Join Our Telegram channel to stay up to date on breaking news coverage

Although the worldwide cryptocurrency market capitalisation recently dropped to $1.28 trillion, it has regained about 3% in the last 24 hours. As new breakthroughs such as DeFi become more evident, businesses and individuals all around the world are understanding the potential of blockchain and crypto. Therefore, the role of decentralised autonomous organisations (DAOs) has been a focal point as interest in decentralised finance continues to expand.

For investors who want to take advantage of the dip, we’ll look at the best DAO coins to invest and trade now to earn maximum earnings.

1. Lucky Block (LBLOCK)

LBLOCK, the Lucky Block token, is our top pick for the best DAO coins to invest and trade now.

At press time, the digital asset trades at $0.001091. This price peg represents a rise of 6.99% in the last 24 hours. LBLOCK has seen a downtrend of 7.01% in the past 7 days. However, this does not nullify the cryptocurrency’s increasing potential. The digital asset has risen by 587% from its launch on January 27th. Additionally, the token continues to remain a significant crypto asset with long-term prospects.

At press time, the digital asset trades at $0.001091. This price peg represents a rise of 6.99% in the last 24 hours. LBLOCK has seen a downtrend of 7.01% in the past 7 days. However, this does not nullify the cryptocurrency’s increasing potential. The digital asset has risen by 587% from its launch on January 27th. Additionally, the token continues to remain a significant crypto asset with long-term prospects.

Following its introduction in January, Lucky Block has become one of the most talked-about platforms this year. Lucky Block is a crypto gaming platform built on the Binance Smart Chain (BSC). The platform allows people worldwide to earn prizes securely and transparently.

Essentially, Lucky Block aims to revolutionise the online gaming industry. The project’s appeal originates from its user investment structure, governance votes, and the potential for long-term holders to profit from jackpot winnings.

Token holders can compete in the regular jackpot by locking in their tokens. When the game is over, one person earns 70% of the jackpot, 10% is donated to charity, 10% is expended on promotion, and 10% is disbursed to all LBLOCK token holders based on their volume of tokens.

Lucky Block has disclosed the NFT prize draws for the Platinum Rollers Club NFTs. The prize draws for the NFT are slated for May 2022. As a result, the giveaway will hold before the Platinum Rollers Club’s 10,000 NFTs are depleted.

Moreover, Lucky Block plans to give away a $1 million LBLOCK prize for this giveaway. They also aspire to give away a Lambo if the NFTs sell out. Platinum Rollers NFT holders are entitled to Jackpot-style victories forever.

2. Uniswap (UNI)

The native token of Uniswap, the Ethereum network’s largest decentralised exchange, ranks second on our list of the best DAO coins to invest and trade now.

Uniswap is a well-known decentralised trading system that automates the trading of decentralised finance (DeFi) tokens. The decentralised trading system introduced the Automated Market Maker methodology. Uniswap’s “liquidity pools” accept Ethereum tokens, and algorithms determine market values based on supply and demand.

By giving tokens to Uniswap liquidity pools, users can receive rewards while authorising peer-to-peer trading. In addition, users can trade tokens, provide liquidity pools with tokens, or even build and launch their tokens.

Uniswap can now be accessed from any web3 location. Moreover, Uniswap has launched Swap Widget. As a result, developers can integrate exchange access with just a line of code.

Swap Widget uses Uniswap’s Auto Router to get the best pricing across the exchange’s v2 and v3 pools. The widget is also available on Uniswap’s Layer 2 deployments. As a result, developers who use Optimism, Arbitrum, or Polygon can use the widget to carry out low-cost swaps.

3. Aave (AAVE)

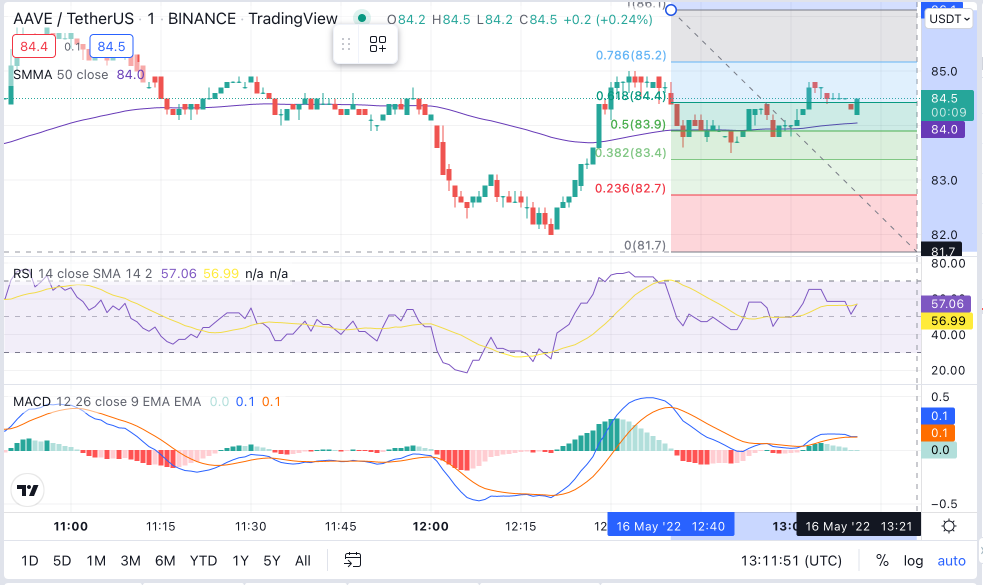

AAVE, native token of Decentralised Finance (DeFi) lending platform Aave, is next on our list of the best DAO coins to invest and trade now.

Aave is a decentralised money market protocol that allows users to borrow, lend, and earn interest on digital assets. Essentially, the protocol provides borrowers consistent interest rates, making it easier to budget.

Flash loans, termed the first uncollateralised loan option in the DeFi market, are one of Aave’s distinctive characteristics. Users of flash loan do not need collateral. Instead, the lender receives money by depositing digital assets into specially built liquidity pools. Borrowers can then utilise this liquidity to obtain a short-term loan with their bitcoin as security.

Aave has announced new plans on the social media platform, Twitter. The protocol will present an entirely new protocol that has nothing to do with money lending. This expected protocol is called the Lens protocol, which serves as the cornerstone for social networks.

Aave also found a like-minded partner in Web3, which designed Lens. Web3 also shares Aave’s vision of a decentralised Internet. The Lens Protocol is open-source, and NFTs will be used to build the complete social network.

Lens Protocol will also look into decentralised autonomous organisation (DAO) profiles and social-based verification. Aave’s foray into social media has been in the works. Founder and CEO Stani Kulechov recently announced that the DeFi behemoth is working on a Twitter equivalent.

4. SushiSwap (SUSHI)

SushiSwap (SUSHI) comes next on our list of best DAO coins to invest and trade now.

SushiSwap is a decentralised cryptocurrency based on the Ethereum network. The digital asset employs smart contracts to create liquidity pools. These liquidity pools allow users to exchange crypto assets without an intermediary. Users can also donate an equivalent value pair of two cryptocurrencies to liquidity pools in exchange for prizes.

The digital asset is an automated market maker (AMM). As a result, investors can build automated trading liquidity between two crypto assets. SushiSwap’s intended audience is DeFi merchants and businesses hoping to profit from the project token craze. The digital asset receives a 0.3% cut of all liquidity pool transactions, and SUSHI is used to repay customers.

UnitedCrowd has announced United Crowd token (UCT) Sushiswap Listing. Essentially, UnitedCrowd is a decentralised ecosystem that blends real-world projects with decentralised finance applications (DeFi).

Users can engage in real assets such as real estate and take advantage of DeFi benefits using United Crowd (UC) Pools. As a result, traditional investment items, such as real estate and flexible DeFi investments, are no longer necessary. Also, the UC Treasury mitigates failure risks. In addition, participation is ensured through the governance token $UCT.

5. Maker (MKR)

Maker (MKR) wraps up our list of the best DAO coins to invest and trade now.

At press time, MKR trades at $1,538. The digital asset is down by 6.49% in the last 24 hours. However, MKR has surged by 43.10% in the past 7 days.

Maker (MKR) is the governance token of the MakerDAO and Maker Protocol. Both platforms are both built on the Ethereum blockchain. Additionally, both platforms allow users to issue and control MKR.

Although MKR tokens do not provide dividends to their holders, they grant holders voting rights over the development of Maker Protocol. MKR tokens are projected to rise in value in line with the success of DAI (crypto asset that aims to maintain a stable 1:1 value with the U.S. dollar).

MakerDAO, a decentralised autonomous organisation (DAO) that serves the popular DeFi lending protocol Maker, has announced a deployment timeline on StarkNet, a decentralised zero-knowledge (ZK) Ethereum rollup.

The integration, which is expected to be fully operational in the third quarter of this year, will improve the multichain capabilities of their dollar-pegged stablecoin DAI and the accompanying Maker Vaults function. This integration will achieve these by lowering transaction costs and network throughput speed.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage