Join Our Telegram channel to stay up to date on breaking news coverage

Ripple Price Prediction: XRP/USD Reaches Bearish Exhaustion as Bulls and Bears Continue Sideways Move

XRP Price Analysis – October 30

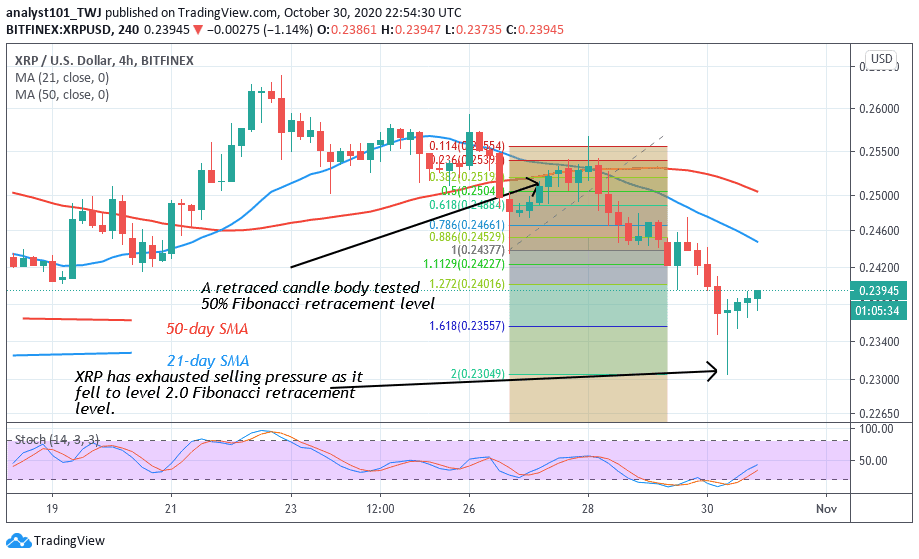

Ripple is range-bound between levels $0.23 and $26.The bulls and bears are yet to break these levels since September 2. XRP/USD has exhausted the selling pressure as prices reach the low of $0.2304. Similarly, the XRP/BTC is in a downward move and selling pressure is likely to continue.

XRP/USD Market

Key Levels:

Resistance Levels: $0.24, $0.26, $0.28

Support Levels: $0.22, $0.20, $0.18

Today, XRP/USD reaches bearish exhaustion as the coin falls to a low of $0.2305. Buyers buy the dips as the coin rebounded at the recent low to move up. Ripple is presently range-bound between levels $0.23 and $0.26. The current price fall reaches the low of $0.2305 which is the lower price range. On the downside, if the price breaks the low of $0.23, XRP will decline to the low of $0.22. Meanwhile, buyers are pushing the price upward to retest the overhead resistance at $0.26.

Meanwhile, from the price action, the Fibonacci tool has indicated the direction of the coin. On the downtrend of October 26, the retraced candle body tested the 50% Fibonacci retracement level. With this retracement, the coin is expected to decline and reach a low of 2.0 Fibonacci extension. That is XRP will fall and reach level $0.2304 Low. This is the same price level where the market reverses.

Ripple (XRP) Indicator Analysis

Ripple price bars are below the SMAs which suggest that the coin is falling. The coin is above the 25% range of the daily stochastic. It indicates that the coin is in bullish momentum. The 21-day SMA and the 50-day SMA are sloping downward indicating the bearish trend.

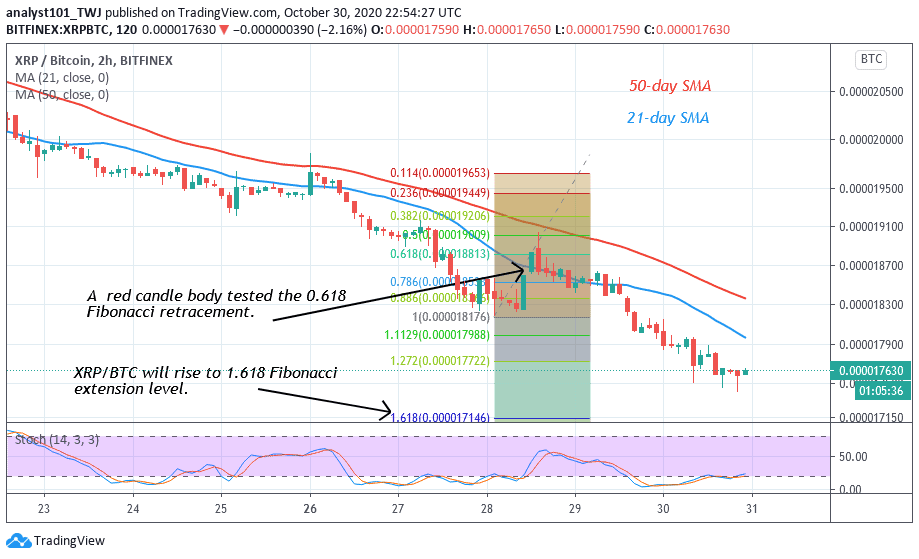

In the case of XRP/BTC, the crypto has been on a downward move since August. The coin is likely to make a further downward move on the downside. On October 28 downtrend; the retraced candle body retested the 61.8% Fibonacci retracement level. That is the XRP/BTC pair will reach level 1.618 Fibonacci extension or Ƀ0.000017146 low.

Join Our Telegram channel to stay up to date on breaking news coverage