Join Our Telegram channel to stay up to date on breaking news coverage

As if Binance’s days couldn’t get any darker, reports have just arrived that Binance.US will be cut off from the banking system due to the SEC lawsuit.

Binance.US is the US variant of Binance, offering crypto trading and staking services. In light of the recent allegations by the SEC, Binance has been under intense scrutiny. Binance.US’s removal from the banking system is one of the results.

Banks Signals Intent to Pause US Dollar Fiat on Binance

From June 13th, Binance.US would no longer be able to support US dollar fiat. A customer revealed in his tweet of an email, which stated that banks seek to cut off ties from Binance.US. The company said that this would impede its ability to process US fiat deposits and US fiat withdrawals.

It’s not all bad news, however, as the company said that it still maintains 1:1 reserves of all its customer’s assets.

Binance.US has announced that it is “suspending all USD deposits and recurring buy orders from now on”. The company has continued that it will transform into a crypto-only exchange.

Binance.US Becomes Victim of Lawsuit Monday

Monday saw the Security Exchange Commission suing the biggest names in crypto. Along with Binance, it also sued Coinbase. And both companies have been sued for more or less the same reasons.

SEC vs Coinbase

With Coinbase, SEC claims that it has “defied the regulatory structures and evades the disclosure agreements that Confress and the SEC have constructed for consumer protection.” Coinbase has rebutted these claims, saying the SEC is taking an enforcement-only approach to go against crypto.

This clash is noteworthy as there was a time when SEC and Coinbase were on OK terms once. And the latest lawsuit feels like a counter-suit against Coinbase as Coinbase sued it in April of this year to get some answers about legalizing crypto securities.

SEC vs Binance

SEC’s rally against Binance is stronger. The Exchange has alleged that the company’s CEO, Changpeng Zhao, secretly sent billions of dollars worth of customers’ money to other companies that he controls. But these are not the end of the charges.

Binance is facing 13 civil charges in total. One of them says that Binance and BAM, its linked entity, have been operating unregistered securities. Many say that Gary Gensler has been looking for a smoking gun, and they found one in a text message from Binance’s former chief compliance officer that read, “We are operating as a f****** unlicensed securities exchange in the USA, bro”.

The SEC has said that it is trying to freeze Binance.US’s assets to protect the customers. Part of that includes the repatriation of clients’ investments abroad.

Binance has obviously denied all of these charges, saying that SEC’s allegations have no ground to stand on. “We will continue to defend ourselves vigorously,” – said the company.

BNB Suffers Due to Binance’s Latest Woes

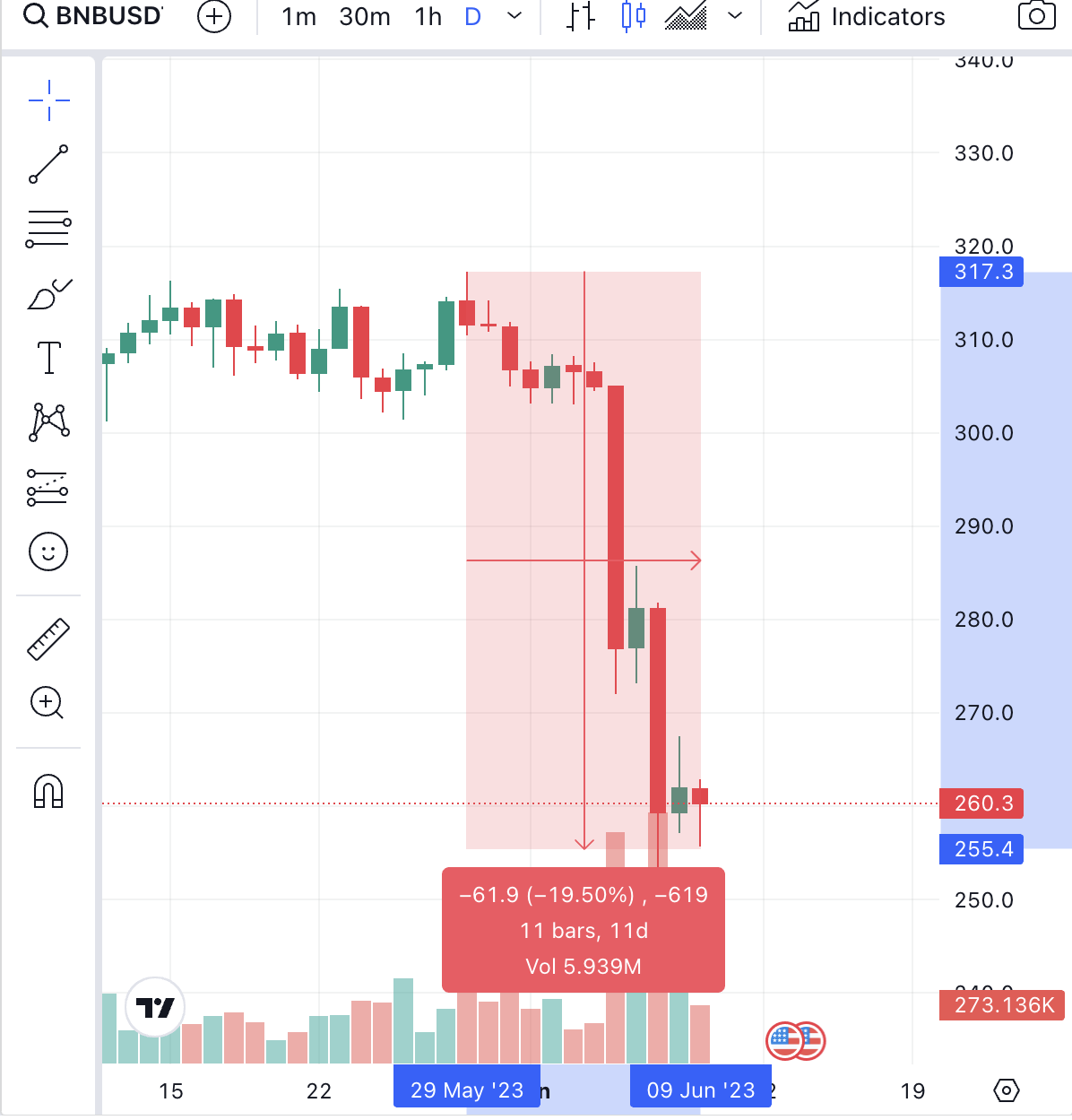

BNB has taken a severe downtrend ever since the news of the latest scrutiny of Binance emerged. The candle chart shows that people are rapidly moving in to cut their losses and sell their BNB holdings.

Since 28 May 2023, the BNB price has taken a fall of 19%. While there are momentary green candles forming, they are not enough to go against the sell-offs.

However, the RSI of 38 shows that FUD regarding Binance is currently driving the BNB market. While there is a possibility for the trend to reverse, market watchers remain uncertain.

Conclusion

SEC’s recent battle against major cryptocurrency exchanges means that the exchange isn’t satisfied with the current state of crypto. Or, it could be the case that it is desperate to pigeonhole crypto assets as securities as soon as possible. Whatever the case may be, this legal battle could potentially have long-term ramifications for the entire crypto space.

Related

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage