Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum (ETH) price flatlined this week even as Cathie Wood’s Ark Invest and 21 shares joined the race to launch the first spot Ether exchange-traded fund (ETF).

And the application came just a fortnight after the firms teamed up to apply for two Ethereum futures ETFs.

We have two more filings for ETFs with Ethereum Futures. This pair is from the @ARKInvest/@21Shares partnership. One will be just ETH futures. The other will be both #Bitcoin& Ethereum futures.

h/t @NateGeraci pic.twitter.com/mgS9QzCdPX— James Seyffart (@JSeyff) August 24, 2023

The token’s biggest hope for a bump is approval next month of a spot Bitcoin ETF. That would signal the opening of the floodgates for other spot crypto ETFs.

Former Securities and Exchange Commission (SEC) chair Jay Clayton approval of a spot Bitcoin ETF is inevitable at some point. That may happen as early as next month, but the SEC has until March before deciding before or against approving seven applications from companies including BlackRock and Fidelity.

Approval of a spot crypto ETF backed by blue chip firms like BlackRock and Fidelity would be a huge boost for the crypto ecosystem, helping it gain mainstream acceptance and possibly triggering a new bull market.

New York Digital Investment Group (NYDIG) has predicted approval of Spot Bitcoin ETFs could result in an influx of $30 billion in new demand for Bitcoin. Approval will trigger ‘enormous inflows,’ research frim K33 said in a Sept. 5 report, adding that it’s reckless of investors not to `aggressively accumulate” Bitcoin at current prices.

Ethereum Co-Founder’s X Account Hacked

Meanwhile, Ethereum co-founder Vitalik Buterin is making headlines after reports his X account was compromised by a phishing link. Over $700,000 was siphoned from victims. It is not yet known the account was compromised, but a SIM swap attack appears probable. The tweet containing the phishing link has been deleted.

Vitalik, if we can't trust your tweets in crypto, then who can we trust? I clicked on the tweet you shared, and it automatically withdrew about $7500 from my radiantkapital account, leaving me in debt. What is this? I lost all my assets. Can you please help? I'm sending you the…

— Serkan( serayd61.eth)🇨🇭 (@serayd61) September 9, 2023

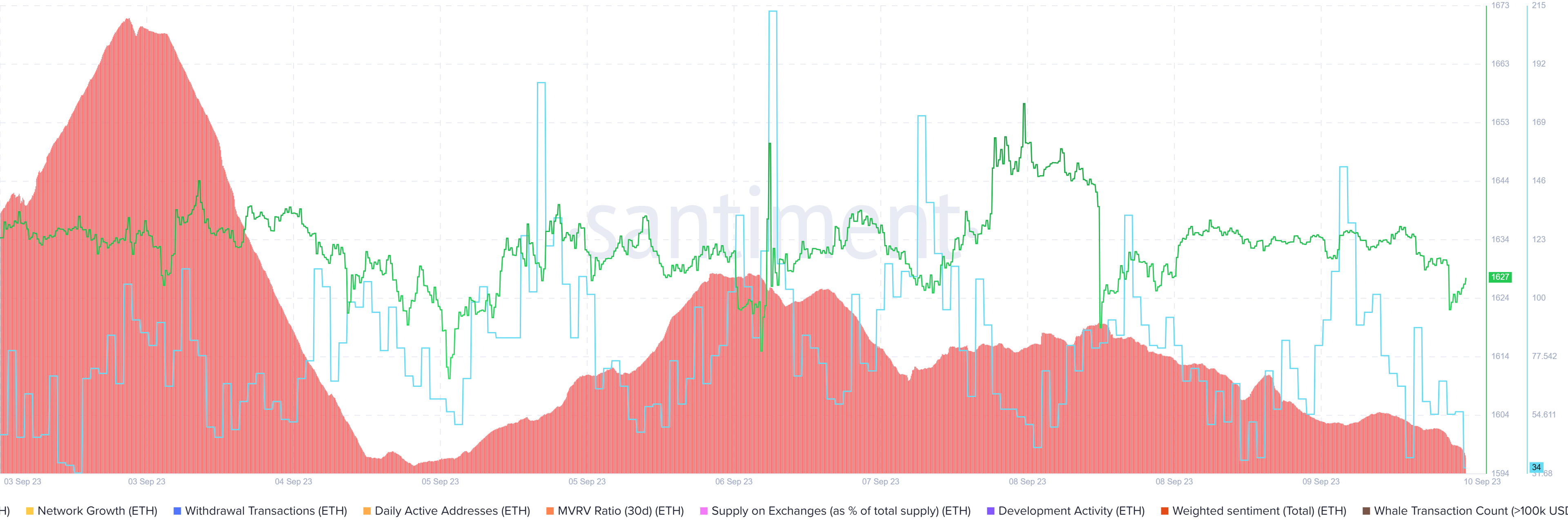

While the attack has not affected the ETH price, it may add fear and uncertainty in the market. Santiment data shows a decline in social volume for the Eth token. It also shows an even steeper downtrend in the volume of active addresses over the last 24 hours.

Ethereum Price Forecast

Ethereum price is $1,627 at publication time, a daily drop of almost 0.5% amid growing FUD in the ETH network. The Relative Strength Indicator (RSI) is dropping, suggesting falling momentum.

Accordingly, Ethereum price could fall below the immediate support of $1,621, possibly extending south to $1,529, collecting buy-side liquidity between the two levels. In the dire case, the drop could extend to the March lows at around $1,420, representing a 12% slump below current levels.

Noteworthy, the Awesome Oscillator (AO) is still negative, solidifying the presence of the bears in the market.

But bulls are steadily gaining ground with the greenness of the AO histogram bars. The decreasing volumes of these bars could see the AO turn positive soon, but it depends on whether the ongoing accumulation pattern is sustained.

Increased activity among bulls could see Ethereum price breach the 50-day Exponential Moving Average (EMA) at $1,726, or higher, to confront the resistance confluence between the 200- and 100-day EMAs at around $1,765. Much higher, and in highly ambitious cases, ETH could tag the $1,841 resistance level, last tested during mid-August.

ETH Alternative

While Ethereum price continues in the consolidation phase, consider WSM, a more promising alternative set to list soon.

WSM is the native cryptocurrency for the Wall Street Memes ecosystem. The token is available for purchase using ETH, USDT, or bank card. Thus far, the presale collections have gone above $25 million as the countdown to the listing continues.

Owing to the successful record of accomplishment registered during the presale phase and its strong fundamentals, experts have ranked it among projects with potential for 10X gains.

The project offers WSM holders an opportunity for passive income using the stake-to-earn feature. Staking is rewarding, with the incentives calculated based on your percentage of the $WSM staking pool and the APY.

Almost $300 million has been staked so far, with stakers enjoying a stark 67% in annualized percentage yields (APY). This massive degree of participation sets the groundwork for enhanced project stability as well as resilience. This has the potential to alleviate huge market fluctuations characteristic of project public premieres.

The staking mechanism helps in the mitigation of potential market crashes as it discourages investors from sell-offs. The rapid accumulation of staked tokens adds to what is in the circulating supply and is a vivid illustration of the community’s optimism for this incentive-oriented mechanism.

Also Read:

- Ethereum Price Prediction: A Bearish Triangle Points To A 10% ETH Drop

- Wall Street Memes (WSM) Presale Countdown – A 10x Surge Expected at Launch

- Top 3 Crypto Presales to 10x Your Investment in 2023 – Launchpad XYZ, yPredict and Wall Street Memes

- Wall Street Memes Prepares for Takeoff with a Listing on Leading Exchanges

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage