Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – September 10

The Ripple price has given us two straight bullish sessions.

XRP/USD Market

Key Levels:

Resistance levels: $0.27, $0.28, $0.29

Support levels: $0.21, $0.20, $0.19

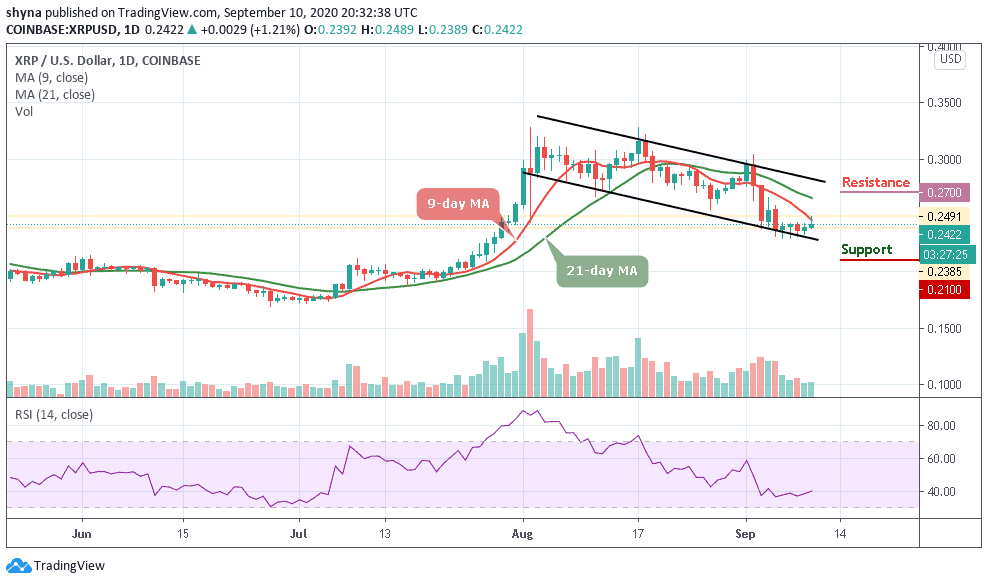

XRP/USD bulls have stayed in control of the market for the second straight day as the price rises from $0.232 to $0.248. However, the market price is trending in a downward channel formation and hovering below the 9-day and 21-day moving averages. The technical indicator RSI (14) is seen crossing above the 40-level. This indicates that the daily trend is still bullish while the overall market sentiment is bearish.

Will XRP Break Through Resistance Level $0.260 or Reverse?

At the time of writing, XRP/USD is trading at $0.242 after touching the high of $0.248. A building bullish momentum suggests that XRP could continue to scale the levels towards $0.25 critical resistance. From a technical point of view, the price is currently in the hands of the bulls as observed by the RSI (14) which is about to cross above 40-level. As the RSI (14) rises to higher levels, the bullish grip may continue to strengthen.

For now, the nearest resistance for the market is $0.27, $0.28, and $0.29. As it appeared on the daily chart, there’s no sign of a decisive move at the moment. However, if the $0.22 support gets weak, a price break-down may occur as the bears may find a new monthly low at $0.21, $0.20, and $0.19 support levels.

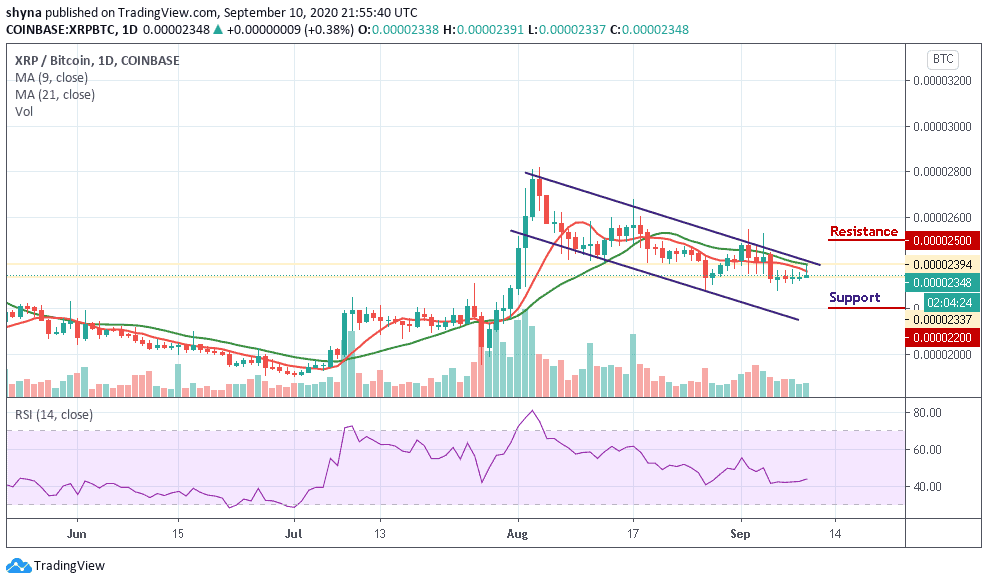

When compares with Bitcoin, the pair is consolidating within the channel and moving below the 9-day and 21-day moving averages. Meanwhile, the buyers have been trying to push the price above the moving averages so as to take it to the resistance levels of 2700 SAT and above.

Looking at the daily chart, if the bulls failed to hold the price, then XRP/BTC may experience more downtrends and the nearest support levels for the coin are located at 2100 SAT and 2000 SAT. Meanwhile, the technical indicator RSI (14) moves to cross above 40-level, which indicates more bullish signals.

Join Our Telegram channel to stay up to date on breaking news coverage