Join Our Telegram channel to stay up to date on breaking news coverage

The XRP token witnessed a significant price surge, right after the news of the bipartisan crypto bill made headlines.

Amidst the bearish crypto market sentiment, the 7.6% rise in price resulted in a wave of optimism among investors. And many believe that if the bill passes, the price of XRP is very likely to explode.

Follow along as we explore what the crypto bill is about and how it influences the growth of Ripple.

Invest in Ripple via eToro Now

Your capital is at risk.

The Crypto Bill and Ripple Relation

The Securities and Exchange Commission (SEC) filed legal action against Ripple Labs in 2020. Two of Ripple’s executives were alleged to have raised over $1.3 billion through an unregistered digital asset offering.

The SEC, under its complaint, said that Christian Larsen- the company’s co-founder and former CEO, and Bradley Garlinghouse- the current CEO, had raised capital to finance their venture. The fundraising was done through the offering of XRP, the native token of Ripple, to investors around the world.

This was back in 2013 when the offering was termed to be unregistered and so was the asset. Along with that, Ripples was also suspected of distributing tokens in exchange for services, involving labor for example.

Larsen and Garlinghouse were also alleged to have made personal sales of the XRP token, amounting to more than half a billion dollars. These allegations were put in place because the defendants did not register their sales, which goes against the rule book of the Federal Securities Laws.

This case has been hovering over the head of Ripple for more than a year now.

Buy Ripple at Low Fee via eToro Now

Your capital is at risk.

Relevant Regulations in the Crypto Bill

A new regulatory framework is being introduced in the new crypto bill, which, upon implementation, will help mitigate the relevance of fraudulent activities in the industry.

Under this bill, cryptocurrencies will be identified under two asset classes; commodities and securities. However, before determining the asset class, every asset will be considered an ancillary asset. And therefore, unlike previously, XRP won’t exactly be under the purview of the SEC.

Owing to this, the case against Ripple Labs may become weak, providing investors with more confidence for the future of XRP.

As per Stephanie Avakian, Director of the SEC’s Enforcement Division, “Issuers seeking the benefits of a public offering, including access to retail investors, broad distribution and a secondary trading market, must comply with the federal securities laws that require registration of offerings unless an exemption from registration applies,”

Another benefit upon the passing of this bill, and potentially the case landing in Ripple’s favor, is the possibility of Ripple debuting with an IPO. They’ve been thinking about this for a while, but haven’t explored the possibility due to ongoing lawsuits.

Commenting on the same, Garlinghouse said “I think we want to get certainty and clarity in the United States with the U.S. SEC. You know, I’m hopeful that the SEC will not slow that process down any more than they already have,”; “But you know, we certainly are at a point in the scale, where that is a possibility. And we’ll look at that once we’re past this lawsuit with the SEC.”

The developers’ team of Ripple actively welcome a regulatory framework to the crypto industry, as they believe it’ll provide a good opportunity for growth, helping attract capital from investors who have been hesitant due to lack of clarity.

Ripple plans on replacing the global payment system with blockchain technology and being an important part of the same. For this to function, the ecosystem needs a reliable currency, unlike the Terra UST. Which crashed to the very bottom, wiping out more than $40 billion of investors’ wealth.

A company regulated under the jurisdiction of the US, providing all payment options at convenience while being highly liquidable, is sure to prosper as crypto-powered payments take over the system. Along with being safe and trustable for investors.

There are multiple ways to how the passing of this bill favors XRP– and if things go right, the token could very likely explode.

How far can it go? Well, let’s take a look at that too.

Your capital is at risk.

XRP Price Prediction

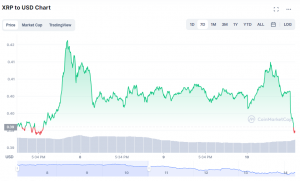

The price movement of XRP has been pretty bearish for a while, just like the entire crypto market. Currently, the price stands at $0.386 and has been showing an almost side-by-side movement for the past week.

Unlike most other tokens, the price of XRP hasn’t been extremely volatile for the past month. However, the price shows strong signs of moving 25% either way. If that happens, the price can either border $0.30 or $0.50, or land somewhere in between.

For this year, it’s tough to expect XRP to cross the $0.60 threshold. Unless the crypto market decides to follow an uprising trend.

Ripple Price Chart on eToro

Next year, we can expect the XRP price to show an exponential pattern. Primarily because the crypto bill passed this year is expected to go through a year later. If it does, it’ll very likely supplement the price growth of the token.

By then the price of XRP is supposed to easily pass the $1 level, and over a longer timeframe, even through $5. However, that’s at least not the case for the next 3 years.

Your capital is at risk.

These predictions don’t exactly make a strong case given the current market conditions, but as the crypto industry becomes more regulated, the adoption and increasing investments are sure to supplement the overall growth.

As of now, the token has a market cap of $18.6 billion, with 48 billion XRP tokens in circulation.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage