Join Our Telegram channel to stay up to date on breaking news coverage

Custodia Bank’s recent legal win against the Federal Reserve has brought renewed optimism, challenging the authority and delay in their “master account” application.

Custodia Bank’s Legal Victory Sparks Hope in Battle Against Federal Reserve

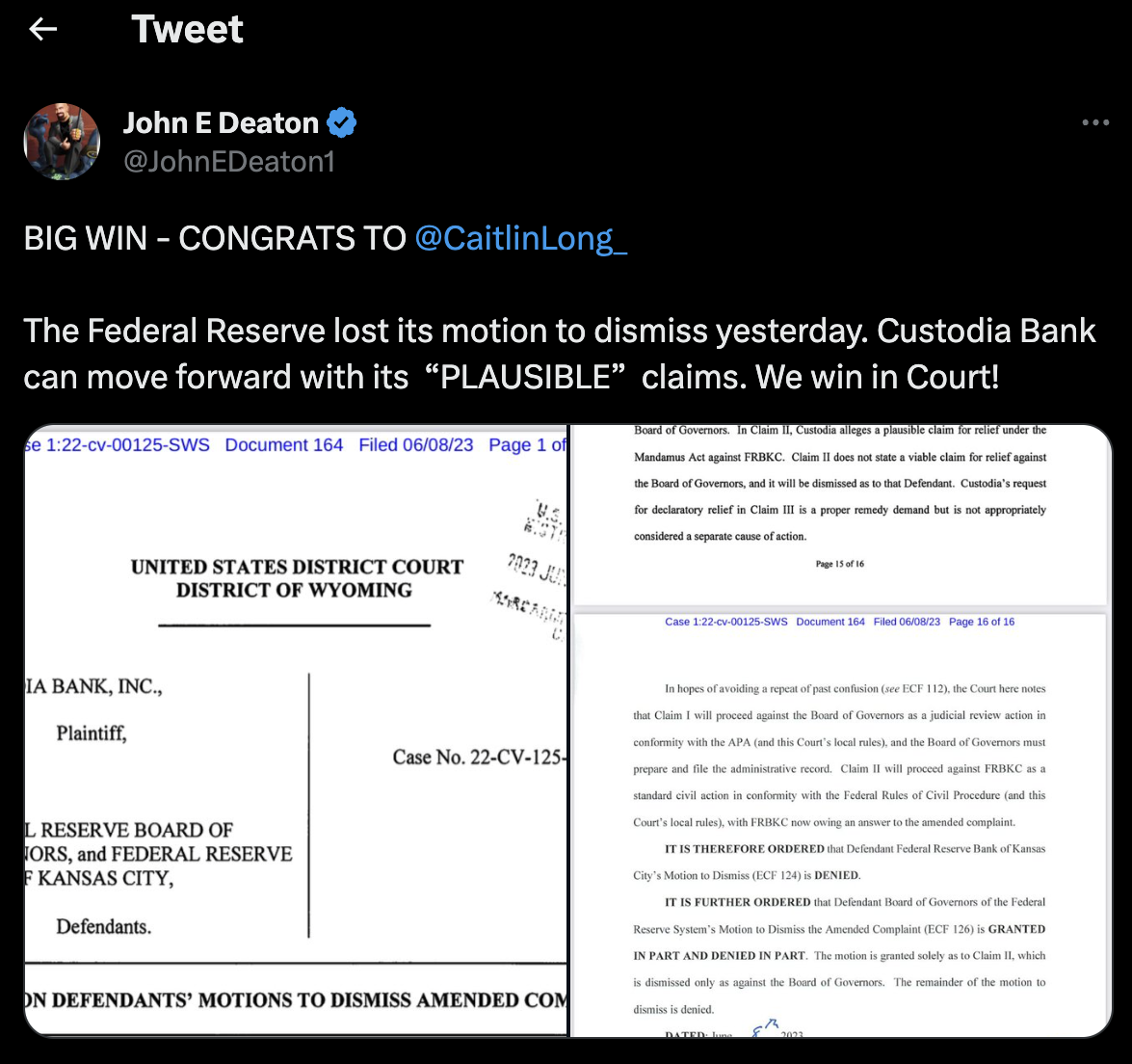

The Bank achieved a big win in its legal fight with the Federal Reserve. A Wyoming Federal Judge ruled against the Federal Reserve’s attempt to dismiss Custodia Bank’s lawsuit, giving the bank renewed hope for their battle against the institution.

Custodia Bank, founded in 2020 by Caitlin Long, seeks to connect digital assets with the US dollar system.

In a lawsuit filed in June 2022, Custodia accused the Federal Reserve of unlawfully delaying its application for a crucial “master account,” which is necessary for the bank to operate effectively within the U.S. financial system.

In January, the crypto bank revised its complaint, now questioning whether the Federal Reserve has the authority to obstruct Custodia’s acquisition of a master account.

The representative from Custodia Bank shared their perspective. They highlighted that the Federal Reserve has allegedly reinterpreted federal law to bestow upon itself unique authority without any explicit mandate from Congress. They expressed anticipation for the court’s scrutiny of the Federal Reserve’s exercise of power in this regard.

While Custodia Bank holds authorization as a Special Purpose Depository Institution (SPDI) under Wyoming law, it still needs a master account from the Federal Reserve to utilize its banking capabilities.

This master account would grant Custodia access to the Fedwire network, which facilitated more than 200 million transfers totaling over $1 quadrillion in 2022.

After submitting its master account application to the Federal Reserve Bank of Kansas City in October 2020, Custodia Bank asserts that it has yet to receive any response. This lack of communication has resulted in delays in development and an atmosphere of uncertainty for the bank.

Custodia Bank has expressed concerns about what it perceives as the Federal Reserve’s overstepping its authority.

The Fed has never held such authority in US history

The bank’s spokesperson stated:

The Fed has never held such authority in US history, nor does it need the discretion to block banks that already have been validly chartered by state banking authorities that rigorously separate the wheat from the chaff. Indeed, the Wyoming Division of Banking rejected more than 150 prospective applicants before Custodia received its bank charter.”

As a result of the prolonged processing of the master account application, Custodia has encountered obstacles in entering the financial services market. Consequently, the bank has sought collaboration with a correspondent bank that already holds a master account.

The recent ruling from the Wyoming Federal Judge indicates that the court might soon address the issue of whether the Federal Reserve properly dealt with Custodia’s application.

Twitter Reaction – Attorney Deaton Highlights Significance of Custodia Bank Lawsuit Amidst Ripple and Coinbase Legal Battles

In response to the latest outcome of the case, Attorney Deaton expressed the significance of the lawsuit. He suggested that it might be one of the most important cases currently. However, some questioned why Deaton considered the Custodia Bank lawsuit as such, given the ongoing legal battles involving Ripple and Coinbase.

Addressing this inquiry, attorney Deaton explained that all legal battles involving crypto companies like Ripple and Coinbase hold importance. But he emphasized that many crypto enthusiasts may not fully comprehend the significance of the Custodia Bank lawsuit.

According to Deaton, crypto companies require banking services for seamless onboarding and offboarding of funds. He mentioned the recent phenomenon of Chokepoint 2.0. It reportedly led to the collapse of financial institutions like Silicon Valley Bank (SVB) and Signature Bank.

Deaton also highlighted the regulators’ efforts to impede the crypto industry by instructing traditional financial institutions to cease providing services to crypto-related businesses.

Custodia Bank, with its unique concept, aims to counter these restrictive measures imposed on crypto businesses. It utilizes fractional banking while maintaining 100% reserves, which eliminates concerns about a bank run. It also ensures the availability of funds and assets at any given moment.

Related Articles

- Best Crypto Staking Platforms

- No More Banking for Binance.US after SEC Lawsuit

- Asset Freeze Bombshell: SEC Takes Aggressive Stand Against Binance.US

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage