Join Our Telegram channel to stay up to date on breaking news coverage

Uniswap founder Hayden Adams says banks are “a massive scam” when compared to decentralized finance (DeFi) platforms. This comes after three high-profile bank collapses sent players in both the crypto and financial markets panicking.

The Collapse of Signature Bank, SVB, Silvergate Shake Up Financial Market

The crypto space witnessed a number of devastating bankruptcies in 2022 triggered by the collapse of Do Kwon’s Terra Ecosystem. This was exacerbated by the demise of Sam Bankman-Fried’s crypto empire FTX cryptocurrency exchange in November 2022.

The contagion effects snowballed into 2023 with major players like Genesis filing for bankruptcy after holding on longer than the likes for Celsius Network, three Arrows Capital, Vauld, BlockFi and Voyager Digital which had filed for bankruptcy last year.

As if this was not enough, the crypto market now stares at weeks of uncertainty and volatility after two crypto-friendly banks, Signature Bank and Silicon Valley Bank (SVB) were forced to halt their operations in the US over the weekend.

Signature Bank shut down in connection with Silicon Valley Bank collapse https://t.co/UdFcYny73B

— Fox News (@FoxNews) March 13, 2023

The collapse of the SVB and the Signature Bank comes only a few days after Silvergate, another cryptocurrency-friendly bank, chose to cease operations on March 9 citing the effects of the FTX collapse.

Just as with the collapse of centralized exchanges (CEXs) customers now have big amounts of funds locked in these banks including crypto companies. For example, Circle, the company that issues the USD Coin (USDC) stablecoin, revealed that more than $3.3 billion of its reserves were locked in SVB. This caused USDC to deviate from its dollar peg reaching all-time lows of $0.87 on Saturday. Other stablecoins such as DAI, FLAX, and USDD which hold reserves in USD

Fortunately, USDC has since recovered back to $0.99 courtesy of an official statement by Circle reassuring users that “$3.3 Billion of USDC Reserve Risk [has been] Removed.”

Uniswap Founder Thinks Banks Can Rug Users Any Time

The demise of Silvergate Bank, Signature Bank and SVB has left players in the financial markets questioning whether banks are safe custodians of customer funds. One such person is Hayden Adams, the founder of Uniswap decentralized exchange (DEX), who has criticized banks’ “collateral requirements” adding that they only give a very small percentage of their revenue to depositors. Adams was also concerned that banks might “rug” customers at any time.

If you compare banks to DeFi protocols you realize what a massive scam they are

Only 10% collateral requirements? Only a tiny fraction of returns paid out to users? Users can get rugged at any time?

Feeling bad for everyone negatively affected by degen banks 🙁

— hayden.eth 🦄 (@haydenzadams) March 11, 2023

As commercial entities, banks in the United States are subject to state and federal laws depending on their licenses. According to the fractional reserve system, banks are required to make a certain proportion of customer deposits available for withdrawal. Therefore, banks only need to keep a specific amount of cash on hand and can create loans from the rest of the deposits.

However, in the event of a bank run—a surge in customer withdrawals that depletes the liquidity of the bank—deposits may have to wait longer.

Last week, California regulators placed Silicon Valley Bank (SVB) under the Federal Deposit Insurance Corporation’s (FDIC) receivership following a bank run. During the weekend, a lot of individuals and companies, including Circle, the creator of the fiat-backed stablecoin USDC, were exposed and unable to access their money.

According to Hayden, the very fundamental foundation of the global financial system is a “massive scam” because of this limitation and the vulnerability of banks. Since then, the Federal Reserve of the United States has said that it will only help depositors access their funds, ruling out any plans to bail out the banks.

DeFi Protocols Benefit From The USDC De-Peg

The collapse of FTX saw a massive exodus from CEXs to DeFi protocols and DEXs such as Uniswap and Sushiswap. There were also increased withdrawals from CEXs as users preferred storing their crypto in self-custody wallets.

DeFi protocols are standards, codes, and procedures that govern decentralized financial applications guided by smart contracts. Platforms like Uniswap operate every day of the week on several blockchains, including Ethereum, allowing peer-to-peer swaps of cryptocurrencies.

Uniswap has emerged as one of the largest decentralized exchanges in the world since its launch in November 2018. UNI, its governance token, has rallied 15% from the $5.4 psychological level on Sunday to hit a high of $6.24 on Monday.

UNI/USD Daily Chart

At press time, Uniswap had retreated to $6.13 but it traded in a third consecutive bullish session. And with the Relative Strength Index (RSI) pointing upward, the UNI price was set to continue growing.

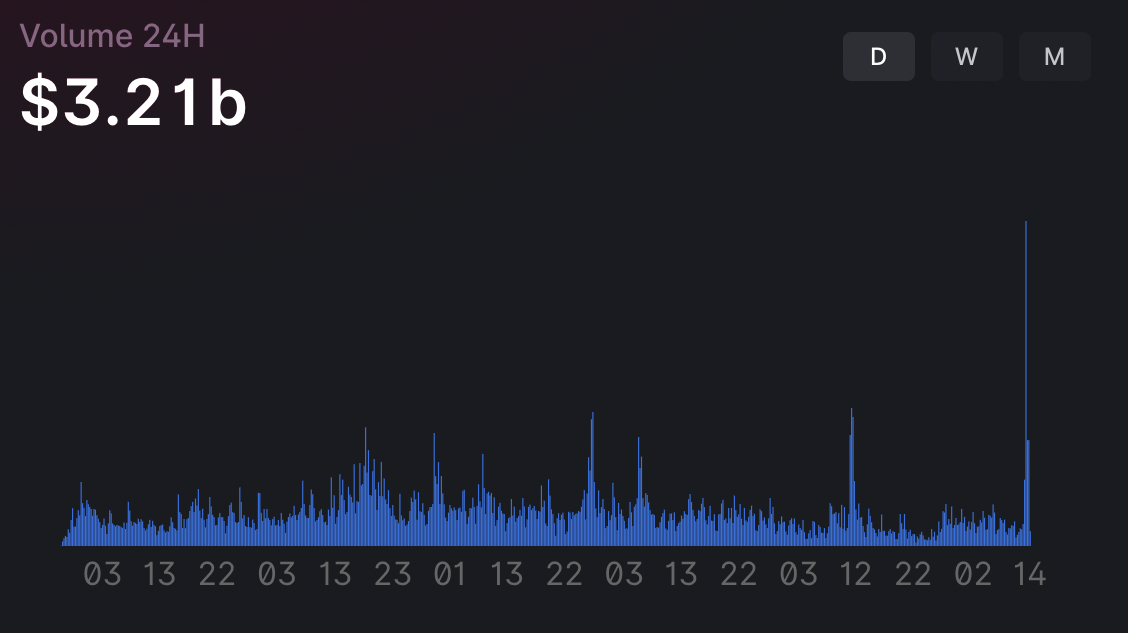

In addition, Uniswap posted a surge in daily trading volume amid the de-pegging of USDC reaching $3.35 billion on Ethereum on March 12.

Uniswap Daily Trading Volume on Ethereum

As of the time of writing, Uniswap had a total value locked (TVL) of $3.6 billion, according to data from DeFiLlama.

Another top DEX Curve saw the price of its native token CRV rise by 27% over the same time frame with the daily trading volume surging to $1.07 billion on March 10. At press time, its total value locked stood at $4.78 billion.

Related News:

- Binance Converts $1 Billion Industry Recovery Initiative Funds From BUSD To BTC, Ether And BNB

- Maker Price Prediction for Today, March 13: MKR/USD Could Hit $1100 Resistance

- No Government Bailout For Silicon Valley Bank, Says Yellen

- How to Buy Cryptocurrencies

Join Our Telegram channel to stay up to date on breaking news coverage