Join Our Telegram channel to stay up to date on breaking news coverage

After a successful two-week run which saw Bitcoin rise almost 27%, the coin seems to have lost momentum. Bitcoin’s recent decline of 2.17% in the last 24 hours has pushed it below the $21,000 level. The global crypto market showed a similar trend as multiple cryptocurrencies (like Ethereum, Polkadot, etc.) have also fallen below the Wednesday level.

As a result, the crypto market’s total valuation has once again fallen below the $1 trillion level (at $996 billion), which it had earlier managed to surpass on 14th January (after two months). Although Bitcoin is in a significantly better position than where it was a month ago, many investors were counting on its recent run would help it move beyond the $22,000 mark.

Bitcoin’s price decline is supposed to indicate the initiation of a bull trap, which could bring huge losses to the investors who invested in the cryptocurrency in the past two weeks. However, this dip could be attributed to the US Department of Justice’s clampdown on Bitzlato, which was involved in money laundering activities.

However, the crypto market has more positive news than negative, as recent policy decisions and inflation figures could help it get out of the ever-ending crypto winter. With a further decrease in inflation figures, we could very much witness growth figures similar to post-2022.

Crypto and the Decreasing PPI

The Crypto market’s health greatly depends on the performance of the overall economy. 2022 turned out to be a bad year for crypto, primarily because of the increasing inflation levels in the US and Europe. Indexes like Producer’s Price Index (PPI) and Consumer Price Index (CPI) can determine both the short-term as well as the long-term performance of the crypto market.

Producer Price Index (PPI) indicates the increase and decrease in the price of output earned by producers in the economy. A decrease in PPI is followed by a future decrease in Consumer Price Index (CPI), as consumers would not be willing to pay more when the price of output for the producers decrease.

An increase in PPI leads to a decrease in production growth, which further leads to job cuts in the economy (big companies are used to laying off thousands of employees before a possible recession). A decline in employment level also leads to a decline in investment activities. On the other hand, a decrease in PPI could bolster the securities and crypto market.

As per the US Bureau of Labor Statistics, the Producer Price Index (PPI) declined by 0.5% for the month of December. The PPI for final demand for the month of December has shown a year on year growth of 6.2%, which is significantly lower than its November figures (7.4%). A major reason behind PPI’s downward movement could be attributed to a whopping 13% decline in gasoline prices.

A decline in PPI could also help relax the previously aggressive stance of the Fed towards increasing interest rates. In the past two years, the Fed has increased interest rates a whopping seven times. The recent interest rate hike by the central bank, however, came as a relief for investors as the hike was decreased to only 50 bps from 75 bps in the past four sessions.

DOJ’s Clampdown on Bitzlato

Bitcoin’s dip in the last 24 hours is suspected to be because of the US Department of Justice’s action against Bitzlato. As per DOJ, Bitzlato is a lesser-known crypto exchange which was frequently used by criminals for money laundering. DOJ has arrested the Hong Kong Based exchange’s CEO Anatoly Legkodymov on charges of supporting criminal activities.

DOJ claims that the founders and other executives knew about the illegal activities being carried out on their platform, which was used to launder almost $700 million in the past five years. Bitzlato has been labelled a “primary money-laundering concern” by the Financial Crimes Enforcement Network (FinCEN), thereby cutting it off from the global financial system.

Bitcoin’s Price Movement

Although the Fed’s interest rates seem to be decreasing with every subsequent session, Bitcoin’s performance near future could still be worsened by the large-scale liquidations by institutional investors. Various shareholders of FTX may find the need to sell their Bitcoins.

Bitcoin, because of being the industry leader, has always been a highly volatile asset (even among cryptocurrencies). This makes the coin even more vulnerable to any policy decisions or macroeconomic indicators that affect the crypto market.

2022 saw a growing preference for new-age utility tokens among investors while the bitcoin rolled down during the crypto winter. These tokens are backed by novel and exciting projects that provide utility to their users. Unlike a normal cryptocurrency which depends on the market conditions for its growth, these utility tokens grew with the growth of their project.

Other Alternative Coins

Some of the new-age cryptocurrencies which have particularly done well in their presales have been listed below.

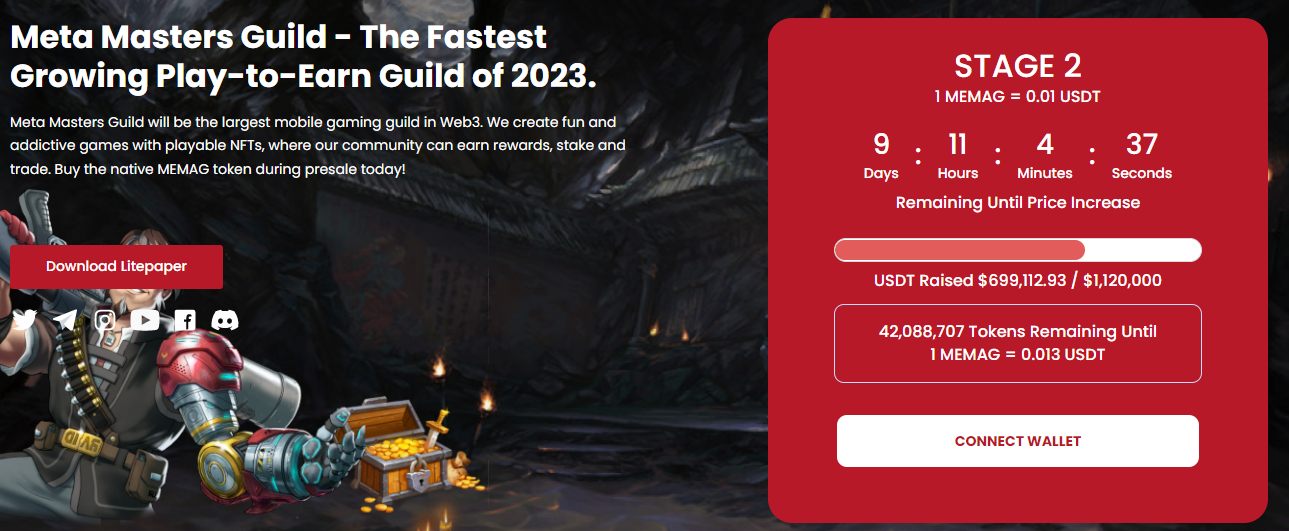

MEMAG

The web 3-based Meta Master’s Guild is the largest mobile gaming guild. It allows its users to play multiple exciting games on mobile phones and earn rewards for the same. Players are rewarded in the form of “gems”, which can then be converted into MEMAG (the official token of Meta Master’s Guild). Users have the discretion to either sell their tokens or stake them to earn staking rewards.

The team behind Meta Master’s Guild has tried to make the games as exciting as possible. They believe that rewards alone cannot attract users for long and that it could be only done if the games are engaging. The Play to Earn platform has managed to raise $679,428 in stage 2 of its presale. MEMAG is currently available to investors for $0.01, which could increase in further stages.

RIA

Calvaria, like Meta Master’s Guild, is also a Play to Earn platform where players can play Duels of Eternity, an online card game. Players are first supposed to purchase a deck of cards using RIA (Calvaria’s internal currency) to start playing Duels of Eternity. The game offers exciting awards to players in the form of RIA tokens which they can further use for upgrading and purchasing new cards. The game is accessible both through a mobile phone and a PC.

With 12 days remaining before the ending of stage 5 of its presale, Calvaria has successfully sold 93% of the issued tokens. The platform has managed to raise $2.86 million well as of now.

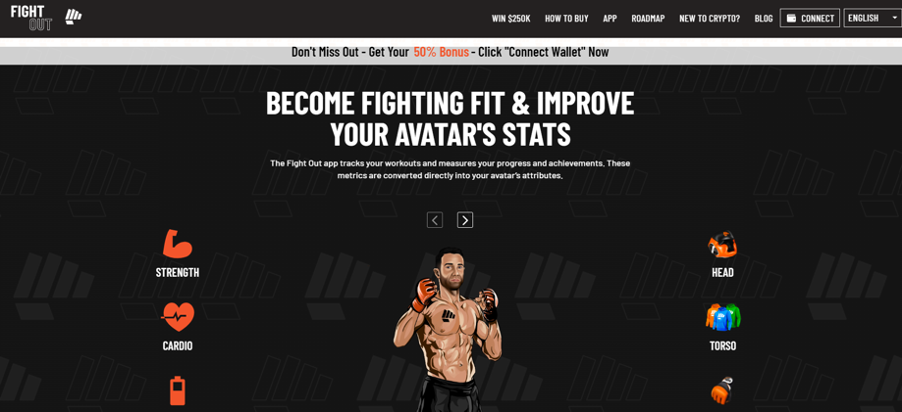

FGHT

FightOut is a blockchain-based health app which rewards its users for completing exercises and other tasks. The platform also gives a free live session to its users upon signing up. Users are supposed to enter their physical details and targets, which the platform then uses to create tailor-made tasks for them. The platform ensures the completion of these tasks by using the in-app sensors. The tokens could be used to purchase merchandise or can be cashed out to earn profits.

Earlier available at $0.016, FightOut’s price has doubled as it entered a new stage of its presale. Prices are predicted to rise even further as the coin is supposed to make its CEX debut on April 5th.

Conclusion

Bitcoin, despite losing 2.17% in the last 24 hours, hovers above the $20,000 mark. With a decrease in inflation, the coin is supposed to cross $22,000 and grow even further along with the entire crypto market.

Read More-

Join Our Telegram channel to stay up to date on breaking news coverage