Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum, the second-largest cryptocurrency and the largest blockchain in the world has once again become a hot topic for discussion among investors as the blockchain network nears its much-awaited Shanghai Upgrade.

The crypto has been constantly pushing towards achieving further innovation and sustainability in the past few years. The same was made clear with the launch of its Beacon chain (shift from Proof-of-work to Proof-of-Stake consensus mechanism). The Merge which happened last year has helped the platform become one of the cleanest blockchains environmentally.

Through The Merge, Ethereum has changed its transaction processing mechanics. The platform earlier used to rely on heavy computer tools that consumed a lot of energy. This shift has helped Ethereum cut its contribution to the Green House Gas emissions by almost 99%.

Since The Merge, the Shanghai Upgrade has to be Ethereum’s biggest project in 2023. With the Shanghai Upgrade, happening in March 2023, Ethereum plans to do away with the indefinite lock-up of withdrawals and allow its validators to withdraw ETH from its staking pools.

With a staking pool worth $29 billion, investors fear a mass sellout of the previously locked ETH. A sellout of that proportion would trigger the downward movement of the cryptocurrency. However, a recent report by Binance highlights that the possibility of this happening seems remote and that such an upgrade would, if anything, help Ethereum increase its staking pool.

Shanghai Upgrade

Ethereum’s Shanghai Upgrade would take place in the month of March this year. Although Ethereum allows the staking of its cryptocurrency, it had not permitted the withdrawal of the same. The ETH tokens staked by the validators were locked indefinitely in the staking pools. Such a move deprived validators of withdrawing their ETH from these staking pools.

Ethereum has a relatively low staking ratio of just 14% which could be attributed to the platform’s zero withdrawal policy. However, the Shanghai Upgrade by allowing withdrawals (both partial as well as full), would make ETH an even more attractive staking option than before.

In a bid to test the feasibility of this new upgrade, Ethereum also launched a Testnet named Zhejiang which was able to simulate the withdrawals successfully this past week.

Ethereum’s Staking Stats

Ethereum, although having $29 billion in its staking pool, is still far behind its competitors in staking ratio. The staking ratio refers to the percentage of total currency supply that is added to the staking pool.

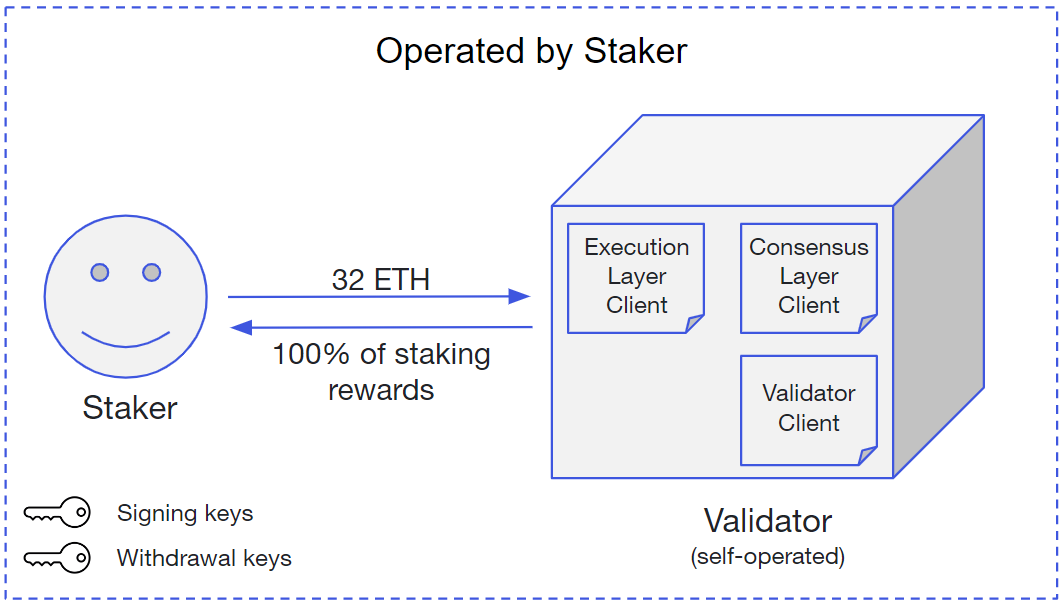

As per the Ethereum team, a validator, to activate his validator software, needs to deposit 32 ETH in the staking pool. This requirement of a minimum deposit prevents a lot of investors from being validators. However, an average investor is also able to stake ETH using crypto exchanges like Binance, Coinbase, etc.

Special platforms like Lido and Rocket Pool are some of the biggest contributors to Ethereum’s staking pool. Lido allows investors to stake ETH and in return issues a token called stETH. Through the interchange of tokens, Lido promotes liquid staking so that an investor can reap the benefits of staking from the ETH he has staked and is also able to do transactions using the derivative currency (stETH).

Lido accounts for 29% of all the ETH in the staking pool, making it the single largest contributor to the Ethereum staking pool. Investors fear that Lido’s withdrawal of ETH from the staking pool after the Shanghai Upgrade could lead the currency and their investments on a downward spiral.

However, a withdrawal of such proportions by Lido may never happen in the first place. This is primarily because Lido, through the concept of Liquid staking, has already provided the investors with much-needed liquidity by issuing stETH for their ETH.

Liquid Staking

Liquid Staking, as already discussed, enables an investor to stake the currency and still have its liquid value. Liquid staking forms 57% of Ethereum’s total staking pool. This means that a majority of the contributors are not dealing with the liquidity issue caused due to the indefinite lockup. This also means that these investors are in no hurry to withdraw their stakes from the pools.

Why Shanghai Upgrade would not lead to a mass Withdrawal of ETH?

Shanghai Upgrade despite fears, may not trigger a mass withdrawal of tokens. Investors, despite being well aware of the indefinite lock policy, have been staking in the Ethereum staking pool since 2020. They believe in the innovative capacity of Ethereum and its potential for growth in the long run.

Moreover, as the whole crypto market is experiencing a crypto winter, a lot of investors might end up losing money in case they decide to withdraw their tokens. Therefore, the fear of Ethereum’s Shanghai Upgrade leading to mass withdrawal seems a little farfetched. On the contrary, such an event can help improve Ethereum’s staking ratio.

Shanghai Upgrade may bring Growth in ETH Staking

Experts believe that the opening of the withdrawal function would make Ethereum, an even more, attractive staking option than before. A lot of investors were hesitant to invest in Ethereum’s staking pool because of its indefinite withdrawal policy. However, by eliminating such a condition, Ethereum might witness a rise in its staking numbers.

Conclusion

Ethereum’s Shanghai Upgrade is being done in the interest of its investors who otherwise might hesitate to stake ETH in absence of a definite withdrawal period. The Shanghai Upgrade would help the blockchain attract even more investors in the long run. Ethereum through its many projects has shown time and again that it recognizes its responsibility towards its various stakeholders (environment, investors, society, etc.).

Read More-

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage