Join Our Telegram channel to stay up to date on breaking news coverage

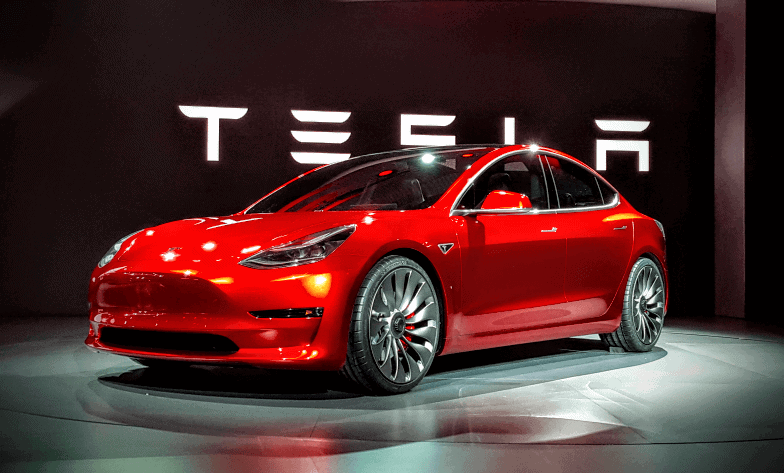

Elon Musk, who had recently declared his overall neutrality over cryptocurrencies, enjoyed a net worth surge. Originally only being worth $1.7 billion, Musk is now pegged at $32 billion after his electric vehicle automaker, Tesla, had its share price explode. With a rise in share price clocking over the 30% mark, the company is a living example of how keen investors are to put money in new technologies.

Achieving Success Via 15% Of Volumes

The personal fortune that Tesla holds has climbed more than $10 billion since October last year, with no signs of slowing down. A majority of this growth comes from positive investor sentiments in regard to the electric vehicle automaker. The overall shift of Tesla’s investor bullishness shows that the world is ready to take part in the world’s cutting edge technologies, crypto included.

What’s incredible is that Tesla managed to pass both Ford and GM in the overall market cap. While the idea may not be as outlandish as it would seem, thanks to how well-known Tesla is, but the key factor in its impressiveness comes from volumes. Ford had sold 2.4 million units to achieve its market cap, with GM selling 2.9 million (Learn how to buy Tesla stocks here). Tesla, however, managed to overtake both parties with a sale of just over 360 000 units. With a difference of over two million units, Tesla still managed to overtake the major automakers of the time.

Price vs. Demand

What makes this shift even more impressive is the price difference. Tesla doesn’t really go cheap, it simply can’t. Instead of creating a budget model, they just double down on their existing ones. A basic lesson in price and demand is that the more expensive something is, the less keen the general public is to get it. Even with this working against the automaker, Tesla still managed to rival major heavyweights in the industry. The only company beating Tesla in the market cap is Toyota, though it’s unlikely that demand for its vehicles will overtake the Japanese automaker as well. Simply put: There are more people keen on buying Toyotas than there are Teslas.

Unexpected Push For New Technologies

The massive rally for the electric automaker was such a surprise, even the analysts at Wall Street were caught off guard. With this massive rally, it seems that investors are grasping a key concept of innovation: It can make you very rich. Tesla’s been known for having rough sales thanks to a wide range of factors, but thanks to new developments in technology, the automaker is going well.

With any luck, this will translate into the financial sector as well. In particular, cryptocurrencies. Just as Tesla is cutting edge for the automobile industry, cryptocurrencies are the financial equivalent. With new DeFi technologies, it’s only a matter of time before overtakes the conventional market.

Join Our Telegram channel to stay up to date on breaking news coverage