Join Our Telegram channel to stay up to date on breaking news coverage

Will Shangai Upgrade Push the Price of Eth?

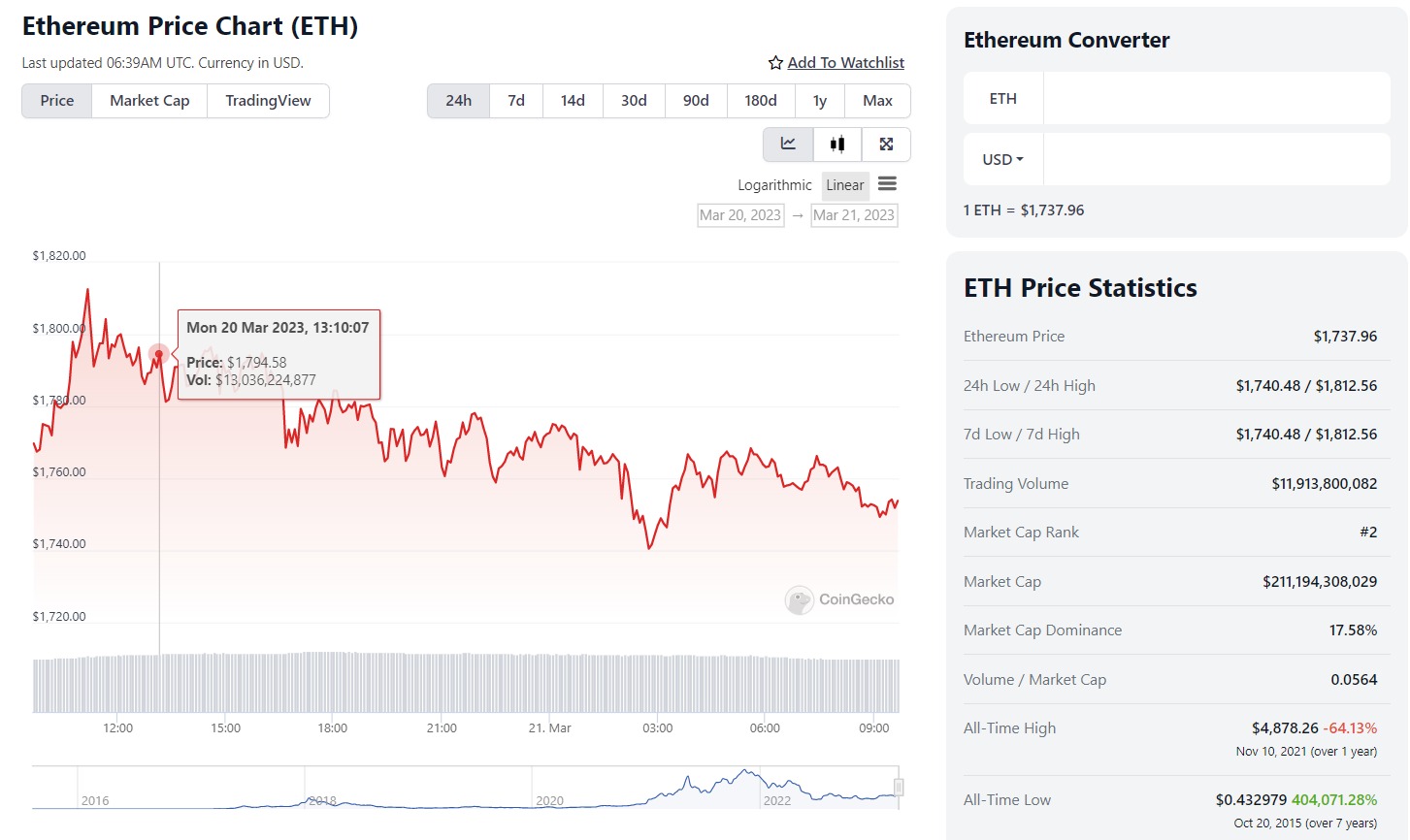

WuETH experienced a significant drop in value. However, it seems to have found support at a key psychological level and is currently bouncing back up. At the time of writing, the price of Ethereum (ETH) is trading at $1,733.30, with a trading volume of $11,914,583,422 over the past 24 hours.

This indicates a decrease in price of -2.62% over the last day, although there has been an increase in price of 4.52% over the past week. Ethereum’s current market cap is $211,194,308,029, based on its current circulating supply of 120 million ETH.

Shanghai Upgrade Set to Boost Ethereum’s Price and De-Risk Staking

Credit Suisse is still in a difficult position, which puts the European and global financial systems at risk of further shocks. If more shocks occur, cryptocurrencies such as ETH may take additional hits, even though the recent rally suggests the market is insulated from fears over bank stability.

However, assuming the situation stabilizes, Ethereum is poised for gains, particularly next month when the Shanghai update is set to roll out. The upgrade is already running on the Goerli testnet and will enable the withdrawal of staked ETH.

Shanghai upgrade on Goerli is a success, and you are still fudding withdrawals?

Oh sweet summer child

— od1n fr33 the 8th 🐺🔊 (@odin_free) March 14, 2023

While some have raised concerns about a surge in selling pressure, the negative impact of the upgrade is likely to be relatively contained. This is because withdrawals of staked ETH cannot happen all at once, as developers have set daily limits on how many validators can withdraw 32 ETH per day. Currently, this limit is set at 1,800, which means that Shanghai is more of a positive than a negative for Ethereum.

The update de-risks staking for users and encourages many to stake ETH, knowing that they can un-stake at any time. Shanghai will also provide the technical underpinnings for future Ethereum upgrades, including sharding, which enables parts of the Ethereum blockchain to process separate batches of transactions in parallel.

Will Shangai Upgrade Push the Price of Eth?

Therefore, Shanghai is more likely to boost ETH’s price than pull it down. Moreover, it’s worth noting that ETH has had deflationary tendencies since last year, thanks to the Merge and EIP 1559, which have caused it to burn more ETH than it issues, especially during peak periods.

The dominance of Ethereum in the cryptocurrency ecosystem highlights its potential to attract mainstream and enterprise adoption. With this in mind, the future looks promising for ETH, and it is expected to rise to $2,000 in the coming months, provided the current banking crisis does not lead to a full-blown financial crisis.

ETH Price Prediction: ETH/USD Daily Chart Analysis

The price of ETH has been on an upward trend, especially since the year began. However, there has been some resistance along the way that has made it move differently than intended. ETH rose from the bottom support level of $1150 after camping for months. The bulls pushed the price of ETH to the resistance level, which saw the price consolidate shortly before embarking on the reversal bearish move.

The price had also formed a double top pattern, which indicates that the price is about to fall in trade. The bearish move has been cubbed by the bearish pin bar, which has formed at the bottom of the short reversal, creating a psychological support level and a higher low. The bulls look strong as they push the price past the previous resistance level, which has been tested again.

Moreover, the price of ETH is trading above the 50-day and 200-day moving averages. At the time of writing, the 200-day moving average coincided with the psychological support level. This indicates that the bullish rally is inevitable and that the bulls will increase prices. The relative strength index is also bullish, trading above 50 at 59. The key levels to watch out for and double as our prediction are $2054 and $2728, respectively.

Related

- Bitcoin Price Prediction for Today, March 20: BTC/USD Begins Technical Correction as Price Hits $27,313 Support

- ADA Price Prediction: Bulls Push the Price Up. Can ADA Reach the $0.53 Resistance?

- FTX Sues Bahamian Liquidators for Seizing Millions of Dollars in Assets

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage