Join Our Telegram channel to stay up to date on breaking news coverage

Uniswap (UNI) price displays optimism as it trades in a second straight bullish session. One last push for the decentralized exchange (DEX) token to $6.5 is possible. However, there are stiff barriers that may stifle UNI’s potential recovery.

Uniswap Price Still Trading On Shaky Ground

The volatility in the wider crypto market and the recent short-term recoveries have provided some bullish momentum for Uniwap, but the DEX token is not out of the woods yet.

UNI is up 9.31% on the day in the midst of short-term bullish moves displayed by cryptos across the board. The crypto market is up 6.17% in the past 24 hours to $829.5 billion with the largest crypto by market capitalization Bitcoin (BTC) trading at $16,570, up 5.42% on the day. The now proof-of-stake Ethereum token was trading at $17,170. After rising 8.3% over the same time frame.

The question crypto market participants have at the moment is whether digital asset prices could sustain the recovery in the short term.

Analyzing Uniswap’s Price Action

Uniswap’s daily trading volume spiked by 14% to $157 million on Tuesday. The recent increase in Uniswaps price was accompanied by an increase in 24-hour trading volumes as retailers moved to benefit from the positive price movements.

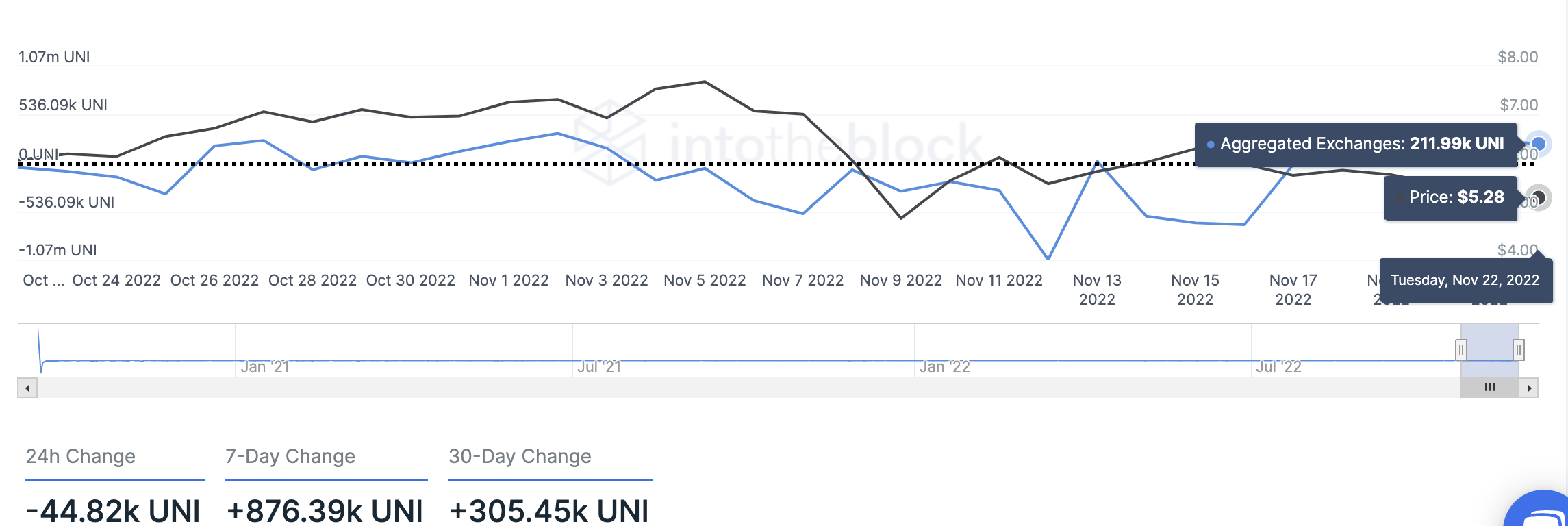

However, today’s trade volume is down 14.55% to $138.3 million, despite the rise in price. This can be attributed to decreased exchange inflows according to IntoTheBlock’s on-chain flows data. According to the chart below, around 212,000 UNI moved to all exchanges on November 22. This was a decrease of 44,820 UNI from the day before.

UNI On Chain Flows

A drop in exchange net flows could be a suggestion that short-term investors and traders are moving their tokens from exchanges to hold on to them in anticipation of higher price moves.

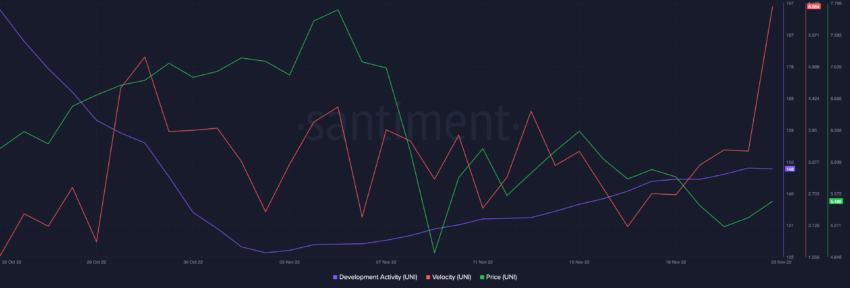

Despite the turbulent uncertainties in the macro market, Uniswap has been recording increasing development activity as it seeks to rise from the lower levels.

Development activity is an on-chain metric by Santiment that helps investors gauge the project’s commitment to creating a working product. From the firm’s chart (below), it’s evident that there has been a steady rise in development activity from Uniswap developers.

Uniswap Development Activity

While anticipating the price moves, investors are advised to also keep an eye on price movements as UNI responds to all these market and on-chain indicators.

Uniswap Price Bulls Eye A Return To $6.5

After dropping to multi-year lows around $4.78, Uniswap rallied approximately 36% before being rejected by the $6.50 psychological level. The UNI price then corrected to $4.95 before recovering to the current price of around $5.479.

If the price turns up from the current level, it would start a new move upward. The DEX cryptocurrency could then climb to the psychological level at $6.0 and then later to the November 15 range high of around $6.5. This would represent an 18.61% ascent from the current price.

UNI/USD Daily Chart

The token was trading in a second straight bullish session and the relative strength index (RSI) had turned up toward the midline, suggesting that the selling pressure is decreasing. In addition, the Arms (TRIN) index was positioned at 1.03, a suggesting that there were more buyers than sellers in the market.

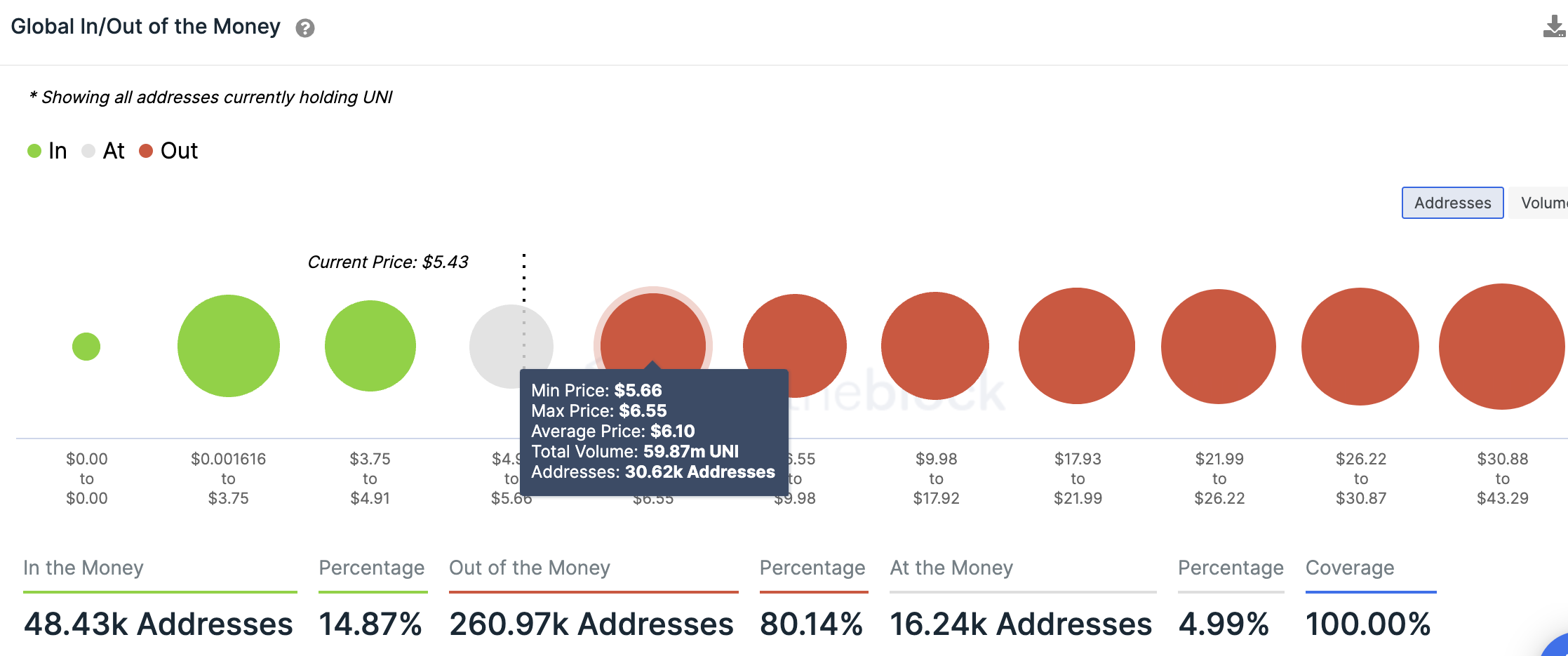

This positive view could invalidate if the price fails to rise above the moving averages sitting between $6.23 and $6.25. According to the Global in/Out of the Model (GIOM) by IntoTheBlock, these SMAs are within the $5.66 and $6.55 price range where about 59,870 million UNI are being held by around 30,620 addresses.

Any attempts to push the price above this level would be met by intense selling pressure from these suppliers who may wish to break even.

Uniswap GIOM Chart

The GIOM indicator also shows that UNI faces relatively stiff resistance on the upside. It sits on relatively weak support at the $4.7 swing low, where 20,120 addresses hold approximately 11.64 million UNI.

From the current price, a fall below the $5.16 mark could spell trouble for the DEX token. If this happens, the next line of defense may emerge from the $5.0 psychological level, before revisiting the $4.78 swing low.

Other Tokens To Consider For Portfolio Diversification

The recent market crash occasioned by the FTX fiasco has left investors wondering which tokens are safe to invest in. Others are looking for ways to diversify their investments to include some new tokens which are likely to skyrocket and multiply their investments in the near future. Uniswap price presents an optimistic outlook for $6.5, but traders are still doubtful whether the ongoing recovery is sustainable.

This coupled with uncertainties in the macro space push investors to scout for tokens that may make above-average returns in the near term. Most of these tokens have ongoing presales, with solid underlying fundamentals ahead of their initial listings on popular exchanges.

RobotEra (TARO)

RobotEra is one of the best cryptos in the metaverse to invest in today. It has close similarities to the popular Sandbox virtual reality project. The project aims to create a metaverse with various digital assets as part of the virtual reality world.

RobotEra gives you the opportunity to customize and “create your own metaverse.”

The possibilities of the metaverse are being recognized by global brands, such as @Nike

🤖 #RobotEra provides various opportunities to personalize and create your own metaverse

Don’t miss a chance to build your own land ⬇️https://t.co/UJ3inonrXH

— RobotEra (@robotera_io) November 22, 2022

RobotEra’s native token TARO powers the platform’s ecosystem and is currently on presale. In future, holders of TARO will be able to buy land and Robot characters as NFTs within the Metaverse.

TARO is going for $0.02 during the presale and the team has so far raised more than $180,000. Investors are encouraged to take this early opportunity to get their TARO before the price increases to $0.025 over the next stages.

Dash 2 Trade (D2T)

Another project promising handsome gains as the end of the year draws near is Dash 2 Trade, a blockchain project providing traders with an easier way to navigate the market. With the analytics provided on this platform, traders can build and test strategies on a simplified platform. Moreover, Dash 2 Trade offers trading signals with accurate buy/sell opportunities for anyone to make the most out of the market.

According to a November 22 Twitter post by the Dash 2 Trade team, “a trader can identify and analyze the factors that influence the price of cryptocurrencies” with actionable insights from the D2T ecosystem.

D2T is an ERC-20 token built on the Ethereum Network and is used to power the Dash 2 Trade platform. This token allows access to crypto analytics, signals and social trading features needed to excel in the market.

D2T is on presale now and has so far garnered $6.8m. Don’t miss out on the opportunity to invest in this generational wealth token at this early stage.

Related:

Join Our Telegram channel to stay up to date on breaking news coverage