Join Our Telegram channel to stay up to date on breaking news coverage

The market is experiencing a notable shift as a new group of large investors enters it. Over the past few months, high-net-worth individuals have been steadily accumulating Bitcoin. These new whales or wallets holding at least 1,000 BTC acquired within the last six months are driving increased market activity.

With their growing presence, the likelihood of Bitcoin’s price surpassing the $150,000 to $160,000 range is increasing. Such a development could have a significant impact on the broader cryptocurrency market. As a result, many investors are seeking tokens with strong growth potential that could benefit from these market movements. This article explores the best crypto to invest in right now, highlighting promising assets that may see substantial gains in response to Bitcoin’s potential price surge.

Best Crypto to Invest in Right Now

KCS is currently valued at $11, marking a 0.50% increase over the past 24 hours and a 2.85% gain for the week. Meanwhile, MIND has secured $7.4 million in presale funding and is nearing its goal. In other developments, Stellar has launched the Anchor Network, a system designed to connect traditional finance (TradFi) with decentralized finance (DeFi).

1. KuCoin Token (KCS)

KuCoin Token (KCS) is the native cryptocurrency of the KuCoin exchange, launched as a profit-sharing token. It was initially issued as an ERC-20 token on the Ethereum network, making it compatible with most Ethereum wallets. In the future, KCS is expected to serve as the primary asset for KuCoin’s decentralized financial services and community governance.

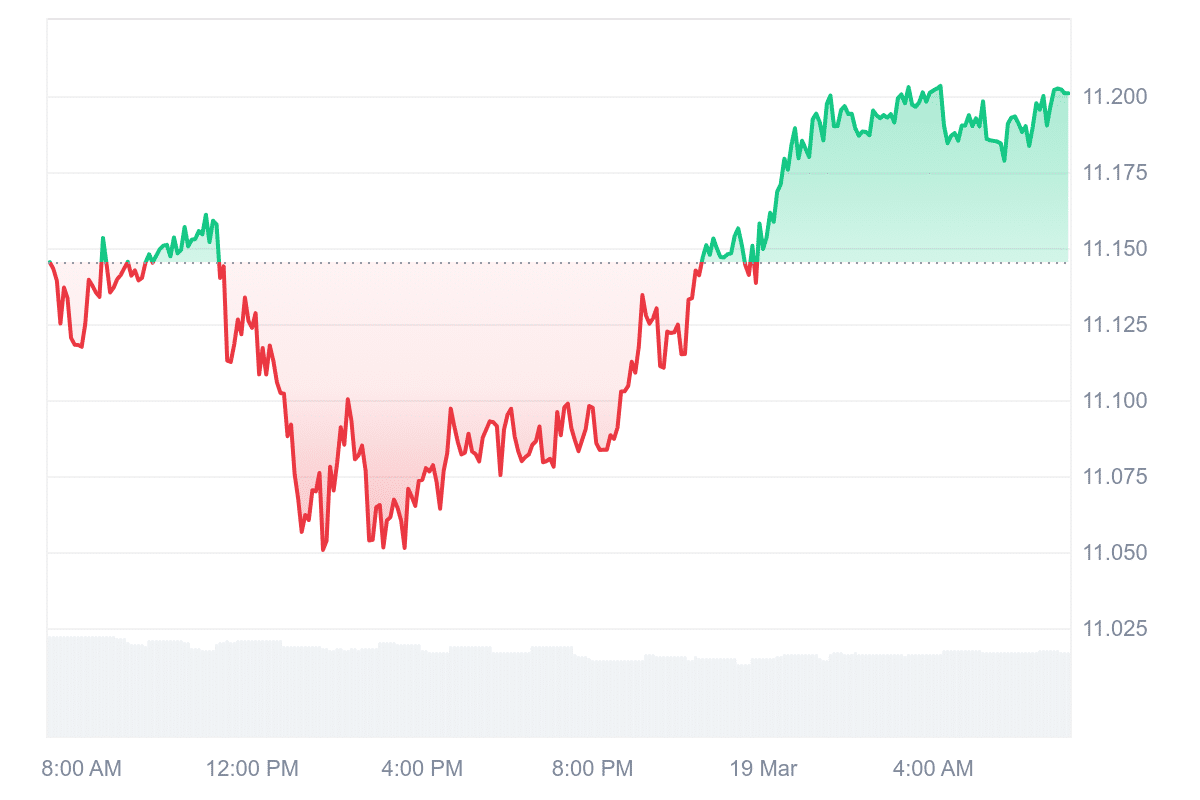

Currently, KCS is priced at $11, reflecting a 0.50% increase in the past 24 hours. Over the last week, it has also gained 2.85%. The token is trading above its 200-day simple moving average (SMA) of $9.50, marking a 16.90% increase. This suggests that KCS has maintained relatively strong performance compared to its historical price trends.

The 14-day Relative Strength Index (RSI) stands at 55.68, indicating neutral momentum. This suggests that the price may continue moving sideways without significant upward or downward pressure. Despite these trends, KCS remains significantly below its all-time high, currently down by 61%.

Furthermore, KCS plays a key role in the KuCoin ecosystem, offering utility within the exchange and potential future applications in decentralized finance. Its price movements suggest stability in the short term, but broader market conditions will influence its long-term performance.

2. Chainlink (LINK)

Chainlink Automation has been integrated into Velodrome, a decentralized exchange on the Superchain network. This integration, developed in collaboration with Hack, aims to improve protocol operations on OP Mainnet and other Superchain networks. The initial focus is on automating reward distributions, which could enhance efficiency and reliability for Velodrome users.

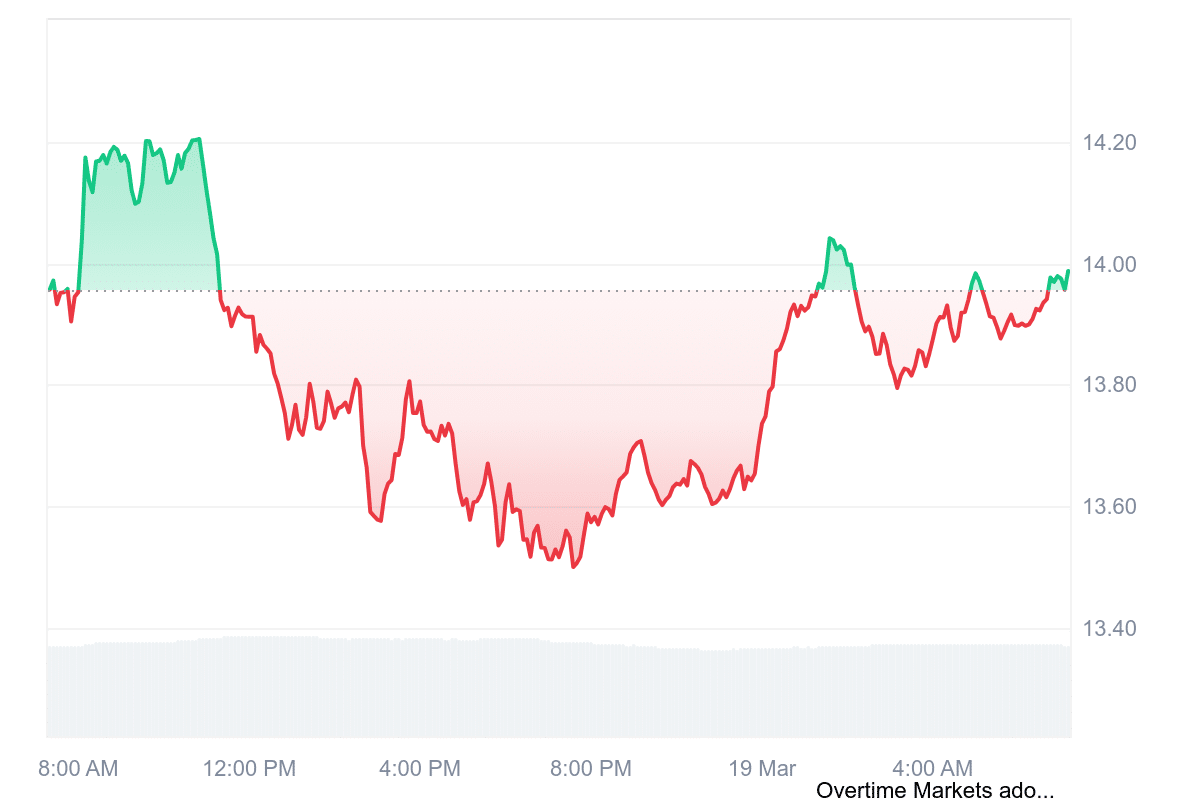

Meanwhile, Chainlink (LINK) has experienced market fluctuations, with its price ranging between $11.80 and $17 in recent weeks. Despite this volatility, on-chain data indicates a bullish trend, as 640,000 LINK tokens were withdrawn from exchanges in a single day. Large withdrawals often suggest investors are moving assets to private wallets, which can reduce selling pressure and indicate long-term holding.

Currently, LINK is trading at $14, facing resistance at $15. While buyers have attempted to push prices higher, market momentum remains weak, leading to a consolidation phase. The 14-day Relative Strength Index (RSI) is 44.19, signaling neutral conditions, meaning the price may move sideways in the short term.

Velodrome is a decentralized exchange and liquidity marketplace on the Superchain, serving as the leading DEX on multiple layer 2s.@VelodromeFi, in collaboration with @hack_bg, has integrated Chainlink Automation to help power protocol operations on OP Mainnet and across the… pic.twitter.com/JMZqmHeAVZ

— Chainlink (@chainlink) March 17, 2025

Additionally, LINK has a 24-hour trading volume-to-market cap ratio of 0.0765, suggesting sufficient liquidity. Over the past 30 days, volatility has stayed low at 11%, indicating relatively stable price movements compared to other cryptocurrencies. Forecasts suggest a potential 30.37% price increase, with LINK possibly reaching $18.11 by April.

3. MIND of Pepe (MIND)

MIND of Pepe (MIND) is a blockchain-based project that integrates artificial intelligence to assist cryptocurrency investors. It has raised $7.4 million in presale funding and is approaching its target. The project aims to help users navigate the volatile crypto market by providing insights through an AI-powered trading assistant.

$MIND is inevitable…

Best Wallet is your best way in.

◉ Track the pre-sale in real-time

◉ Buy & claim effortlessly

◉ Get alerts before the massesThe shift is happening. Stay ahead. 👁https://t.co/Ha0J8BwATp pic.twitter.com/ehFuS6v2r6

— MIND of Pepe (@MINDofPepe) March 16, 2025

The system uses a method called hive-mind analysis, which gathers data from a large group of investors to identify potential trade opportunities. By analyzing market sentiment and trends, MIND of Pepe seeks to offer informed suggestions for buying and selling cryptocurrencies. The goal is to improve decision-making by leveraging collective intelligence.

The MIND token, currently priced at $0.0035518, is expected to increase in value as it moves through different presale phases. This has drawn interest from investors looking for AI-driven trading tools.

Furthermore, MIND of Pepe focuses on community involvement. Users actively engage on platforms like X and Telegram, where they discuss market trends and product development. This interaction encourages transparency and collaboration, which are important for projects in the crypto space.

4. Stellar (XLM)

Stellar is a decentralized network designed to connect financial systems and facilitate fast, low-cost transactions. It enables users to create, send, and trade different types of cryptocurrencies while linking individuals, banks, and payment providers. The goal is to make financial transactions more efficient and accessible.

Recently, Stellar introduced the Anchor Network, a system that bridges traditional finance (TradFi) with decentralized finance (DeFi). This integration aims to expand blockchain technology’s reach by allowing financial institutions to interact more easily with digital assets.

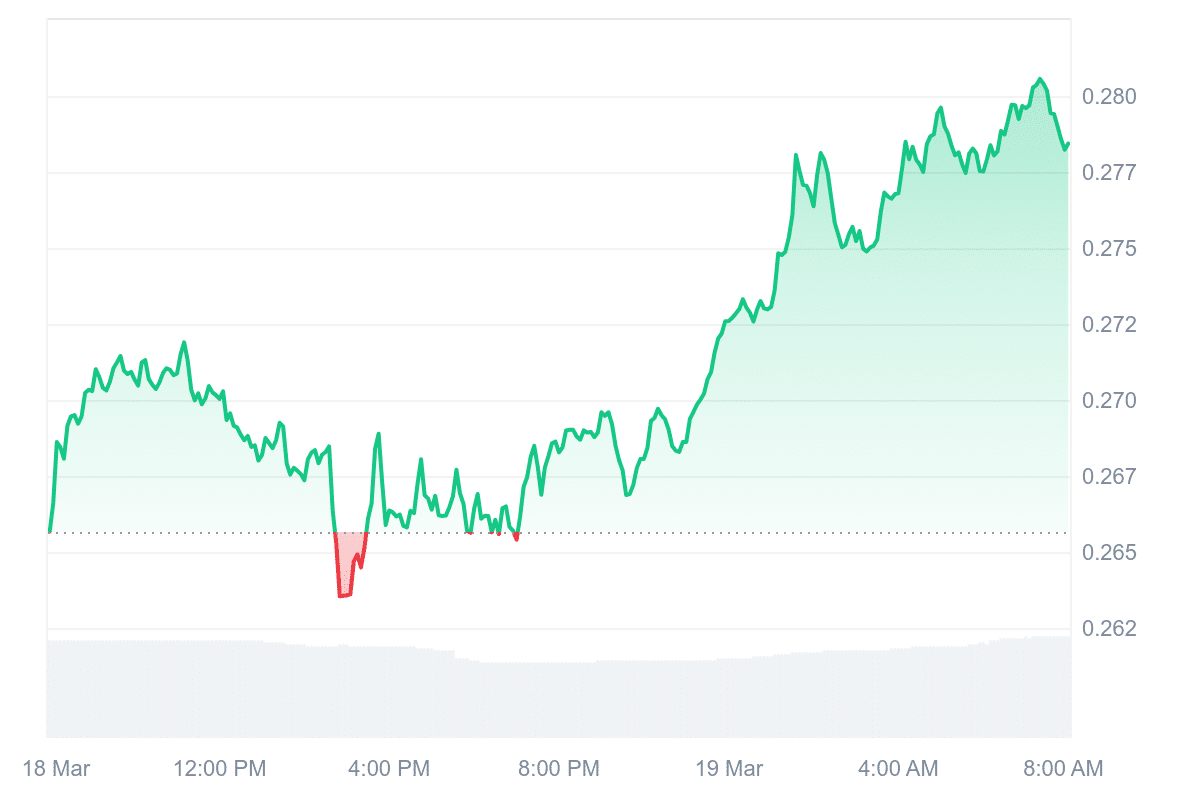

At the time of writing, XLM is priced at $0.27, reflecting a 4.41% increase in the past 24 hours. Investors are monitoring the $0.42 resistance level. If the price surpasses this point and maintains upward momentum, it could lead to a further rise toward $1.60. This would represent a significant price movement, potentially attracting more market participants.

Traditional banking 🤝 the world of digital assets.

The Stellar Anchor Network bridges the gap between TradFi and DeFi, making the benefits of blockchain technology widely accessible. #BetterOnStellarhttps://t.co/t3RuqPGipy

— Stellar (@StellarOrg) March 14, 2025

Technical indicators provide insight into XLM’s market position. The Relative Strength Index (RSI) remains neutral, suggesting there is room for further growth. Additionally, moving averages indicate increased buying activity, which could support price stability or further gains.

5. MANTRA (OM)

MANTRA (OM) is a decentralized finance (DeFi) platform and Layer 1 blockchain designed for security and regulatory compliance. It focuses on tokenizing and trading real-world assets while aligning with legal standards. This approach makes it suitable for institutions that require compliance with financial regulations.

Unlike fully open blockchains, MANTRA provides a permissionless environment tailored for permissioned applications. This structure allows businesses and institutions to use blockchain technology while meeting legal requirements. The platform includes pre-built decentralized applications (dApps) from recognized brands and integrates with on and off-ramp solutions for easier transactions.

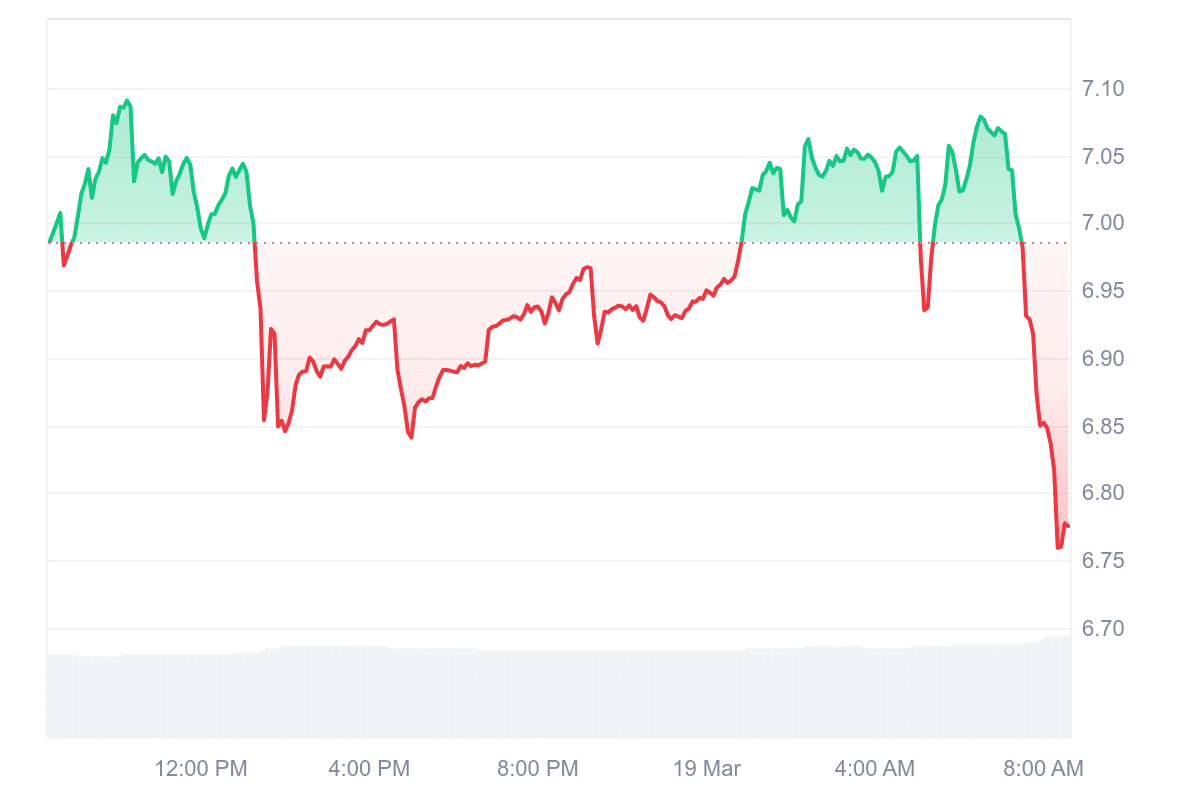

From a market perspective, MANTRA has shown positive price performance. It is trading 175.60% above its 200-day simple moving average (SMA) of $2.44, indicating strong momentum. It has had 15 positive trading days in the last 30 days, reflecting stable market activity. Liquidity remains high relative to its market cap, suggesting ease of trading.

Technical indicators show a neutral outlook. The 14-day Relative Strength Index (RSI) is at 47.78, meaning the asset is neither overbought nor oversold and may continue trading sideways. Meanwhile, the Fear & Greed Index stands at 32, indicating cautious investor sentiment.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage