Join Our Telegram channel to stay up to date on breaking news coverage

Economists at global investment bank JPMorgan shed some light on global viewpoints they look forward to unraveling in 2023 and 2024. According to them, the probability of United States sliding into a recession exceeds the possibility of avoiding one.

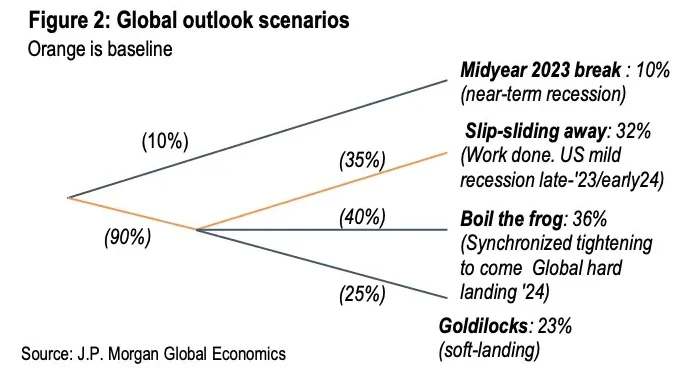

A statement by Business Insider explains that the investment bank presented four probable global outlook scenarios in which the “boil the frog” recession emerged as the justifiable outcome.

What is ‘Boil The Frog’ Recession?

Boiling the frog is a phrase commonly used to describe a situation where people fail to act on a potential problem until it gets more severe and eventually bubbles over. The firm said that it is the most likely outcome underlining that a recession is likely to happen.

The outcome – to which the economists assigned a 36% probability – involves the US toppling into recession just like the rest of the global economy. Aggressive monetary tightening policies in response to inflation, which JPMorgan expects to stay persistently elevated, is the chief catalyst to this hitch.

“The Central bank aspirations for a soft landing have tempered the pace of tightening. However, hopes for a painless slide in inflation back to target are likely to be dashed, requiring policy to turn sufficiently restrictive to break the back of the expansion,” the analysts explained. “Broad-based developed-market tightening points to a more synchronized global downturn sometime in 2024.”

“Slip-sliding away” recession, which the economists think has a 32% chance of happening, is the second most-likely outcome. It involves a mild US recession from late 2023 to early 2024, as a continuation of the ongoing credit crunch pushes the US into a downturn while other economies worldwide remain resilient.

For now, JPMorgan says the US has a 23% chance of a Goldilocks soft-landing scenario, where the economy avoids a recession altogether. It also perceives a 10% chance the US will slip into an immediate economic downturn in mid-2023.

Consumers Forced To Eat Sparingly

Lately, the founder of Alden Investment Strategy, Lyn Alden, stipulated on Twitter how retail sales were getting pretty recessionarily low. It is an emblem that consumers have started to cut back on their spending to accomodate with the unbearable economic times.

1️⃣ @LynAldenContact points to a possible slowdown in the US economy. Alden notes that retail sales have been declining in recent months, and that this could be a sign that consumers are starting to pull back on their spending. https://t.co/h4H89TREjP

— Crypto Koryo (@CryptoKoryo) May 23, 2023

For the past year, experts have been flagging the risk of a recession as inflation nudged a 41-year-high prompting the Federal Reserve to raise interest rates to control economic growth.

Economist Steve Hanke termed the situation an “ugly” recession, while gold bug Peter Schiff, his counterpart, anticipates a “massive” recession and a severe financial crisis.

In addition, Bloomberg’s Intelligence senior commodity strategist, Mike Glone, believes the US economy is on a path toward a “severe deflationary recession.” However, Blackrock CEO Larry Fink does not foresee a significant US recession this year.

Federal officials have warned that the rates could soar. Moreover, 74% of market participants foresee a rate-rise of another 25 basis points in July, thus lifting the Fed funds target range to 5.25-5.55%.

IMF Raises Red Flags Over Severe Financial System Turmoil

On the other hand, the International Monetary Fund (IMF) slightly trimmed its 2023 global growth outlook and warned that severe financial system turmoil could slash output to recessionary levels.

According to Financial Asset News, the World Bank and IMF are on a bid to benchmark the recent increase in financial market volatility since the fog around the world economic outlook has thickened.

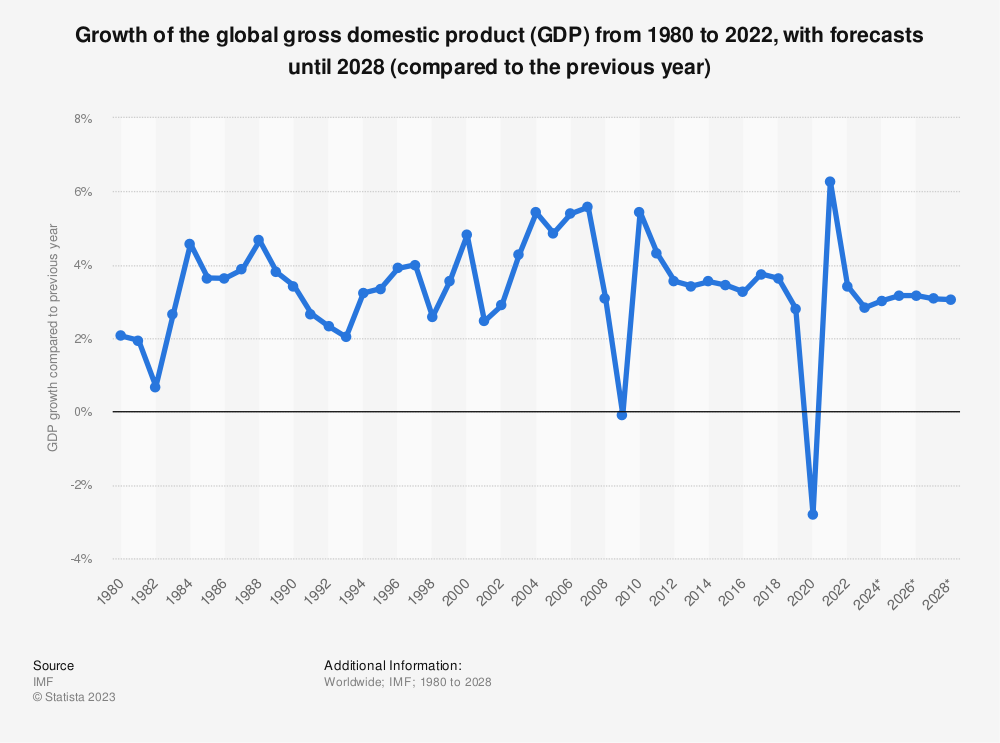

The IMF predicts global real GDP growth rate to be 2.8% in 2023 and 3.0% in 2024, a slowdown from 3.4% in 2022 due to tighter monetary policy. The forecasts for 2023 and 2024 were down by 0.2% due to weaker performances in some larger economies, with expectations of further monetary tightening to fight inflation.

According to Pierre Oliver Gourinchas, the chief economist at the IMF, monetary policy needs to focus on price stability to keep inflation expectations in check. In a Reuters interview, Gourinchas explained how central banks should not halt their fight against inflation because of financial stability risks, which look very contained.

Meanwhile, a recession in the United States would be an uncalled-for burden to the cryptocurrency market, which has just started to recover from a one-and-a-half-year downturn. Bitcoin’s climb to a 12-month high slightly above $31,000 is testament to the improving macro environment.

Market watchers fear that any sudden change in the current conditions could lead to another pullback. A recession would, therefore, exert even greater pressure on a market that has had to endure several battering’s recently, including a crackdown on US-based crypto entities by the Securities and Exchange Commission (SEC).

Related Articles

- Zimbabwe’s Gold-Backed Digital Token: Insufficient to Address Country’s Currency Challenges, Experts Explain

- Kraken’s Director, Dan Held, Estimates Bitcoin Worth $100K

- Chinese Authorities Seize $4.2 Billion Laundered Funds from PlusToken

Join Our Telegram channel to stay up to date on breaking news coverage