Join Our Telegram channel to stay up to date on breaking news coverage

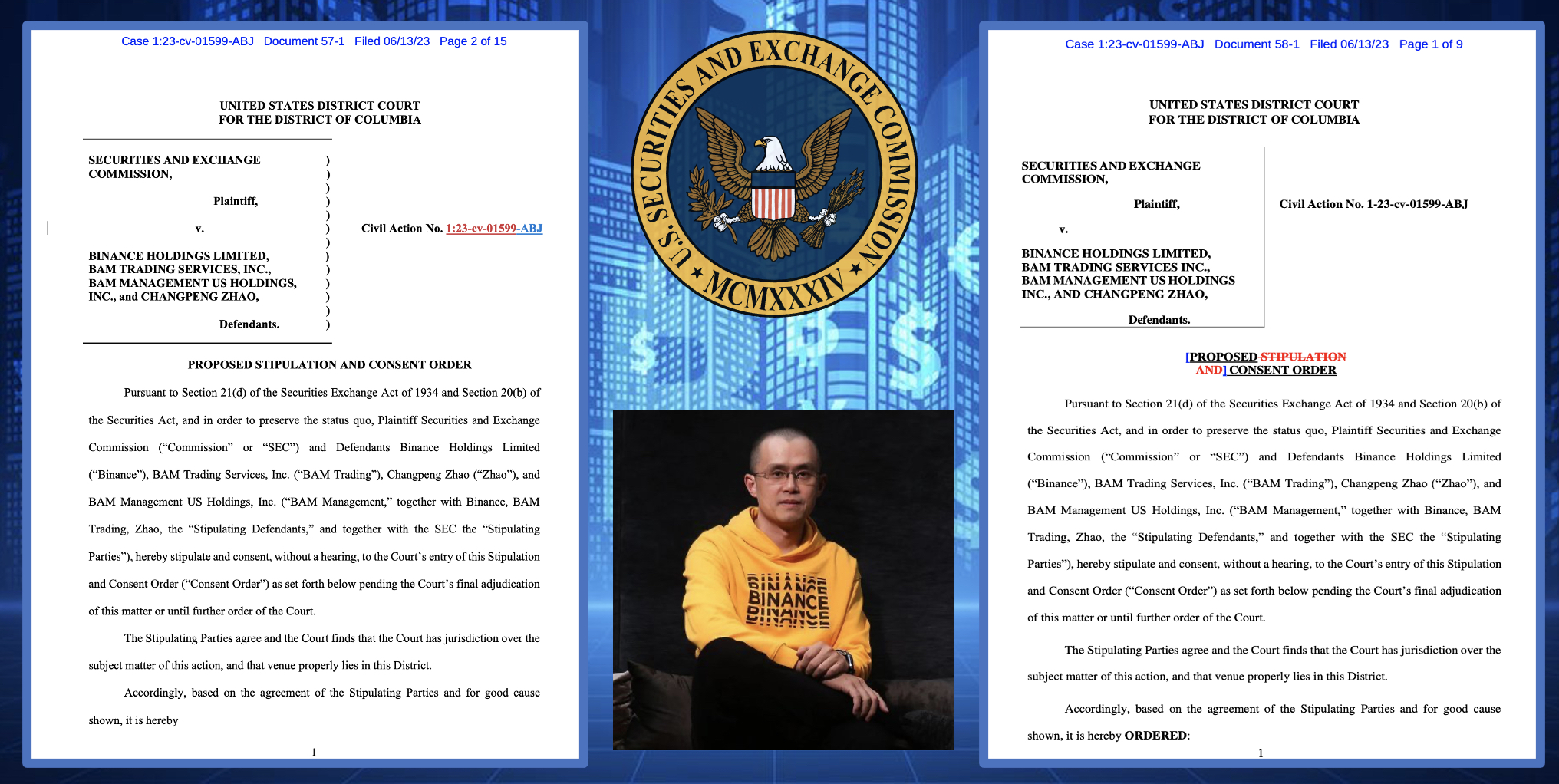

In the legal face-off between Binance.US and the Securities and Exchange Commission (SEC), District Judge Amy Berman Jackson has stepped in, advocating for a compromise.

Facing allegations from the SEC of unlawful operations, Binance.US could experience severe implications from an all-out asset freeze, a scenario that could also affect the digital asset markets broadly.

Judge Jackson has, therefore, redirected the case to a magistrate judge.

The goal is to formulate a solution that shields customer funds while permitting the continuation of the exchange’s operations, striving for an outcome satisfactory to both parties.

Finding a Middle Ground

According to a Bloomberg’s report, during a hearing held on Tuesday, Judge Jackson expressed her belief that the SEC and Binance.US were not too far apart in their positions.

Recognizing that the technical details of a potential compromise would be better handled by the parties themselves as she delegated the task to a magistrate judge.

If an agreement is reached, it would negate the need for the judge to rule on the SEC’s request for a temporary restraining order against Binance.US.

Binance.US has vehemently denied the SEC’s allegations and emphasized that customer assets are secure.

The exchange argued that a complete asset freeze would not only harm its business but also have adverse effects on customers.

One of Binance.US’s lawyers urged the judge not to impose such a severe measure, stating:

“We are not willing to accept the death penalty eight days into our case.”

The attorney representing Binance.US highlighted the necessity of maintaining the exchange’s ability to cover ordinary business expenses, including rent, salaries, vendors, and software licensing. He expressed concerns that an asset freeze would be misinterpreted by banks and reiterated the potential negative impact it could have on the digital asset markets.

Judge Jackson shared these concerns and acknowledged the far-reaching consequences of shutting down the exchange entirely. She said:

“Shutting it down completely would create significant consequences not only for the company but for the digital asset markets in general.”

Recognizing the importance of preserving customer funds while allowing the platform to operate, Judge Jackson emphasized the need to find a compromise that safeguards both interests.

Former SEC enforcement attorney John Read Stark took to Twitter to share his observations on the ongoing hearing before Judge Amy Berman Jackson. Stark highlighted that there was a noticeable clash between the objectives of both the SEC and Binance.US during the proceedings.

Predicting the ruling, he stated:

“There is a lot of conflict between what each party wants to achieve in this hearing.”

Proposed Compromise and Requests

Binance.US submitted a compromise proposal that suggested transferring US customer crypto assets to new wallets controlled exclusively by US-based officers at Binance.US. The exchange also requested permission to continue paying employees and covering operational costs, with no assets being transferred or payments benefiting any Binance entity without a court order.

In response, the SEC proposed that Binance repatriate customer assets to the US federal government, where they would be under the control of entities outside the reach of Changpeng Zhao, the founder and CEO of Binance Holdings Ltd.

The regulator expressed openness to a narrowly-tailored exception to an asset freeze, allowing the company to cover its operational expenses. The SEC requested a detailed account of the exchange’s business expenses and professional fees to better understand the requirements for sustaining its operations.

Asset Freeze and Offshore Transfers

The SEC’s motion for an asset freeze was prompted by concerns that Binance could transfer customer assets offshore. In a memorandum submitted earlier, the SEC claimed that Binance and Zhao had a history of commingling customer funds and moving them outside the US or onto the blockchain, thereby evading the court’s jurisdiction.

The memorandum indicated that Binance.US holds over $2.2 billion in customer assets, while Zhao, a foreign national, has made it clear that he does not consider himself subject to the jurisdiction of the court.

The outcome of these discussions will have significant implications for Binance.US, its customers, and the wider digital asset markets. Both parties now have an opportunity to find common ground that protects customer funds while allowing the exchange to continue its operations within the confines of the law.

Related News

- Best Crypto to Buy Now

- U.S. Judge Denies Binance.US Asset Freeze For Now

- SEC Asks Coinbase for More Time to Clarify Crypto

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage