On this Page:

It’s the dream of every crypto investor to get in early on a coin that provides 1000x returns, turning even small $100 investments into $100,000. These explosive gains are possible when buying micro-cap tokens early, and investors will often take a gamble on projects before they blow up in hopes of being richly rewarded. But how to know which of the millions of coins on the market will be the next crypto to expolode?

This guide explores the next crypto to 1000x in 2025, revealing micro-cap projects with unprecedented upside potential. Learn how seasoned traders discover explosive cryptocurrencies early and the key risks to consider before getting involved.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

current price: $0.0017 | raised: $43,101,164 | Learn more | ||

| 2 |

|

$0.01 | 1.61% | $660,758,815 | $78,379,517 |

$0.01

―

$0.01

|

| 3 |

|

current price: $0.09 | raised: $332,936 | Learn more | ||

| 4 |

|

$0.64 | 1.56% | $508,947,897 | $43,765,707 |

$0.62

―

$0.65

|

| 5 |

|

current price: $0.0025 | raised: $6,709,798 | Learn more | ||

| 6 |

|

$0.0091 | 0.90% | $161,825,317 | $1,956,404 |

$0.0089

―

$0.0093

|

| 7 |

|

current price: $0.0038 | raised: $12,227,141 | Learn more | ||

| 8 |

|

$0.10 | 0.08% | $97,741,806 | $18,364,525 |

$0.10

―

$0.11

|

| 9 |

|

current price: $0.06 | raised: $483,110 | Learn more | ||

| 10 |

|

$0.09 | 0.16% | $85,991,322 | $2,724,553 |

$0.08

―

$0.09

|

| 11 |

|

$0.0(7)93 | -4.52% | $84,080,359 | $349,403 |

$0.0(7)90

―

$0.0(7)98

|

| 12 |

|

$0.0040 | -4.39% | $55,120,253 | $2,029,051 |

$0.0039

―

$0.0042

|

| 13 |

|

$0.48 | -7.51% | $41,557,300 | $308,004 |

$0.47

―

$0.51

|

| 14 |

|

$0.0(5)26 | 0.32% | $225,586 | $265,161 |

$0.0(5)25

―

$0.0(5)26

|

| 15 |

|

$0.03 | 1.09% | $140,613 | $29,280 |

$0.03

―

$0.03

|

| 16 |

|

$0.01 | -3.34% | $61,501 | - |

$0.01

―

$0.01

|

Solaxy

SOLX 🔥Selling Fast 🎯presale stagePudgy Penguins

PENGUSnorter Bot

SNORT ⭐New 🎯presale stageApeCoin

APE

BTC Bull

BTCBULL Top Meme Coin 🎯presale stageDigiByte

DGB

Mind of Pepe

MIND ⏳Last Chance to Buy 🎯presale stageUsual

USUAL

SUBBD

SUBBD 🎯presale stageArdor

ARDRMIU

MIUSupra

SUPRADevvE

DEVVECat-Dog

CATDOGDora Factory [OLD]

DORAMonkex

MONKEXCryptos That Could 1000x in 2025

Here are five projects that could be the next crypto to 1000x:

1. LayerZero ($ZRO)

LayerZero Price Chart

(ZRO)LayerZero (ZRO)

LayerZero ($ZRO) is a permissionless omnichain messaging protocol that brings interoperability to the broader blockchain ecosystem. It supports all blockchain standards with smart contract functionality, including Ethereum, Polygon, Optimism, BNB Chain, and Avalanche.

Integration with LayerZero enables cross-chain capabilities, allowing projects to tap into communities without compromising decentralization and security. DEXs, for instance, can facilitate swaps between Ethereum and BNB Chain, while DeFi protocols can connect lenders and borrowers from Base and Arbitrum.

LayerZero’s native token, $ZRO, is used for transaction fees and governance. Holders vote on key project proposals — an existing referendum asks whether protocol revenues should be converted to $ZRO and burned, with 96% in favor. If approved, this token dynamic will make LayerZero a deflationary asset, increasing its scarcity over time.

Find out more about LayerZero:

2. Daku ($DAKU)

Daku Price Chart

(DAKU)Daku (DAKU)

Launched in December 2024, Daku ($DAKU) is a Solana-based token that merges two high-growth narratives — meme coins and AI. The project delivers weekly AI-generated stories, providing its growing community with a light-hearted take on crypto culture. The stories are centered on “AIGENT DAKU”, a canine spy who hunts scammers and exposes the corrupt system.

The roadmap has several objectives, including Solana partnerships and merchandise launches in phase two. After that, the team plans to launch an exclusive NFT collection and begin regular token burns. However, the roadmap provides no additional details about these products.

Daku has a capped token supply of just under 1 billion tokens, and there was no presale event — the team opted for a fair launch on Raydium after its Pump.Fun initiation.

Find out more about Daku:

3. Digibyte ($DGB)

DigiByte Price Chart

(DGB)DigiByte (DGB)

DigiByte ($DGB) is one of the most established blockchains in the market. It launched in January 2014 as a Bitcoin fork, reducing transaction speeds from 10 minutes to just 15 seconds. DigiByte also increased Bitcoin’s scalability by 4 times, though this is minute when compared to modern blockchains like Solana and Avalanche.

As an open-source blockchain, it uses five mining algorithms — SHA256, Scrypt, Skein, Qubit, and Odocrypt. This framework allows anyone to solo mine $DGB, even with basic GPUs. DigiByte’s mining payouts reduce by 1% monthly until 2035, where the maximum supply of 21 million tokens will be reached. After that, miners earn transaction fees when successfully verifying a block.

DigiByte is one of the few proof-of-work blockchains to support smart contract transactions, providing DeFi projects with true decentralization. Its Dandelion privacy feature is also notable, which obfuscates IP addresses when users send and receive funds.

Find out more about DigiByte:

4. DevvE ($DEVVE)

DevvE Price Chart

(DEVVE)DevvE (DEVVE)

DevvE ($DEVVE) is a Layer-1 ecosystem that claims to be the most scalable and energy-efficient blockchain in the industry. The project uses 1/3 billionth of Bitcoin’s energy and is 1/10 millionth cheaper than Ethereum. DevvE has a theoretical scalability of 8 million transactions per second, making it highly suitable for the Web 3.0 era.

One of DevvE’s key target markets is the institutional sector — its blockchain is designed for regulatory compliance, with plug-and-play solutions for existing structures. Its objectives are secured by global patents in multiple areas, including fraud prevention and privacy protection.

The blockchain’s native token, $DEVVE, is used for transaction fees, asset transfers, and staking. It also backs the Evergreen Fund, an actively managed fund that invests in high-potential ESG startups. $DEVVE’s has a maximum supply of 300 million tokens, with about 89.65 million in circulation.

Find out more about DevvE:

5. Supra ($SUPRA)

Supra Price Chart

(SUPRA)Supra (SUPRA)

Supra ($SUPRA) is an up-and-coming Layer-1 blockchain that launched in late 2024. It’s designed specifically for Web 3.0 dApps that require institutional-grade transaction throughput. It can handle up to 500,000 transactions per second, fully tested and verified across 300 independent nodes.

The blockchain offers lightning-fast speeds with sub-second finality, another important factor for dApp functionality. Unlike other Layer-1 blockchains, Supra was designed with MultiVM compatibility, so it can handle smart contracts from any ecosystem. In addition to Ethereum and EVM networks like Base and Polygon, there’s also support for Solana, Cosmos, and Aptos.

With full Oracle integration, dApps in the Supra ecosystem can access near-real-time data — finality is reached in 600- 900ms. This feature enables dApps to access accurate and unbiased data from non-blockchain sources.

Find out more about Supra:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What Makes a Crypto Project Capable of 1000x Growth?

Several factors enable crypto assets to produce 1000x gains. Let’s break down the key factors.

Market Demand

A strong market is essential for crypto assets to become the next crypto to explode. Tokens that are purchased for reasons other than just speculation often offer real platform solutions.

A good example is Chainlink. It provides blockchain ecosystems with real-time data from the traditional world, with Oracles ensuring information is accurate and unbiased. Stakeholders pay transaction fees to access that data, settled in Chainlink’s native token, $LINK.

Solana is another example of how strong market demand can produce explosive gains. Ecosystem users need $SOL to pay fees, a requirement whenever smart contracts are deployed. $SOL fuels millions of meme coin transactions and DeFi protocols like Raydium and Jupiter. Investors who joined Solana’s 2018 funding round secured $SOL tokens for just $0.04. The $SOL price reached $294.33 in 2025, delivering gains of over 7,000x.

Retail clients can evaluate potential demand by assessing use cases. The key question to ask is what reason do ecosystem users have to purchase the tokens? Having a use case alone isn’t sufficient — it must be innovative enough to achieve demand on a global scale. Only then can the crypto project generate 1000x gains.

Community Support

Crypto projects must have significant community support to produce explosive returns. Project founders and executives should frequently update their holders, such as weekly or monthly AMAs (Ask Me Anything), roadmap progress, or newly secured partnerships. Holders also expect seamless communication, often with community admins on Telegram or Discord.

Investors can gauge community strength in several ways. One method is to evaluate social media metrics like followers, shares, and likes. 1000x cryptocurrencies often go viral on X before blowing up, so thoroughly assess engagement levels. Seeing the same projects “shilled” on social media is another good sign. It could reflect a strong and committed community that’s happy spending time promoting their investments.

However, investors shouldn’t take community support and engagement at face value. Projects may inflate social media metrics using bots, so make judgements on whether they’re realistic.

Trending Presales

Solaxy

SOLX 🔥Selling FastSnorter Bot

SNORT ⭐New

BTC Bull

BTCBULL Top Meme Coin

Mind of Pepe

MIND ⏳Last Chance to Buy

SUBBD

SUBBDTokenomics

Tokenomics is the “token economics” of the project’s supply, a key research method to find the next crypto to 1000x.

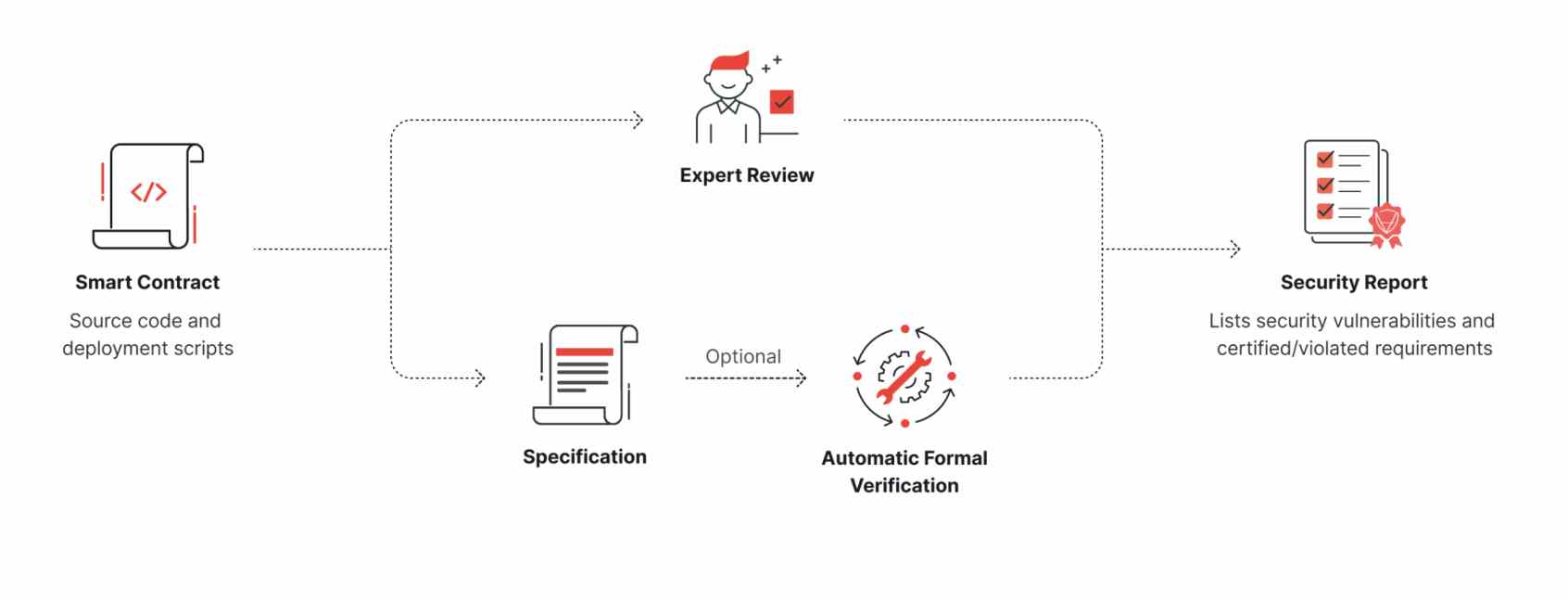

Start by assessing the total supply, or the total number of tokens created. Some cryptocurrencies have a capped supply, which prevents additional tokens from being minted. A smart contract audit should verify this limitation on new token mints, as scammers can insert malicious terms that aren’t flagged by an untrained eye.

Most prefer capped supplies as it ensures predictability and scarcity, eliminating the risk of future token dilution. Bitcoin is one example — its total supply is capped at 21 million, with new coins mined every 10 minutes until this figure is reached.

Not all cryptocurrencies have capped supplies, though. Successful projects like Solana and Ethereum have an unlimited supply, with new tokens frequently created to cover staking rewards. It’s important to consider whether inflationary pressures will impact long-term sustainability and growth.

The circulating supply is equally important — this is the percentage of tokens in the public domain. 1000x cryptocurrencies often issue 100% of their supply at launch, a key safeguard against rug pulls and market manipulation. With all tokens trading on exchanges or held in personal wallets, prices are determined by market forces, similar to stocks and commodities.

Be cautious if the circulating percentage is low, since this suggests the founders hold a large quantity of tokens. OFFICIAL TRUMP ($TRUMP), Donald Trump’s Solana meme coin, is an example of poor token dynamics. The Trump team holds 80% of the total supply, released over multiple vesting unlocks across three years. The most likely outcome is that $TRUMP tokens will be sold by the team, raising serious questions about integrity and longevity

Deflationary token supplies are also preferable when finding 1000x cryptocurrencies. This framework reduces the total supply over time, often through “token burn events.” BNB, for instance, frequently burns tokens by sending them to an inaccessible wallet, removing them from the supply. Each burn makes BNB more scarce, increasing its perceived value like traditional share buybacks.

Do note there’s no single blueprint for success — each supply metric must be assessed individually.

Unique Features

Seasoned crypto investors flock to projects that offer innovative features, especially those that solve existing real-world problems through technological breakthroughs.

Uniswap ($UNI), for instance, revolutionized crypto trading when it launched in 2020. Its DEX model leverages automated market makers (AMMs), replacing traditional order books with liquidity pools. Traders buy and sell cryptocurrencies without requiring market participants: tokens are swapped instantly, and prices are determined by the AMM algorithm. Uniswap also makes crypto trading more accessible. Users don’t need to open accounts or provide ID documents, as markets are accessed through wallet connections. Uniswap’s innovative features reflected its token price, delivering huge returns to those investing in the project early.

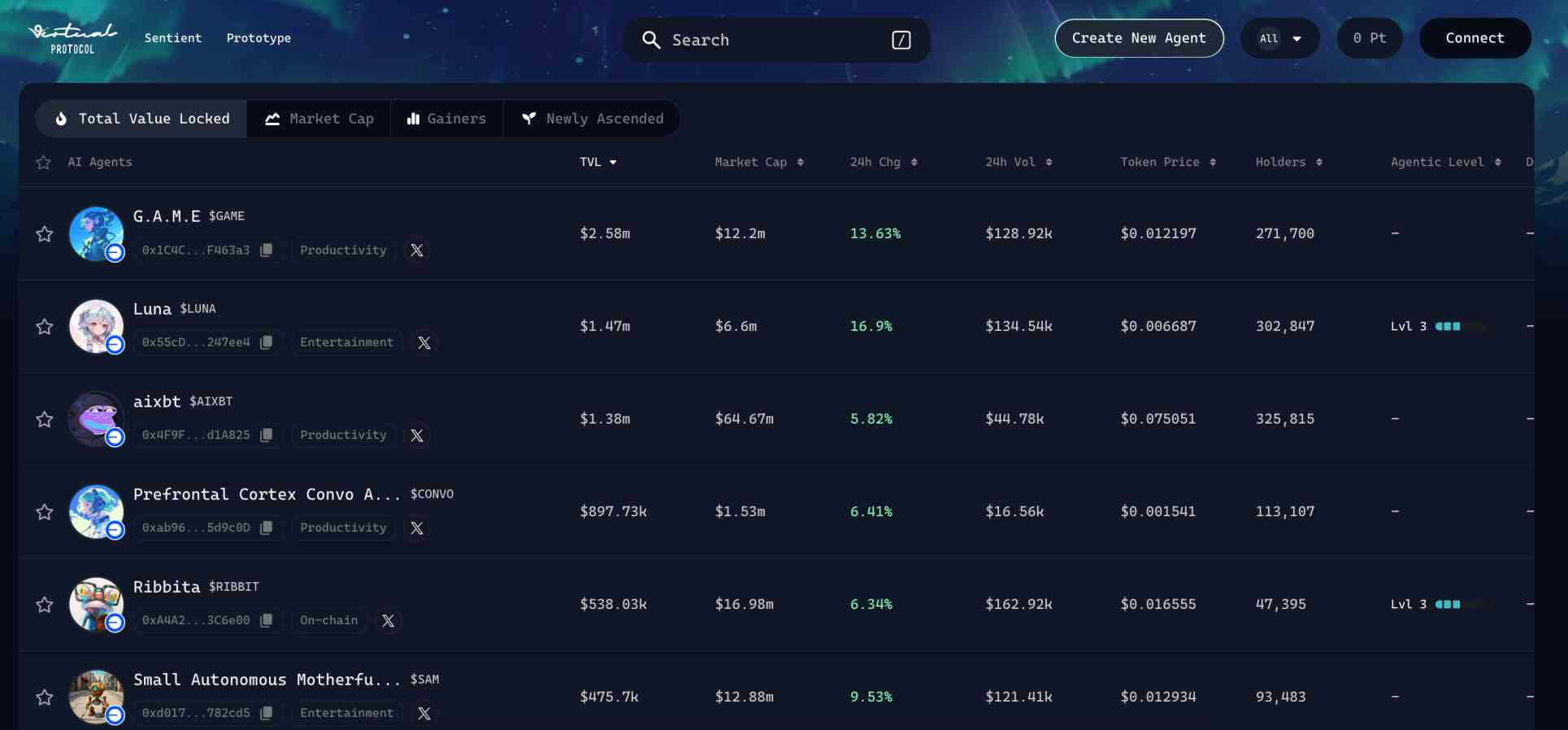

A more recent example is Virtuals Protocol ($VIRTUAL), a decentralized platform that allows users to create artificial intelligence agents. Launched on the Base network, its artificial intelligence agents perform autonomous tasks across different platforms, such as DeFi optimization, social media interaction, and automated trading. $VIRTUAL is the ecosystem token, and users need it to access AI agent services. Anyone who bought $VIRTUAL in January 2024 would have paid just $0.007605 per token. The project reached an all-time high of $5.07 12 months later, generating gains of over 66,000%.

Investors should remember that innovative features alone won’t lead to explosive returns — the project’s native token must serve identifiable use cases. Utility-driven tokens not only drive institutional demand but also industry stakeholders who plan to engage with the technology.

Early-Stage Investment Opportunities

1000x cryptocurrencies are achieved when investing in projects early. Investors risk capital on unproven concepts or pre-development products, which are reflected in the project’s valuation.

Traditional investing offers a similar concept. Uber was valued at just $4 million in 2010, long before ride-sharing apps became mainstream. It reached an $82.4 billion valuation at its 2019 stock IPO, over 20,600x higher than 2010.

One strategy to find early-stage investment opportunities is top crypto presales, also known as initial coin offerings (ICOs). Ethereum’s 2014 ICO offer $ETH for just $0.31 per token. $ETH reached an all-time high of $4,891 in 2021, delivering life-changing gains of over 1.5 million percent.

With the exception of private rounds (usually reserved for institutional investors and venture capitalists), presales and ICOs provide exposure at the earliest stage possible. Teams hold fundraising events before crypto exchange listings, often at a discounted price. It’s like investing in Uber long before its shares were listed on the NYSE, providing a significant first-mover advantage.

How to Identify the Next 1000x Crypto

Seasoned investors use a wide range of research methods to find the next crypto to 1000x. Let’s explore the most effective methods in more detail.

Researching Low Market Cap Projects

Projects with micro-cap valuations have the best chance of being the next crypto to explode. Micro-cap cryptocurrencies generally have market capitalizations below $50 million, which results in a much higher risk-reward spectrum.

However, for 1000x growth, investors need to focus on cryptocurrencies much further down the valuation rankings. Take a new token launch valued at $2 million—1000x gains require a market capitalization of $2 billion. Less than 40 cryptocurrencies have market capitalizations above $2 billion, reflecting a tiny percentage of the broader market.

Some investors look for micro-cap cryptocurrencies valued at under $1 million. A $100,000 valuation, for instance, would require a $100 million market capitalization.

Selecting the right market capitalization is a trade-off between risk, volatility, and upside requirements. There’s no single solution, so investors should evaluate their risk tolerance when researching potential options.

While subjective, crypto analysts also evaluate perceived valuations against current market prices. A micro-cap token could be worth a small fraction of its true value due to broader market conditions. Extended bear markets often shave significant valuations from up-and-coming cryptocurrencies, especially those from the micro-cap category. These market cycles often present the best time to get involved, allowing investors to buy the dip at discounted prices.

Analyzing Roadmaps and Development Activity

We’ve established that 1000x crypto tokens are often new projects with innovative, utility-driven products and micro-cap valuations. These projects are almost always pre-launch, so investments are made before a working product or service. This is the required compromise when investing in assets that have the potential for significant growth.

The first step is to analyze the project’s roadmap, which details its development goals and anticipated completion date (usually stated in quarters). Investors should evaluate whether the roadmap objectives are realistic, given their complexity and stated deadlines.

Investors should track the roadmap to ensure timely progress. Projects that consistently meet roadmap milestones on or before the deadline instill trust with the broader markets. The result is that existing investors are confident to hold their tokens while development continues.

Arbitrum ($ARB), the popular Layer-2 network for Ethereum, highlights that early-stage investments can pay off when roadmap targets are achieved. The team actively shared development updates with its community, including verified testnet results. Seed round investors paid just $0.004648 per $ARB in 2019, over two years before Arbitrum’s mainnet launch. $ARB reached an all-time high of $2.40 in January 2024, providing seed round investors gains of over 51,000%.

Tracking Institutional and Whale Interest

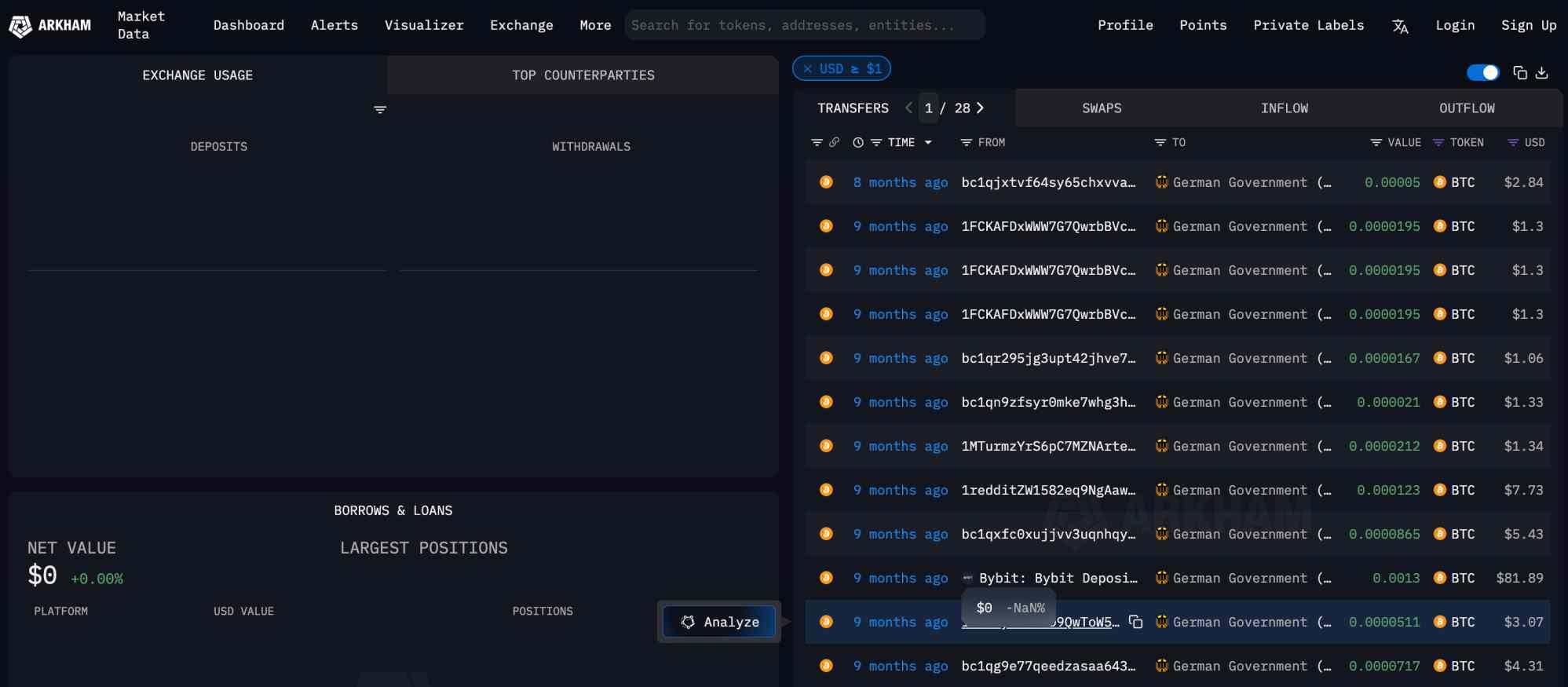

The so-called “Smart Money” is a key factor when identifying 1000x cryptocurrencies. Smart money often includes institutional investors and crypto whales. They quietly enter the market early and secure the lowest valuation. These investors conduct substantial due diligence to ensure legitimacy and long-term potential. The key takeaway is that anyone can follow the smart money when they know where to look.

One method is to use whale tracking websites. They identify and track wallet addresses linked to the most successful investors, alerting users whenever funds move. Large investments from these wallets signal strong future potential, especially if it’s in a new project with a micro-cap valuation. Wallet tracking also helps with risk management — whales dumping their early-stage tokens is a big red flag, alerting investors to potential issues.

Investors should also look for innovative projects that have secured funding from notable institutions. Polygon ($POL, formerly $MATIC) received early backing from Andreessen Horowitz (a16z), Tiger Global Management, and Coinbase Ventures. The team initially sold $MATIC for just $0.00079 per token during the seed round. It climbed to an all-time high of $2.92 in 2021, reflecting price gains of over 360,000%. While the seed round was reserved for institutions, $MATIC launched on exchanges in April 2019 at $0.0058, allowing retail clients to get in early before the price explosion.

Social Media and Hype Cycles

Not all 1000x cryptocurrencies are driven by real utility and adoption rates. Social media and hype cycles also play a big role in identifying the next crypto to explode, especially for speculative meme coins.

FOMO (fear of missing out) often begins when influential figures get involved, such as Elon Musk’s frequent Dogecoin ($DOGE) posts in 2020/21. Each tweet reached over 100 million followers, with mainstream media also picking up on Musk’s fascination with the Dogecoin narrative. The Dogecoin price soared by thousands of percent as a result.

Pepe ($PEPE), an Ethereum-based meme coin with no use cases, also enjoyed unprecedented success from social media hype. The project gained viral traction almost immediately, with crypto influencers and engaged communities sharing Pepe memes on X, TikTok, and other social networks. Pepe, originally a micro-cap token valued at under $1 million, reached an $11 billion market capitalization in late 2024, reflecting substantial gains.

Experienced investors use third-party tools to find trending cryptocurrencies on social media before they explode. LunarCrush is one example — the platform offers key social engagement metrics and sentiment analysis, delivering real-time alerts.

Checking for Exchange Listings and Liquidity

Early-stage cryptocurrencies initially list on DEXs. The team adds funds to a DEX pool, creating open trading markets without an application process. DEXs offer a launchpad for new projects, but major centralized exchanges (CEXs) are required to support 1000x growth. This is due to a significant disparity in trading volumes.

Consider that over $185 billion was traded on CEXs in the past day, with DEXs handling just $8 billion. The key consequence is limited liquidity, which creates volatile markets, wild pricing swings, and unfavorable slippage.

Major CEXs, on the other hand, offer substantial liquidity, allowing whales to enter the market without extreme volatility. Binance, Coinbase, and other tier-one platforms have millions of active traders and deep order books — the perfect recipe for explosive price action. CEXs, particularly regulated platforms, also appeal to retail clients preferring user-friendly interfaces and convenient payment methods.

There will, however, be instances when DEXs are the only option, especially when hunting early-stage tokens with micro-cap valuations. In this instance, seasoned investors use data aggregation websites (e.g., DEXTools and Dex Screener) to evaluate liquidity strength, a key safeguard to implement.

One method is to compare the DEX liquidity pool with 24-hour volumes. A healthy liquidity/volume ratio is 20-50%, while 100% or more suggests hype is quickly building. Investors should also verify whether the liquidity pool is locked. This safeguard helps prevent the “rug pull” risk, where scammers withdraw the pool’s liquidity, causing the token price to crash.

Promising Sectors for the Next 1000x Crypto

Crypto narratives drive capital flows, with 1000x cryptocurrencies often active in high-growth sectors. Let’s explore the most promising crypto niches for 2025.

AI and Blockchain Integration

AI is one of the hottest investment sectors to watch. A Grand View Research study predicts global AI revenues will exceed $1.8 trillion by 2030, reflecting compound annual growth rates (CAGR) of 35.9%.

Innovative AI projects use blockchain technology and cryptocurrencies for a range of different use cases. Infrastructure projects like Bittensor ($TAO) are popular with AI investors. The decentralized machine learning network allows users to contribute data models, a key requirement for AI training. Bittensor uses a peer-to-peer framework — those contributing models earn $TAO.

The best AI coins also operate as secondary-layer projects. Aixbt ($AIXBT) is an autonomous AI agent designed to analyze crypto trends, providing end users with real-time insights and narratives before they’re reported in the mainstream media. The project is another example of how early backers can make substantial gains. $AIXBT was priced at just $0.00007943 in November 2024, climbing to $0.9475 just two months later. This explosive rally delivered returns of over 1 million percent.

Decentralized Finance (DeFi) 2.0

DeFi 2.0 is an undervalued crypto sector with exponential growth potential. It’s the next generation of decentralized financial services, addressing previous flaws like unsustainable yields and high network fees. DeFi 2.0 projects prioritize scalability, cost-effectiveness, and long-term sustainability, ensuring the market is accessible on a global scale. The user experience is also improved, a core factor for beginners who might not be familiar with blockchain mechanisms.

One example is Reaper.Farm, a DeFi 2.0 platform that enables users to automate yield farming activities. Users deposit crypto tokens, and Reaper.Farm automatically stakes them via third-party protocols. The project maximizes yields, reinvests them, and automatically claims the compounded returns.

DeFi 2.0 analysts also point to automated financial systems. Smart contracts replace human portfolio management, handling manual tasks like rebalancing and yield optimization. They also double as investment advisors, suggesting the best DeFi coins to buy.

Lending is another high-growth area being revolutionized by DeFi 2.0 stakeholders. Morpho ($MORPHO), for instance, connects lenders and borrowers via peer-to-peer smart contracts, with interest rates adjusted dynamically based on demand and supply. Morpho also improves capital efficiency, allowing borrowers to move away from over-collateralized loans like in older DeFi ecosystems.

Several tier-one institutions backed Morpho early, including Coinbase Ventures, Pantera Capital, and Brevan Howard. The $MORPHO price climbed from $0.7099 in November 2024 to $4.17 in January 2025, with some experts expecting further rallies later in the year.

Layer-2 and Scaling Solutions

Scalability is the amount of throughput a blockchain can handle, usually measured in transactions per second. Web 3.0 ecosystems need significant scalability to handle increased demand.

Legacy blockchains like Bitcoin and Ethereum were designed without scalability mechanisms — they’re capped at about 7 and 12 transactions per second, respectively. These limitations are particularly damaging for Ethereum. Its ecosystem hosts thousands of decentralized applications (dApps), from DEXs like Uniswap and SushiSwap to NFT marketplaces, metaverses, and play-to-earn games. Each dApp action, such as token swaps or staking deposits, triggers a separate smart contract transaction, causing network congestion and high fees.

Layer-2 networks provide an immediate solution. Base, the Layer-2 network backed by Coinbase, can handle thousands of transactions per seconds at almost zero fees. Arbitrum is another popular Layer-2 solution. Multiple Ethereum dApps using the network for transaction efficiency, including Chainlink, Maker, The Graph, Curve, Compound, and yearn.finance.

The underlying technology varies depending on the Layer-2 project, but most handle transactions off-chain. Optimistic rollups, leveraged by Arbitrum, Optimism, and Base, assume that transactions are valid unless someone challenges them. Zk-Rollups, another method that allows Layer-2 scaling, generates cryptographic proofs for each transaction batch, which is validated almost instantly by the Ethereum blockchain.

Layer-2 networks aren’t only designed for scalability and transaction efficiency — they also expand what legacy blockchains can do. Stacks ($STX), one of the best Layer-2 coins, is a great example. It brings smart contracts to the Bitcoin blockchain, allowing DeFi capabilities for the world’s biggest crypto ecosystem. The $STX price traded at just $0.04501 in March 2020, climbing to $3.84 in April 2024. Although it delivered gains of over 8,000%, many experts believe that Stacks is worth just a fraction of its long-term potential.

Gaming and Metaverse Coins

Blockchain gaming, one of the fastest-growing sectors in the 2020/21 bull market, includes various niches,

Play-to-earn (P2E) games reward users with native crypto tokens for completing in-game tasks, such as winning battles or accumulating points. Players can use those tokens to purchase in-game upgrades, boosters, and wearables like avatar clothing. P2E cryptocurrencies often trade on exchanges, so players can also sell their tokens for real money.

With NFT integration, players get full ownership of ecosystem assets, such as battle cards or virtual creators. NFTs also fuel metaverse cryptocurrencies like Decentraland and The Sandbox. Users can purchase and own virtual real estate, and build custom houses, hotels, and other infrastructure. Metaverse land is tradable on NFT marketplaces, with prices influenced by demand and supply.

Another category is infrastructure projects, which provide critical frameworks for gaming coins and NFTs. Immutable X’s ($IMX) Layer-2 solution, which supports popular P2E games like Gods Unchained, Ember Sword, and Illuvium, delivers enhanced scalability, lower fees, and faster transactions. $IMX was purchased by early adopters for just $0.025 per token, rising to $9.50 at its peak.

Real-World Asset Tokenization

Real-world asset (RWA) tokenization, a market estimated to reach $30 trillion by 2030, allows traditional assets to exist on the blockchain. The world’s biggest institutions, including Goldman Sachs and BlackRock, are already investing in this market. By leveraging blockchain, tokenization unlocks unprecedented opportunities on a global scale, so it could be home to several 1000x cryptocurrencies.

Large real estate projects like multi-family homes and resorts can be fractionized into small units, making them affordable in the retail sector. Each token uses an NFT to prove ownership and enable free market trading. RealT is an early mover in this space, offering access to US properties in seven states. It has already onboarded over 65,000 registered investors, highlighting real adoption. RealT users also earn rental income from their fractional tokens, just like in the traditional real estate sector.

RWA tokenization is also expanding into stocks. Users can invest in global equities 24/7, no matter their location — a great option for those living in countries with limited brokerage access. Tokenized stocks can be used for collateral, unlocking cost-effective financing without relying on centralized lenders. They’re also ideal for AI-backed portfolio managers operating in DeFi 2.0 ecosystems.

Difficult-to-reach commodities are another market that RWA will revolutionize. From crude oil, natural gas, and gold, tokenized commodities facilitate borderless trading and seamless storage.

Privacy Coins and Security-Focused Cryptos

Demand for privacy has never been higher. Most cryptocurrencies are pseudonymous, given the traceability and transparency of the blockchain ledger. Anyone can view blockchain transactions once the wallet address is discovered, which can lead to surveillance and data harvesting.

Privacy coins are designed to make transactions truly anonymous. Launched in 2014, Monero ($XRM) is one of the pioneers of crypto privacy. Individual transactions generate one-time stealth addresses, ensuring senders and receivers benefit from complete confidentiality. Monero’s Ring CT feature hides transfer values, so amounts are only known to the transacting parties.

Investors should also explore security-focused projects when identifying 1000x cryptocurrencies. They make the broader blockchain ecosystem safer, reducing the risks of hacks and data leaks. One project to watch is Secret Network, a Layer-1 blockchain that specializes in smart contract encryption. The project is aimed at stakeholders involved with sensitive data, making it a great option for medical facilities and even political campaigns.

Privacy-centric projects are, however, facing increased regulatory scrutiny. Several countries have banned or heavily restricted them, as EU regulations forced Binance to delist its privacy-focused tokens. The crypto markets are strongly against censorship and draconian regulation, so recent government scrutiny could propel privacy coin valuations.

Meme Coins With Utility

The meme coin sector is best known for its speculative narrative. While the overwhelming majority of meme coins offer no use cases, this overstated market is evolving. Teams are no longer focusing solely on hype and FOMO, with utility-driven meme coins building real products for token holders. Combined with loyal communities and sustainable tokenomics, these meme coins are the future.

Shiba Inu ($SHIB) was one of the first meme coin projects to develop token use cases. Its metaverse platform offers immersive experiences, vibrant social events, and land ownership. Shiba Inu’s ecosystem includes DeFi features too, including token swaps, staking, and liquidity provision.

Floki ($FLOKI) is another example of how speculative meme coins can transition into fully-fledged utility ecosystems. Projects from 16 networks can deposit tokens into a FlokiFi pool to prove their long-term commitment. FlokiFi also facilitates vesting schedules and NFT launches. In addition to FlokiFi, the project also has a metaverse world with play-to-earn games.

Shiba Inu and Floki are already large-cap meme coins, though, so they won’t be the next crypto to 1000x. Investors will need to look for up-and-coming projects connected to high-growth narratives like the Base network or AI.

Risks and Challenges of Investing in 1000x Cryptos

Here are the main risks when buying cryptocurrencies with 1000x potential.

High Volatility

All cryptocurrencies are volatile, but price swings are particularly extreme when investing in micro-cap projects — a key requirement to deliver 1000x gains. Investors who target a $3 billion valuation must enter the market at a $3 million market capitalization. These micro-cap tokens can rise and fall by significant amounts, often by double-digital percentage in a day.

High volatility risks increase significantly when investing in early-stage projects, which commonly list on DEXs with a small liquidity deposit. Even small buy or sell orders create substantial price movements, an uncomfortable experience for most beginners. The best practice is to start small, placing multiple micro-value orders to take advantage of dips.

Riding the 1000x wave also requires a strong mindset. Explosive cryptocurrencies don’t increase indefinitely, so investors should expect several major pullbacks of 70% or more. These corrections can result from early investors cashing in their gains or broader market conditions, such as a weak Bitcoin sentiment.

Knowing whether price declines are temporary or permanent is also difficult to predict. Due to these high volatility risks, investments should only be made with money you’re prepared to lose.

Market Manipulation

Micro-cap cryptocurrencies are at high risk of market manipulation due to their low liquidity.

Pump-and-dump schemes are common, with insiders initially buying tokens early at the lowest price possible. The insiders then create significant hype, often dedicating funds to influencers and social media ads. The objective is FOMO, with retail investors buying tokens thinking they’ve found the next crypto to 1000x. Valuations continue to rise, and once retail is fully involved, the insiders dump their tokens. The price crashes, giving insiders substantial profits while holders are left with worthless tokens.

While pump-and-dump schemes are difficult to spot, identifying red flags can reduce the risks. If a price rally is due to marketing hype rather than evidence of a working product, it could be a scam. Massive volume spikes after a crypto influencer posts on social media are another warning sign.

Almost all 1000x cryptocurrencies have real communities, minimum viable products (MVPs), and sustained volume, even in their early growth periods. Investors should avoid buying cryptocurrencies because of short-term pricing metrics — most will fail to deliver returns.

Scams, Rug Pulls, and Security Risks

Pump-and-dumps are just one type of crypto scam to know about — many others exist.

Malicious smart contracts, where developers insert malicious code to defraud investors, are behind many scams. Honeypots, for instance, allow investors to buy tokens but not sell. The founders’ whitelisted wallet is the only one that can bypass these restrictions. Parabolic price increases with zero dips are almost always honeypots, especially in low-cap markets where volatility is the norm.

Smart contracts also facilitate hidden minting functions. These allow founders to create unlimited tokens after the launch, which, when dumped on the market, crashes the price. Scammers can also insert terms to create a significant transaction tax. For instance, a 99% tax is transferred to the founder’s wallet while the investors keep just 1%.

Investors can mitigate smart contract scams through due diligence. Auditing companies like CertiK offer extensive security assessments of smart contracts, so risks like honeypots and mints should be identified. Projects that skip the contract audit process are likely scams, so investors should avoid them.

You’ve likely heard of the rug pull scam, too. Founders deposit liquidity into a DEX with flexible terms, so they can withdraw funds at any time. Withdrawing that liquidity means the token becomes untradable, which invariably crashes its price.

Rug pulls, just like smart contract scams, can be avoided when following best practices. Legitimate 1000x crypto projects lock their liquidity with trusted third-party lockers like Team.Finance or Unicrypt. This security step prevents founders from withdrawing the liquidity for a certain timeframe. Serious projects with long-term ambitions set a lock period of at least one year — anything less than three months lacks credibility and commitment.

Lack of Long-Term Viability

Explosive cryptocurrencies are often short-sighted projects that capitalize on narratives or real-world events.

Peanut the Squirrel ($PNUT), for instance, was launched to honor an eastern gray squirrel of the same name. Peanut, whose Instagram account surpassed 500,000 followers, was seized and euthanized by New York authorities. $PNUT rallied from $0.03396 to $2.47 before the hype died off and the price crashed.

Even utility-driven projects with innovative concepts can lack long-term viability. Projects generate pre-development hype about new technology they’re building without verifiable evidence that they exist. Prices crash once the markets lose faith, so frequently checking roadmap progress is crucial

Investors can also evaluate long-term sustainability through the token’s use cases. Question whether end users have a reason to purchase and hold the tokens, or if they merely exist for price speculation. Real 1000x prospects create tokens with genuine utility, which leads to rising demand over time.

Latest Trading News

Investment Strategies for Finding 1000x Cryptos

Seasoned investors deploy various strategies when exploring 1000x cryptos. Here are some of the most effective methods.

Diversification and Risk Management

Diversification is a proven risk management strategy used in all investment circles. It’s particularly important when investing in cryptocurrencies with 1000x potential — these explosive gains are only possible with micro-cap tokens. Most micro-caps, just like penny stocks, fail to deliver investment returns, which often causes significant losses.

The diversification strategy spreads investment funds across a wide range of assets. It ensures that no single losing investment heavily impacts the broader portfolio value. When investing in micro-cap tokens, only one token needs to blow up to see substantial returns, even if the remaining assets lose money.

The first requirement is to do thorough research on high-growth crypto categories that have long-term potential, such as AI, RWA, DeFi 2.0, privacy, and blockchain gaming. Investors can then pick high-quality projects from each category, covering several sub-niches. Exposure to DeFi 2.0, for instance, might include projects involved in yield-generating products like liquidity provision and lending, alongside infrastructure networks and security-focused solutions.

1000x prospects should only make up a small percentage of the overall portfolio. Investors might allocate a majority of their funds to more risk-averse cryptocurrencies, including large-caps like Bitcoin, Ethereum, Solana, and BNB. Exposure to mid-cap leaders is also an option, such as Uniswap, Sui, and Compound.

Using Fundamental and Technical Analysis

Investors use fundamental and technical analysis to predict future market movements, although they serve different purposes.

Fundamental analysis focuses on what matters most — use cases, token dynamics, market capitalization, adoption rates, crypto community strength, and partnerships. There’s less focus on short-term pricing data, as investors make assessments about long-term fundamentals that can lead to sustainable growth over time.

While technical analysis is popular with short-term trading strategies, it also helps investors time entries and exits. One example is the Relative Strength Index (RSI), a technical indicator that assesses overbought or oversold conditions. Seasoned investors will often buy cryptocurrencies with strong fundamentals when the RSI drops below 30, which highlights oversold conditions and a potential rebound. This strategy allows investors to enter the markets at a more favorable price.

Discovering repeated support levels is also valuable when trading 1000x crypto tokens. This is a specific price point where buyers consistently enter the market, acting as a strong defence against sellers.

Following Smart Money and Influencers

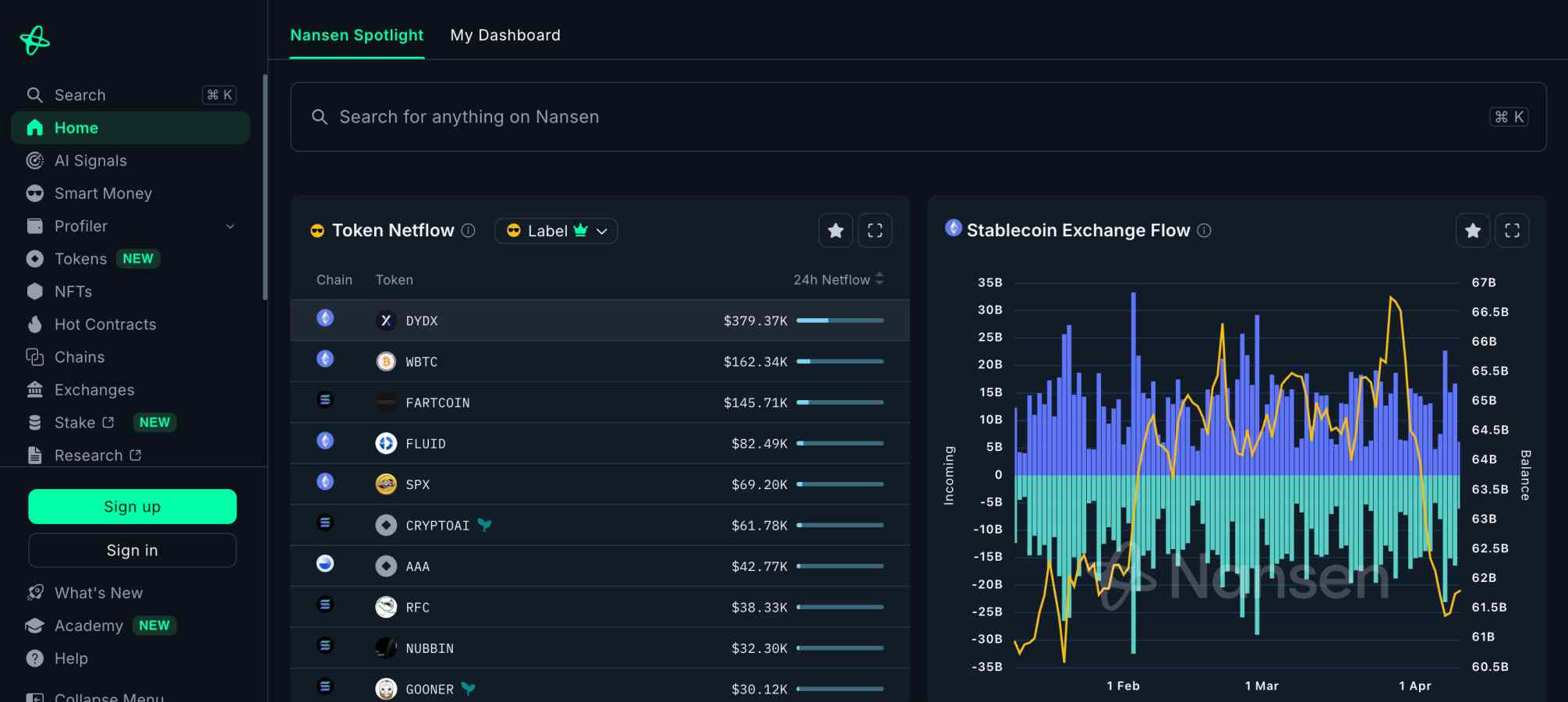

Beginners often have success when following smart money, such as venture capitalists and crypto whales. These investors have a proven track record of picking explosive cryptocurrencies early — they spot trends and opportunities long before the hype cycle. You can use third-party platforms like Nansen and Arkham to discover smart money movements. These providers automatically track successful wallet addresses, so users receive a notification when tokens are bought or sold.

Investors can also track relevant influencers with substantial followings. Social media accounts with over 1 million followers can be highly influential in crypto — a single Tweet can create hype and FOMO almost immediately. The key risk is that some crypto influencers are paid shills, so they don’t truly believe in the project. The tokens are often dumped after the initial price rally, causing the price to crash.

Holding vs. Short-Term Trading

Investors can choose between a long-term or short-term strategy — each has benefits and drawbacks.

Most experts recommend long-term holding unless you actively trade with technical and high-level research skills. This strategy allows you to ride out short-term volatility and maximize the full explosive growth curve. Most 1000x success stories happen over several years, with multiple corrections and dips along the way. Long-term holders remain focused on the fundamentals rather than short-term swings.

BNB validates the long-term vision. Those who bought BNB during its 2017 ICO paid just $0.15 per token. BNB hit an all-time high of $793.35 in December 2024, reflecting gains of 5289x over five years.

A long-term outlook is also less stressful. You won’t need to constantly check pricing charts or portfolio values — you’re in the market for the long run.

Short-term trading does have its benefits, though, especially when capitalizing on viral meme coins. Take the $TRUMP token launch as an example. Despite having zero use cases and unfair tokenomics, $TRUMP increased by 20x in its first 48 hours. Investors who saw Donald Trump’s launch announcement made some quick profits before moving on to the next opportunity.

Next 1000x Crypto FAQs

1000x cryptocurrencies increase by 1000 times the token cost price, delivering gains of 100,000%.

The biggest risk is high volatility. 1000x cryptocurrencies are low-cap tokens, so most fail to deliver returns.

Yes, many 1000x cryptocurrencies were meme coins, including Shiba Inu and Pepe. These meme coin projects exploded due to social media virality and fair tokenomics.

High-potential crypto sectors include AI, DeFi 2.0, RWA, privacy coins, and layer-2 solutions. Meme coins also remain a high-growth market.

Yes, investors are increasingly using AI to find the next crypto to 1000x. AI extracts and analyzes prices, on-chain movements, social metrics, and more to deliver real-time insights.

Only consider projects with locked DEX liquidty and audited smart contracts without vulnrabilities. Investors should also assess the token supply and distribution. What is a 1000x crypto?

How do I find low-market-cap gems before they explode?

What are the biggest risks of investing in potential 1000x cryptos?

Are meme coins capable of 1000x growth?

Which sectors have the highest potential for 1000x gains?

Can AI help identify the next 1000x crypto?

How do I avoid scams and rug pulls when investing in small projects?

References

- Uber’s first investors open up about their wild ride (CNN)

- Instagram-famous squirrel euthanised by authorities (The BBC)

- Trump’s new meme coin soars on his first day in office, lifts other tokens (Reuters)

- Cryptoverse: Every frog has its day as pepe pops 7,000% (Reuters)

- Artificial intelligence market size, share & trends analysis report by solution (Grand View Research)