Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price recorded an astonishing performance last week, soaring almost 28% to cross the $28,000 landmark. However, bulls’ aspiration to hit the $30,000 mark was cut short after the $29,000 psychological level rejected the price. Efforts by bulls to reclaim the trajectory have proved futile, with king crypto stretching another leg lower. Now, Bitcoin price has retraced back to the $27,000 zone after an intraday high of $28,023 on March 27.

Bitcoin price suffers overhead pressure due to these factors

The recent surge was attributed to plummeting confidence in the global banking system. After several US regional banks and the Swiss giant Credit Suisse recorded concerning news, investors were spooked. This made them shift to BTC as a safe haven. Towards the last stretch of March, however, the risk of other banks winding down appeared to be subsiding. This stifled the upside potential of Bitcoin price recording more gains.

The latest attack of the Commodity Futures Trading Commission (CFTC) against Binance and its CEO, Changpeng Zhao is another factor. The regulator charges the largest crypto exchange by trading volume for violating US trading and derivatives laws.

Today, the CFTC filed an unexpected and disappointing civil complaint. This is despite our working cooperatively with the CFTC for over two years.

According to the CFTC, Binance and the CEO are operating an “inefficient compliance program,” violating the law deliberately. In a retaliatory tweet, Binance CEO called the accusation ‘fake disappointing news.’ He also posted a number 4 tweet, often associated with Fear, Uncertainty, and Doubt (FUD).

4

— CZ 🔶 BNB (@cz_binance) March 27, 2023

Later the same day, the Binance executive penned an official address in response to the CFTC lawsuit. In the address, CZ details four key issues about his position and that of the exchange.

- Technology for compliance and US blocks

We are aware of no other company using systems more comprehensive or more effective than Binance

- Cooperation and transparency with law enforcement

We intend to continue to respect and collaborate with the US and other regulators worldwide.

- Registration and licenses

With 16 thus far, Binance holds the highest number of licenses/registrations globally and is well-regarded by the exchange’s user base.

- Trading

Binance does not trade for profit or “manipulate” the market under any circumstances.

My Response to the CFTC Complaint | Binance Blog https://t.co/TadyotM7HN

— CZ 🔶 BNB (@cz_binance) March 27, 2023

CZ also noted that “the complaint appears to contain an incomplete recitation of facts.” He added that they disagree with the characterization of most of the claims made by the regulator.

Bitcoin needs to hold above the $26,000 psychological level, or else all is lost

At the time of writing, the Bitcoin price is $27,096, after shedding almost 3% on the last day. However, trading activity for the king crypto was up around 27% to $18.5 billion. This is presumably because investors are liquidating their BTC holdings.

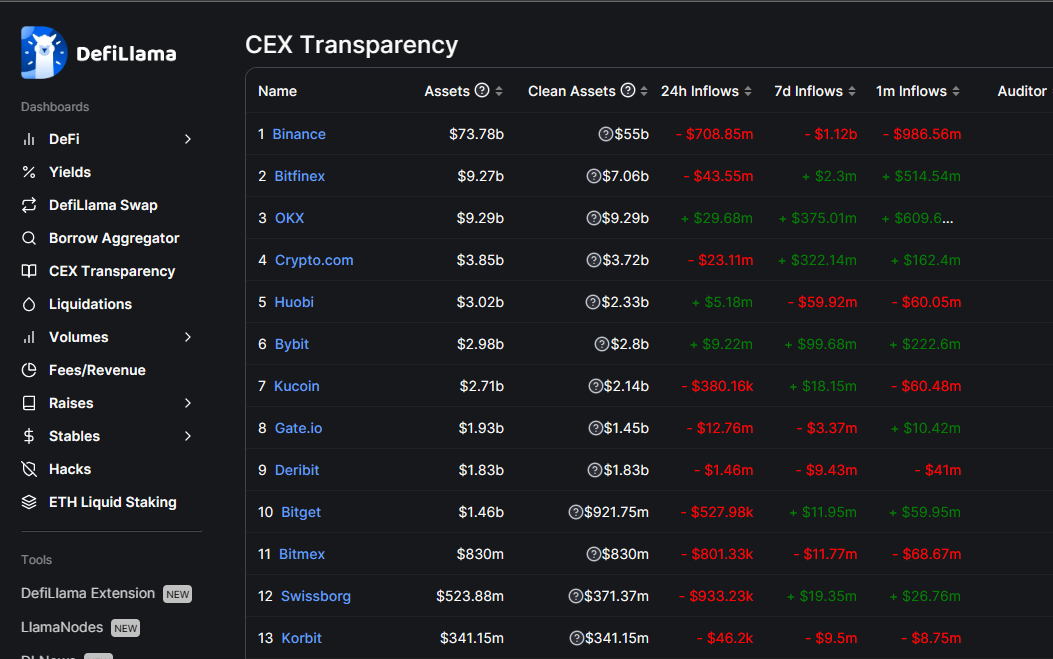

DeFiLlama data on its centralized exchanges’ transparency dashboard shows that Binance processed $708.85 million in transactions over the past 24 hours. This adds credence to the FUD theory.

Bitcoin Price Prediction

If selling pressure increases, Bitcoin price could plummet further to crack past the psychological support of around $26,000. Failure to use this supplier congestion zone as a turnaround point could see the flagship crypto squat further to tag the March 17 lows of $24,979. Such a move would denote a 7.86% downswing from current levels.

We can expect a possible trend reversal around the aforementioned level.

If this level fails, Bitcoin price could extend another leg down to find support due to the Simple Moving Averages (SMAs). In this regard, the first base to touch would be the 50-day SMA at $24,096. Next, it could revisit the support confluence presented by the horizontal line and the 100-day SMA at $21,919.

In the worst-case scenario, the people’s crypto could plummet, tagging the 200-day SMA at $20,000.

BTC/USDT 1-day chart

Conversely, considering the northbound trajectory of the SMAs, more buyers were coming in, and Bitcoin price could increase. Similarly, the Relative Strength Index (RSI) had just repelled the mean line and changed direction, a sign of bullish activity in the BTC market.

If buyer momentum increases, Bitcoin price could ascend to confront the first roadblock at the $28,372 resistance level, thereby reclaiming the March 23 highs.

In highly bullish cases, BTC could pump further, tagging the $30,430 resistance level, or continue the northbound move toward the $31,932 resistance level. Such a move would constitute a 17.86% increase from current levels.

The bullish thesis draws support from the histograms, which were still flashing green to suggest buyers were leading the market.

Bitcoin Mining Perspective

The Bitcoin hashrate has also spiked to all-time highs of 398 exahash, causing analysts to speculate that miners are starting to turn their rigs back on and Bitcoin price could rise.

Bitcoin's hashrate touched 400 Exahash. At the current growth rate in 2023, we'd reach a Zettahash by the end of 2025.

I'm getting questions and concerns from people.

Where is the growth coming from? Is it nation-states? Secret mining operations? Did someone find some exploit? pic.twitter.com/MMWfgPbqty

— Sam Wouters (@SDWouters) March 27, 2023

Based on data aggregator YCharts, the Bitcoin network hash rate has dropped to 344.63 as of March 27, an increase from 335.32 on March 26. Nevertheless, it remains up from 178.77 one year ago. According to Bitcoin financial service provider River Financial’s research analyst, Sam Wouters, the spike in hash rate could be attributed to unused mining inventory coming online, new facilities going live, and entrepreneurs finding cheap mining sources.

Accordingly, we could see surging prices for Bitcoin in the coming weeks.

BTC Alternatives

While we monitor the Bitcoin price action for the next few days or weeks, consider Fight Out, a play-to-earn (P2E) project whose presale window is almost closing. Based on the website, there are barely two days left.

https://twitter.com/Fight0utCS/status/1640396592913035264

The project’s presale for the FGHT token has raised upwards of $5.93 million thus far. The project meets players where fitness, health, and general well-being intersect. It motivates users by shifting their attention from traditional fitness systems such as gyms and workout centers, bringing forth more fulfilling elements. This makes it a revolutionary platform committed to solving user problems.

Fight Out is deployed on the Ethereum blockchain as the ideal base for changing the narrative. To this end, developers have structured a gamified community where members can achieve cost-effective fitness goals while earning financial success.

Fight Out platform also has several exciting future plans, including launching a fitness app during the second quarter of 2023. The move will incorporate wearable technology as well as in-gym sensors that will track every physical metric while improving user performance.

Related

- Bitcoin Price Holds at $27,800 -Is $31,200 The Next Target?

- Bitcoin Price Prediction for Today, March 27: BTC/USD Slumps as Price Targets $26,500 Support

- Top Cryptocurrency 2023 – Best Altcoins to Buy and Hodl

Join Our Telegram channel to stay up to date on breaking news coverage