Join Our Telegram channel to stay up to date on breaking news coverage

Making the most profit from a bearish market requires attention to the profitable altcoins and meme coins with explosive potential. However, identifying cryptocurrencies with explosive potential might take work, as most funds are attracted to pumping assets.

Today’s article explores the performance of cryptocurrencies that have dominated the gainers list in the last 24 hours. The objective is to identify the next cryptocurrencies to explode and inform investors and traders about each token. The post also includes an overview of the market trend for crypto assets, which have the potential to post significant gains in the future.

Next Cryptocurrency To Explode

Experts suggest that investors are more likely to discover the next booming crypto among upcoming projects. With this in mind, they should consider the potential of the new presale coin, MIND of Pepe (MIND). MIND has raised an impressive $6 million in about three weeks. It merges AI intelligence with the viral appeal of meme coins to tap into AI-driven projects and meme-based tokens.

1. Hyperliquid (HYPE)

The Hyperliquid airdrop on November 29, 2024, was a significant moment for the crypto community. Over 90,000 users received HYPE tokens, reinforcing Hyperliquid’s commitment to its community rather than focusing on venture capitalists. This strategy helped the project stand out in the crowded market.

HYPE once soared past $30 but struggled to maintain momentum, leading to a period of price consolidation. The market has since formed a pattern of lower highs and lows, with $13 USDT proving to be a strong resistance level. A potential dip might occur before the price stabilizes and another rally is attempted.

If buyers maintain pressure, HYPE could push towards $16.126 and $18.833. However, failure to hold above $12.236 USDT might trigger a decline toward $21.782 USDT or lower. The market remains uncertain, and traders are keeping a close watch on price movements.

Hyperliquid has redefined trading.

When a whale shorts $450M+ BTC and wants a public audience, it's only possible on Hyperliquid.

When headlines say "Bitcoin Market on Edge," they are equating "Hyperliquid" with the "market."

Anyone can photoshop a PNL screenshot. No one can… pic.twitter.com/0fmBmXNOOg

— Hyperliquid (@HyperliquidX) March 17, 2025

Adding to the tension, a Hyperliquid whale recently placed a massive Bitcoin short valued at $520 million, leveraging 40x while Bitcoin trades at $79,530. This suggests a bearish outlook, with risks of market disruption if Bitcoin surges unexpectedly. A sudden price increase could trigger a wave of liquidation, increasing volatility and uncertainty.

Market analysts are observing the short position and its potential effects. Analysts warn that if Bitcoin surpasses $85,561, liquidations could intensify, leading to further instability. This is not the first high-stakes move on Hyperliquid—just last week, a trader placed a $285 million leveraged Ethereum bet, resulting in a $4 million loss for the platform. In response, Hyperliquid adjusted leverage limits for Bitcoin and Ethereum to manage risks.

2. Dymension (DYM)

Dymension (DYM) is attracting attention for its use of the Inter-Blockchain Communication Protocol (IBC) to standardize roll-ups, similar to how ERC standards transformed token creation. Its RollApps combine scalability, speed, and the roll-up business model, positioning Dymension as a key player in blockchain interoperability.

Currently, DYM is testing its descending trendline resistance, hinting at a potential breakout. Analysts suggest that if the breakout occurs, it could lead to medium-term gains of up to 350%, making DYM a promising option for investors seeking high returns.

The token previously surged from a symmetrical triangle pattern near $2.42, signaling an uptrend. However, its price has since dropped significantly to $0.4218. DYM is now approaching a resistance level at $0.55, which could lead to a 30.393% increase from its current price.

Despite a Fear & Greed Index score of 32 (Fear), market sentiment remains neutral. Interestingly, DYM’s daily trading volume has jumped by 107.94% in the past day, suggesting growing investor interest and optimism.

With strong fundamentals and an active community, DYM is well-positioned for future growth. If the project secures key partnerships, it could surpass $3.50 by year-end, further strengthening its role in the blockchain space. Investors are keeping a close watch, anticipating its next major move.

3. MIND of Pepe (MIND)

A whale recently secured an impressive $10 million in profits through a highly leveraged Bitcoin short position—an opportunity that MIND of Pepe ($MIND) is built to identify with its advanced AI-driven capabilities.

MIND of Pepe has rapidly gained attention as one of 2025’s most talked-about presale projects, raising nearly $7.5 million in just over two months. This surge in funding is fueled by the development of its AI-powered crypto trading technology, designed to help investors navigate both rising and falling markets.

The project leverages hive-mind analysis, collecting insights from a vast network of investors on platforms like X. By tracking trends and monitoring trader discussions, MIND of Pepe identifies potential market opportunities that others might overlook.

Using this data, MIND of Pepe generates actionable insights. It continuously evolves and refines its strategies without requiring manual updates, ensuring it remains aligned with the latest market trends.

New Frontier. $MIND pic.twitter.com/nzLqmRJkk3

— MIND of Pepe (@MINDofPepe) March 18, 2025

Early adopters can currently acquire $MIND tokens for $0.0035518. However, with less than 42 hours remaining before the next funding stage increases the price, time is running out to secure a stake in the project at this lower entry point.

4. EOS (EOS)

For years, EOS struggled to keep up with emerging trends such as Web3 gaming, NFTs, and token launches. Despite maintaining liquidity due to its legacy exchange listings, some platforms removed the token due to low activity. EOS also lost support for its native USDT when Tether phased out the token because of low chain usage.

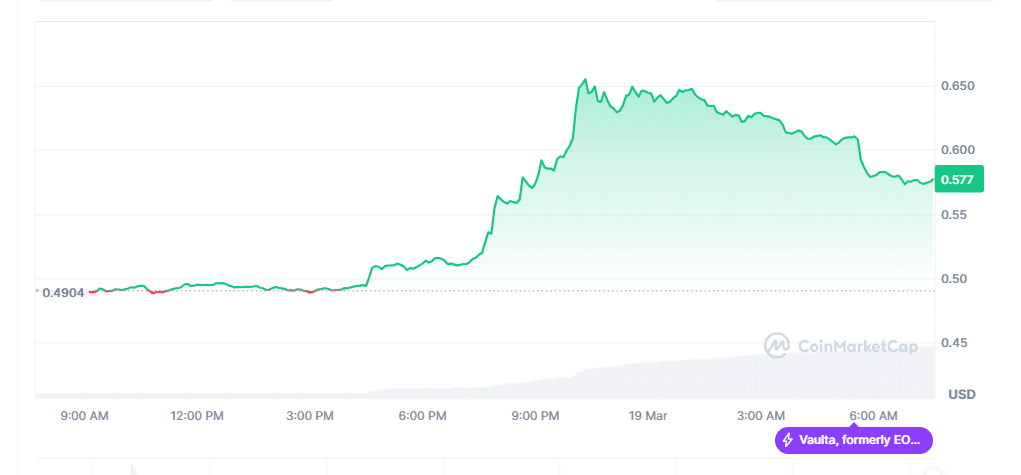

Following news of a rebranding, EOS saw a 27% recovery, reaching $0.63. The project retained its listings on Binance and OKX, allowing the token to respond quickly to the announcement.

With expectations of increased network activity, the value of EOS tokens may rise. The platform operates using a RAM market to support on-chain computation, which recently saw a surge, pushing its valuation to $15.6 million.

EOS remains one of the most well-funded blockchain projects. It held a year-long public sale through a Dutch Auction, raising $4.2 billion in ETH over weekly periods. The project later secured an additional $60 million in venture capital funding.

Introducing Vaulta – the evolution of Web3 Banking begins today.

Over the next two months, we’ll be unveiling more details and strategic launch partners as we prepare for the full transition from $EOS to Vaulta.

🔹 Today: Vaulta officially announced.

🔹 Early May: New token… pic.twitter.com/k8XqQLU0Zl— Vaulta (prev. EOS) (@Vaulta_) March 19, 2025

However, EOS is currently facing an address poisoning attack, where small amounts of tokens are sent from spoofed addresses. This attack came just a day after EOS announced its rebrand to Vaulta, a move aimed at bridging traditional finance with blockchain technology.

The security firm SlowMist detected the attack, which takes advantage of EOS’s human-readable addresses. Unlike traditional fake token scams seen on Ethereum and BNB Chain, this attack involves imitating exchange wallets, including those belonging to Binance and OKX. Attackers are sending 0.001 EOS to multiple addresses, hoping to confuse users into sending their tokens to fraudulent wallets.

5. Bubblemaps (BMT)

Bubblemaps has established a reputation for providing tools that visualize token ownership and blockchain transactions using interactive bubble-like graphics. The team emphasized that the funds raised will help advance its mission of making blockchain data more accessible, transparent, and easy to understand.

At the time of writing, BMT surged by 28% in the last 24 hours, reaching $0.2279 at 4:30 a.m. EST. Trading volume skyrocketed by 442% to $609.95 million, reflecting a strong wave of investor interest. This price and volume spike came just days after BMT launched. Initially, the token dropped to $0.074 on March 12 but has been gradually recovering. Resistance at $0.10 was a key challenge before the token broke past it.

Momentum picked up significantly at the start of the week, and on March 17, BMT saw a strong rally, ultimately reaching its all-time high of $0.3212 on March 18. The price surge followed the announcement that BMT would be listed on Binance, further fueling excitement in the market.

Bubblemaps officially launched its Token Generation Event (TGE) on March 11, 2025. According to Binance, the event was exclusively hosted on the BNB Chain via PancakeSwap and ran from 8:00 a.m. UTC to 10:59 a.m. UTC on launch day.

$BMT is live on Binance https://t.co/mN5JBSz6bZ https://t.co/NFlTLMoJB9 pic.twitter.com/vioeEmGRNq

— Bubblemaps (@bubblemaps) March 18, 2025

During the TGE, 40 million BMT tokens were made available at a price of $0.02 each, aiming to raise $800,000 in BNB to support future development. This distribution accounted for 4% of Bubblemaps’ total supply of 1 billion tokens.

The team stated that each wallet’s contribution would determine its share in proportion to the total BNB deposited. Moreover, a participation cap of 3 BNB per wallet was implemented to ensure fair distribution.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage