Join Our Telegram channel to stay up to date on breaking news coverage

The big hope for Bitcoin (BTC) is approval of spot Bitcoin Exchange-Traded Funds (ETFs) and former Securities and Exchange Commission (SEC) chair Jay Clayton says that’s inevitable.

Approval may happen as early as next month but the SEC has until March next year to approve or decline the seven applications from companies including BlackRock, Fidelity and Ark Invest.

To some, BlackRock is in pole position and may be first to get the green light. The asset manager has some $9 trillion in assets under management and has received only one rejection from 576 ETF applications.

BlackRock has applied for 576 ETFs.

They have only ever been rejected once.

That's a 99.8% success rate on their ETF applications.#Bitcoin Spot ETF approval is not a matter of if, it's a matter of when. pic.twitter.com/msDDFg9Y2A

— Crypto Rover (@rovercrc) September 9, 2023

Take note also that Grayscale Investment recently secured a victory in its longstanding legal battle against the SEC. On August 29, a court ruled that the SEC’s decision to prevent Grayscale from converting its Grayscale Bitcoin Trust into a spot Bitcoin ETF was “arbitrary and capricious.”

The victory compels the SEC to review its decision, increasing the odds for an approval of the first spot Bitcoin ETF in the US. An excerpt from the ruling read:

…ORDERED and ADJUDGED that Grayscale’s petition for review be granted, and the Commission’s order be vacated, in accordance with the opinion of the court filed herein this date.

Bitcoin jumped almost 10% on the news with up to $50.7 million in short positions liquidated against $20.2 million longs. The scales appear to be steadily moving in favour of a “yes” from the SEC rather than a “no.”

Bitcoin Price Prognosis With A Spot BTC ETF Approval In The Horizon

BTC is currently exchanging hands for $25,856, a daily drop of 0.21%. As is characteristic of weekends, the volume of trades is minimal, with momentum indicators flattening out. Meanwhile, Bitcoin price continues in its range-bound horizontal slide.

Knee-high within a demand zone, Bitcoin price has a chance to push north for as long as it sustains above the mean threshold at $25,261.

A bullish outlook, in this case, comes as a demand zone is defined by aggressive buying. If the bulls act now, the king of crypto could leap to overcome the resistance presented by the 200-, 50-, and 100-day Exponential Moving Averages (EMA) at $27,043, $27,298, and 27,690 levels, respectively. BTC could restore above the uptrend line in a highly bullish case, potentially hitting the $30,000 psychological target. This would indicate a 15% rise above current levels.

In highly ambitious cases, the move north could extrapolate to the $31,804 high, where Bitcoin price was rejected around mid-July.

The histogram bars’ green feel on the Awesome Oscillators (AO) points to a presence of bulls that could bode well for Bitcoin price if sustained.

Nevertheless, the Relative Strength Index is flat, meaning bulls could be sitting on their hands. Its trajectory, almost crossing below the signal line (yellow band), exposes BTC to the risk of a fall.

A decisive move below the mean threshold at $25,261 would invalidate the bullish prospects. Bitcoin could then lose the $24,000 psychological support or revisit the March 13 lows at $21,915 in the dire case.

Meanwhile, consider buying BTCBSC, a more affordable alternative with the potential for more gains. Besides that, it gives you a second chance in case you missed out on the BTC bandwagon in 2011.

BTC Alternative

BTCBSC, the native cryptocurrency for the Bitcoin BSC ecosystem, is currently selling for $0.99, the same price Bitcoin retailed for in 2011. The presale is moving fast, with almost $740,000 raised so far.

https://twitter.com/Bitcoinbsctoken/status/1700479231866610175?s=20

It is worth mentioning that while BTCBSC is not a fork of Bitcoin, its name-sharing does not make it a pump-and-dump scheme. Instead, the BEP-20 token only provides daily income with BTCBSC price gains. Also, stakers can use it for passive returns, achieved through ultra-high annual percentage yields (APY).

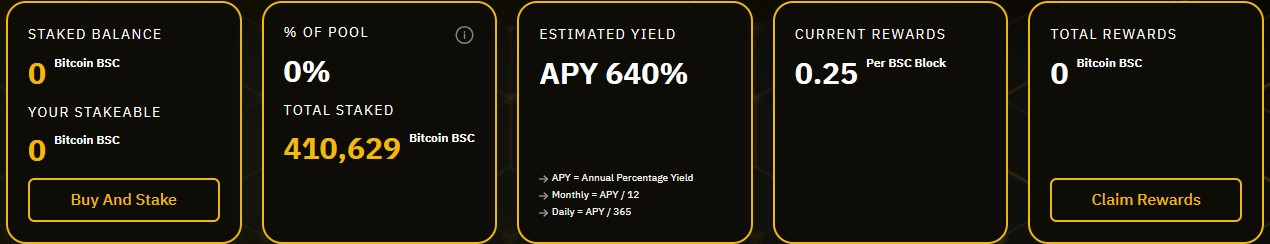

Up to $410,629 BTCBSC tokens have been staked, with the APY reaching 640%. The rewards will be distributed to users block-by-block, with 69% of the total supply reserved for staking. Join the community of stakers for high APY here.

https://twitter.com/Bitcoinbsctoken/status/1700056426066989204?s=20

Buy BTCBSC in the presale here.

Also Read:

- Bitcoin Price Prediction: BTC Eyes Soaring 20% Rally – Will the Bull Run Continue?

- New Low Market Cap Crypto Presale – Bitcoin BSC (BTCBSC), An Alternative to Bitcoin

- New Crypto Presale Under $1 on Binance Smart Chain With High Staking APY – $BTCBSC

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage