD and ETH/USD. The trading fees are in line with the rest of the market, offering 0.06% for takers (market orders) and 0.019% for makers (limit orders).

Margex is also one of the best exchanges with bonuses, since you can receive up to $10,000 in bonus credits once you sign up.

Margex’s Best Features

- Perpetual futures: Futures trading is Margex’s core feature, and perpetual futures are the main part. Leverage can reach up to 100x, but most pairs have 50x or 25x. There are over 40 trading pairs.

- Copy trading: Margex offers a neat copy trading feature where you can replicate the trades of top investors, without paying any added fees.

- Staking: Staking BUSD, USDT, USDC, ETH, and BTC comes with daily interest payments, no lockup periods, and around 7% APY in most cases.

3. BloFin — Exchange With a Tiered KYC System and Robust Security

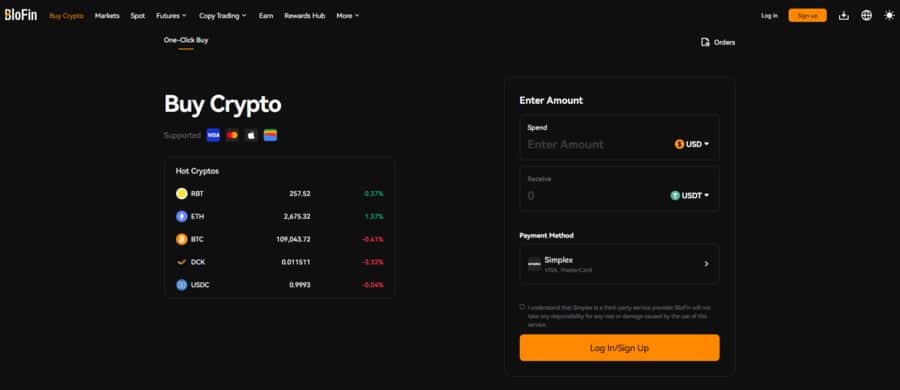

BloFin is one of the best no-KYC crypto exchanges, as it lets you buy crypto with a single click, trade through both spot and futures trading, and even use staking and copy trading.

We list it among the best no-KYC crypto exchanges because it uses a tiered system where you can trade and even withdraw up to 20,000 USDT daily without going through the KYC procedure. If you decide to verify, you can unlock a 1 million USDT limit with a simple personal info verification and a 2 million USDT limit with an address verification.

The fee structure is in line with industry standards. Makers pay 0.1% spot trading and 0.02% futures trading fees, and takers are charged 0.1% for spot trading and 0.06% for futures trading. Fees can drop significantly through discounts and by advancing in the VIP scheme.

BloFin’s Best Features

- Single-click purchase: The no-KYC exchange supports two third-party payment processors, through which you can use Visa, Mastercard, Apple Pay, and Google Pay.

- Futures trading: You can get up to 150x leverage on select pairs, while the platform supports over 300 trading pairs. You can also use trading bots if you want to automate your strategy for digital assets.

- High security: BloFin holds licenses in various jurisdictions, including Singapore, Switzerland, Australia, Canada, and even the US with a federal MSB license. Moreover, the platform boasts strong security protocols and Proof of Reserves.

4. KCEX — Flexible KYC Crypto Exchange With Minimal Fees

KCEX is a no-KYC exchange with flexible KYC requirements. While this approach is attractive to new users, it also comes at the expense of more comprehensive services. Still, the platform does cover both spot and futures trading.

Without KYC, you can withdraw as much as 30 BTC a day, which is a sizable amount that’s bound to fit the needs of most traders. However, to get the full set of features the site offers, you still need to verify.

As for the fees, they are generally zero on most fronts. There are no fees on spot trading, and only takers need to pay a minimal 0.01% fee on futures contracts. KCEX also has a zero withdrawal fee event where you’re not required to pay any fees on requested cashouts.

KCEX’s Best Features

- Futures trading: KCEX focuses on offering futures contracts, and many of them have a maximum leverage of 100x.

- Promotional lineup: You’ll always find a wide range of promos on the platform, including tasks that lead to USDT bonuses.

- Large number of cryptocurrencies: The platform supports more than 500 cryptocurrencies and over 700 spot trading pairs.

5. BingX — Trade Over 1,000 Coins and Benefit From a Variety of Features

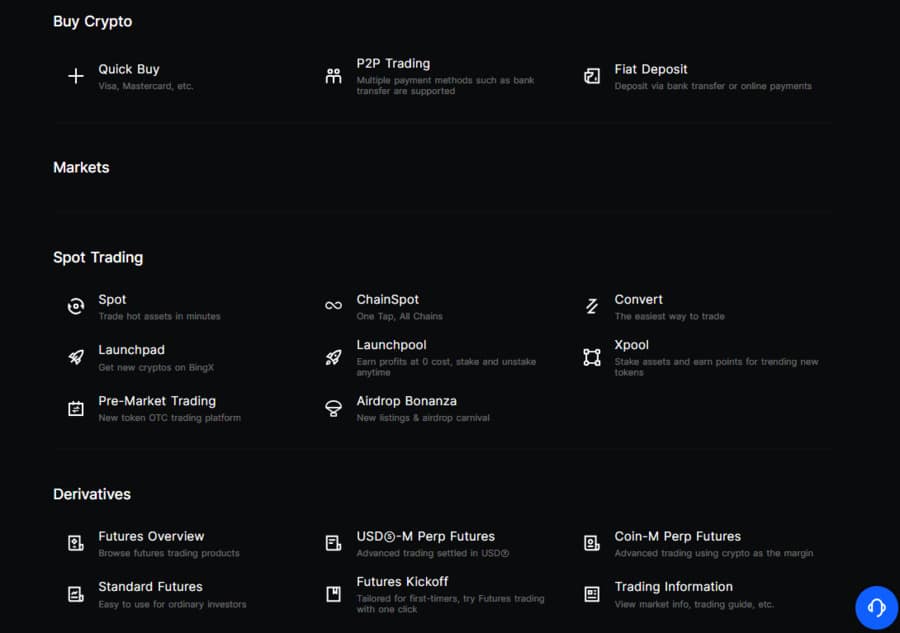

BingX is noted for its large set of features, the ability to trade more than 1,000 cryptocurrencies, and an even larger number of crypto trading pairs. The platform offers quick buy options, fiat deposits, P2P trading, spot trading, staking, contrast airdrops, various derivatives, copy trading, loans, and even dual investment.

Futures trading comes with up to 125x leverage on select pairs, but it’s important to note that non-crypto futures products like forex and commodities can come with much higher leverage, which can go up to 200x.

The platform utilizes a unique no-KYC exchange protocol that relies on an integrated Sumsub KYC system. You can use some basic features without completing KYC, but to get higher withdrawal limits and access to all bonuses and site features, you need to undergo full verification.

BingX’s Best Features

- Copy and social trading: You get access to over 17,000 elite traders, and you can copy any of their trades. Each trader profile comes with a selected set of stats to help you decide whether you should copy them.

- Advanced trading tools: The platform offers a wide range of order types, including limit, market, TWAP, and trigger trailing stops, among others. Besides that, you get access to integrated TradingView charts.

- Fiat on-ramp options: BingX supports a large number of fiat currencies you can use to buy crypto. Various payment methods are supported, including SEPA transfers, credit and debit cards, and Apple Pay.

6. Bitunix — Get Up to 8,000 USDT in Bonuses and Trade Without KYC

Bitunix is a global crypto derivatives exchange that focuses on futures trading, where you can get leverage of up to 125x. You also get to try your hand at spot trading, P2P trading, flexible investment solutions, dual investment, and copy trading.

Moreover, Bitunix is also known as a non-KYC crypto exchange when it comes to basic use. You can trade and withdraw up to $500,000, but this figure may vary, as it’s not always the same for everyone. Still, like with the majority of platforms, to get the full service on the site, you need to complete the KYC process.

Spot trading fees are good for makers, as they start at 0.08%, while takers pay the standard 0.1%. Futures trading fees are in line with the industry, starting from 0.02% for makers and 0.06% for takers. All fees can drop significantly based on your VIP tier, which is determined by your trading volume and account balance. The more you trade and hold, the higher your level.

Bitunix’s Best Features

- Copy trading: The platform features a copy trading option with numerous filters to help you find top-performing traders. You can also earn a 10% share from your followers if you become a lead trader.

- Fiat crypto purchase: You can purchase crypto with fiat using the P2P trading option, or you can use one of several third-party payment processors and payment methods.

- Dual investment: Bitunix offers a dual investment feature with no trading fees, no slippage, and high returns of up to 344.92%.

7. WEEX — Claim a Daily Check-in and a 30,000 USDT Welcome Bonus

WEEX is one of the rare centralized exchanges that still features a non-KYC crypto exchange mode. In essence, you get to register, deposit, and do some basic trading with just your email. It isn’t much, but it’s more than what most CEXs offer if you don’t complete KYC.

This is a relatively new no-KYC exchange, so it’s no wonder it offers many promotions. New traders can earn up to 30,000 USDT in welcome bonuses, and it’s all done through the Rewards Hub. Bear in mind, though, that most of the promos require KYC verification to be completed beforehand, but you still get a 10 USDT coupon just for adding a recovery phone and email.

The platform is continually expanding its portfolio. According to CoinGecko, WEEX already supports around 800 digital assets and over 900 trading pairs. Spot trading fees are 0.1% for both takers and makers. Futures trading fees, however, are slightly higher than those found on many non-KYC platforms, with takers charged 0.08%.

WEEX’s Best Features

- Futures trading: WEEX focuses on perpetual futures settled in USDT, and offers leverage of up to 200x on select pairs.

- User-friendly interface: The interface WEEX offers is suitable for both beginners and experienced traders. While it follows a standard layout found on most platforms, its clean design makes navigation straightforward, even for first-time users.

- WXT token: WEEX offers a native cryptocurrency, WXT, which you can hold to receive free airdrops every week.

What Is a No-KYC Crypto Exchange?

A no-KYC crypto exchange (or a non-KYC crypto exchange) is a crypto exchange that doesn’t require users to undergo the Know Your Customer (KYC) process. But what exactly is KYC? It’s a standard identity verification procedure used worldwide by financial services to prevent fraud, money laundering, and other illegal activities.

The procedure is used to verify your identity, age, and address. To do that, platforms ask for proof, meaning you need to provide personal documents like a government-issued ID, a utility bill, and often even a selfie to show these documents are indeed yours. Verification is performed through an automated process, where you need to upload images of the relevant documents.

The non-KYC exchange’s system then verifies these images in minutes, hours, or in some cases, days. Once that’s out of the way, you can start trading. As you may imagine, this process can slow down access to the trading platform and may leave users feeling uneasy about sharing their personal and banking information.

While KYC is mandatory for centralized exchanges (CEXs), decentralized exchanges (DEXs) are generally exempt, provided users deal only in crypto. This is why many non-KYC crypto exchanges allow users to use their services without undergoing KYC, as long as they only deposit and trade cryptocurrencies. Our list contains mainly centralized exchanges.

However, due to constantly tightening regulations, many no-KYC exchanges have to place limits on how much you can withdraw, so you’ll still have to undergo KYC if you want to withdraw more than the limits allow.

Exchanges with no KYC whatsoever are rare, and they typically don’t allow the use of fiat.

Potential Advantages of Non-KYC Exchanges

To gain a better understanding of no-KYC exchanges and what they offer, here’s an overview of their main benefits:

- Improved privacy: By not having to provide personal information and documents, you get more privacy on the trading platform. This reduces the risk of sensitive data being exposed or mishandled, and allows traders to maintain greater control over their personal information.

- Anonymous trading: Without undergoing KYC, you can remain anonymous while trading on the platform. Many exchanges let you use a nickname or alias, and that’s all other traders get to see.

- Quicker access to the platform’s features: With just a few basic details needed for registration and the fast processing of crypto deposits, you can start trading on a non-KYC crypto exchange in minutes.

- No hassle of providing documents: For some users, the biggest issue with submitting documents on crypto exchanges isn’t privacy, it’s simply the hassle of the process. They want a quicker experience without unnecessary delays.

- Wider availability: Many no-KYC exchanges, most notably DEXs, can operate internationally and in a greater number of jurisdictions due to fewer regulations. This is why they are generally more broadly available than KYC crypto exchanges.

- More available cryptocurrencies: No-KYC exchanges often offer a wider range of cryptocurrencies since they face fewer regulatory hurdles. This is particularly true for niche tokens and newly launched coins.

How to Buy Crypto Without KYC

Buying crypto on a non-KYC exchange is the same as buying crypto on a regular KYC crypto exchange, except you skip the verification step. This makes the whole process even simpler and faster. Here’s how to do it on Best Wallet:

- Download the wallet: Visit the official Best Wallet website and download the app on your phone. The wallet offers a dedicated app for both Android and iOS devices.

- Set up your wallet: Follow the in-app instructions on how to set up your wallet. There are several steps involved, but the process is simple, and the app tells you exactly what you need to do.

- Buy desired crypto and amount: Once the wallet is ready, visit the Buy section, choose the crypto you wish to purchase, and the fiat currency you want to use. Select one of the available payment methods. Input the amount you’re willing to buy or what you want to spend, and the system will calculate the opposite and the fees. Tap Buy and complete the process.

How to Pick a No-ID Crypto Exchange

When choosing a non-KYC exchange, the key factor is their KYC policy. If the platform truly requires no verification, that’s ideal, but many will have some form of KYC in place. That’s why it’s important to read through the fine print. If you can’t find the info or if it’s not clear enough, don’t hesitate to reach out to customer support.

Next, check if the exchange supports users from your country. If this information isn’t readily available, again, contact customer support for confirmation.

Then, research the platform’s reputation and licensing to ensure it’s safe to use. If you’re still uncertain, consider sticking to a verified exchange like the ones we recommend.

Once that’s done, you can move on to the services it covers and the terms it imposes:

- Check the number of trading crypto pairs it covers and how many different cryptocurrencies you can buy or sell.

- Review the daily trading volume to ensure there’s enough activity so you don’t need to wait too long per trade.

- Look at the trading fees. Since you’re there to buy, check the taker fees for spot and futures trading. The fees are usually 0.1% for spot and 0.05% or 0.06% for futures.

- If you’re going to buy crypto with fiat, check the payment options that are supported and the third-party services used.

- Look into the withdrawal limit placed on user funds for customers who don’t complete the KYC exchange’s requirements.

Are No-KYC Crypto Exchanges Legal?

The legality of these crypto exchanges varies significantly depending on your location, i.e., the jurisdiction you fall into.

Countries that have robust anti-money laundering (AML) regulations tend to place stronger restrictions on crypto exchanges, and some even label no-KYC exchanges illegal. Others allow a tiered KYC approach, but the situation is very fluid in this regard, so it’s important to check where the government in your country currently stands before making a decision.

Regulations vary from country to country, with some having far stricter rules than others. The US is the most obvious culprit here, as it heavily restricts the operation of no-KYC exchanges.

The global trend is to have stricter KYC and AML rules imposed on crypto platforms, so you can expect the number of non-KYC exchanges to dwindle in the future.

Is it Safe to Use Crypto Exchanges Without KYC?

Unfortunately, non-KYC exchanges are generally considered less safe than their counterparts. The problem with this model is that anonymous crypto exchanges easily attract dubious parties who engage in illicit transactions, such as money laundering or tax evasion.

Moreover, non-KYC exchanges might invest fewer funds in security compared to centralized exchanges, since they don’t abide by the same strict rules as other exchanges, even decentralized exchanges. This makes them more prone to cyberattacks. To make things worse, many lack insurance for their users’ funds, so you can even stand to lose crypto in case of a breach.

Even the more reputable non-KYC exchanges carry risks, such as sudden shutdowns and even loss of user funds in certain countries if regulators decide to clamp down on them.

That’s why it’s crucial to stick with reputable and trustworthy sites like the ones recommended on this page. They’ve been tried, tested, and vetted by our experts, allowing you to move forward with confidence.

Conclusion

No-KYC crypto exchanges offer many benefits. They let you trade without completing the time-consuming KYC verification process, meaning you get to start more quickly. They offer enhanced privacy, as you’re anonymous while trading crypto assets, and even the fees might be lower compared to KYC exchanges.

Unfortunately, the number of platforms is decreasing, and many are reducing the scope of services that can be used without KYC verification. The exchanges on this list are among the few reputable options that still allow trading digital assets, at least to some extent, without completing KYC. Among our selection of the best no-KYC crypto exchanges, our top no-KYC exchange option is Best Wallet, but it’s important to weigh each exchange’s benefits carefully and choose the one that best fits your needs.

References

- KYC in Crypto: What is It & Why It’s Important (SEON)

- Crypto exchange OKX latest target of DOJ, hit with $505M penalty over AML, KYC failures (Compliance Week)

- What is AML and KYC for Crypto? (Chainalysis)

- KYC in Crypto Requirements for 2025 (KYC Hub)