Join Our Telegram channel to stay up to date on breaking news coverage

The Kadena price prediction reveals that the KDA price shows signs of renewed bullish momentum as it rebounds within an ascending channel, supported by key moving averages and increasing buying pressure.

Kadena Prediction Data:

- Kadena price now – $0.604

- Kadena market cap – $192.29 million

- Kadena circulating supply – 317.12 million

- Kadena total supply – 1 billion

- Kadena Coinmarketcap ranking – #251

Getting in early on crypto projects can be a game-changer, and Kadena (KDA) is a great example of why. Since hitting its all-time low of just $0.1213 on January 11, 2021, KDA has surged over 386%, showing the kind of potential early adopters often look for. While it’s currently trading well below its all-time high of $28.25 set in November 2021, the impressive recovery from its lowest point highlights the importance of spotting opportunities before the crowd catches on.

KDA/USD Market

Key Levels:

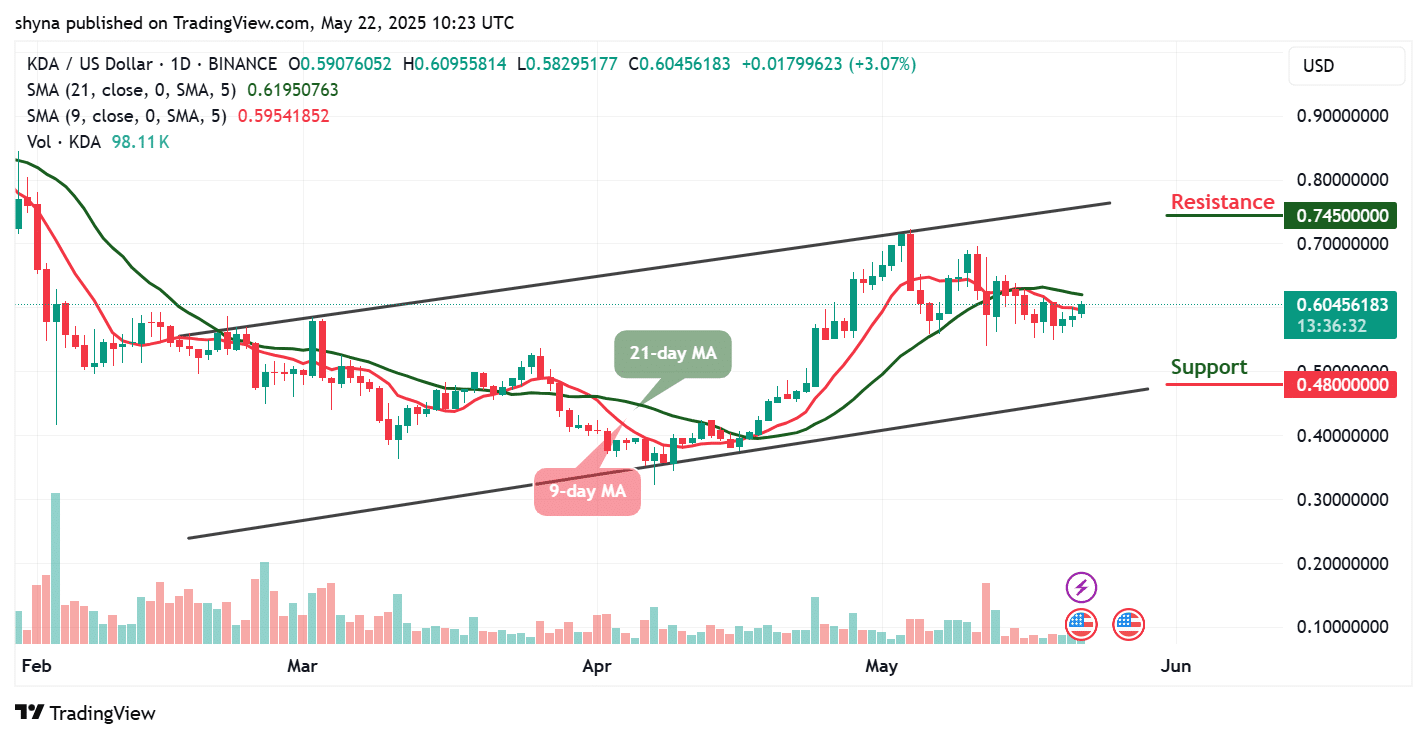

Resistance levels: $0.745, $0.750, $0.755

Support levels: $0.480, $0.475, $0.470

KDA/USD is currently showing a rebound within an ascending channel structure after finding support at the 21-day moving average. The daily chart highlights renewed buying pressure, as evidenced by a strong bullish candle that pushes the price above both the 9-day and 21-day MAs. This recovery signals the potential for continuation toward the $0.700 resistance level if momentum sustains. However, the price action remains favorable for the bulls as long as it stays above the channel’s midline and the short-term moving averages.

Kadena Price Prediction: KDA/USD Attempts Channel Continuation

A closer look at the price structure suggests that KDA may be gearing up for another push higher, having successfully tested previous resistance as support. Meanwhile, the convergence of the moving averages below the current price supports a bullish outlook, and if buyers manage to break through the $0.745 resistance, a move toward $0.750 and $0.755 could follow. However, any failure to breach the upper boundary of the channel could lead to sideways trading or minor pullbacks in the short term.

Massive Kadena (KDA) Move

Nevertheless, if sellers regain control, KDA could slide back to retest support at $0.50 before heading toward the critical supports at $0.480, $0.475, and $0.470, respectively. Despite this risk, the broader structure remains positive as long as the price holds within the ascending channel. Moreover, a drop below the 21-day MA would weaken the bullish case, but for now, technical signals lean toward further gains, especially if trading volume picks up and market sentiment remains supportive.

KDA/BTC Eyes Support Retest as Bullish Momentum Cools

The daily chart for KDA/BTC reveals a notable decline in momentum, with the price currently trading just above the lower boundary of an ascending channel. Despite a minor rebound of +2.06% during the latest session, KDA is still struggling to reclaim ground above the 9-day moving average, which sits around the 0563 SAT mark. This weakness reflects short-term bearish pressure as recent candles continue to close below both the 9-day and 21-day moving averages. As a result, the pair now hovers near a critical inflection point, where a failure to hold above the channel’s lower trendline could expose KDA to further losses.

Technically, if KDA fails to maintain support above the 0546 SAT level, the price could fall toward the 0400 SAT support zone, which aligns with the channel’s base. On the other hand, any renewed bullish push that successfully reclaims the 0607 SAT level (21-day MA) could reignite upward momentum toward the resistance area near 0685 SAT. Volume remains relatively muted, suggesting indecision, and the next directional cue will likely be determined by whether bulls can defend current levels and push for a recovery, or if bears take advantage of the weakening structure to drive a breakdown from the ascending pattern.

Meanwhile, Crypto analyst @rMarcusAurelius encouraged followers on X to closely monitor the weekly KDA chart, highlighting the emergence of a broadening bottom pattern—typically seen during downtrends—which may signal an upcoming bullish reversal and a strong opportunity to continue accumulating.

https://twitter.com/rMarcusAurelius/status/1921886327127060971

Alternatives to Kadena

KDA/USD shows a bullish rebound within an ascending channel, supported by renewed buying momentum and a strong daily candle pushing the price above short-term moving averages. The structure indicates room for further gains as long as the price holds above the channel’s midline, although failure to break higher may lead to consolidation or minor pullbacks, and a drop below key support or the 21-day moving average could weaken the bullish outlook. Notably, KDA can now also be purchased on the Best Wallet platform. This new decentralized wallet has raised over $12.6 million in its presale and is being positioned as a competitor to MetaMask, Trust Wallet, and Coinbase Wallet, though some uncertainty remains around its listing.

Best Wallet Presale Launched or No

Despite some confusion about the official launch status, the project continues to show potential growth, and all essential details—including whitepaper, audit reports, and the roadmap—are available on the official website. If you’re looking to get in early on a crypto wallet project with a solid foundation and plans, consider participating in the presale by connecting your wallet and purchasing through the official link. As always, conduct your research before investing, but don’t miss out on what could be a significant opportunity in the evolving crypto landscape.

Related News

- Kadena Price Prediction for Today, March 1 – KDA Technical Analysis

- Crypto Trading Meets AI — And Best Wallet Just Bagged $12.5M To Bring Them Closer

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage