Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price rose a fraction of a percent in the last 24 hours to trade at $105,555 as of 11:47 p.m. EST on trading volume that plunged 59% to $14.8 billion.

This comes as a massive military parade to celebrate the US Army’s 250th anniversary triggered nationwide “No Kings” protests against President Donald Trump. The demonstrations took place against a backdrop of intensifying fears of political violence.

Bitcoin Price Risks 12% Extended Loss If The $102K Support Fails

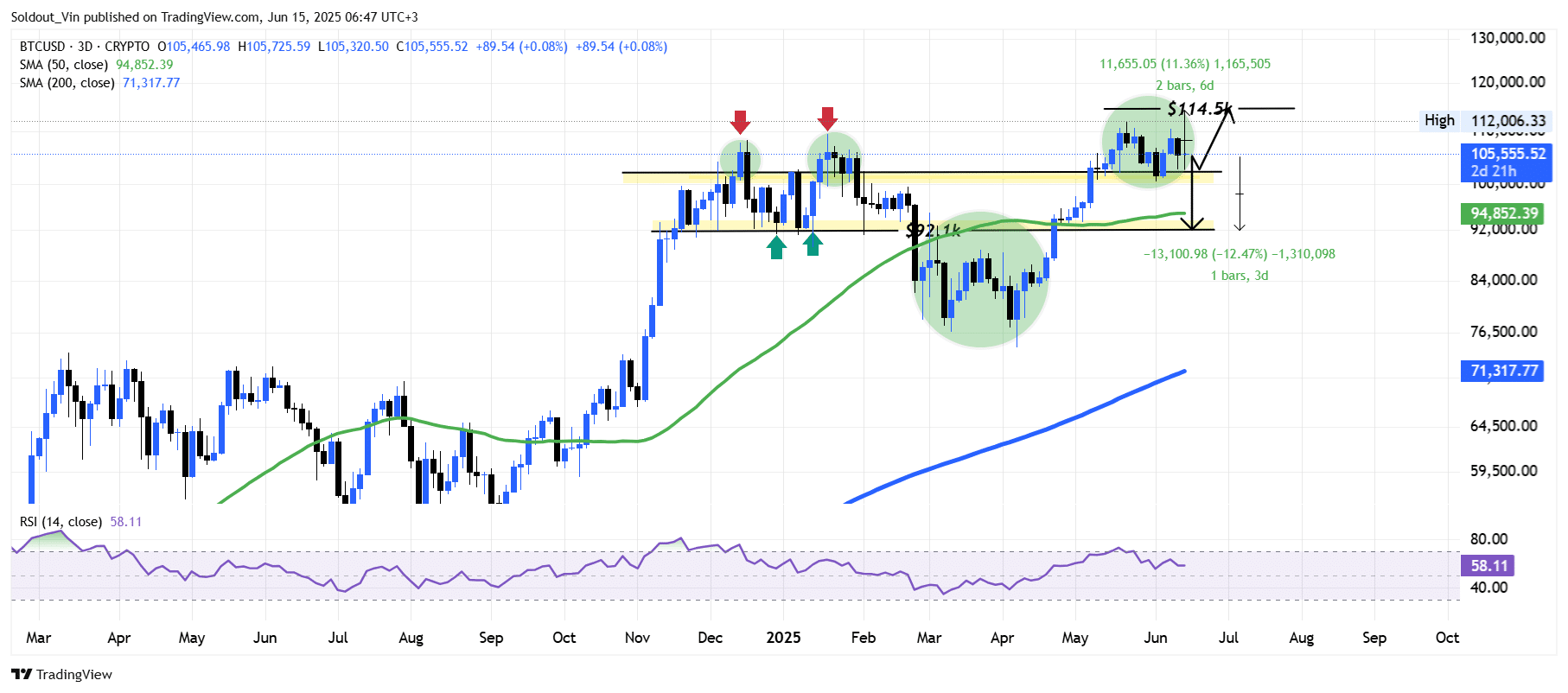

The BTC price on the 3-day chart shows the asset hit an intraday high of $106,074 before retracing to its current price.

The Bitcoin price action reveals a reversal after a brutal sell-off in the previous day, where the bulls seem to have found support at $102,747.

Those green arrows highlight some key support zones where bulls came back in and pushed prices higher. If the same level of enthusiasm still holds, it might curtail the precedent fall to $78,000 at around $92,544, backed by the 50-day Simple Moving Average (SMA) ($94,852).

The Relative Strength Index (RSI) at 58.11 sits in neutral territory, but facing downward, signaling that bullish momentum is waning. Since it is not oversold yet, there is more room to fall before a reversal.

According to the Bitcoin price analysis, bears could still have some control if the $102,000 level fails, which could possibly push the price through a 12% drop to the $92,100 support level.

BTC/USDT Chart Analysis (Tradingview)

The $90k-$94k support zone is critical. If it holds, we could see a grind back to above its all-time high (ATH) at $114,500K. This bullish outlook is also supported by the price of BTC trading above the 200-day and 50-day SMAs.

Meanwhile, investors are piling into a new Bitcoin-themed meme coin called Bitcoin Hyper (HYPER), Bitcoin’s first Layer 2 chain.

According to 99Bitcoins, a popular crypto channel on YouTube with over 723K subscribers, HYPER is one of the best crypto ICOs to buy right now.

Bitcoin Hyper Presale Closes On $1.5 Million – Buy And Stake For 599% APY

Bitcoin Hyper is a low-cap Bitcoin Layer 2 presale that’s already raised $1.25 million. The project is gaining early attention for combining scalability, fast transactions, and meme coin characteristics within Bitcoin’s Layer 2 ecosystem.

Although Bitcoin dominates the crypto space, its network lacks the speed needed for modern use. Bitcoin Hyper aims to change that by launching the first Layer-2 scaling solution explicitly built for BTC.

This new Layer 2 runs on Solana’s Virtual Machine (SVM), enabling fast transaction speeds, lower fees, and support for high-performance applications. The project will utilize a Canonical Bridge to track BTC deposits and reflect them on the Layer-2 network.

🚨 Bitcoin Hyper is now live in Best Wallet! 🚨@BTC_Hyper2 is building Bitcoin’s first Layer 2 focused on real scalability — enabling fast, cheap BTC transactions, meme coins, dApps, and more.

It’s secured by Bitcoin L1 and powered by Solana VM tech for high speed and massive… pic.twitter.com/5Ktj12RCR1

— Best Wallet (@BestWalletHQ) June 5, 2025

If you buy and stake now, you can also unlock a 599% annual return. The rate decreases as more people join, so it’s best to get in early.

Investors interested in participating in the presale can visit the official Bitcoin Hyper website to buy HYPER tokens for $0.0119 each using crypto or a bank card.

Buy before the next price increase in less than 34 hours.

Visit the Bitcoin Hyper website.

Related Articles

- Top Trending Cryptos on Solana Chain Today

- Solana ETF Issuers Submit New Filings

- New Cryptocurrency Releases, Listings, & Presales Today

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage