Join Our Telegram channel to stay up to date on breaking news coverage

XRP price traded with a bullish bias on the 12-hour timeframe at the start of the week. The altcoin has risen by 3.5% over the last 24 hours to trade above $0.35. As XRP trades within a large price range, the price could eventually break above the upper limit of the range. This range breakout should provide an opportunity for interested investors, confirming the start of a sustained recovery.

Factors That Could Influence XRP Price In 2023

Several narratives and key events have driven the crypto market in 2022. The same is likely to occur in 2023. In this article, we dive into the main factors that are likely to influence the XRP price and the broader digital asset place.

-

Macroeconomic Factors

Market participants are understandably tired of macroeconomic trends driving the crypto industry’s trends. Nevertheless, it still has influence over the sector that crypto investors cannot ignore or indeed ignore at their own peril.

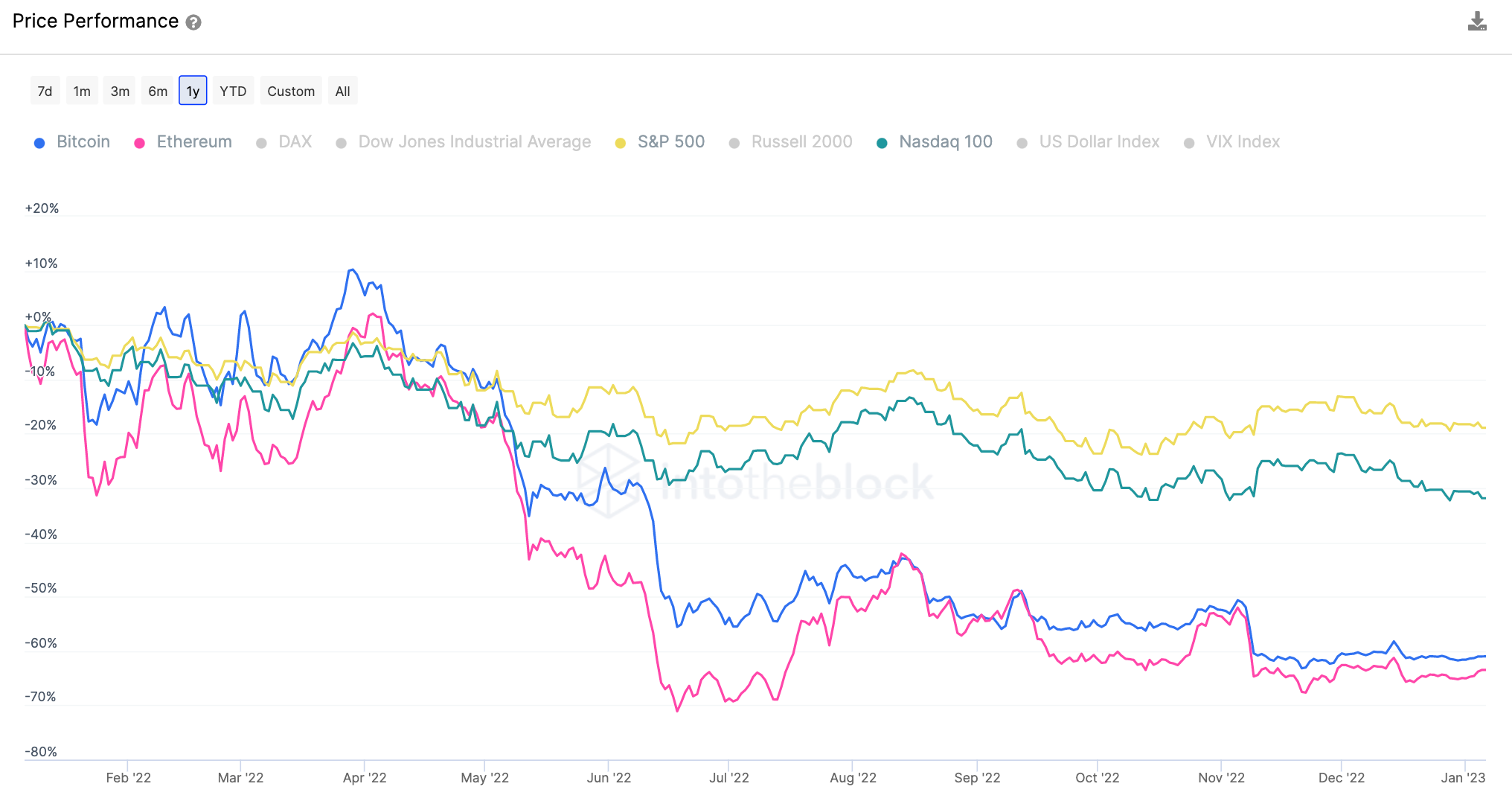

According to capital markets data from IntoTheBlock, the correlation between cryptocurrency prices and equities reached a record high in 2022. The chart below shows that the yearly-average correlation coefficient between the pioneer cryptocurrency BTC and S&P 500 prices hit an all-time high at 0.55 last year.

Capital Market Insights

The question on everyone’s mind at the moment is whether the macro environment will continue to set the momentum for crypto prices. To try and answer this question, it is important to understand how major events affect the relationship between crypto and other financial markets.

On the one hand, the correlation between digital currency and stock prices dropped in Q4/2022 as the FTX/SBF/Alameda Research fiasco rocked the crypto market. This could mean that cryptocurrencies may finally dissociate themselves from the happenings in the larger financial markets to operate on their own rules.

On the other hand, stock analysts believe stock prices may continue to drop if inflation rates and consumer prices do not stop their upward trajectory. According to IntoTheBlock, there could be continued overhead pressure on crypto prices from correlation-driven bots and “any remaining forced seller with exposure to both asset classes.”

Findings from a Bloomberg survey reveal that 81% of respondents are expecting a recession in 2023. The surveyed investors also believe that the Federal Reserve will continue its hawkish stance this year, adding credence to a market-wide consensus that stock prices will hit new lows in 2023.

Nevertheless, it is still early in the year to definitively determine the relationship between XRP price and macro factors as more economic figures such as unemployment data and CPI numbers are released. Analyzing these carefully, together with major on-chain and social data expected for XRP, is key to those hoping for a bullish cross-border payments token.

2. Social Sentiments And Adoption

XRP is the native token of the Ripple blockchain, a platform providing international financial settlement solutions. It is designed to offer a fast and cost-effective alternative to traditional forms of international remittances, allowing financial institutions to send and receive payments from different countries across the globe at minimal fees.

Increasing adoption points to a rise in user interest in the Ripple services which in turn positively affects the XRP price. Last week, Ripple Labs, the company behind XRP, announced a partnership with the government of Palau to launch a stablecoin to be used in the country.

#ICYMI, the Republic of Palau turned to Ripple to explore a USD-backed stablecoin and associated use cases on the #XRPL, which could provide a viable alternative to #CBDCs for countries like Palau.

Learn more about our partnership: https://t.co/EdXByYju8G

— Ripple (@Ripple) December 19, 2021

On November 15, Ripple Labs announced that it collaborated with MFS Africa, a leading fintech company with the largest mobile money network on the continent. This partnership is aimed at streamlining mobile payments for users across 35 African countries. SVP Global Customer Success at Ripple said

Our partnership with MFS Africa comes off the back of our expansion into a dozen new markets this year alone. Crypto can and is eliminating the traditional problems associated with cross-border payments such as lengthy transfer times, unreliability and excessive cost, while complementing our formerly purely fiat financial infrastructure at low cost.

On the business front, Ripple Labs has been working on key developments geared toward increasing its presence in Europe. The company has made significant milestones regarding its Paris- based Lemonway and Xbaht in Sweden. These businesses at the heart of Europe now have the opportunity to leverage Ripple’s On-Demand Liquidity (ODL), in turn increasing XRP’s adoption.

As such, XRP continues to be a popular choice for many crypto investors despite the drabbish performance of the XRP price as its use by financial institutions continues to grow over time. Adding credence to this positive outlook for XRP is bullish sentiment surrounding the crypto.

According to Santiment, an on-chain data analysis firm, there is a “notably” bullish crowd sentiment on XRP even as interest in Bitcoin, Binance Coin and Cardano decreases. This positive sentiment coupled with positive fundamentals and increased adoption is likely to boost XRP.

😩 With #crypto market caps bouncing very much in independent directions, we're seeing notably euphoric crowd sentiment on $XRP & $ETH. Traders are less interested in $BTC, $BNB, & $ADA. Historically, #bearish sentiment projects perform better on average. https://t.co/bU3eilpyty pic.twitter.com/fQyreiWjUa

— Santiment (@santimentfeed) January 8, 2023

3. The Impact Of The XRP vs. SEC Lawsuit

In December 2020, the United States Securities and Exchange Commission (SEC) brought charges against Ripple Labs, CEO Brad Garlinghiuse and co-founder Christian Larsen, alleging that they sold XRP as “unregistered securities” in an ICO that raised more than $1.3 billion. The lawsuit also alleged that Larsen and Garlinghouse made a total of $600 million in total as personal gains.

The SEC argues that XRP should be considered security rather than a cryptocurrency that should be under its regulation.

As such, a verdict in favor of the blockchain company will set a pleasant legal precedent for the broader crypto market. This is why this case is being closely observed not only by the “XRP Army” but also by other stakeholders in the industry.

It goes without saying that the case has had a direct impact on the XRP price. The price of the international payments token plummeted 25% immediately after the news of the lawsuit broke out in 2020, with the asset being delisted from major crypto exchanges, including Coinbase. Four months later, Ripple had a small victory over the agency with a judge granting the cryptocurrency company access to the SEC’s internal documents, a win that propelled XRP above a three-year high of $1.

The long and short of this is, whatever the verdict of the case, it will have a lasting impact on XRP’s price. A verdict in favor of the regulatory agency would make XRP security in the U.S. alone as the SEC does not have jurisdiction beyond the country’s borders. A win for Ripple should offset most of the damage to XRP, propelling its price, probably to new record highs.

Short-Term XRP Price Prediction

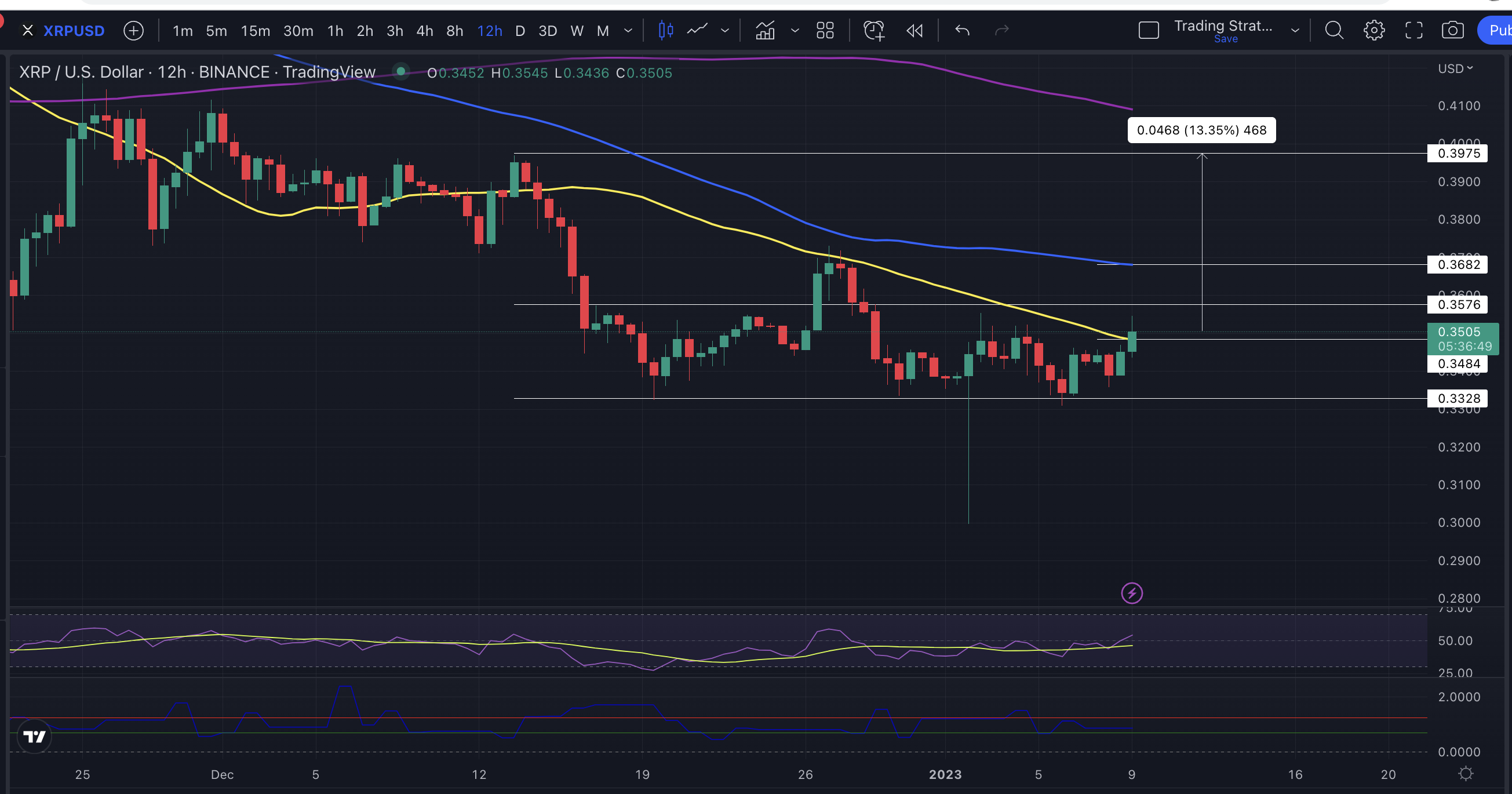

After being rejected by the $0.40 resistance level, the XRP embarked on a sell-off that was halted at the $0.332 support level. Since then, the price has been oscillating in a wide area stretching from $0.332 to $0.357.

There was a successful attempt to breach the upper limit of the range on December 26, but this turned out to be a bull trap as bears sold on the rally to the 50 simple moving average (SMA) which sat at $0.369. What followed was an 11% descent toward the lower limit of the range.

At the time of writing, the XRP price was hovering around $0.35 and sat on immediate support embraced by the 50 SMA at $0.348. Increased demand pressure from this level could propel the price above the upper limit of the range to confront resistance from the 100 SMA at $0.368.

A rise above this level would clear the path for a run-up to the $0.397 range high, representing a 13.35% climb from the current levels.

XRP/USD 12-Hour Chart

Supporting XRP’s bullish thesis was the upward movement of the relative strength index (RSI) which illustrated a return of the bulls into the market. The price strength at 53 suggested that the buyers had begun taking control of the XRP price.

In addition, the Arms Index (TRIN) reading was at 0.83 as seen on the same chart (see above), potentially confirming that there is a bullish bias in the market. Market participants could, therefore, expect the crypto to sustain the ongoing recovery to higher highs.

However, things may turn awry for the XRP price if it produces a daily candlestick close below the 50-day SMA at $0.348. Such a move could see the token drop to seek solace from the lower limit of the range at $0.332. A drop further would trigger massive sell orders to new record lows.

Other Promising Alternatives To XRP In 2023

It is important to consider the factors that may influence the price of a crypto asset before making an investment decision in 2023. For XRP, the macroeconomic factors, increasing adoption, and the ongoing SEC vs. Ripple case are likely to affect the asset’s price this year.

However, things might not go as planned and XRP may not perform as expected. As such, it is always advisable to diversify your portfolio by investing in new tokens in a presale that guarantee handsome returns once the asset is listed on top crypto exchanges. One altcoin that has good fundamentals and could potentially yield high returns in 2023 is C+Charge (CCHG).

C+Charge (CCHG)

Until recently, large corporations have dominated the carbon credit industry, despite the ethical issues around the space. That is where C+Charge comes in. C+Charge is a blockchain project that is committed to putting carbon credits in the wallets of ordinary folk who actively help in environmental conservation.

With a particular focus on those driving electric vehicles (EV), C+Charge brings the much-needed difference in a terminal generation. Courtesy of C+Charge, drivers will enjoy redeeming credits just for charging their cars at a C+Charge station.

🌿 At C+Charge, we help everyone to make an impact on climate change and receive carbon credits by simply purchasing $CCHG

Make your steps and change the world 💚

Join our presale now ⬇️https://t.co/ixe18bPqzI

— C+Charge (@C_Charge_Token) January 8, 2023

The project’s native token CCHG is currently in presale with over $81,000 already raised by the team.

Related News:

- How to Buy C+Charge Crypto Token (CCHG) on Presale

- C+Charge New Crypto Presale | Next Cryptocurrency to 10X Your Money?

- New Cryptocurrency C+Charge Launches – How to Invest in 2023

- How to Buy Bitcoin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage