Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is down 0.8% in the last 24 hours to trade for $41,981 as of 4:30 a.m. EST time.

Despite the slump, the primary trend remains bullish backed by a 21% increase in 24-hour trading volume.

This comes on the back of a hot BTC market in 2023, steered by anticipation for the BTC halving event slated for April 2024 and the hype around Bitcoin exchange-traded funds (ETFs) approvals expectation.

The euphoria has not only inspired the likes of Google to demonstrate readiness for spot ETF product launches but also has industry experts anticipating strong price surges for the king of cryptocurrency.

In the latest development, El Salvador is making headlines once again, conferring regulatory approval for the first Bitcoin bonds. It marks the actualization of a longstanding plan, with the BTC bonds expected to be out for issuance during the first quarter (Q1) of 2024.

🚨BREAKING NEWS🚨

The Volcano Bond has just received regulatory approval from the Digital Assets Commission (CNAD).

We anticipate the bond will be issued during the first quarter of 2024.

This is just the beginning for new capital markets on #Bitcoin in El Salvador.

🇸🇻🌋🚀

— The Bitcoin Office (@bitcoinofficesv) December 12, 2023

“This is just the beginning for new capital markets on Bitcoin in El Salvador,” said the announcement. The bonds are slated for offering on the regulated division of crypto exchange Bitfinex called Bitfinex Securities.

El Salvador President Nayib Bukele has underscored the announcement even as this development marks history in the making.

Wen volcano bond? 🥺

— Nayib Bukele (@nayibbukele) December 12, 2023

Bitcoin Price Outlook As BTC Trades Within A Weekly Supply Zone

After a 10% crash during the early hours of the Asian session on December 11, Bitcoin price continues to trade within a weekly supply zone.

This supply barrier stretches between $40,698 and $46,999. To confirm the continuation of the uptrend, the price must record a decisive weekly candlestick close above the mean threshold of the supply zone at $43,860.

Meanwhile, the odds continue to favor the upside, with the recent correction hinting at a possible bear trap. It presents as a healthy correction in an otherwise overbought market as the Relative Strength Index (RSI) has held above the 70 level since October 20 on the weekly timeframe.

The healthy correction is underscored by the fact that the $40,000 psychological level continues to hold as a support floor. The Awesome Oscillator (AO) indicator is also bullish, holding within the positive territory as its histogram bars flash green.

Increased buying pressure above current levels could see Bitcoin price overcome the supply zone, flipping it into a bullish breaker, confirmed by a break and close above the $48,725 resistance level.

In a highly bullish case, Bitcoin price could extend, shattering past the $50,000 psychological level before tagging the $54,763 resistance zone. Such a move would constitute a 30% climb above current levels.

Extremely ambitious cases could see Bitcoin price extend a neck higher, breaking past the $60,000 level to reclaim the range high around $69,000, levels last tested in November 2021.

Converse Case

On the flip side, if the weekly supply zone continues to hold as a resistance block, Bitcoin price could face a rejection. This could send BTC below the critical support at $40,000, invalidating the “healthy correction” narrative.

In the dire case, the slump could extend towards the $30,000 psychological level, below which the prevailing bullish outlook would be invalidated.

On-chain Metrics To Support Bitcoin Bullish Outlook

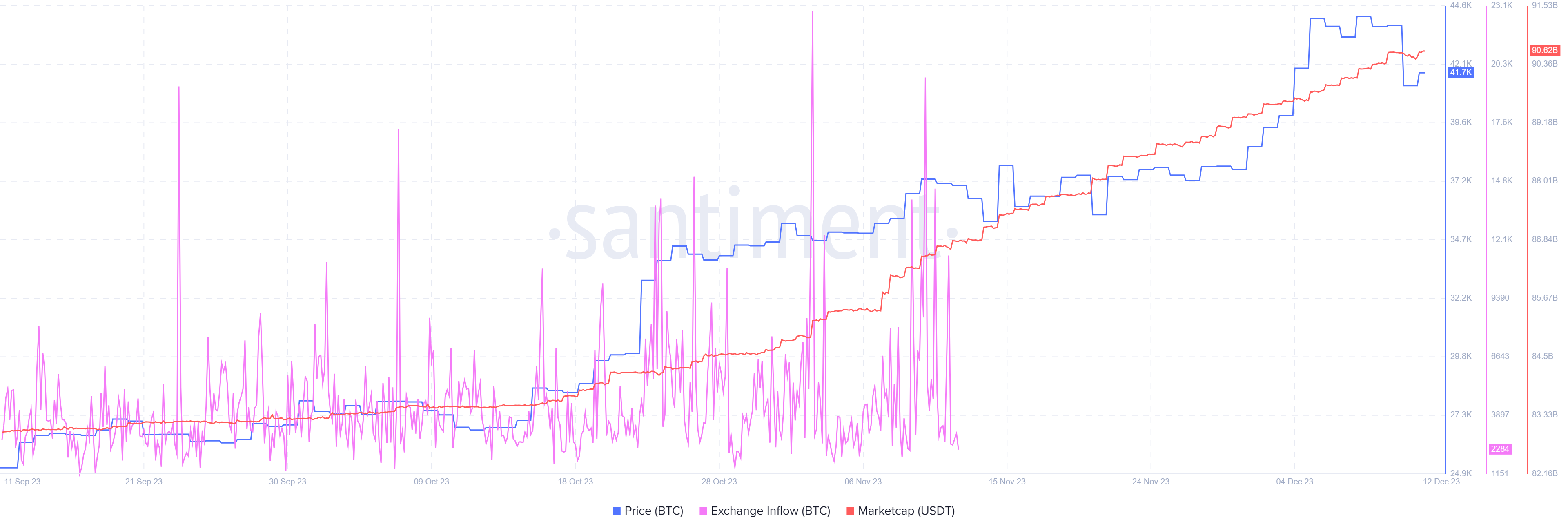

Behavior aggregator Santiment supports the bullish outlook. Specifically, its exchange inflow on-chain metric is dropping, suggesting that BTC holders are not demonstrating intentions to sell. Typically, when tokens flow into centralized exchanges, it often suggests traders want to sell.

The Tether (USDT) stablecoin market capitalization metric also corroborates this thesis. Its upward trajectory suggests increasing capital inflow into the BTC market as investors plan to buy BTC.

Amid increasing interest in the BTC market, two Bitcoin derivatives, BTCMTX and BTCETF, are making headlines as investors anticipate a new bull run. They both feature among the best five crypto presales to buy now, with experts anticipating 10X growth potential.

Promising Alternative To Bitcoin

BTCMTX

This is the powering token for the Bitcoin Minetrix ecosystem, a stake-to-mine project committed to making Bitcoin ownership a reality even for the ordinary folk. It uses a cloud-mining approach, striking off all hassles relating to the traditional BTC mining approaches.

These include space, heat, hardware costs, and third parties who are often associated with swindles.

#BitcoinMinetrix stands out for its cost-effectiveness. 💰

By eradicating the necessity for hardware expenses, it offers a efficient approach to mining. 🛠️

Users can partake in mining without the burden of physical equipment, making it an accessible and economical option. pic.twitter.com/pPGTpEe0YM

— Bitcoinminetrix (@bitcoinminetrix) December 12, 2023

Token sales have reached $5.232 million out of the target objective of $6.079 million, as investors buy BTCMTX tokens for $0.0122 each.

#Tether freezes 41 wallets linked to OFAC's SDN List, taking precautionary measures. 🔒

CEO Paolo Ardoino emphasizes a safer #Stablecoin ecosystem.

How do you think such actions impact the stability and trust in stablecoin technology?#BitcoinMinetrix attains another… pic.twitter.com/EOIjneI5f3

— Bitcoinminetrix (@bitcoinminetrix) December 12, 2023

Notably, this price tag will only stand for less than five days. Do not miss this window as it offers a chance for affordable entry before yet another price hike. Visit the Bitcoin Minetrix website to buy BTCMTX in the presale here.

BTCETF

Elsewhere, BTCETF, which powers the Bitcoin ETF Token ecosystem, is also trending. It is advertised as the only project that rewards holders as BTC ETFs are approved. The project is also in the presale, recording upwards of $3.614 million so far.

El Salvador’s #Bitcoin bonds gain regulatory approval for an early 2024 issuance on Bitfinex Securities, a regulated division of @bitfinex.

President Nayib Bukele confirms Q1 2024 issuance. 💸

What impact do you foresee these #Bitcoin-backed bonds having on El Salvador's $BTC… pic.twitter.com/zj7Yc2f7yg

— BTCETF_Token (@BTCETF_Token) December 12, 2023

Investors looking to join the Bitcoin ETF Token ecosystem can do so now by acquiring the BTCETF token for just $0.0066. This price tag will only last for the next 31 hours, with the window closing fast. Head over to the Bitcoin ETF Token website to buy BTCETF in the presale here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- How To Buy Bitcoin ETF Token On Presale – Alessandro De Crypto Video Review

- Bitcoin Price Prediction: Willy Woo Says BTC Likely To Slump To $39K As Investors Look To Presale Coins Like This Bitcoin ETF Approvals Play For Explosive Gains

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage