Join Our Telegram channel to stay up to date on breaking news coverage

Optimism (OP) price remains bullish despite the slump after a 100% breakout from the $0.895 low recorded on July 10. On this rally, the Ethereum Layer-2 (L2) token ascended to an intra-day high of $1.829 on August 8. However, as long traders took profit, OP price corrected south but is yet to write off the stunning rise.

Meanwhile, investors must not overlook XRP20, a promising meme offering investors that missed the Ripple (XRP) train a second chance. This is despite the two tokens (XRP20 and XRP) having no direct relationship. The token has raised over $1.5 million in presale sales, with solid prospects for even more.

Optimism token’s breakout was initiated by mania around Ethereum L2 tokens, with Arbitron (ARB) enjoying the wave. However, the OP token managed to sustain the euphoria while its peer L2 tokens engaged load-shedding gears. This came as a result of network effort as well as user interest.

Network Effort As A Driver For Optimism Price

Regarding network effort, Optimism’s price benefitted from its token unlocks event that excited investors. The latest token unlocks for the Optimism network saw up to 24.16 million OP tokens unleashed to its circulating supply. While this incident is typically bearish based on economic dynamics (demand versus supply), long-term investors see it differently. To them, it is an opportunity to grow their holdings. The ensuing buying pressure bodes well for the price.

⚠️ On Sunday, Optimism $OP, a Layer-2 blockchain, is scheduled to release tokens worth $36 million!

(Per @Token_Unlocks) pic.twitter.com/A6N1aYor28

— BecauseBitcoin.com (@BecauseBitcoin) July 25, 2023

Similarly, spot traders spend their capital accumulating in alignment with the buy the rumor, sell the news narrative. This buyer momentum also contributed to the price surge.

Role Of User Interest In Driving Optimism Price

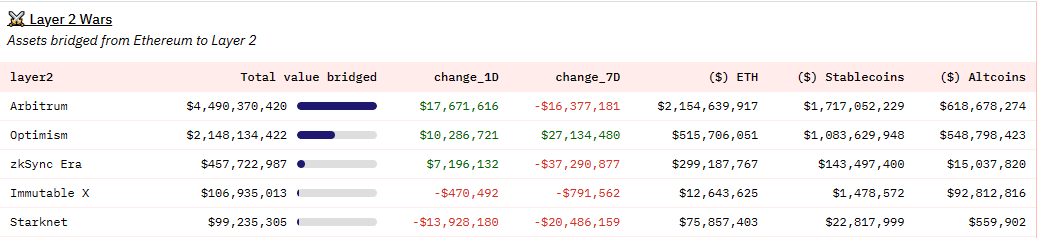

User interest in OP token catapulted OP to the second position in the Ethereum L2 wars after Arbitrum. Optimism went as high on daily user metrics, threatening Arbitrum in terms of daily transactions.

It is worth mentioning that Optimism’s growing popularity has inspired industry investigators to take an interest in OP Stack. This is its signature software for the optimism ecosystem, with the website adding that:

It [OP Stack] operates as a standardized, shared, and open-source development stack powering the Optimism network and maintained by the Optimism Collective.

Users can use OP Stack to build their chains. The new Ethereum L2 demonstrated this, Base, incubated under Coinbase, built on OP Stack’s open source. Another L2 on OP Stack is Mantle. This touts itself as “a modular L2 blockchain built to help scale Ethereum and drive mass adoption of decentralized technologies.”

3/ OP Stack was used by @BuildOnBase (L2 from Coinbase).

It was also used by @0xMantle, another contender for a top L2 with the mainnet just launched. pic.twitter.com/BNUsSX2OLL

— Przemek Chojecki || PC Crypto (@prz_chojecki) July 28, 2023

Also, the recent trend in the market focusing on Sam Altman’s Worldcoin (WLD) played a role in driving OP. This is because WLD debuted atop the Optimism ecosystem.

Optimism Price Forecast As Users Watch OP’s Stunning Rise

Optimism price is down 11% from its peak of $1.829 after a rejection from the 1.876 level around which long traders’ take profits were triggered. The ensuing selling pressure has seen OP flip the 200- and 100-day Exponential Moving Averages (EMA) support back to resistance. This is at the $1.638 and $1.597 levels, respectively.

With the 50-day EMA at $1.523 barely holding, Optimism’s price could extend a leg south. This could see OP dip into the demand zone between the $1.379 and $1.096 range. For the layperson, a demand zone is an area where traders are willing to buy aggressively. It passes as a bullish zone considering that once the price reaches here, the balance would have shifted to the demand side.

The demand zone holds more substantial buyers than sellers, so that implicit buying could manifest around this zone, primarily because of institutional buyers. Therefore, Optimism’s price could correct around this level to resume its move north.

However, if this order block (demand zone) fails to hold as a support, Optimism’s price could slip through and render it a bearish breaker. The subsequent selling pressure could see the Ethereum L2 token drop to find the next possible support around the $0.866 support floor. This would denote a 45% slump from current levels.

However, Optimism price could find an inflection point around the 50-day EMA or after dipping into the demand zone. If this plays out, OP could restore above the 100- and 200-day EMA, potentially using them as jumping points toward the $1.876 barricade.

Optimism price could extend a neck north after breaching the resistance above level to tag the $2.406 hurdle in a highly bullish case. Such a move would constitute a 50% climb above current levels.

Promising Alternative To OP

XRP20 is a distinct initiative inspired by Ripple’s original XRP token. It seeks to replicate Ripple’s past profitability while incorporating additional functionality and yearly yields. What sets XRP20 apart is its inclusion of features like staking for lucrative returns and a deliberate token burn mechanism. It has a total token supply of 100 billion, with only 40% currently accessible during the presale phase. This is a show of transparency and risk reduction.

During the ongoing presale, an impressive 20 billion tokens have been purchased within a mere 8-day period, underscoring robust investor enthusiasm. Knowledgeable individuals predict significant gains of 20 times or more, solidifying XRP20’s status as a prominent performer. Seize the opportunity to potentially invest in XRP20 at a discounted rate to reap substantial rewards. To learn more, visit the official website.

XRP20 Unveils Effortless Trading Experience Through Dedicated DEX Liquidity Pool

In a recent announcement, XRP20 has revealed plans to enhance trading efficiency with its native token. A substantial allocation of 10 billion tokens has been designated for the debut Decentralized Exchange (DEX) liquidity pool.

https://twitter.com/XRP20AMA/status/1689890392701902848

This strategic move aims to ensure seamless transactions, bolstering stability and user experience for traders engaging in buying and selling activities. XRP20’s commitment to refining the trading landscape is expected to resonate positively with the community as the platform fosters innovation within the crypto ecosystem.

XRP20 Presale Progress: Nearing $2 Million Mark

https://twitter.com/XRP20AMA/status/1689760252621672448

The XRP20 project has achieved significant momentum during its presale, amassing approximately $1,930,863 of its $3,680,000 target. Currently, one XRP20 token is accessible for $0.000092.

Also Read:

- Optimism Crypto Price Prediction – What’s Next for OP?

- Optimism Price Prediction: With OP Unexpected Drop, BTC20 Becomes Talk of The Town

- Ripple Price Prediction: XRP Rockets, But Have You Seen the Potential of XRP20 Yet?

- How To Buy XRP20 Presale Guide – Alessandro De Crypto Reviews’ The New XRP’

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage