Join Our Telegram channel to stay up to date on breaking news coverage

With more than 80% of the vote, a temperature-checking vote recommending the deployment of Uniswap v3 over BNB Chain was approved. This is true despite community objections to shifting the decentralized exchange system (DEX) toward a platform with a higher degree of centralization.

The vote garnered “the greatest quantity [of participating wallets] throughout the entire Uniswap Governance History,” with only 0.1% of voting wallets accounting for 99% of either the 24.9 million votes, but Uniswap may also be experiencing centralization issues.

Only five blockchains—Ethereum, Polygon, Arbitrum, Optimism, as well as Celo—are participating in Uniswap’s v3 protocol, with 90% of its entire value locked on Ethereum (TVL). Compared to Curve (12) and Sushi, two popular DEXs, this is more traditional (23).

The proposal, promoted by Plasma Finance, might challenge the $2.45 bn TVL of Pancake Swap, the top exchange on the BNB Chain, which is a fork of Uniswap’s more straightforward v2.

How BNB Chain can Help Uniswap Reach New Heights

One of the most often forked protocols is Uniswap v2, with SushiSwap’s infamous “vampire assault” depleting a significant amount of Uniswap’s TVL earlier in 2020. In April 2021, Uniswap introduced version 3 under a two-business license to fight this. The v3 code would become open-source upon expiration and is likely to fork on several blockchains.

Before the fork, Plasma Finance, which runs on Uniswap v3 and has its own responsive liquidity management system, Quadrat, is eager to build v3 TVL on the retail-friendly BNB Chain.

Furthermore, it would also result in the most well-known DEX for Ethereum migrating to a more centralized setting. When it suspended the whole network in reaction to a breach back in October, BNB Chain showed just how far it is from the principles of immutability and decentralization in the cryptosphere.

Uniswap Votes: What Does It Mean for Crypto Investors?

BNB Chain (formerly Binance Smart Chain) is popular among so-called “retail” investors, particularly during the height of the bull market, during which they were pushed out of Ethereum. This is due to its fast speeds and low costs. Although v3 may benefit traders, it isn’t retail-friendly in terms of supplying liquidity.

Liquidity providers can define a price range within which they’re prepared to assist trade using Uniswap v3. To continue to be lucrative, they should be updated when prices diverge. Since more experienced traders arbitrage price discrepancies, many market participants simply stick to idle LPing (as in v2), which ends up being a losing game since they gain less in trading costs than they incur in so-called transitory losses.

In response, Uniswap provided its study, which demonstrated passive LPs do indeed generate profits. However, it turned out that the inquiry was incorrect.

A protocol’s degree of decentralization depends on the blockchain it is based on. And throughout the past year, several examples of the dangers of centralized cryptosystems have been shown.

Uniswap customers’ assets on the BNB Network won’t be supported by the same decentralization guarantees, even though governance is expected to remain on Ethereum for the time being.

Given its potential prominence as one of the leading instances of decentralization in the industry, this makes the seeming desire for relocation appear a little strange.

80% of respondents to a Uniswap poll support the move of decentralized cryptocurrency exchanges to BNB Chain

About 80% of UNI token owners participated in a “temperature check” to see whether the Uniswap community supported moving the decentralized exchange’s V3 system to BNB Chain.

Around 20 million tokens were cast in support of the change as of Sunday night, when voting on the Plasma Labs-sponsored initiative came to a close. According to a tweet from Plasma, “Our proposal to install Uniswap v3 over the BNB Network has passed the “Temperature Check” with 20 million “yes” votes and 6,495 $UNI participants (the most number in the history of Uniswap Governance).

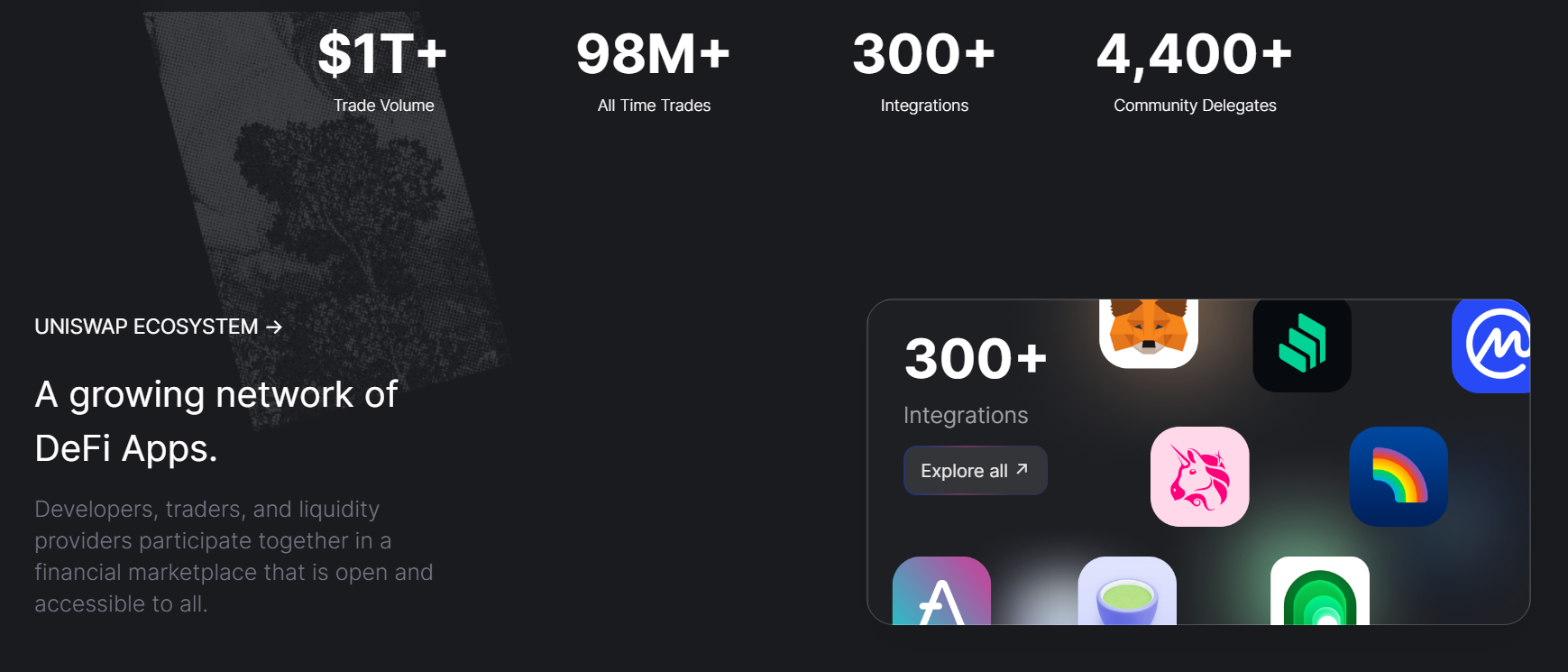

Smart contracts are used by Uniswap and other decentralized exchanges (DEXs) to match deals and provide liquidity between traders. According to DeFiLlama, it secures over $3.4 billion in different tokens spanning five blockchains, including V3, which controls $2.6 billion of that total.

According to Plasma, who claims that the move is justified, BNB Chain, a public ledger closely associated with the centralized crypto trading platform Binance, has a huge and expanding user base, offering a potential new industry in addition to high transfer speeds and low fees, attempting to make it a suitable forum for Uniswap’s DEX services.

Developers stated in that request that “deploying on BNB Chain might assist Uniswap to leverage the rising demand for DeFi there in the Binance ecosystem.” “BNB Chain offers distinctive features like staking and cross-chain compatibility that might improve the functioning of Uniswap v3.”

A transition to BNB Chain might, among other advantages, bring in “1-2 million new users” and at least $1 billion more in liquidity through the BNB Chain ecosystem.

In the upcoming weeks, it is anticipated that Plasma will release a formal proposal explaining the change.

To implement the V3 protocol, Uniswap holders switch to the BNB PoS chain rather than Ethereum

Deploying the third iteration of the decentralized marketplace (DEX) system on BNB Chain, an adversary of the Ethereum network, is a decision made by holders of Uniswap (UNI).

The Uniswap team conducted a “temperature check” poll following the debate on the administration forum to see whether the community supports the plan. 20% of the votes were against the update, while the remaining 80% were in support of the deployment.

To better serve all customers in the Web3 environment, the ConsenSys executive added that the company thinks Uniswap must be “chain agnostic.”

The Plasma Finance team predicts that it might take between 5 and 7 weeks to deploy the required smart contracts on the BNB Chain after the governance proposal has been approved.

The BNB chain outran the Ethereum blockchain in terms of distinctive addresses on December 22. According to BSC Scan statistics, there are 233 million unique addresses on the blockchain, which is more than Ethereum’s 217 million. Although the chain claims to be “the largest layer 1 blockchain,” the figures are still a very small fraction of the 1 billion unique addresses on the Bitcoin network.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage