Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price is up almost 10% in the last week to trade for $2,058 as 2:39 AM EST.

Over the last 24 hours trading volume is up 50% as the asset continues to gain attention and trading activity is increasing. The fact that price is on an overall uptrend with the trading volume also rising is a good sign., with ETH holding above $2,000 for five days in a row.

ETH remains on an overall uptrend, indicated by Ethereum price holding above an ascending trendline. Prospects for more gains remain alive as technical indicators still support the upside.

With some traders identifying a bullish flag technical formation on the weekly timeframe, optimists say it may be the last chance to buy ETH before the bull run. While it’s too soon to say the market is heading for a flippening, where Ether overtakes BTC’s market cap, things are at least looking up for ETH.

$ETH has already broken the Bullish flag on the Macro chart.

If it retests, it could be the last Buying opportunity before the bull run.

Weekly RSI has also broken the Major Trendline.

My long term target is at $6180. ✍️#Crypto #Ethererum #ETHUSDT pic.twitter.com/ugWvFwlj1E

— Captain Faibik (@CryptoFaibik) November 13, 2023

Speculation of a spot Ether exchange-traded fund (ETF) continues to provide tailwinds for Ethereum price.

Pre-ETH News:

– ETHBTC to bleed. BTC outperforms into comment window / Jan 10Post-ETH News:

– Non-zero prob of ETH cannibalizing BTC ETF flows appearsETHBTC will outperform today/tomorrow but after market will refocus on immediate BTC comment window date

— kwaker oats (@kwaker_oats_) November 9, 2023

This explains why the second-largest cryptocurrency by market capitalization continues to outperform Bitcoin.

#ethereum has broken through key levels recently.

Expecting a push to $2500 as it continues to lag behind #btc

I personally think $ETH outperforms #bitcoin in the next cycle.

Especially with the deflationary tokenomics and the potential for institutions to earn yield.

— MB CRYPTO (@mb_crypto) November 11, 2023

Ethereum Price Outlook With ETH Holding Above A Bullish Breaker

After a 13% hard pump on November 9, provoked by news concerning BlackRock iShares and its soon-to-be Spot ETH ETF, Ethereum price shattered past a supply zone extending from $1,864 to $2,004. The breakout converted the supply barrier to a bullish breaker.

Nevertheless, the rally ran out of steam, causing a rejection from the $2,141 range high. Now, it appears Ethereum price is coiling up for a second attempt to breach the $2,143 resistance level.

Increased buyer momentum could deliver the target for Ethereum price, potentially overcoming the $2,141 range high to clear the equal highs at $2,143. In a highly bullish case, the gains could extend for the largest altcoin by market capitalization to foray past the $2,200 and 2,300 psychological levels to tag $2,400. Such a move would constitute a 15% climb above current levels.

Technical indicators such as the Relative Strength Index (RSI) support this outlook. Its position above 50 points to a strong price strength, reinforced by the Awesome Oscillator (AO) sustaining in the positive territory. This adds credence to the bullish thesis.

Noteworthy, with the RSI above 70, ETH is considered overbought. However, it is not a sell signal until this momentum indicator crosses below the 70 mark. Meanwhile, traders with open long positions should keep them open as Ethereum price could still extend north.

Converse Case

On the flipside, increased selling pressure could see Ethereum price slip below the ascending trendline. A break and close below this level could plunge ETH into the supply zone turned bullish breaker under the $2,000 psychological level. A break and close below the midline of this order block at $1,938 would solidify the downtrend.

In the dire case, the slide could extend for Ethereum price to draw towards the $1,800 psychological level. Lower, the $1,753 support could provide a possible turnaround for ETH, but if it fails, the cryptocurrency could slide further to test the $1,530 support floor.

Ethereum On-chain Metric To Support Bullish Outlook

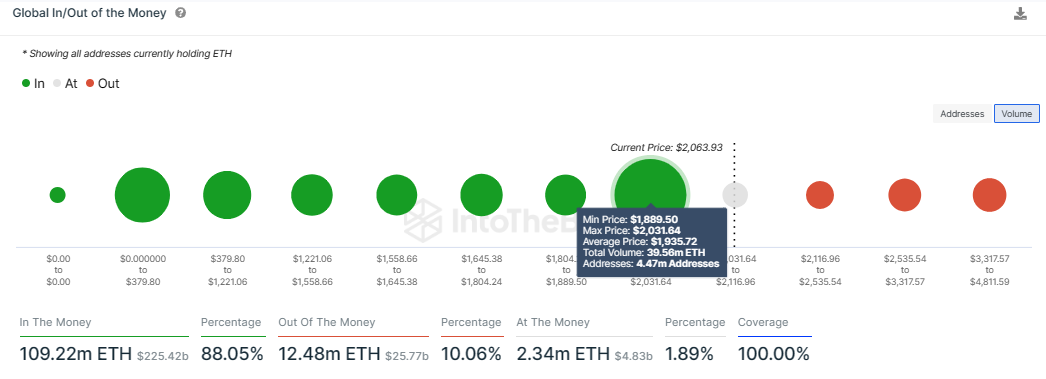

On-chain metrics from IntoTheBlock’s Global In/Out of the Money (GIOM) support the bullish outlook. As indicated in the chart below, Ethereum price has stronger downward support. Most of this support extends from $1,889 to $2,031 where 4.47 million addresses bought approximately 39.56 million ETH tokens at an average price of $1,935.

Any efforts to send Ethereum price down would be countered by buying pressure from that many addresses that bought almost 39.56 million ETH tokens at an average price of $1,935.

The data also shows that at the current rate, 88.05% of ETH holders are sitting on unrealized profit (in the money). This is relative to the 10.606% of token holders that are sitting on unrealized losses (out of the money). Meanwhile, only about 2% of token holders are breaking even (at the money). As long as there are more holders in profit, the selling appetite is bound to be low. This is especially true as the market shows optimism, first towards the much-awaited bull run and the prospects for a spot ETH ETF to launch soon.

Shifting your gaze from Ethereum and consider YPRED, a new crypto presale that is selling out fast! You do not want to miss out.

Promising Alternative To Ethereum

YPRED, the powering token for the yPredict project, empowers the world’s first all-in-one AI ecosystem. The platform was specifically built for developers, traders, quants, and analysts.

🚀 Dive into the exciting world of crypto trading with #yPredict! 🤖

Our cutting-edge AI and machine learning tech empowers traders with invaluable insights for better-informed decisions and increased profit potential. Plus, we open doors for AI enthusiasts to monetize their… pic.twitter.com/ZtWFZVxJV6

— yPredict.ai (@yPredict_ai) October 17, 2023

The project is value-adding for anyone who would engage it, providing real-time trading signals from innovative predictive models by the top 1% of AI experts. You also get real-time sentiment analysis on all popular crypto coins, with AI finding you the most effective indicators you need for your asset.

🚀 Explore the future of crypto trading with #YPredict! 🤖

Harnessing AI and ML, we empower traders with data-driven insights for smarter decisions and bigger profits. Our platform invites AI enthusiasts to monetize predictive models too. 💰

Pattern recognition, sentiment… pic.twitter.com/mKyf59qM6z

— yPredict.ai (@yPredict_ai) October 11, 2023

Leveraging the power of state-of-art predictive models and data insights developed by leading AI developers and experts, yPredict gives market participants an unbeatable edge in different industries. Be it in finance, health, or human resources.

The project is still in the presale stage with a single YPRED token selling for $0.11. Early entrants position themselves for a profit of not less than 9% once the project is listed. This is because the listing price is $0.12.

Featuring among the ten most trending crypto projects to buy in 2023, the project’s presale has already accrued more than $4.815 million in presale sales. The target is $6.507.

Visit the yPredict website to buy YPRED in the presale here.

Also Read:

- How to Buy yPredict Token – YPRED Presale

- yPredict Price Prediction – YPRED Coin Price Potential

- Last Call for Best AI Crypto Presale of 2023 – New Crypto Project yPredict Launching Soon

- Top 3 Crypto Presales to 10x Your Investment in 2023 – Launchpad XYZ, yPredict and Wall Street Memes

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage