Join Our Telegram channel to stay up to date on breaking news coverage

Nestcoin, a startup leading crypto and Web3 activities in Africa, has been linked to the collapsed FTX exchange. With FTX’s bankruptcy proceeding, Nestcoin has laid off at least 30 employees, while the salaries of the remaining employees have been reduced by 40%.

FTX affiliates in Africa are counting losses

The CEO of Nestcoin, Yele Bademosi, made the revelation in a letter sent to investors. He also acknowledged that the company custodied assets with FTX. FTX customers have been unable to withdraw their funds from the platform since the exchange filed for bankruptcy.

Bademosi also said that the company’s sister company of FTX, Alameda Research, invested in a $6.45 million funding round. Alameda had a less than 1% stake in Nestcoin. The other African companies where FTX and Alameda invested include Bitnob, chipper Cash, Jambo, Mara, and VALR.

There is also speculation that Alameda and FTX might have required portfolio companies to hold their assets on the FTX exchange as part of the terms of investment. However, if these terms existed, they never applied to all companies, as some might have rejected the offer.

Many retail customers and crypto companies custodied their crypto assets in FTX because of the platform’s 8% annual interest rate. This marketing technique allowed it to attract African users and compete with giant exchanges such as Binance. FTX has around 100,000 customers in Africa.

In the last two years, FTX grew its presence in Africa as crypto adoption in the continent increased due to a lack of banking access. Some reports have said that FTX had planned to create a regional office in Nigeria before its collapse.

The FTX bankruptcy filing included BTC Africa, the parent company of AZA Finance, a Kenya-based payment automation and settlement platform. However, FTX retracted this statement in a tweet and removed AZA Finance and its subsidiaries from the filing.

FTX exchange bankruptcy hearing starts

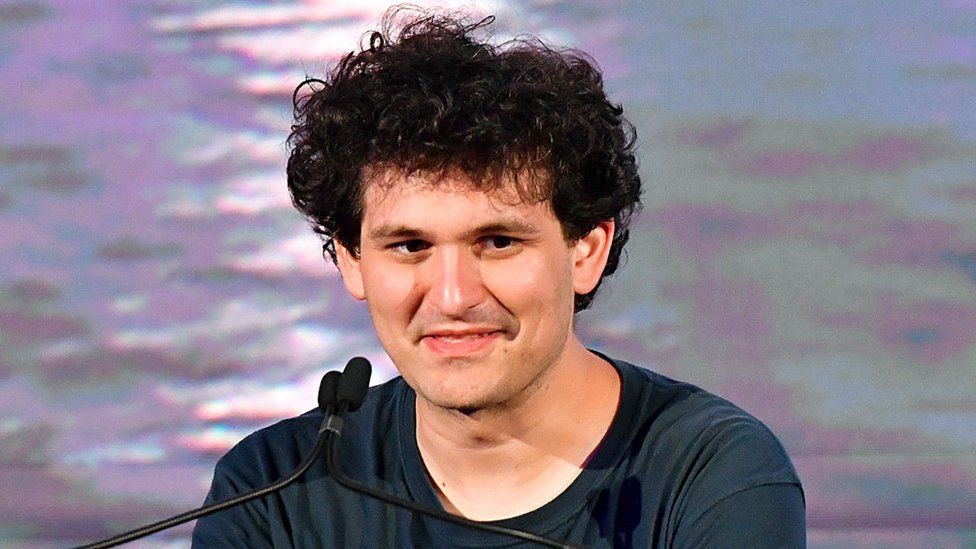

The demise of the FTX exchange has caused notable effects across the cryptocurrency market. The bankruptcy filing shows that it owes more than a million to creditors. The former CEO of FTX, Sam Bankman-Fried, used customer funds to support Alameda Research.

The demise of this exchange will attract more regulatory attention to the sector. In Nigeria, where FTX was pushing operations, cryptocurrency transactions using licensed banking institutions are prohibited. The country even launched a central bank digital currency (CBDC) to tame the use of private cryptocurrencies. The collapse of FTX might intensify a crackdown on the crypto market.

Before its collapse, FTX had a valuation of $32 billion. However, after a bank run on the exchange, it needed more than $8 billion in rescue funds. The bankruptcy filing has revealed that money was either missing or stolen from the platform. Additionally, FTX executives also purchased real estate properties in the Bahamas.

Bankman-Fried has since come forward to say that he regrets filing for bankruptcy. According to him, he could have managed to raise the needed funds if he had not given in to the pressure.

Related

- FTX Owes $3.1bn to 50 Biggest Creditors

- The FTX Sex Tape Leak: What’s Happening Now?

- Getting money out of FTX could take years, if not decades

Join Our Telegram channel to stay up to date on breaking news coverage