Join Our Telegram channel to stay up to date on breaking news coverage

Magic Labs secured $52 million in funding, backed by PayPal Ventures, signaling the rising importance of Web3 technologies. With over 130,000 developers and 20 million wallets, the company plans to compete with industry leaders like MetaMask and Trust Wallet.

Magic Labs Raises $52 Million in Strategic Funding Round

During a week marked by significant investments in the crypto industry, Magic Labs emerged as a clear winner. The use of digital assets to revolutionize global financial markets has driven companies like PayPal Holdings to invest significantly in blockchain technology.

The wallet-as-a-service provider successfully secured an impressive $52 million in a strategic funding round led by PayPal Ventures, with the participation of Cherubic, Synchrony, KX, Northzone, and Volt Capital, as stated in a press release.

As a result, Magic Labs, with over 130,000 developers and more than 20 million wallets, can now compete in the same category as MetaMask, Trust Wallet, and Ledger hardware wallet.

This latest funding round propelled the San Francisco-based firm’s total raised funds to over $80 million, elevating its valuation to just under $500 million, as reported by Fortune.

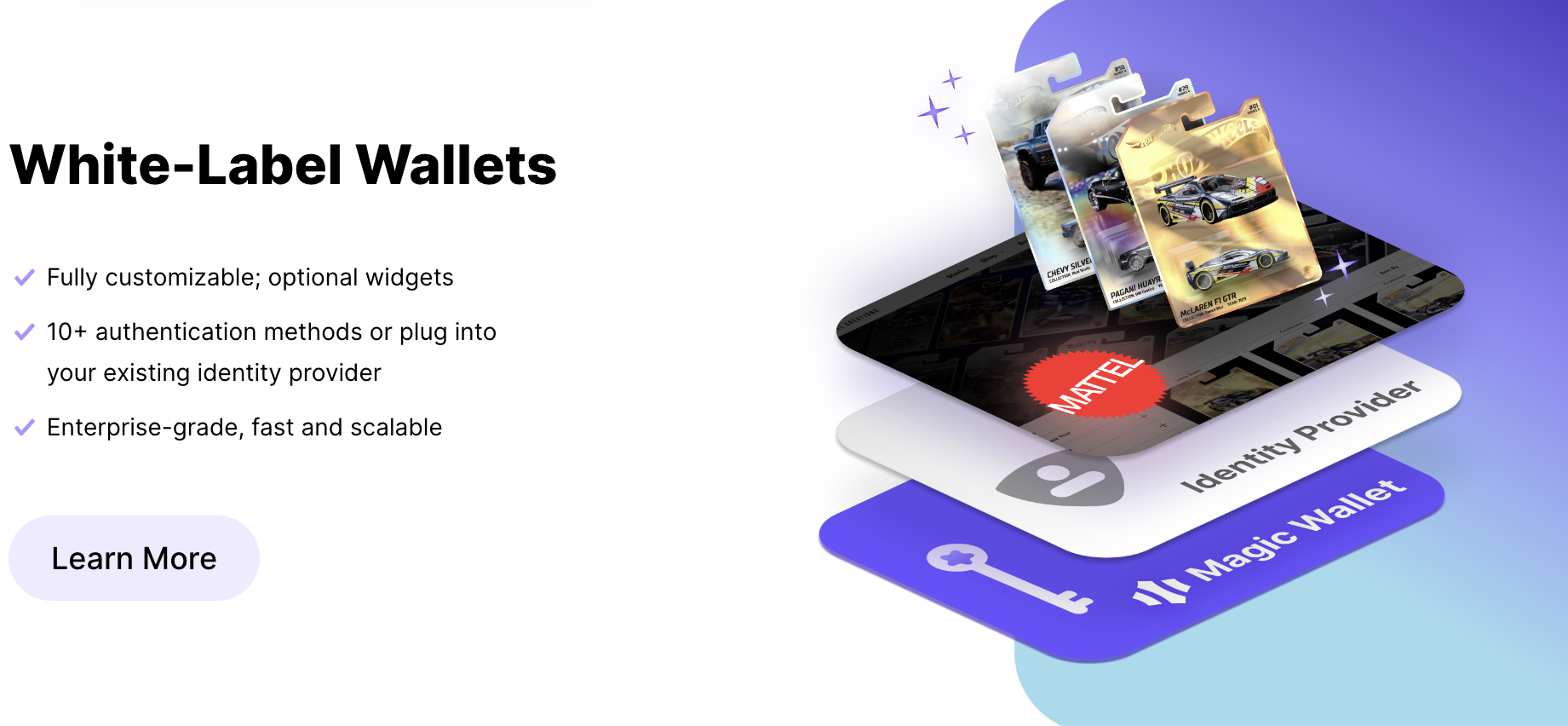

Magic Labs operates by providing software development kits (SDKs) of their wallet to clients, many of which are Fortune 500 companies. These clients can then customize the crypto wallet to suit their preferences and offer it to their customers through their own applications.

One prominent client of Magic Labs is the retail giant Macy’s, while toy manufacturer Mattel, known for its Hot Wheels brand, also utilizes Magic Labs’ wallet-as-a-service. Mattel recently launched a peer-to-peer NFT marketplace for its virtual collectibles in April, relying on Magic as its service provider.

Alan Du, a partner at PayPal Ventures, highlights the significant role played by Magic Labs in promoting the widespread acceptance of Web3.

Du emphasizes that Magic Labs provides a secure and intuitive solution, enabling companies to effectively engage millions of users through their applications and effectively onboard individuals who are new to the Web3 environment. By offering wallet creation services, Magic Labs empowers businesses to tap into the expanding Web3 user base and facilitate seamless adoption of this transformative technology.

Magic Labs already adheres to various regulatory standards, including the California Consumer Privacy Act, Systems and Organization Controls 2 Type II, the European Union’s General Data Protection Regulation, International Organization for Standards protocols, and the Health Insurance Portability and Accountability Act. This ensures the safe adoption of digital assets through the Magic protocol.

PayPal Ventures Invests in Magic Labs to Tap into Web3 Potential

PayPal’s investment in Magic Labs is in line with its existing framework for embracing cryptocurrencies. PayPal already enables users to purchase popular digital assets such as Bitcoin, Ethereum, and Bitcoin Cash, demonstrating a growing demand for these assets over traditional fiat currencies. By investing in a wallet-as-a-service provider, PayPal Ventures signals its commitment to meeting the needs of digital asset enthusiasts.

Magic Labs has made significant strides in ensuring a safe and compliant environment for its users by obtaining regulatory approvals from various authorities.

The company has received endorsements from notable entities such as the California Consumer Privacy Act, Systems and Organization Controls 2 Type II, the European Union’s General Data Protection Regulation, the International Organization for Standards protocols, and the Health Insurance Portability and Accountability Act. These regulatory approvals serve as a testament to Magic Labs’ dedication to maintaining a secure and compliant ecosystem for its users.

The California Consumer Privacy Act, for instance, emphasizes the protection of personal information, while the European Union’s General Data Protection Regulation sets stringent guidelines for data privacy and security.

Despite entering a competitive market dominated by established players like MetaMask, Ledger, and Trust Wallet, which recently secured significant funding rounds, Magic Labs remains optimistic about its prospects. The company aims to attract a growing community of Web3 developers and users by offering enhanced and user-friendly services.

Magic Labs stands out by providing over 20 authentication methods, including email, SMS, and social authentication, ensuring convenience and security for users. Moreover, Magic Labs supports multiple on-ramp platforms, including Credit, Debit, and Instant Bank ACH, with PayPal leading the list of available options.

Web3 Gaming Dominates Crypto Funding – Over $151 Million Raised as Industry Sees Surge

Last week witnessed a surge in funding for the crypto industry, particularly in the realm of Web3 gaming. Over $151 million was raised by approximately 12 crypto startups, highlighting the growing significance of this sector.

Openfort, a company dedicated to developing a wallet-as-a-service product for Web3 gaming, secured $3 million in funding. Gumi Cryptos Capital and Maven 11 took the lead in the seed round, with participation from Game7, NGC Ventures, and Newman Capital. Openfort aims to provide the necessary infrastructure to support crypto transactions within popular games, revolutionizing the gaming experience in the Web3 era.

Account abstraction, a technique allowing smart contracts to initiate transactions themselves, is a key focus for Openfort. This approach, also being explored by Visa’s crypto team, is expected to enhance the smoothness and simplicity of the gaming experience, particularly by abstracting gas fees and enabling transactions with ERC-20 tokens.

In another gaming-related investment, Pomerium, a Web3 game developer, received an undisclosed investment of $20 million in an angel round. This funding will contribute to the growth and development of their innovative gaming projects.

Worldcoin, a blockchain-based financial and identity network co-founded by Sam Altman, creator of OpenAI, successfully raised an impressive $115 million in a Series C round. Blockchain Capital led the investment, with participation from a16z, Bain Capital Crypto, and Distributed Global.

Other notable fundraisers from the week include Semafor, a news site that secured $19 million to replace funds previously received from FTX’s Sam Bankman-Fried. LabDAO raised $3.6 million with the help of Inflection.xyz and Village Global to advance the decentralization of drug discovery.

Sort, a smart contract platform for Web3 app developers, raised $3.5 million in a seed round led by Lemniscap. Finally, Num Finance, a local stablecoin issuer in Latin American countries, obtained a $1.5 million investment in a pre-seed round led by a stablecoin-focused Reserve.

These investments reflect the increasing momentum and enthusiasm surrounding Web3 technologies, as entrepreneurs and investors recognize the potential for innovation and disruption in various industries.

Related Articles

- Best Web 3 Tokens to Buy

- Best DeFi Wallets

- Ripple Joins $40 Million Fund for Web3 Infrastructure as Key Investor

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage