Non-fungible tokens (NFTs) are unique digital assets stored on a blockchain, usually Ethereum or Solana. “Non-fungible” simply means that the asset is unique and can’t be directly replaced or exchanged for another asset. For example, a U.S. dollar is fungible because it can be easily replaced for another identical dollar.

NFTs, on the other hand, are like original paintings or rare collectibles, such as one-of-one baseball cards, where each item is provably unique. In this guide, we will explore the genesis of NFTs, the rise, fall, and comeback of the NFT market, and what NFTs are used for in 2025

Key Takeaways

- NFTs (Non-Fungible Tokens) represent unique digital assets stored on a blockchain. They prove ownership and authenticity of items like art, music, or virtual goods.

- NFTs are not interchangeable. Each one has distinct properties and value.

- NFTs are used in gaming, virtual real estate, event tickets, identity verification, and more.

What Is a Non-Fungible Token (NFT)?

NFTs, or non-fungible tokens, are unique digital assets typically used to represent art, music, collectibles, game items, virtual real estate, and more. They are stored on blockchains like Ethereum or Solana and contain metadata and proof of authenticity that make them verifiable and tamper-proof. This allows creators to sell their work directly, with ownership and provenance publicly traceable, often including features like royalties for future resales.

The term “non-fungible” means that each asset is one-of-a-kind and not interchangeable with any other asset on a 1:1 basis. This is in contrast to fungible assets like cryptocurrencies or fiat money, where each unit is identical in value and function. One Bitcoin is always equal to another Bitcoin, just as one dollar equals another dollar.

A Brief History of NFTs

NFTs erupted into the mainstream in 2020 and 2021, but they had been around for many years by that point. Developers played around with tech similar to NFTs all the way back in 2012 and 2013. The first clear predecessor of NFTs, a project called Colored Coins, was launched in 2012. Colored Coins represented denominations of Bitcoin “colored” with a little bit of extra data (called metadata), allowing them to stand for real-world assets.

Bitcoin’s blockchain simply wasn’t built for this kind of utility, so Colored Coins didn’t gain much steam. The first collections of NFTs, as we know them today, were launched in 2017. Larva Labs, a fledgling company, launched CryptoPunks in June of that year. CryptoPunks are a collection of 10,000 unique (non-fungible) pixel art characters stored on the Ethereum blockchain.

Just a few months later, CryptoKitties, a collection of cat NFTs, launched and gained popularity quickly as it allowed users to collect and even breed their digital cats. It became so popular that it congested the Ethereum network, making transactions extraordinarily expensive and slow.

The tremendous success of CryptoPunks and CryptoKitties proved the value of unique, verifiable NFTs. Both collections are still remarkably popular (and expensive), even though the NFT market has fallen a long way from its peak. The two collections inspired other creators to launch over a hundred thousand NFT collections over the years. Many of these NFTs are similar, art-focused projects, but the technology has spread to countless industries including gaming, music, real estate, and sports collectibles.

How Do NFTs Work?

NFTs are powered by blockchain technology to verify ownership and ensure the non-fungibility (or uniqueness) of digital assets. When an NFT is minted, a new record is added to the blockchain, a kind of decentralized, tamper-proof ledger that anyone can view and use.

Each NFT is usually linked to a specific digital file like an image, GIF, video, or audio file using a smart contract. Smart contracts are lines of code that automatically execute when certain predetermined conditions are met. An NFT’s smart contract acts similarly to a house deed and a certificate of authenticity, linking the NFT to the creator and recording every transaction or transfer, ensuring the holder can prove ownership.

NFTs can be minted on many different blockchains, though most live on Ethereum, using the ERC-721 or ERC-1155 token standards (unlike ERC-20 tokens). Other popular blockchains for NFTs include Solana, Avalanche, Polygon, and even Bitcoin.

Are NFTs Profitable Anymore?

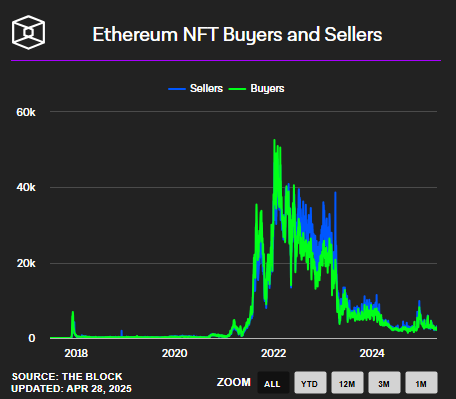

The NFT market experienced a massive boom in trading volume in 2020 and 2021, making countless NFT millionaires. However, NFT values crashed along with the rest of the crypto market after the collapse of Terra Luna. Plenty of NFT collections still hold substantial value, but almost every top collection is worth much less than it was during the peak.

Since 2022, NFT trading volume has fallen dramatically, and so has mainstream adoption. This has made it much more difficult to trade NFTs profitably, though it’s still possible. Even at its height, making a profit with NFTs was no easy feat, given their extreme volatility and short lifespans. Trading NFTs has always been incredibly risky due to the inherent volatility and low liquidity, and this likely won’t change soon.

How to Buy NFTs

Investing in NFTs can seem daunting at first, but it’s actually a rather simple process. Here’s a step-by-step guide to help you get started:

Step 1: Get a Personal Crypto Wallet

Naturally, you will need to get a crypto wallet before you can start buying NFTs. Some of the most popular free options include MetaMask, TrustWallet, and Coinbase Wallet. Check out our full guide on how to choose the best crypto wallet for you for a more detailed guide.

Step 2: Buy Crypto and Send It to Your Crypto Wallet

Now, you will need to buy some crypto if you don’t already own some. If you want to buy NFTs on Ethereum, you typically need Ether (ETH), as most NFTs on the network require it. If you have your eyes on a Solana NFT, you will typically need to buy Solana (SOL) for the same reason.

Make sure that you have at least a little more crypto than the listed price of the NFT, as you will need to pay gas fees and any marketplace fees.

Step 3: Choose an NFT Marketplace

Once your wallet is all setup and funded, it’s time to pick an NFT marketplace. There are quite a few options available, and each has its own specialties, benefits, and drawbacks. Here are some of the most popular NFT marketplaces to consider:

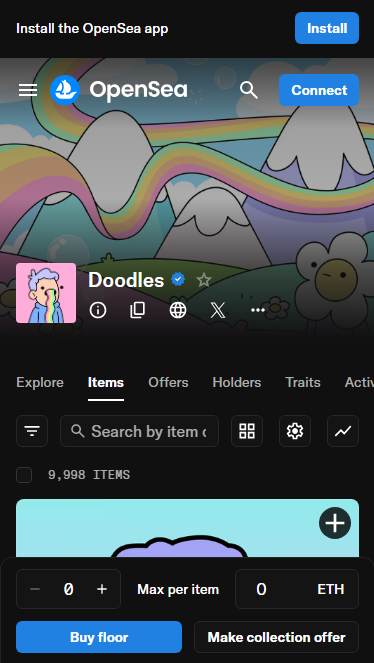

OpenSea – The largest and most well-known marketplace with a massive selection of NFTs, including art, music, generative collections, domain names, and more. It supports 18 different blockchains, including Ethereum, Polygon, Arbitrum, Optimism, Base, and Klatyn.

Blur – A fast-growing Ethereum-based marketplace popular with advanced NFT traders due to its low fees and advanced trading features, including tools to buy or list multiple NFTs at once.

Magic Eden – One of the top marketplaces for Solana NFTs, though it has expanded to support Ethereum, Polygon, and even Bitcoin Ordinals.

Rarible – A popular community-centered marketplace that offers special rewards and community governance features through its $RARI token.

Foundation – A highly curated NFT marketplace with a clean, minimalist user interface that focuses on high-end digital art and various limited-edition NFTs.

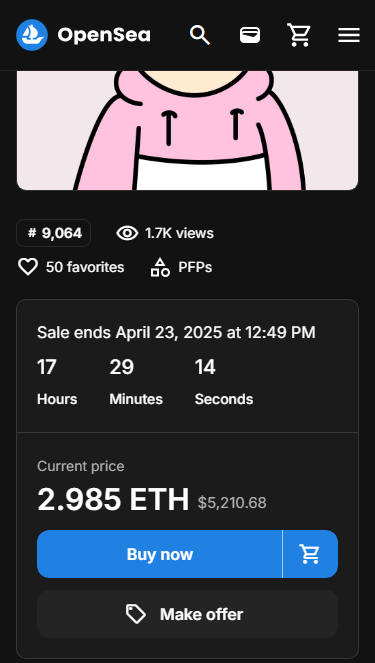

Step 4: Choose Your New NFT and Make Your Purchase

Once you have picked your NFT marketplace, navigate to its official site (make sure you have the right domain) and connect your wallet. It’s finally time to shop around for your new NFT. Most marketplaces let you filter by price, blockchain, category, collection, and even rarity to find the perfect NFT for you.

Before you go through with your purchase, click on it to view its details to make sure it’s legitimate. Double-check the name of the creator and the collection and review the collection’s trading activity. Popular or valuable collections usually have an extensive history of trades, while scam collections often show little or no activity.

If you’re sure that you have the right NFT, you can go ahead and make your purchase. On OpenSea, you can either buy it for the listed price by clicking “Buy now” or click “Make offer” to put in a bid for less. Note that OpenSea requires you to use Wrapped Ether (wETH) for these bids. You can use a decentralized exchange like Uniswap (or MetaMask’s swap feature) to quickly and cheaply swap ETH for wETH.

After you click “Buy now,” your wallet should pop up with a transaction request. All you need to do is click “Confirm” and wait for the transaction to go through. In just a few seconds or minutes, your new NFT should show up in your wallet.

Most Exciting Real-World NFT Use Cases

NFTs aren’t just about basic digital art or collectibles. They are already reshaping multiple real-world industries by making ownership, transactions, and authentication more efficient. Here are some of the most exciting real-world use cases for NFTs right now:

1. Real Estate Tokenization

NFTs are already being used to represent ownership of tangible assets like real estate. They can help make transactions easier, faster, cheaper, and more transparent. Instead of having to go through the whole traditional process, drowning in mountains of paperwork and third-party verification, buyers can simply purchase an NFT that represents ownership rights to a property, significantly streamlining the process. Platforms like RealT, Propy, and Securitize already utilize this technology.

2. Gaming and the Metaverse

Gaming has long been considered the next frontier for the crypto sphere, and NFTs are already becoming an integral part of countless games. Players can own in-game items, such as weapons, cosmetics, digital real estate, and much more, and even trade them for profit. Successful NFT games like Axie Infinity, The Sandbox, and Decentraland have already proven how useful the technology can be in the gaming industry, and this may just be the beginning.

3. Ticketing

NFTs have already taken the ticketing world by storm, helping to fight both fraud and scalping. Instead of traditional tickets or QR codes that can be copied or resold easily, NFT tickets are provably unique, easily verifiable, and traceable through the blockchain. This helps artists, teams, and venues gain more power over their events and even allows them to earn royalties on secondary sales. Attendees can also benefit because NFTs are a great way to reward fans with exclusive perks tied to their NFT tickets.

How to Avoid NFT Scams

Unfortunately, the NFT space has been flooded with scams for many years. From thousands of fake collections to countless phishing attacks, NFT beginners are often a top target for these scammers. Here are some key tips to help you avoid getting scammed:

1. Never Share Your Seed Phrase

This is the penultimate rule of crypto. Never share your seed phrase with anyone you don’t thoroughly trust. No legitimate NFT marketplace, wallet support team, developer, or community manager will ask for your seed phrase. If you do give it up, they can (and will) drain your wallet in seconds.

2. Double-Check All URLs

Always make sure you are on the correct marketplace or site. Scammers often try to trick you into connecting your wallet with a fraudulent lookalike site to drain your wallet. Avoid clicking search ads in Google results, as this is a common vector for these scammers, and always bookmark the correct site for later use.

3. Verify the Collection and Creator

Anytime you search for an NFT collection on OpenSea or other top marketplaces, you will likely come across counterfeit collections. Some NFT marketplaces, including OpenSea, have a verification system so look out for these badges (such as the blue checkmark on OpenSea). Make sure to check the collection’s recent activity and history as well as any real NFT project with a reasonable size will likely have substantial trading volume.

4. Avoid Suspicious Airdrops

Every once in a while, you may randomly receive an NFT from an unknown wallet. Never interact with them, as they are almost certainly scam NFTs. If you do try to sell it or even just interact with it, it could initiate a malicious smart contract to drain your wallet.

5. Use a Hardware Wallet to Store Your NFTs

Cybersecurity experts agree that hardware wallets are generally safer than software wallets because they aren’t connected to the internet. They are far less vulnerable to phishing and similar attacks, though that doesn’t mean you should put your guard down when using them.

The Future of NFTs

The future of NFTs, while uncertain, is remarkably bright despite the dramatic drop in value of top NFT collections. The utility of NFTs is simply too great for ticketing businesses, gaming companies, real estate firms, and other innovative companies to pass up. As blockchain technology continues to mature and more industries recognize the many advantages of verifiable digital ownership, NFTs are set to become even more integrated into our everyday lives. Whether you’re an entrepreneur, digital artist, gamer, real estate investor, or just a fan of new technology, understanding how NFTs work could open the door to countless new opportunities in the evolving digital economy.

FAQs

What are NFTs?

NFTs or non-fungible tokens are unique digital assets stored on a blockchain that prove ownership and authenticity of items like digital art, music, collectibles, and even real world tangible assets like real estate.

Are NFTs worth anything anymore?

While most NFT collections have fallen substantially in value since the 2021 bull market, many of the top collections are still extremely valuable.

What is an example of NFTs?

One of the most famous examples is CryptoPunks, a collection of 10,000 unique pixel art characters that are often sold for millions of dollars a piece.

Why would anyone buy an NFT?

There are many reasons to buy an NFT, including collecting digital art, accessing exclusive communities, investing in speculative emerging technology, and simply trading for profit.