Join Our Telegram channel to stay up to date on breaking news coverage

GMX is one of the most trending cryptocurrency projects right now – a permissionless, decentralized perpetual swap and spot exchange. By connecting their wallets, traders can utilize it to quickly trade cryptocurrency on-chain. The GMX protocol contains a native token called GMX that serves as governance, utility, and value-accrual token.

Users can stake GMX tokens to have access to additional incentives as well a share of the protocol fees charged by GMX. The networks Arbitrum and Avalanche are supported by GMX.

Is it smart to buy GMX over the next years?

Were going to explore GMX coin and if its worth it to buy, we can see it’s pumping this month and it’s ranked around 80 in the top 100 coins. As it’s gaining traction during the crypto winter, it’s potentially a good investment. We can see that there are $8 million worth of tokens in circulation, that is not a huge supply which is also good.

We see GMX pumping recently, is it risky to buy GMX now though? Find out in the video below.

What is GMX?

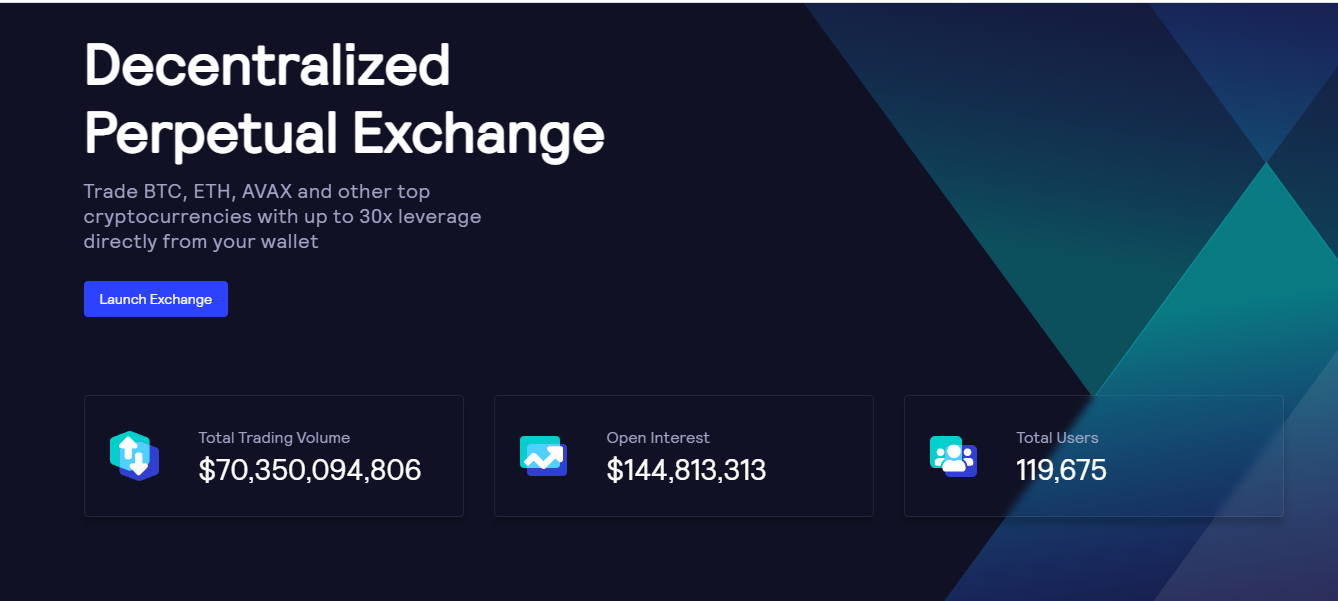

GMX is a decentralized spot and perpetual exchange, you may trade popular cryptocurrencies with up to 30x leverage directly from your wallet and pay cheap swap costs and no price effect trades. By offering zero-price effect trades and cheap swap costs, GMX seeks to improve the trading experience.

Trading is conducted through GLP, the local multi-asset pool, which pays liquidity providers fees. In addition GMX aggregates prices from other high volume-exchange using Chainlink Oracles for dynamics pricing.

GMX was initially introduced on the Arbitrum One blockchain in September 2021, when the network went operational. A method created to increase the speed and scalability of ethereum smart contract is called Arbitrum, an ethereum layer-2 rollup. The development of GMX later proceeded on Avalanche, a high-speed EVM-compatible blockchain, in January 2022.

See our guide to the best cryptos to buy now.

How GMX Works

A multi-asset pool named GLP facilitates trading on GMX. It is consists of 50% – 55% stablecoins, 25% BTC, and 10% of other altcoins like Chainllink and Uniswap. Any of the index assets can be used to create GLP token, which can then be burned to redeem any index asset. It immediately stakes and is not transferable, in contrary to the GMX token. Between Arbitrum and Avalanche, GLP has a different price, rewards, and index framework.

Related

- GMX Price Prediction Today, December 2, 2022: GMX/USD Is Marching Towards the $56 Price Mark

- GMX Price Prediction as GMX Token Surges Towards Record Highs Above $50

- 4 Best Cryptos to Buy Now, December 1: MATIC, GMX, TAMA and IMPT

- Biggest Crypto Gainers Today November 22 – LEO, BCH, D2T, GMX, TARO, IMPT, Tamadoge

- What is the Next Cryptocurrency to Explode

Join Our Telegram channel to stay up to date on breaking news coverage