Join Our Telegram channel to stay up to date on breaking news coverage

The Multichain (MULTI) price has been recovering after an 80% slump from its May 28 high of $5.350. The $0.991 support level broke the fall for MULTI, and now the altcoin is nurturing an uptrend. As the chart below indicates, the token is finding its way from the thickets of the Exponential Moving Averages (EMA), making them the inflection points to determine MultiChain’s next move.

MultiChain Fundamentals Influencing Price

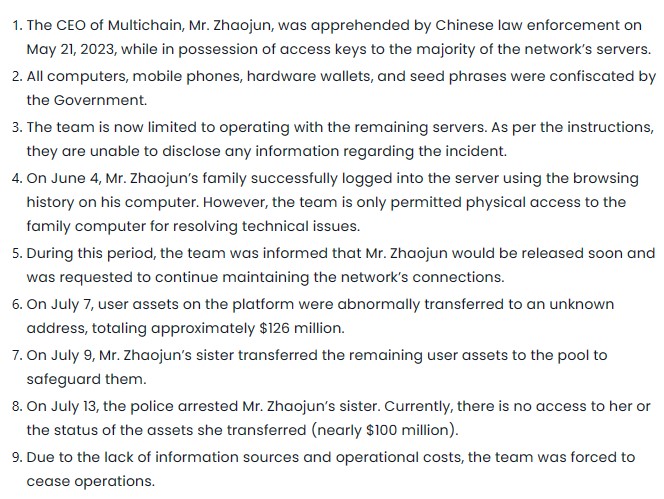

When considering the MultiChain ecosystem, one principal factor stands out. After his recent arrest, the network’s CEO and his sister are due for release this month. Zhaojun was arrested by Chinese authorities in July, together with his sister, on allegations of “tampering with user funds.”

1. On May 21, 2023, Multichain CEO Zhaojun was taken away by the Chinese police from his home and has been out of contact with the global Multichain team ever since. The team contacted the MPC node operators and learned that their operational access keys to MPC node servers had…

— Multichain (Previously Anyswap) (@MultichainOrg) July 14, 2023

Below is a complete rundown of how the events took place, according to CoinWire

To prioritize the security of user assets, Binance exchange temporarily suspended deposits and withdrawals for Multichain-bridged tokens amid the uncertainties.

Besides the expected release, the network is also anticipating collaborating with a major industry player. The speculation has inspired a resounding demand for MULTI’s products locally and internationally.

$MULTI #MultiChain is pumping today on Binance👀

There are rumours going around that the CEO of $MULTI is being released this month by the Chinese authorities.

What’s next?

👉Partnership with a major industry player

👉The demand for $MULTI‘s products has been growing rapidly in… pic.twitter.com/Jehs20CJgk— 💎ALTSTEIN TRADE💎 (@Altsteinn) September 11, 2023

There is no confirmation of the identity of the expected partner, but the InsideBitcoins team will bring you updates as they unfold.

MultiChain Price Forecast as MULTI Tests 100-day EMA

The MultiChain price action since late May has seen MULTI consolidate within the confines of two boundaries of the descending parallel channel. As indicated, bullish and bearish fakeouts formed part of the allure for traders, catching some off-guard, especially the more conservative lot, but skilled traders saw it coming.

At the time of writing, the MultiChain price is $2.234 after flipping the 50-day EMA at $1.766. This hurdle was transformed from a resistance level to support amid growing momentum, paving the way for MULTI to test the 100-day EMA.

The daily chart for the MULTI/USDT trading pair shows that the histogram bars of the Awesome Oscillatory are turning green. This indicates that the bulls maintain a presence in the MULTI market, increasing the odds for further upside potential.

With a forecasted four-fold move north, MultiChain price could overcome the 100-day EMA at $2.690 after confirming its northbound move above the 50-day EMA. MULTI could shatter the 200-day EMA at $4.127 in a highly bullish case, possibly extending north toward the supply zone (SZ) at around the psychological $8 level.

On the other hand, if selling momentum abounds, the MultiChain price could continue south. A rejection from the 100-day EMA at $2.689 could see MULTI ultimately lose the 50-day EMA support before falling back into the downtrend channel at $0.991. A break below the midline of this bearish technical formation would confirm the downtrend.

MULTI Alternative

BTCBSC takes the front-row seats when considering possible alternatives to MultiChain. It is the ticker for the Bitcoin BSC ecosystem, giving investors who missed the Bitcoin (BTC) train in 2011 a second chance.

Embrace the nostalgia of Bitcoin’s beginnings with #BitcoinBSC! 🕰️

Revisiting April 2011 prices, when #Bitcoin cost was only 99¢ each. 🚀

Join us on this journey down memory lane and experience market accessibility like never before.

🔗https://t.co/oM0YP8IlbV pic.twitter.com/dUJluWiWeW

— Bitcoinbsc (@Bitcoinbsctoken) September 12, 2023

Bitcoin BSC is built atop the Ethereum-based Binance Smart Chain, known for multiple value additions. These include speed, security, smart contract capabilities, affordability, and efficiency, delivered through seamless access through the everyday Trust Wallet or MetaMask decentralized applications (dApps). This makes it easy to store and trade Bitcoin BSC.

The project is in the presale stage, with over $1.259 million raised so far. Interested investors can buy BTCBSC for $0.99 using Ethereum (ETH), Binance Coin (BNB), or Tether (USDT). The project has a staking feature running, meant to reduce selling pressure on the token while providing a means for passive income.

Other options for passive income earning include the referral program. To get the referral link, first connect your wallet. The link is unique to you, and when you share it, everyone who uses it to join the Bitcoin BSC bandwagon will be an income earner for you. Specifically, you will get 5% from every transaction they make.

With these amazing features, experts say BTCBSC is among the few tokens with the promise of 10X gains. Do not miss out for any reason.

Also Read:

- How To Buy Bitcoin BSC On Presale – Alessandro De Crypto Video Review

- New Low Market Cap Crypto Presale – Bitcoin BSC (BTCBSC), An Alternative to Bitcoin

- New Crypto Presale Under $1 on Binance Smart Chain With High Staking APY – $BTCBSC

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage