Join Our Telegram channel to stay up to date on breaking news coverage

The Sandbox price is trading with a bearish bias at $0.7995, down 11.85% in the past 24 hours, making it the fourth biggest loser on Thursday. SAND has a 24-hour trading volume of $641.79 million at press time, which has declined 24.67% on the day. With a live market cap of $1.2 billion, the Sandbox is at #44, according to CoinMarketCap ranking.

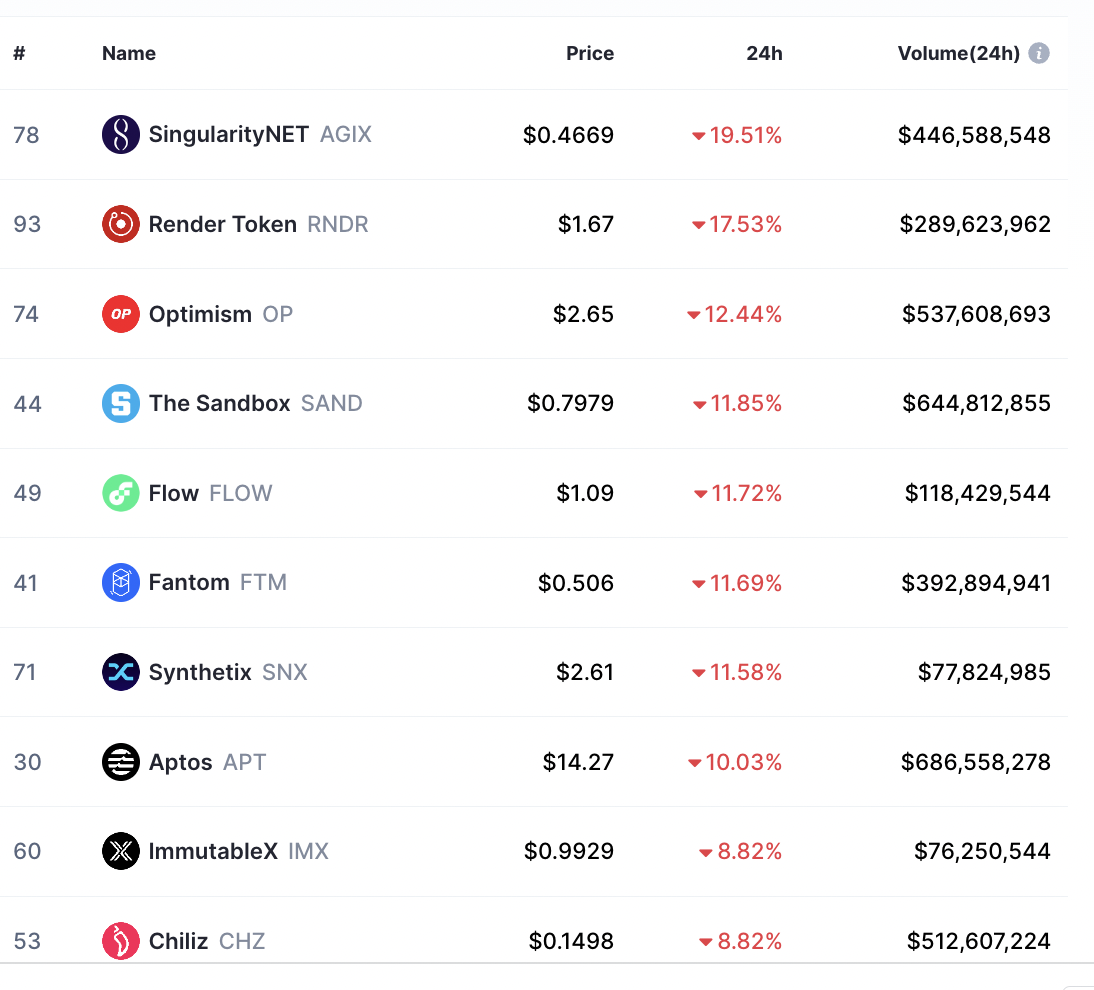

Other cryptos leading the declines on Thursday are SingularityNET (AGIX) which was the largest loser with 19.51% losses in the last 24 hours, followed by the Render Token (RNDR) and Optimism (OP) which were down 17.53% and 12.44% respectively. Flow (FLOW) came in fifth with 11.72% declines over the same time frame.

Top Crypto Losers February 9

These altcoins were following a marketwide decline led by the big crypto Bitcoin, down 2.22% on the day to trade at $22,696. The now proof-of-stake (PoS) token Ether was trading at $1,633, after dropping 2.25% in the last 24 hours.

Despite the ongoing market correction, the SandBox price still appeared strong with more room for the upside. However, bulls needed to overcome the roadblock at $0.84 to secure a sustained recovery.

The Sandbox Price Upside May Be Capped At $0.84

SAND is up more than 54% in the past 30 days with 32% of these gains being recorded on February 7. This followed the news that the Metaverse crypto company had partnered with the Saudi Arabia Digital Government Authority (DGA), signing an MoU that allows both entities to share and engage in benefiting from the Metaverse and the underlying technology.

Despite these positive fundamentals, the Sandbox price is still 90% below its $8.49 all-time high (ATH) reached on November 28, 2021.

The Moving Average Convergence Divergence (MACD) indicator had just sent a call to buy SAND. This happened on February 8 when the 12-day Exponential Moving Average (EMA) crossed above the 26-day EMA, indicating strength amongst the buyers. The moving averages had also presented a bullish cross when the 50-day Simple Moving Average (SMA) (yellow line) crossed above the 100-day SMA (red), an indication that the uptrend was strong.

Despite this bullish outlook from the technical indicators, the token was trading in a second straight bearish session with the Relative Strength Index (RSI), though in the positive region, was facing down. This indicated that the bears were taking control of the market and were determined to frustrate the uptrend.

SAND/USD Daily Chart

Even if the price could turn up from the current levels, it would be met by aggressive selling from the $0.817 and $0.867 supplier congestion zone. Note that the price was turned down from this level in November after the FTX fiasco sell-off sent SAND tumbling 62% to the $0.37 swing low.

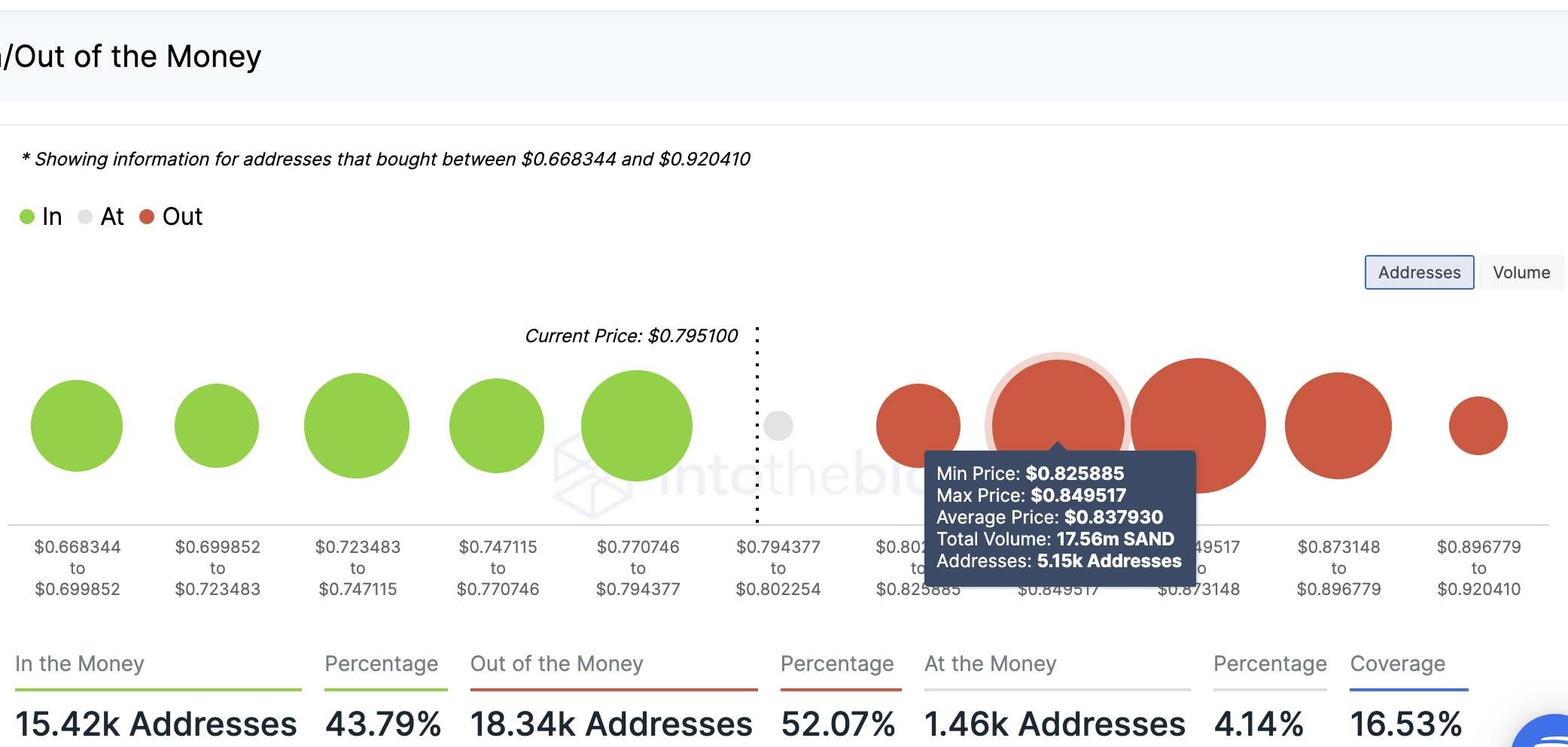

The stiffness of this barrier was corroborated by on-chain metrics from IntoTheBlocks In/Out of the Money Around Price (IOMAP) model. According to the IOMAP chart below, this area is around the $0.84 resistance level where 17.56 million SAND were previously bought by approximately 5150 addresses.

SAND IOMAP Chart

Any attempt to push the price above this level could be met by immense selling from this cohort of investors who may want to break even. As such, though SAND looks strong, its upside is capped around the $0.84 region, for the short term.

On the downside, the ongoing correction may extend the losses producing a daily candlestick close below the 200-day SMA sitting at $0.7936 with the first line of defense emerging from the $0.7013 support level. A drop further could see the Sandbox price revisit the $0.6119 foothold, where the 50-day and 100-day SMAs appeared to converge. Market participants could expect bulls to take a breather here before initiating another recovery.

Alternatives To SAND

Besides the Sandbox, there are other projects in the Metaverse with the potential to explode in 2023 with promising returns for early investors. One such project is RobotEra, a platform that lets you be transported to the planet of Taro and converted into a robot. The robotic armies fought a devastating battle against the natives, destroying their land. The robots’ victory came at a high cost to Earth, and the players must use every available resource to help reconstruct the world.

The native token of the network, TARO, is currently in what is “already dubbed as one of the hottest presales of 2023” with over $837,000 raised so far.

History is being made! 🌍#Indonesia is launching the world's first government-backed #cryptoexchange

Get ready for a revolution in digital currency!$TARO is already dubbed as one of the hottest presales of 2023 🔥

Learn more ⬇️https://t.co/BAR0I5LNtV#P2Egaming #Presale

— RobotEra (@robotera_io) February 7, 2023

Visit RobotEra to find out more about how to participate in the ongoing presale.

More News

- Bloktopia Metaverse Crypto Pumping New Land BLOK NFTs – RobotEra Presale Stronger Potential?

- The Graph GRT Crypto Price Prediction 2023 – Will GRT Pump Further?

- How to Buy Cryptocurrencies

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage