Join Our Telegram channel to stay up to date on breaking news coverage

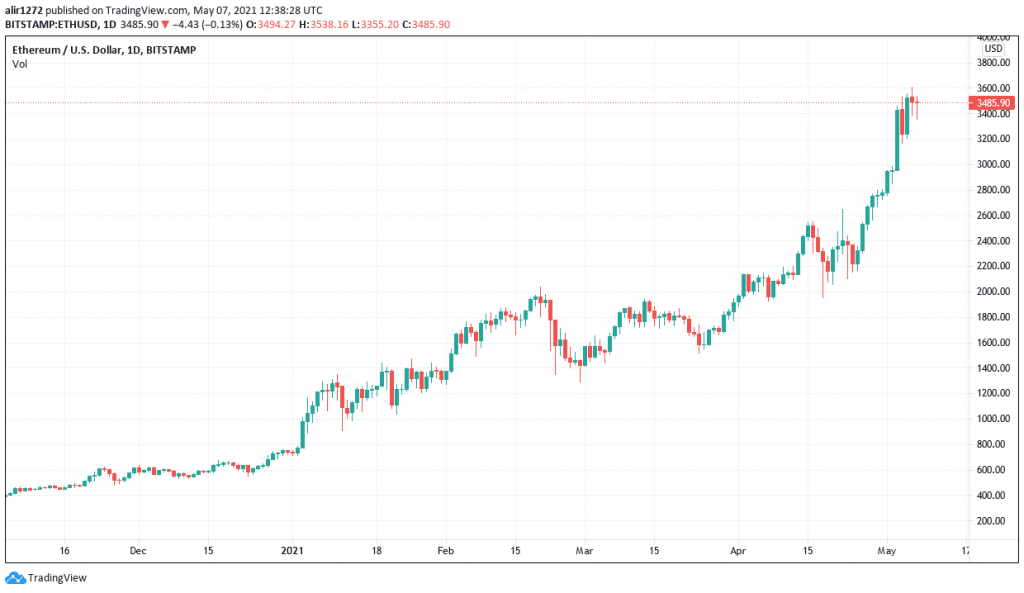

Ethereum (ETH) has surged in value by over 400% since January 2021 and the main reason is the popularity of DeFi protocols, with a growing portion of ETH supply committed to the sector.

Glassnode, a leading on-chain analytics company, has published a report analysing smart contracts on Ethereum. It shows that smart contracts currently hold 22.8% of the total ETH supply. This percentage increased from 16%.

Furthermore, the supply of Ethereum on leading crypto exchanges has sharply declined in recent months. The ETH supply now held on these exchanges is currently at 12% compared to the 17% reported in September 2020.

More Ethereum on DeFi Applications

The Glassnode report shows that large ETH volumes were withdrawn from known exchange wallets, reaching more than 200,000 ETH daily. The ETH tokens transferred from exchanges are finding their way into smart contracts and DeFi applications.

The demand for ETH on DeFi protocols is boosting the value of the cryptocurrency. As of the time of writing, ETH has breached the $3,400 mark, and its market cap is more than $390 million. Ethereum now has a market cap greater than PayPal and MasterCard.

This will be the first time that Ethereum’s value reaches $3400. Some market speculators even predict that the coming months may be bullish for Ethereum and bearish for Bitcoin. With Bitcoin unable to reach its previous $60,000 ATH, Ethereum’s market dominance is growing.

Increased institutional inflow

Because Ethereum can host and run decentralised applications, including DeFi, its institutional inflows have been growing strongly. The latest report from digital asset manager CoinShares shows that ETH attracted $30 million in institutional inflows last week. ETH assets under management held by institutions has now hit $13.9 billion, according to CoinShares

Grayscale, the largest global digital asset manager, recently published financials for all its crypto assets under management. The company currently has over 3.1 million ETH, valued at more than $11 billion.

Ethereum 2.0 is also reporting an uptake. The layer two network upgrade now has 4.3 million in staked ETH with a value of almost $15 billion.

Even with the high transaction fees on Ethereum, activity on its network has increased in recent months. This should continue push up the value of Ethereum and investor returns.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage