Join Our Telegram channel to stay up to date on breaking news coverage

A segment of the total trading volume is attributed to the decentralized finance (DeFi) sector. This segment contributes $9.83 billion or 12.24% to the total crypto market 24-hour volume. Therefore, it emphasizes decentralized financial platforms’ continued growth and significance within the broader cryptocurrency landscape.

6 Best Cheap Crypto to Buy Now Under 1 Cent

An intriguing aspect of the market dynamics is the dominance of stablecoins, which currently account for $74.21 billion. The coins constitute 92.37% of the total crypto market 24-hour volume, suggesting investors rely on them for trading and liquidity.

1. Algorand (ALGO)

Algorand starts the day with notable trading patterns, such as a $ 0.206956 price and a market cap of $ 1.66B. The coin reflects a potential trend strength, consistently traded above the 200-day simple moving average. Over the last 30 days, Algorand has experienced 19 green days, accounting for 63% of its recent trading sessions. This indicates a positive market sentiment within this timeframe.

Furthermore, ALGO’s liquidity, assessed by its market cap, is relatively high, facilitating robust trading activities. With a 24-hour trading volume of $ 411.32M and a market dominance of 0.10%, Algorand showcases active market participation.

Currently, 8.01B ALGO is circulating out of a maximum supply of 10.00B ALGO. However, the project’s yearly supply inflation rate is notably high at 12.52%, resulting in 890.86M ALGO in the past year.

Hello Python! 🐍

Dev Preview is the initial release of Python on Algorand.

We can’t wait for you to try it out and share your feedback!

Try Dev Preview today: https://t.co/0bXaVMDnOy

Thank you @MakerXAU for being our technical partners on this effort!

💻 #PythonOnAlgo pic.twitter.com/HIGU5P4iJL

— Algorand Foundation 🐍 (@AlgoFoundation) December 11, 2023

Ranked #11 in Proof-of-Stake Coins and #26 in Layer 1, Algorand’s position reflects its standing in these market segments. Moreover, the sentiment surrounding Algorand’s price prediction is presently bullish. This optimistic projection accompanies a Fear & Greed Index of 67, indicating investor optimism.

2. Osmosis (OSMO)

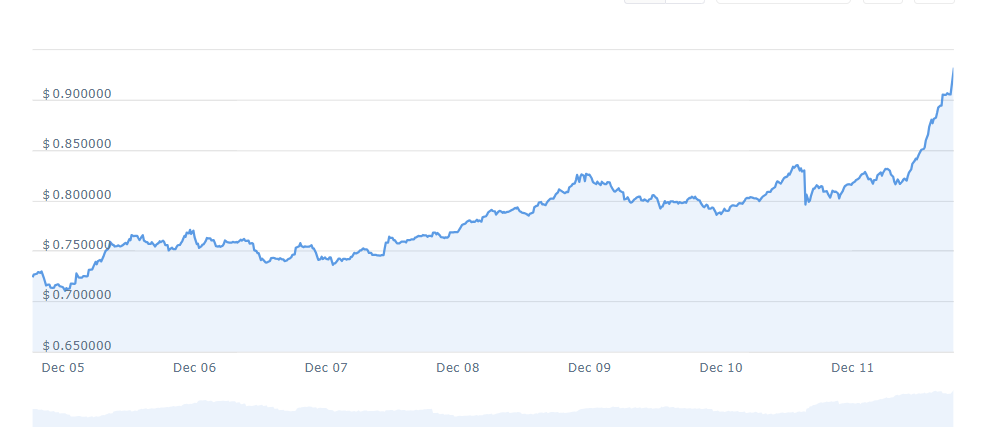

Osmosis increased by 1% over the past year, coasting above its 200-day simple moving average. Over the last 30 days, it experienced 19 positive trading days, constituting 63% of the observed period. Currently, OSMO is positioned close to its cycle high, indicating a potential peak in its trading cycle.

OSMO boasts a market capitalization of $263.30 million and a 24-hour trading volume of $37.87 million. The coin holds a significant liquidity position in the market, further propelled by a market dominance of 0.2%.

Osmosis peaked on Mar 4, 2022, at $11.18, and its lowest point on Oct 19, 2023, at $0.224557. These metrics represent its all-time high (ATH) and low (ATL). Post its ATH, the lowest price observed was $0.224557, termed the cycle low.

The integration of Osmosis into the @exodus_io wallet extends the reach of the Osmosis experience throughout the crypto space.

Users can now enjoy a seamless experience on mobile and desktop, securely storing their assets in a non-custodial wallet.🔒

Welcome to the Lab 🧪 https://t.co/yYdnUoyIVD

— Osmosis 🧪 (@osmosiszone) December 8, 2023

Meanwhile, OSMO’s peak hit $0.932154, which was identified as the cycle high. However, market sentiment appears bullish for Osmosis, with a Fear & Greed Index registering at 67 (Greed).

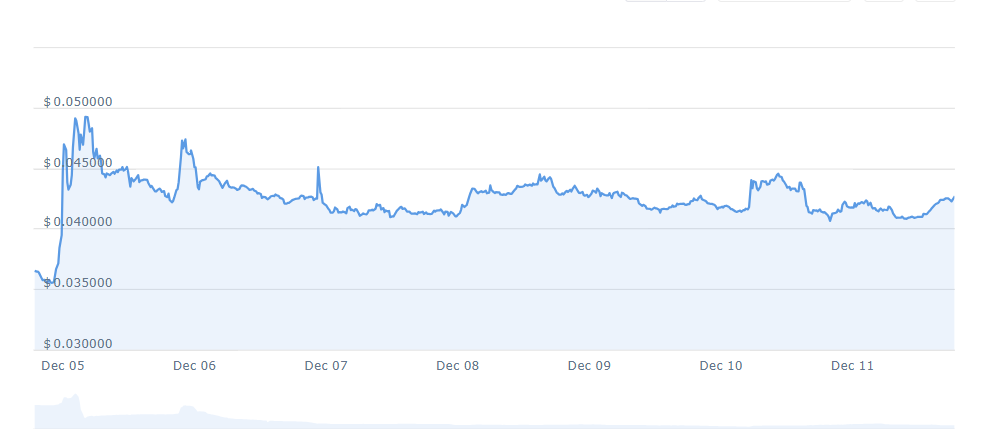

3. Casper (CSPR)

Casper, a blockchain platform, has experienced a notable price surge of 44% in the past year. Currently, CSPR is trading above the 200-day simple moving average, indicating a bullish trend. Furthermore, Casper’s performance has been positive compared to the token sale price. The coin has also witnessed positive growth in 15 out of the last 30 days, accounting for 50% of the observed period.

Market sentiment towards Casper’s price prediction remains bullish, supported by a Fear & Greed Index at 67 (Greed). Moreover, Casper’s circulating supply stands at 11.61 billion CSPR tokens. This is facilitated by a yearly inflation rate of 9.64%, creating approximately 1.02 billion CSPR tokens in the past year.

Caspers platform caters to businesses and developers, positioning itself as a versatile and sustainable blockchain solution. The token’s unique features and practical use cases also contribute to its potential for future growth.

We have an important story to tell…

The concept of tokenization on Casper – combining the power of blockchain technology with the unique consensus mechanism of Casper.

Read @RRKUBLI's interview in @CryptoSlate 👇 pic.twitter.com/MKF3SJX0rF

— Casper (@Casper_Network) December 11, 2023

Furthermore, projected price estimations for the CSPR Coin indicate a potential maximum price of $0.21 by the end of 2023. However, an average price expectation of around $0.10 for 2023 has been forecasted, contingent upon the market aligning with anticipated conditions.

4. Conflux (CFX)

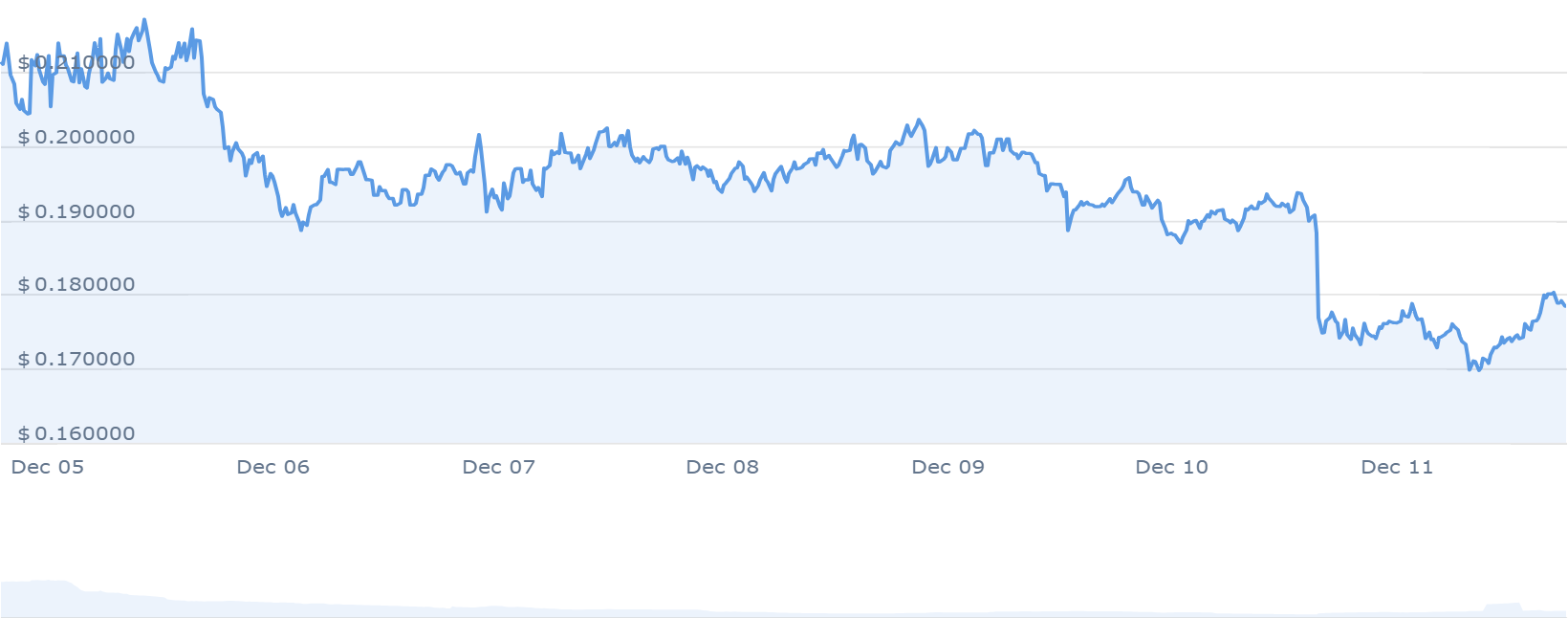

The Conflux had a good year, marked by a 557% increase. This surge has placed it above 93% of the top 100 crypto assets within the same timeframe. Notably, CFX’s current trading value rests comfortably above the 200-day simple moving average, indicating a sustained upward trend.

Conflux’s listing price is $ 0.178576, followed by a $ 65.74M intraday trading volume. Moreover, the coin boasts a market cap of $ 634.11M, showcasing significant liquidity. However, its price remains below its peak of $ 1.720000 recorded on Mar 27, 2021. Conversely, the lowest price experienced was $ 0.021852 on Dec 30, 2022, after its all-time high.

Analyzing its supply dynamics, the current circulating supply of Conflux Network stands at 3.55B CFX out of a maximum supply of 5.28B CFX. Notably, there’s an observed yearly supply inflation rate of 69.84%, leading to the creation of 1.46B CFX within the past year.

🚀 We have great news from the @FireblocksHQ #Spark23 event in Mexico where our team is actively participating. Our Co-Founder @FanLong16, along with @BambaLados and @realdora_eth, recently presented product demo of our BSIM. pic.twitter.com/WXWz9gse89

— Conflux Network Official (@Conflux_Network) December 8, 2023

The market sentiment for Conflux Network’s price prediction is neutral. At the same time, the Fear & Greed Index stands at 67, indicating a leaning towards greed in the market sentiment.

5. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix introduces a novel approach allowing users to stake BTCMTX tokens for cloud mining credits. The project aims to decentralize control and ensure a secure mining experience for token holders.

The staking pool of Bitcoin Minetrix has garnered significant interest, with over 400,000 BTCMTX tokens currently staked. As such, the platform advertises an annual percentage yield (APY) of 103,225%.

Despite its initial developmental phase, Bitcoin Minetrix has seen substantial attention, positioning it among the best cheap crypto to buy. This growth is supported by the ongoing BTCMTX presale, generating over $1,541,299 by selling tokens at $0.011 per token.

In celebration of achieving the 5M raise milestone, we're hosting a competition! 🎉

Create your most unique #BTCMTX Christmas Graphic/Image or Video. 🎨🎥🎄

Tweet, tag us, and include #BTCMTXCOMP in your entry.

The top 3 submissions stand a chance to win a cash prize. 🎁 pic.twitter.com/1nhsatlXUB

— Bitcoinminetrix (@bitcoinminetrix) December 8, 2023

During the presale phase, 70% (2.8 billion BTCMTX) of the total token supply of 4 billion is being offered. Interested investors can acquire these tokens using either ETH or USDT.

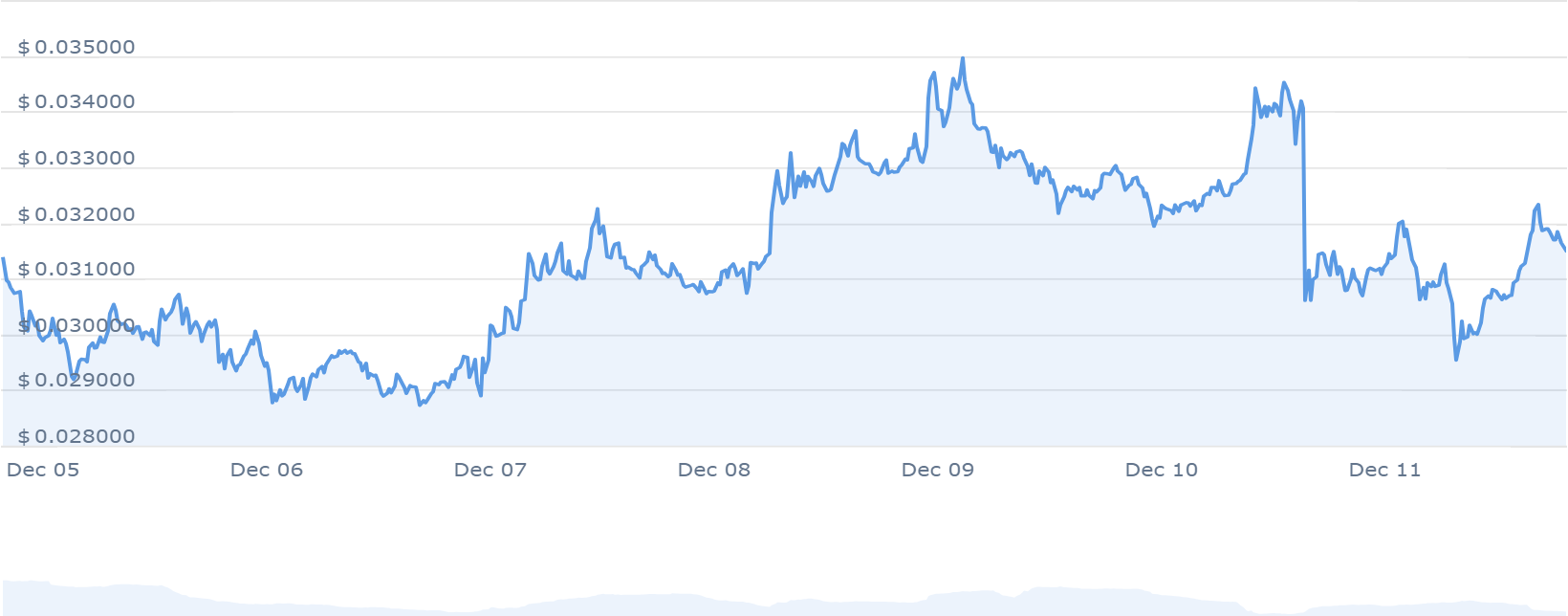

6. Gala (GALA)

GALA coin witnessed a bullish surge, surpassing $0.018 amidst Bitcoin’s surge to $44K. GALA’s price currently sits above its 200-day simple moving average, marking a 28% increase over the past year. In terms of supply dynamics, GALA has a circulating supply of 26.58B out of a maximum supply of 50.00 B. Notably, the yearly supply inflation rate stands at 280.89%, creating 19.60B GALA in the last year.

Moreover, the sentiment regarding GALA’s price prediction currently remains neutral. Meanwhile, the Fear & Greed Index indicates a level of 67, depicting a market leaning towards greed. Additionally, the coin’s rankings are notable, standing at #23 in the Ethereum (ERC20) Tokens sector, #5 in the NFT Tokens sector, and #5 in the Gaming sector.

The recent YGG Web3 Games Summit by @yggevents and @yggpilipinas has shown that the future of Web3 gaming is bright in the Philippines! Pinoy gamers having fun with the @last_expedition showcase with basketball star @jdaredevil2 was our favorite moment! pic.twitter.com/dtpjhe5HI2

— Gala Games (@GoGalaGames) December 6, 2023

Analyzing recent trends, GALA has seen positive movement, with 19 green days in the last 30, accounting for 63% of the time frame. Furthermore, its liquidity is reportedly high based on its market capitalization.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage