Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – November 29, 2020

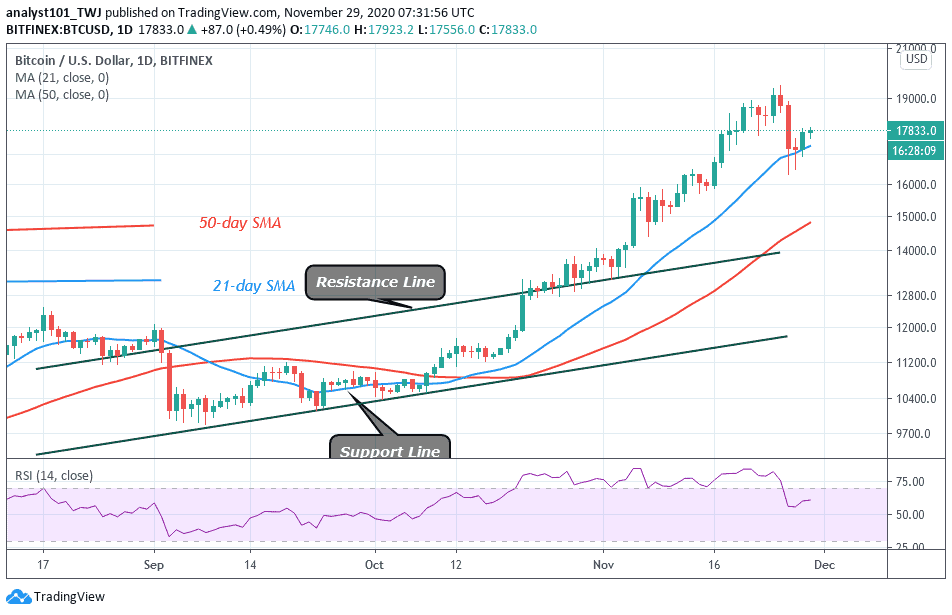

On November 26, the BTC/USD price plunged to $16,400 and it corrected above $17,000. The coin has been consolidating between $16,400 and $17,800 but unable to break above the $18,000 resistance zone. In technical analysis, historical price levels always repeat themselves. BTC price will have a deeper correction as the case in 2017 if the bulls fail to resume upside momentum.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

On December 11, 2017, BTC price rallied to $20,000 but could not continue the upside momentum. Thereafter, the coin fell into a deeper correction. On November 24, 2020, the BTC price also rallied to $19,400 but the uptrend has been repelled. The king coin fell to $16,400 and corrected upward. The upward move has been stalled below the $18,000 resistance. Several traders believe that Bitcoin should correct between $13,000 and $14,500 as the case in 2017.

For example, BTC price had dropped by more than 30% in the bull market of 2017 when BTC rallied to $20,000. Today, Bitcoin is trading at $17,834 at the time of writing. For the past four days, the crypto has been fluctuating between $16,400 and $17,800. On the upside, if the price breaks above $18,000, the upside momentum will resume. Conversely, if the bears break below $16,400, the coin will have a deeper correction.

Decred Co-Founder Explains Rationale behind Bitcoin Bull and Bear Cycles

Bitcoin (BTC) after its launch has been in existence for over 12 years. The king coin has witnessed several bull and bear cycles, each greater than the last. According to Decred co-founder Jake Yocom-Piatt, what drives these cycles’ lies within the human brain. He said: “Bitcoin’s bull and bear cycles are functions of generic human psychology, attention spans, and its deterministic and diminishing issuance”.

Yocom-Piatt also explains the rate of supply of Bitcoin which is constantly decreasing as a percentage of the total circulation. He said: “Bull runs occur when demand begins to outstrip supply, driving up the price, which gets the attention of myopic investors. After a certain amount of time, these myopic investors’ attention span for a bull market fades, and we revert to a bear market. With each bull market, the overall awareness of Bitcoin grows, sowing the seeds for the next Bull Run.”

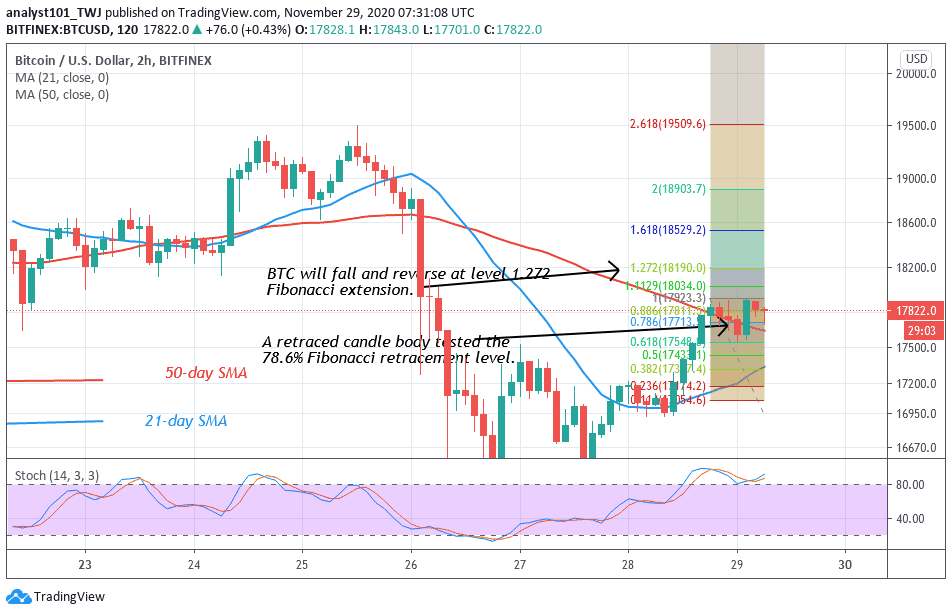

Meanwhile, Bitcoin is a range-bound between $16,400 and $17,800. BTC price is retracing after reaching a high of $17,800. According to the Fibonacci tool, BTC ought to have reversed after reaching level 1.272 or $18,190 high. The crypto will make a deeper correction if the lower price range is breached.

Join Our Telegram channel to stay up to date on breaking news coverage