Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – December 16

Ripple (XRP) is pushing higher as the bulls look firmly in control.

XRP/USD Market

Key Levels:

Resistance levels: $0.65, $0.70, $0.75

Support levels: $0.35, $0.30, $0.25

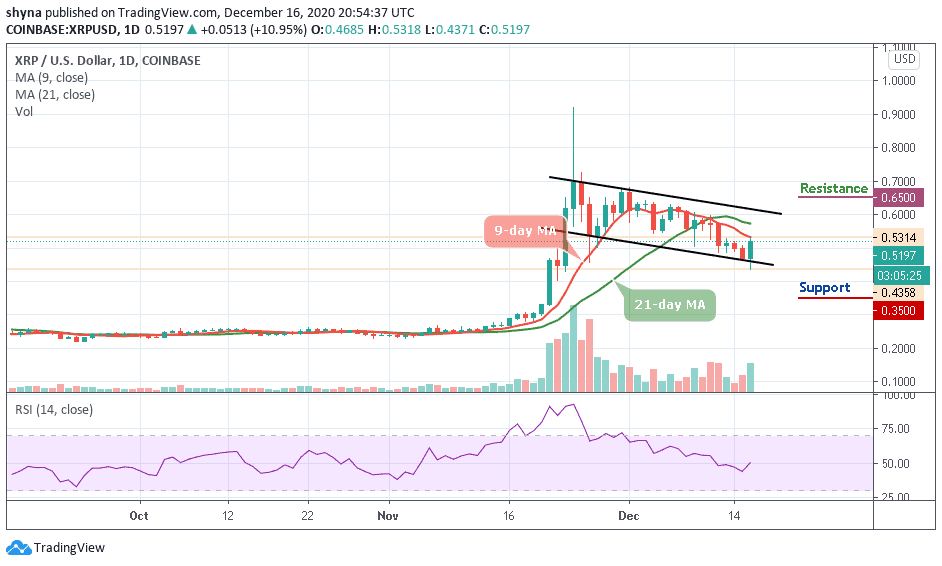

XRP/USD jumps from the daily low of $0.43 in a matter of hours and touches an intraday high at $0.53. However, the coin is currently trading at $0.51 with a gain of 10.95% below the moving averages. The market may remain on the bearish side as the 9-day MA stays under the 21-day MA.

What to Expect from Ripple (XRP)

If the XRP bulls need to experience a shift in momentum, they will need to push the market price above the moving averages, converting the lower boundary of the channel into a support level. However, if the coin continues to trade upward, it may create a bull cross above the upper boundary of the channel. A bullish breakout above $0.60 could take the Ripple (XRP) to the potential resistance at $0.65, $0.70, and $0.75 as the RSI (14) moves to cross above the 50-level.

Nevertheless, XRP/USD is trading at $0.519 after holding above $0.52. More so, a drop beneath the channels may cause the Ripple price to spiral downward and head towards the $0.40 level. Meanwhile, if this level is broken, the sell-off may be extended to critical supports at $0.35, $0.30, and $0.25 respectively.

When compares with Bitcoin, XRP is following the downtrend movement, trading below the 9-day and 21-day moving averages at 2479 SAT. Although the bulls are trying to push the price upward, should in case they succeed, they may likely hit the resistance levels of 3000 SAT and 3200 SAT respectively.

Moreover, if the buyers failed to hold the price, the coin may likely fall below the moving averages; further dropping could bring it towards the lower boundary of the channel to meet the nearest support levels of 1900 SAT and 1700 SAT. Meanwhile, the technical indicator RSI (RSI) is moving around the 40-level, which may likely suggest more downtrends.

Join Our Telegram channel to stay up to date on breaking news coverage