Join Our Telegram channel to stay up to date on breaking news coverage

Binance is allowing its clients to earn interest from staking on the Terra Virtua platform. Participants able to earn a maximum of 47.67% annual percentage yield (APY).

The staking event for the Terra Virtua NFT platform, which is aimed at artists, collectors and gamers, began on 6 May. Early stakers will fill the first spots.

Interest payments will be made daily, with the calculation period beginning at 0.00 UCT each day.

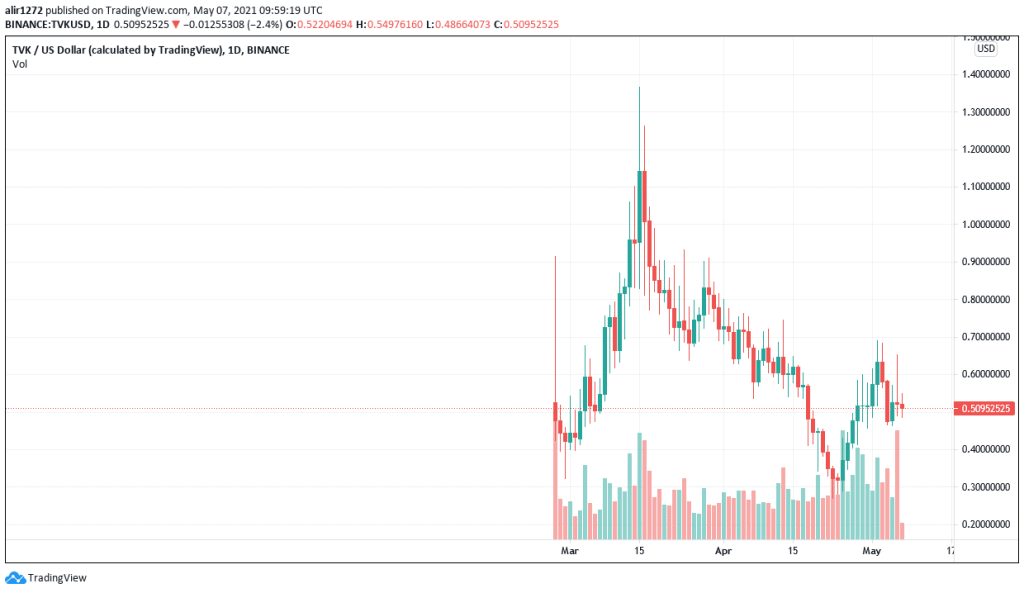

The official announcement from Binance had a visual representation showing staking activity and the standard annual rates users will earn.

Binance will offer several staking products with various periods and APYs related to the TVK. In some instances, users will be able to redeem their assets before maturity.

If a user chooses this option, Binance will give the user back their initial investment minus the distributed interest earned. At the time of writing, TVK was trading at $0.54.

How staking and yield farming has grown

Staking is similar to depositing fiat in return for interest payments. It developed in crypto first as a way of earning interest on coins being ‘hodled’ and then, with the arrival of proof-of-stake blockchains, as a way of committing resources to a project in a method for selecting validators.

Since then staking has been further extended, with stakers becoming, for example, liquidity providers on DeFi networks and being rewarded with a yield in return.

The growth in the number of DeFi protocols operating lending and borrowing products saw an explosion in ‘yield farming’, where traders would hop from one network to another in search of the highest yield in a type of arbitraging strategy.

Depending on the system, the more value staked or ‘locked’ on a network and the longer duration it is locked up for, the greater the rewards. Protocols of proof-of-stake platforms will tend to select verifiers of blocks on the basis of which addresses/nodes have the largest values. Staking has become another way to earn passive income for crypto investors and arguably a more attractive approach than joining a mining pool.

Important things to note

The official report by Binance also gave some pointers about some of the most important things to note. Users can view the staking assets locked away by going to their Binance wallets and the savings section.

The APY will be displayed daily on the Binance page. The period for unlocking the staked products will be 24 hours. As an investor, one should note that staking is very risky because of the high market volatility. However, Binance has assured its customers that it will choose high-quality coins to minimise trading losses.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage