Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – January 8

XRP/USD dropped a bit from $0.324 to $0.284 and this followed a bullish Thursday where the price went up from $0.246 to $0.370.

XRP/USD Market

Key Levels:

Resistance levels: $0.450, $0.500, $0.550

Support levels: $0.180, $0.130, $0.080

Having slumped beneath the $0.320, XRP/USD may continue to show weakness in price and fall at support until the market can find a stable level to reinforce the bullish run. For now, a new low is yet to be ascertained as the bears remain dominant and active over the past days. Meanwhile, traders may need to wait for the bears to exhaust momentum before entering the market. In addition, shorting the Ripple (XRP) may be the best position for now.

What to Expect from Ripple (XRP)

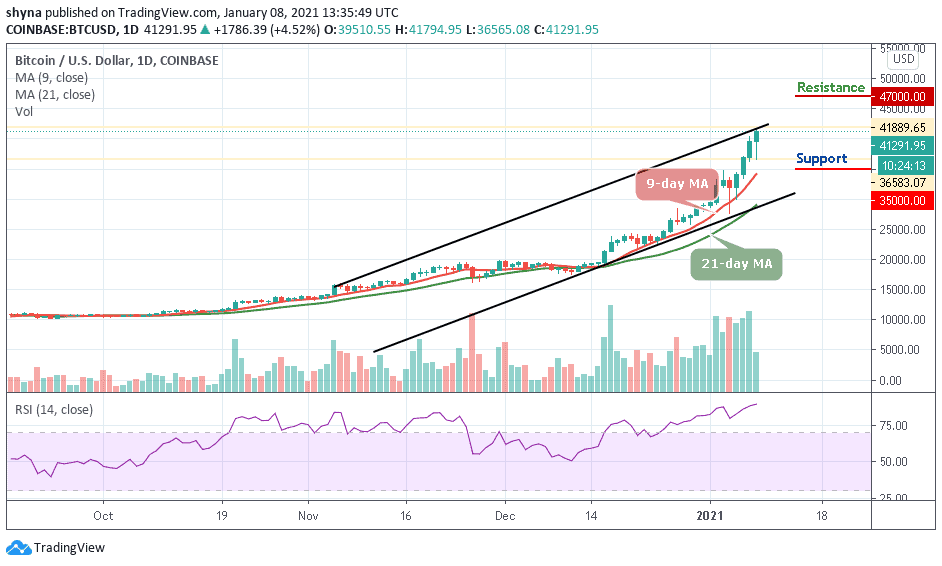

According to the daily chart, if the market resumes sell-off now, the Ripple (XRP) may cross below the 9-day moving average and could find immediate support at $0.225 and $0.220 while the critical supports lie at $0.180, $0.130, and $0.080. However, XRP/USD pair has continued to erode bearishly on the daily time frame as the 9-day MA remains below the 21-day MA.

In other words, a bullish rally could confirm if the market can climb significantly back above the 9-day and 21-day moving averages. Meanwhile, the technical indicator RSI (14) continues to produce a bearish move below the 50-level. Therefore, if the Ripple (XRP) manages to surge above $0.350, the market price may likely reach the resistance levels at $0.450, $0.500, and $0.550.

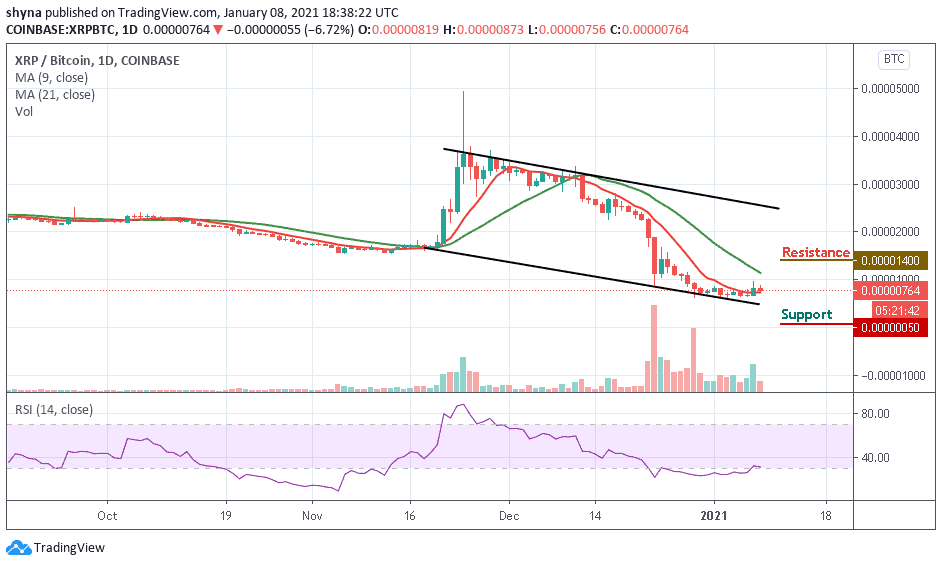

When compares with Bitcoin, the pair is consolidating within the channel and now moving above the 9-day moving average. Meanwhile, the buyers are making effort to push the coin to the north so that the bullish continuation may take it to the resistance levels of 1400 SAT and above respectively.

In other words, as the coin continues to drop towards the 9-day MA, then it may likely cross below the lower boundary of the channel and the nearest support levels to be reached are 0050 SAT and below. Moreover, the technical indicator RSI (14) moves around 30-level, which indicates a sideways movement.

Join Our Telegram channel to stay up to date on breaking news coverage