Join Our Telegram channel to stay up to date on breaking news coverage

There has been a lot of talk lately in the news about central bank digital currencies (CBDCs). Some go as far as claim they are the future of the world’s financial systems. To the regular person, there is little distinction between cryptocurrencies and digital currencies, whereas in the reality, this is misleading, as they are fundamentally different in their purpose, use and possibilities.

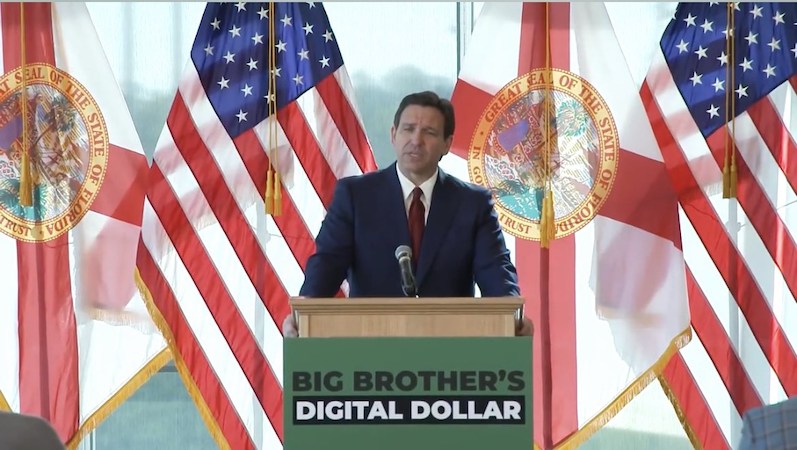

In a gesture that reveals a deeper understanding of the sector, Florida Governor Ron DeSantis moved to protect Floridians’ financial privacy by unveiling legislation on Monday that would outlaw central bank digital currencies (CBDCs) in the state.

The measure would completely ban the use of the technology as a form of money in Florida and would forbid both CBDCs that the U.S. Federal Reserve may establish and CBDCs developed by foreign governments.

From behind a podium that had “Big Brother’s Digital Dollar” written all over it, DeSantis gave the bill’s introduction by mocking the technology, portraying it as a means of enabling financial snooping and governmental overreach.

He claimed that the main purpose of central bank digital currencies was to monitor and rule American citizens. In his words:

What [a] central bank digital currency is all about is surveilling Americans and controlling Americans. You’re opening up a major can of worms, and you’re handing a central bank huge, huge amounts of power, and they will use that power.

Former NSA employee Edward Snowden and ShapeShift founder Erik Voorhees are some of the voices that have spoken against central bank digital currencies in the past. In particular, Snowden pointed out in a video interview that we reported on not long ago that such currencies go totally against the intended purpose of cryptocurrencies, which were designed to escape centralized control:

In recent interviews, Snowden and Voorhees referred to CBDCs as “cryptofascist currencies”, an apt description of tools that can be used to track and control money movements in a way that is unprecedented.

Mark Moss, a successful investor and entrepreneur, also explains in a recent video how the recent closures of the crypto-friendly Silvergate and Signature Bank are government’s attempts to “close the exits on crypto” so that they can continue to maintain control of the money supply and of the existing financial system:

Aren’t stablecoins useful?

Given the high volatility of most cryptocurrencies, many people have turned toward stablecoins, in an attempt to safeguard against price drops, particularly during bear markets. As such, a case is to be made that stablecoins are very useful and perhaps an essential part of the crypto ecosystem. The most widely used coin is Tether (USDT), closely followed by the relatively recent Circle’s USDC, which was recently in the news, and other newer projects.

Due to the fact that the price of a sovereign currency, such as the U.S. dollar, is tied to them, CBDCs are comparable to stablecoins. Yet unlike Circle’s USDC or Tether’s USDT, the two most valuable stablecoins by market size, CBDCs are created and managed by a nation state or central bank rather than by private businesses on decentralized networks.

Since 2016, the Fed has been investigating the possibility of a CBDC, and the American central bank has consistently said that a CBDC would require congressional authorization before being implemented. Experts have suggested that the technology might promote greater financial inclusion—banking the unbanked—but opponents reject it because of the potential for financial monitoring and an increase of governmental control.

Many countries involved in CBDC efforts

The American government is not the only country interested in CBDCs. In fact, according to Ripple,

90% of central banks are actively involved in creating their own CBDCs

The Ripple consortium has been looking to help such central banks develop digital currencies, and the International Monetary Fund (IMF) has clearly stated that over 110 central banks were at various stages of developments with such projects.

China is another country that has been interested in this field, and they have been actively working on a project for a Digital Yuan since at least 2020, while the government have banned cryptocurrency used in mainlaind China.

A government abuse of power and a danger to civil rights

Although the Fed has stated it is still in the early stages of exploring a CBDC and has not decided whether establishing one would be worthwhile, the notion that a digital currency represents a danger to civil rights has gained support in Conservative quarters. The Digital Yuan, a CBDC that China debuted last year, has been used by proponents of a CBDC in the United States as evidence that the country risks slipping behind in technology, while detractors claim it just serves to highlight the country’s ongoing capital controls.

DeSantis criticized President Biden’s executive order on cryptocurrencies from a year ago, which instructed federal organizations to unify on a path for cryptocurrencies, during his speech. Examining a U.S. Central Bank Digital Currency (CBDC) was the title of a part that was included.

Without mentioning specific parties, DeSantis said that if CBDCs were implemented, they would be used to “exercise their agenda,” which, in his view, would include restricting the amount of fuel one could buy or barring someone from purchasing a handgun.

The governor of Florida urged other states to implement legislation banning CBDCs in a similar manner. According to talks he’s had with the state’s vice governor, Dan Patrick, Texas appears certain to follow.

Ron DeSantis hasn’t said if he’ll seek the nomination of the Republicans for president at this time. According to the 2024 Republican Primary Tracker from Morning Consult, he is still one of the front-runners based on recent polls.

DeSantis isn’t the only conservative critic of a CBDC in the US these days; Republican House Majority Whip Tom Emmer (R-MN) proposed legislation last month restricting the Fed’s power to issue a CBDC directly to American customers. Moreover, Emmer claimed earlier this month in a speech regarding CBDCs before the Cato Institute that the technology will jeopardize Individuals’ financial privacy.

During a recent episode of “Tucker Carlson Tonight,” Fox News commentator Tucker Carlson discussed how the failure of Silicon Valley Bank may have been related to the introduction of a CBDC. Although stating that “we’re not suggesting a conspiracy here,” he continued to claim that bank consolidation will result in more government control and the establishment of a CBDC.

Carlson warned that “a currency that politicians control” would result if people didn’t start raising a lot of awareness and pressure. He even suggested it could go as far as not be able to receive food stamps unless CBDC isn’t used, which is not an unreasonable hypothesis, given how governments set their own rules that need to be strictly followed with regards to any financial aid that they may offer.

If people don’t start making a lot of noise and exerting a lot of pressure, it’ll mean… a currency that politicians control. Sign up for the CBDC app today to get your food stamps.

House Bill 1193

In a similar move, recently South Dakota Governor Kristi Noem rejected a little-discussed but crucial law, House Bill 1193, that would have facilitated the implementation of a central bank digital currency by the federal government. One of the largest challenges to American freedom that exists now is countered by defeating this bill.

The endeavor to change certain sections of the Uniform Commercial Code includes passing legislation like H.B. 1193 on a national level (UCC). The UCC is a state legislation that was adopted by all 50 states, not a federal regulation. It has been in existence for more than a century and continues to be crucial in ensuring that cross-state commerce runs smoothly.

Regrettably, several states, including Arkansas, Montana, New Hampshire, North Dakota, Tennessee, Texas, and California, are currently considering similar laws.

H.B. 1193 contains many beneficial suggested changes to the code, but the authors of the bill also included a few very unneeded, deeply worrisome elements. Should the federal government decide to construct one in the future, they would make it simpler for customers to utilize a programmable, traceable, controlled central bank digital dollar in some types of commercial operations.

Related

- Edward Snowden: Crypto is Heading in the Wrong Direction

- CBDCs might “revolutionize” the world’s financial systems

- 90% of central banks are working on CBDC projects, thus it should be based on XRPL

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage