Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is in disarray, and that makes us ignore the fact that Bitcoin and Ethereum aren’t the be-all-end-all of crypto. There are other tokens, like UNI as well, that deserves our full attention.

One of the best DEX active in the market is the Uniswap, and one of the most undervalued cryptos available is the UNI token. However, two days ago, it was up by 14.2%. It was partly because Bitcoin hit above the $20k psychological resistance level (although it hasn’t been able to stay above it), but it makes one wonder how far UNI can go. In this article, we are making Uniswap price predictions based on the current information.

Uniswap Price At the End of September 2022

Once we almost reached the end of September, Bitcoin was able to push above the $20k resistance for the first time in a week. Many thought that “Septembear” is over because not a lot of good price action had been seen in the market post-Ethereum merge.

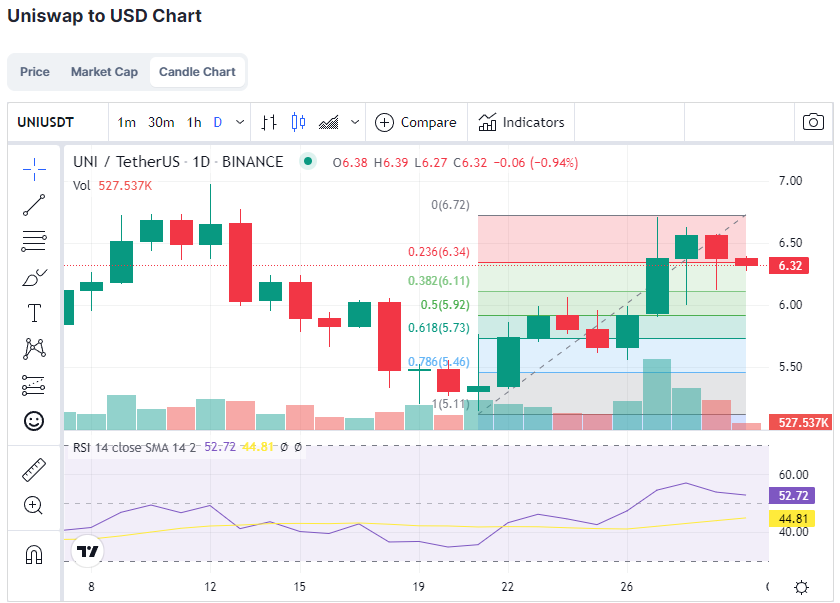

Uniswap DEX’s native crypto, UNI, was one of the tokens that responded well to Bitcoin’s uptick by finding support at 0.236 fibs and closing the day at $6.56.

The UNI price corrected to $6.16 the next day before bouncing to around $6.3, where it is currently accumulating.

Uniswap entered 2022 at $17.2 and accumulated at the level until the middle of January. An increased sell-off corrected its value to $10, at which point Uni started to struggle. It was about to bounce and cross $12 psychological resistance eight days into February, but that was only followed by another retrace.

By the end of February, the UNI price punched below the $8 support before bouncing. Crypto experts started to hypothesize that this crypto can punch down even further. Thankfully, a relief rally happened in April, and Uniswap was valued in double digits again. But it was before the Terra crash.

Uniswap then hit its 2022 bear bottom at around $3.6 in the middle of June, right around the time when Bitcoin dipped below $18k. However, the token has significantly recovered after that, and the time of writing is trading at around $6.30.

Uniswap Price Prediction

To make a price prediction for Uniswap, we can look at its historical data. In 2021, Uniswap was able to reach a $22.15 billion market capitalization. The current market capitalization lies at $4.8 billion dollars, giving this token a massive long-term potential. That is partly because Uniswap remains the decentralized number exchange to this day.

Another factor that can contribute to this token’s growth is the Total Value Locked. Presently, its 24-hour TVL is at 909 million dollars, making it compete against the biggest centralized exchanges.

And when it comes to the current price, it is similar to early 2020, which will lead to massive pumps later on. While the circumstances around this crypto aren’t prepping it for the same level of pump, the current price is stable – which is a major plus in a crypto market.

Other reasons to stay bullish on Uniswap are:

Constant Engagement With the Uniswap Community

Uniswap is big on constantly engaging with the crypto community. One visit to their website, and you’ll note that UNI community members are actively engaging about the future of DeFi. That means Uniswap is consistent with its messaging. So, at least from the branding point of view, Uniswap is committed to the game. Recently, Uniswap also introduced a new Swap widget update. It is a component that developers can import to their react project.

Seems like you loved our recent Swap Widget update 👀

Last month, we added a built-in wallet connector to the Widget—making it easier to add to your app— and since then we’ve seen weekly downloads double 😤

Check out the docs to get started here: https://t.co/VVzcRq5O6K pic.twitter.com/DqPHINN71Y

— Uniswap Labs 🦄 (@Uniswap) September 29, 2022

Investors are Picking DEX over CEX

The crypto bear market started a chain reaction – pushing many investors away from centralized exchanges as the CEXs started to freeze withdrawals. Celsius was one of the major crypto lenders to do so. Such events have reinvigorated people’s interest in decentralized exchanges where they have control over their own assets.

Your capital is at risk.

Liquidity Pools

Uniswap’s liquidity pool allows investors to earn UNI tokens for supporting the DEX. It has been one of the major draws for this platform.

To get a more technical analysis of the price, you can check out this video by crypto YouTuber Jacob Crypto Bury.

Conclusion

Uniswap is one of the most sought-after DEX cryptos in the market that has now stabilized. As the DeFi space grows, we expect to see some upswings in the coming future. However, for now, we have to see how well the price continues to persist in the current accumulation range – making it suitable for long-term buyers.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage