Join Our Telegram channel to stay up to date on breaking news coverage

As open-source transactional assets, cryptocurrencies and their movements are often tracked by investors, analysts and other major financial organizations. This may be to get a general idea of market trends, to invest or trade accordingly, or simply to track particular wallets. However, a huge transaction from a “whale” or someone with massive amounts of crypto often gains major traction. This is exactly what happened, when a Bitcoin whale recently moved BTC worth $135 million, leaving investors with several questions.

The term “whale” is used for an entity with a crypto wallet holding massive amounts of any particular cryptocurrency. These wallet holders own enough crypto to potentially influence the entire asset’s price to a certain level. While BTC is one of the biggest and most difficult cryptocurrencies to influence, market watchers often track wallets with big amounts of the frontrunner crypto. Analysts or crypto-based organizations often gain important data by doing this, while enjoying a good chunk of profits by taking strategic investment decisions accordingly.

5500 BTC Transferred to Another Wallet

🚨 🚨 🚨 🚨 🚨 🚨 5,500 #BTC (135,951,266 USD) transferred from unknown wallet to unknown wallethttps://t.co/5bw1cGeybT

— Whale Alert (@whale_alert) February 16, 2023

As mentioned above, there are multiple entities that aim to provide real-time data on major crypto transactions. Similarly, this huge BTC wallet movement was reported; and by a rather popular crypto tracker- Whale Alert. In total, 5500 Bitcoins were transferred using multiple addresses; which means that the crypto was rerouted across several wallets before reaching its final destination.

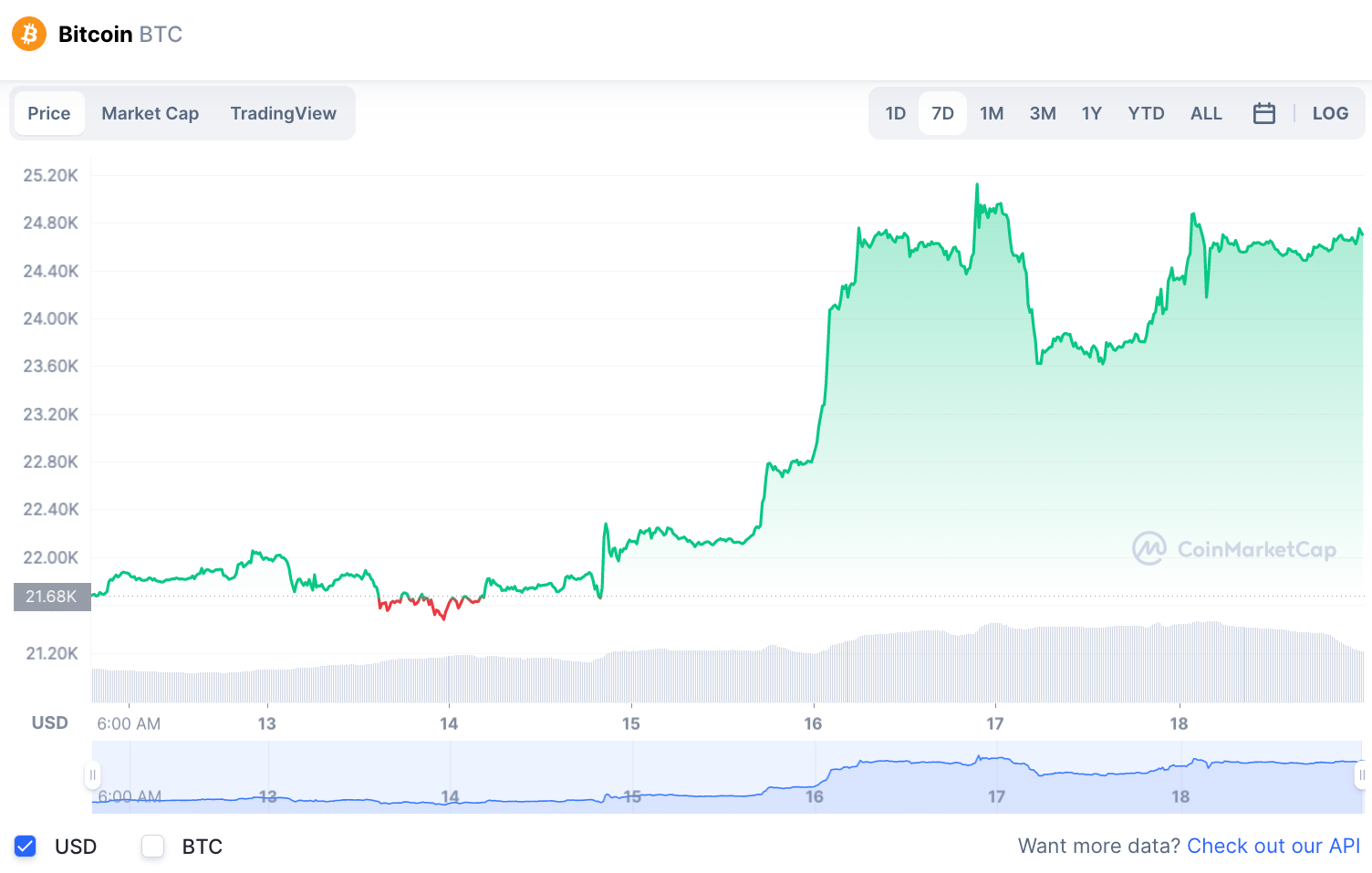

The transaction took place at a point where the price of BTC was about $24,700, which put a price tag of more than $135 million on the entire transaction. According to Blockchain.com, the entire transaction was carried out for a fee of $15.61. While this solidified the idea of crypto transactions being quick and extremely cheap, the investors were only concerned about how it could affect the price of the top asset in the industry.

The reason for this transfer; although speculative, is still unknown. While a simple transfer from one wallet to another wallet may not be a thing for concern, such a huge amount being shifted surely does grab attention.

🥳🚀 #Bitcoin has launched to a 6-month high, surprising the #bearish trader sentiment. With prices jumping above $24.2k for the first time since Aug. 14th, 2022, watch for whale addresses increasing as a sign of increased key stakeholder confidence. https://t.co/ztEhsIYNAY pic.twitter.com/ZJSfjrwJvA

— Santiment (@santimentfeed) February 15, 2023

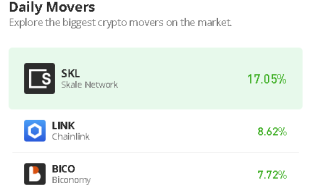

Santiment, a top crypto behaviour analytics platform had recently tweeted about such activities potentially being more common. On 16th February, it stated on the social media platform Twitter, that since the price of BTC was soaring, the chances of newer and more whale wallets being created may be very likely. This was mainly since the price of BTC above a certain level often entices top investors to stock up on more of the crypto, along with top altcoins that could also reap massive profits.

Investors had also been paying attention to comparatively smaller, but fairly sizeable BTC transactions reported by Whale Alert and similar trackers. Multiple transactions worth millions of dollars were recorded within a short period of time, which has surely stirred excitement and some level of concern in the minds of investors.

What Does Such a Transaction Mean for BTC

Major transactions often mean that the whales may be looking to perform certain actions that may affect the price of BTC, irrespective of the level of impact. For instance, a whale withdrawing huge amounts of BTC from their crypto exchange to a private defi wallet may be good news, since it is likely that they may be looking to hold their tokens and not sell. On the other hand, if the crypto is sent from a wallet to an exchange, then it may be a reason for concern for a majority of investors since the chances of the whale dumping their crypto increase.

How Does It Impact the Market?

One or two whale transactions may not essentially affect the crypto market or the price of BTC in general. Infact, a wallet-to-wallet transfer may not even mean much for retail investors. However, a string of whale transactions could mean increased volume and some movement in prices. Since the market cap of BTC is in billions of dollars, single major transactions too, only rarely affect its price. However, a string of transactions to exchanges that may indicate potential selling pressure could be something to be on the lookout for.

There are several other indicators that are often used by analysts to anticipate the next move of whales and trade accordingly. Its impact on the market sometimes is also fueled due to fear. Retail investors may hurry to stock up on the digital currency when they see that whales have been accumulating it. At the same time, they may also start selling if there is a sign of these whales dumping their tokens, which caused a domino effect, bringing the price down considerably.

Bitcoin Price

The price of BTC had barely reached the $25,000 mark before it fell to about $23,700 on 17th February. But the leading crypto quickly managed to regain strength and continue an upward spike, which has brought the token to its current $24,600 level. There has helped investors gain more confidence, which in turn has helped maintain a bullish sentiment across the industry. Several top altcoins are also experiencing growth, with only a few still trading at stagnant price levels. Overall, the market has been green, thanks to positive news and rising investor interest.

What Should an Investor Watch out For

The market may be performing well, but is still maintaining high volatility. Traders usually use this opportunity to make good profits, but at the risk of losing all their funds, The ideal option would be to start investing in parts and being updated about prices at all times. While long-term investors can rest easy, short-term investors may need to buy and sell their funds depending on major price movements which could come at any time. It would be a good idea to not trade using heavy leverage since this current euphoric uptrend may not be stable or consistent.

Keeping track of whale movements can also be a great way to understand where the market is moving on a macro level.

Conclusion

While the growth of BTC is surely a cause for celebration after several months of crypto winter, it may still be too soon to speculate a continuous rise in price or an upcoming bull run. Whales who can impact prices to some extent may make moves, which would be a good starting point for investors to find opportunities to buy or sell their assets for great profits. At a time like this, it is always advisable to be careful and up to date about the latest market news.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage