Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) is currently stabilizing around the $108,000 level, reflecting a broader pause in the digital asset market. Most cryptocurrencies are trading within narrow ranges, showing limited volatility. However, a few altcoins are defying the trend, making noticeable gains and drawing increased investor interest.

Though prices for many assets remain below recent peaks, the uptick in trading volumes and renewed activity around key technical levels suggest a potential shift in market sentiment. With momentum possibly building, now is a crucial time to assess the best crypto to invest in right now.

Best Crypto to Invest in Right Now

This article analyzes crypto assets with massive growth potential, including Bittensor, IOTA, and Raydium. TAO is currently trading at $446.42, marking a modest intraday rise of 0.45%. Meanwhile, SUBBED has surpassed a $5 million market cap milestone, with its token now valued at $0.0555.

1. Bittensor (TAO)

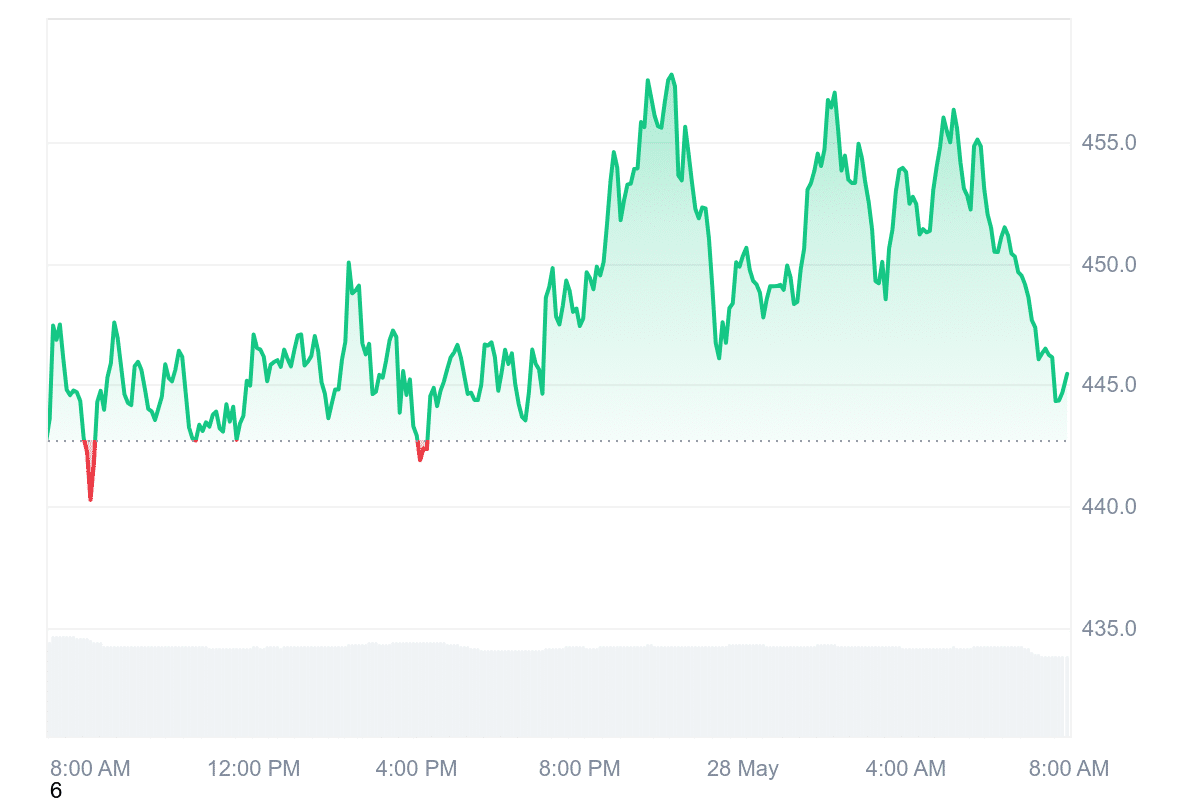

Bittensor (TAO) has shown signs of renewed strength, with its token price climbing above $450 on Monday. The recovery coincides with broader market optimism, partially driven by geopolitical developments. A recent decision by U.S. President Donald Trump to delay a 50% tariff increase on European Union imports until July 9 appears to have buoyed investor sentiment across the crypto sector.

TAO now trades at $446.42, reflecting a slight intraday increase of 0.45%. Further, the token maintains a strong technical position. It’s currently priced 268.45% above its 200-day simple moving average (SMA), which sits at $122.07.

The Relative Strength Index (RSI), a common momentum gauge, is below 60. This placement typically indicates that the asset isn’t overbought and may still have room for upward movement.

Bittensor has experienced 15 positive trading days in the last month. That level of consistency points to a relatively balanced trading pattern. Its 24-hour trading volume to market cap ratio stands at 0.0649, indicating decent liquidity for a token of its size. This ratio helps assess how actively a token is being traded relative to its total value in circulation.

Market sentiment toward TAO appears bullish, and the Fear & Greed Index sits at 71, signaling a state of “Greed.” While not extreme, this level suggests that investors are generally optimistic.

2. Ethereum Classic (ETC)

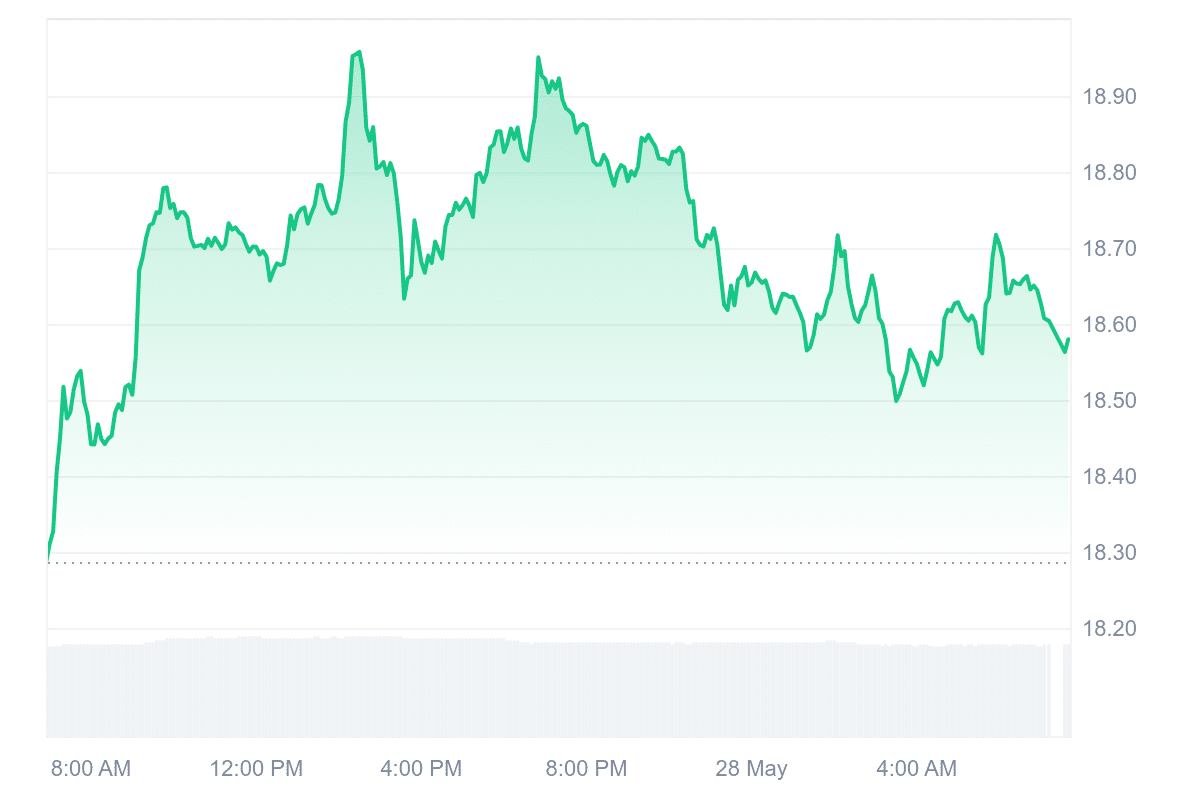

Ethereum Classic (ETC) is showing moderate gains this Tuesday, trading 1.00% higher at $18.62. The movement aligns with broader momentum in the cryptocurrency market, driven by rising interest in digital assets as institutional involvement continues to deepen.

ETC emerged in 2016 after a major security breach led to a controversial split from Ethereum. While Ethereum chose to reverse the effects of the hack, Ethereum Classic preserved the original blockchain, favoring immutability. It operates as an open-source, decentralized platform that enables smart contracts, which are self-executing agreements coded directly onto the blockchain.

Investor sentiment toward ETC remains neutral, despite its recent uptick. This suggests that while the price has moved upward, broader market participants are not yet showing strong directional conviction. Meanwhile, the Fear & Greed Index stands at 71, placing the market in the “Greed” zone, typically a sign of heightened risk appetite among traders.

The token’s 24-hour volume-to-market cap ratio is 0.1595, indicating relatively high liquidity. As Bitcoin reaches new all-time highs and alternative digital assets receive increased traction, Ethereum Classic is drawing attention from investors seeking lower-cost.

3. SUBBD (SUBBD)

As the digital creator economy matures, platforms that prioritize practical innovation over hype are gaining momentum. SUBBD positions itself in this evolving sector by tackling a critical issue for creators: discoverability.

Many online platforms rely heavily on algorithms that favor established names, leaving new or niche creators struggling to get noticed. SUBBD addresses this with AI-powered tools designed to increase visibility and streamline workflows.

One notable feature is the integration of OpenAI’s Whisper, a speech recognition system that transcribes audio content into text. This transcription becomes searchable metadata, enhancing search engine optimization (SEO) and making content more accessible to users with hearing impairments.

The concept appears to resonate with the community. In the days following the platform’s launch, SUBBD attracted over $1 million in capital. This early traction suggests that users see value in tools that not only support content creation but also simplify the process of launching and monetizing digital assets through blockchain technology.

$SUBBD Presale Hits $500k!

Embracing the future of AI Agent content creation…https://t.co/dLCKejpxpp pic.twitter.com/AFeslybq8A

— SUBBD (@SUBBDofficial) May 24, 2025

At the core of the platform is SUBBD, its native token. It serves multiple functions, including enabling payments and unlocking premium tools. More importantly, it gives creators greater autonomy over their income.

The project’s ongoing ICO has raised over $540,000, with each token priced at $0.055525, with two days remaining until a scheduled price increase.

4. IOTA (IOTA)

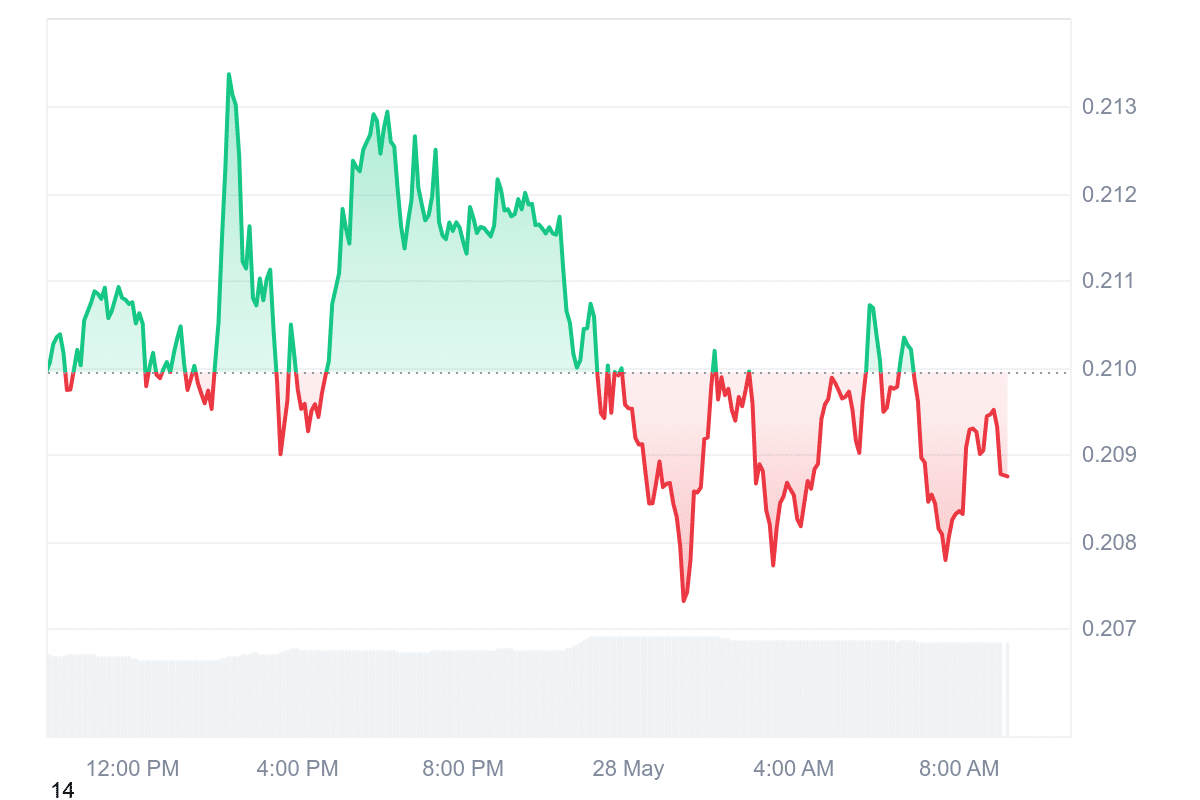

IOTA currently trades at $0.2087, showing a modest 0.50% decrease over the past 24 hours. The market sentiment appears neutral, supported by a Relative Strength Index (RSI) of 56.08. This suggests IOTA is not currently overbought or oversold, implying potential for sideways price movement in the near term.

Over the last month, IOTA has recorded 15 consecutive green days, indicating some consistency in buyer interest. The token also trades 8.85% above its 200-day simple moving average (SMA), currently at $0.191795. This is a generally positive sign, as prices above the long-term average can reflect an uptrend or increased investor confidence.

Its liquidity, measured by the 24-hour trading volume relative to market capitalization, stands at 0.0310. This ratio suggests that while trading activity exists, it’s not unusually high. The current Fear & Greed Index reading is 71, categorized as “Greed.” This sentiment gauge reflects market participants showing a stronger appetite for risk, although such conditions can sometimes precede corrections.

As an open-source protocol, IOTA provides tools for individuals, enterprises, and institutions to interact with Web3 ecosystems. Its design aims to support secure data exchange and value transfer without fees, which distinguishes it from many other cryptocurrencies.

5. Raydium (RAY)

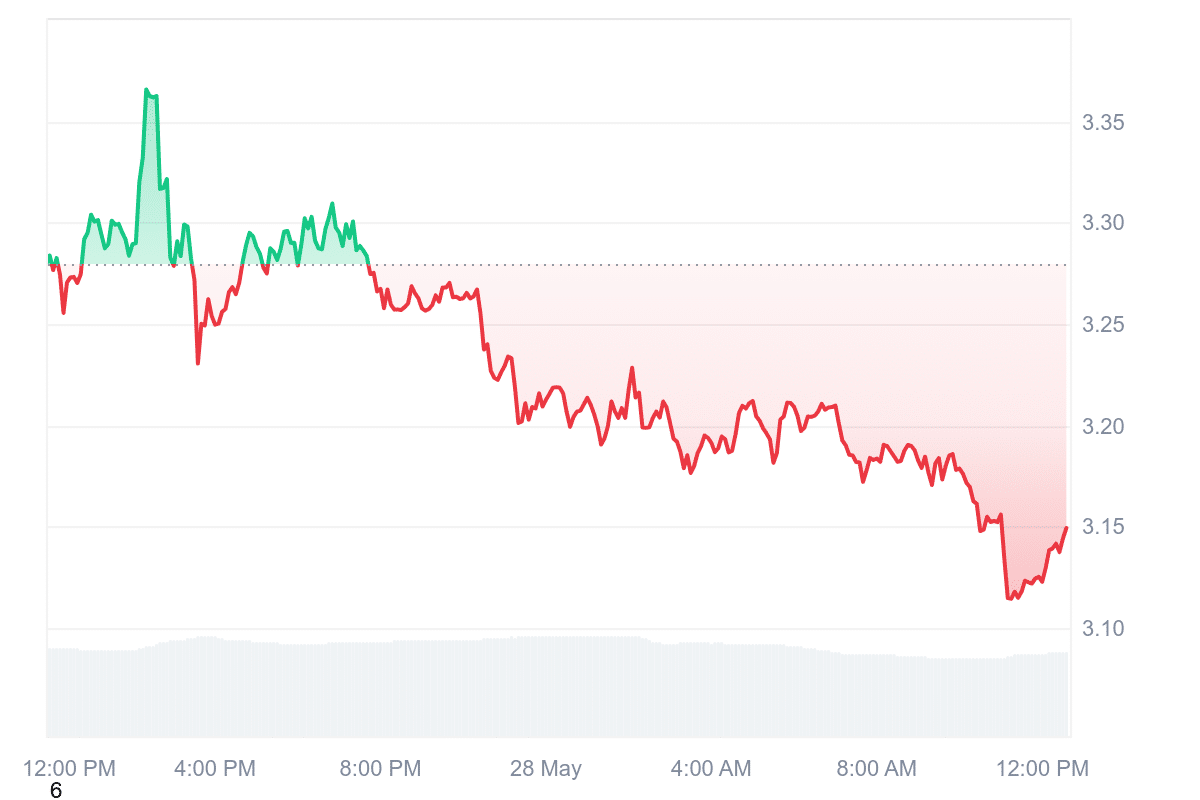

Raydium, currently trading at $3.14, has experienced a slight price decline of 3.77% intraday. Despite this dip, sentiment surrounding the asset remains bullish. Market indicators suggest a mix of stability and cautious optimism, with the Fear & Greed Index registering at 71, indicating prevailing greed among investors.

The platform posted a 24-hour trading volume of $49.6 million, a 4.22% decrease from the previous day. With a volume-to-market cap ratio of 0.0681, Raydium demonstrates relatively high liquidity. This metric suggests that the token is actively traded in proportion to its total market value, which typically implies healthier price discovery and ease of entering or exiting positions.

From a technical standpoint, Raydium’s 14-day Relative Strength Index (RSI) stands at 66.69. While nearing the overbought threshold of 70, it remains within the “neutral” zone. This suggests that the price may consolidate or move sideways in the short term, barring any major market shifts. The token’s 30-day volatility is measured at 10%, indicating a period of relatively low price fluctuation.

Time to accelerate and unlock DeFi for RWAs.

We are excited to welcome Centrifuge to Solana. pic.twitter.com/pXVDh7GXBE

— Raydium (@RaydiumProtocol) May 22, 2025

Within the Solana DEX ecosystem, Raydium has grown into a dominant force, accounting for more than half of the trading volume. It has also conducted over $180 million in token buybacks, signaling strong platform activity and community engagement. This level of dominance enhances Raydium’s influence on decentralized finance (DeFi) trends within the Solana network.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage