Join Our Telegram channel to stay up to date on breaking news coverage

The U.S. regional banking crisis, which may just be beginning, has thrust cryptocurrencies like Bitcoin, Ethereum, and others back into the spotlight this year.

Since hitting lows of roughly $15,000 per Bitcoin late last year, the price of Bitcoin has almost quadrupled, and Ethereum, the second-largest cryptocurrency, has risen alongside it—despite cofounder Vitalik Buterin issuing a major bull run caution.

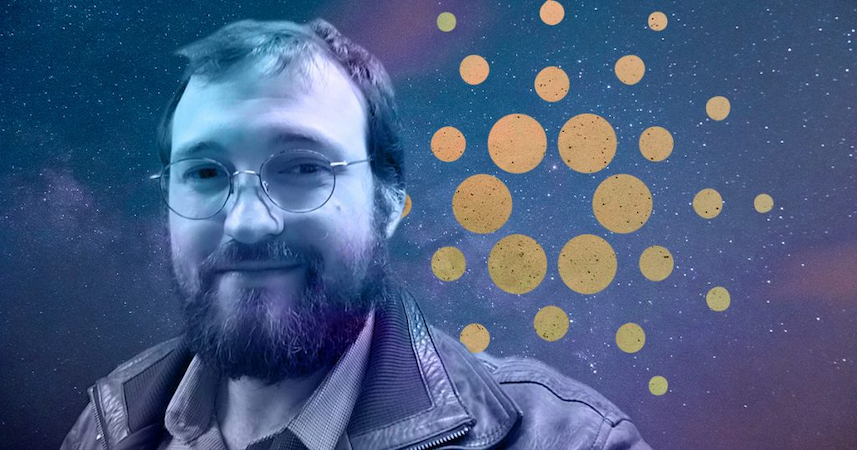

Charles Hoskinson, another co-founder of Ethereum who later went on to establish the Ethereum competitor Cardano (ADA), has now issued a warning that the banking crisis would be worse than the 2008 global financial crisis that prompted the invention of Bitcoin.

“In 2008, we had $373 billion in tied-up assets,” Hoskinson told Fox Business, alluding to the $373 billion in assets that failing banks collectively held in 2008. Hoskinson built Ethereum in 2014 alongside Buterin, Joe Lubin, and five other people.

With a market valuation of $13 billion, Cardano (ADA), developed by Hoskinson in 2016, has risen to become the seventh-largest cryptocurrency in the world, behind only Bitcoin and Ethereum, which each have $566 billion and $232 billion respectively.

I believe that the crisis in 2023 has cost us around $540 billion so far. We’ve only just begun. When you give that whole business model a little shove, it starts to break apart because you lose organizations like Silicon Valley Bank and they become so globally and politically polarized.

In March, the Federal Reserve was compelled to intervene with emergency measures after a dramatic deposit flight from Silicon Valley Bank and Signature Bank, but the fear soon extended to Switzerland’s Credit Suisse, which had to be saved by competitor UBS.

Regulators seized First Republic Bank this week and sold its assets to JPMorgan, the biggest bank in the United States in terms of assets.

Jamie Dimon, chief executive of JPMorgan, who was instrumental in causing the 2008 financial crisis, said,

Our government invited us and others to step up, and we did.

According to Wells Fargo (WFC) analysts, the purchase would result in a 3% gain in net deposits for JPMorgan, which previously owned over 10% of all bank deposits in the United States.

Hoskinson predicted that the phrase “too big to fail” will only result in larger institutions. “We saw this story back in 2008. This is the repeat. Nobody seems to want to watch it, in my opinion.”

The Fed’s quick succession of interest rate increases over the previous year, with rates this week rising to levels last seen before 2008 in an effort to contain spiraling inflation, have contributed to the 2023 financial crisis.

Others have cautioned that if systemic trust is not restored, the financial crisis might spiral out of hand.

According to a tweet from Bill Ackman, CEO of New York hedge firm Pershing Square:

We are running out of time to fix this problem. How many more unnecessary bank failures do we need to watch before the FDIC [Federal Deposit Insurance corporation], and our government wake up? We need a systemwide deposit guarantee regime now.

The regional banking system is at risk. SVB's depositors' bad weekend woke up uninsured depositors everywhere. The rapid rise in rates impaired assets and drained deposits. Zeroing out shareholders and bondholders massively increased the banks’ cost of capital. CRE losses loom.…

— Bill Ackman (@BillAckman) May 3, 2023

Ackman continued to say that:

Confidence in a financial institution may be shattered in a matter of days or decades. The next weakest bank starts to sway as each domino falls.

Are Banks Really Nothing but a Scam?

The failure of the traditional banking system makes crypto all the more of a viable proposition and alternative.

Many voices have spoken against traditional finance and the wrong kind of incentives they have. We have previously reported that Hayden Adams, the founder of Uniswap decentralized exchange (DEX), has been vocal about criticizing the banks’ “collateral requirements” adding that they only give a very small percentage of their revenue to depositors. Adams stated that banks have a regulatory setup that allows them to “rug pull” customers at any time.

Related

- Cardano (ADA) Price Prediction: Will It Embark On A Bullish Trend?

- Hoskinson, the CEO of Cardano, anticipates a flood of venture capital funding by 2024

- Banks Are Nothing But A Scam, Says Uniswap Boss

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage