Join Our Telegram channel to stay up to date on breaking news coverage

Crypto Prices have taken a positive turn as traders decided to rally behind Bitcoin on November 4th in anticipation of the release of the US Jobs Report. The day saw Bitcoin price enforcing the previous day’s whipsaw as the price chart showed a massive green candle, ending the day at $21,151.

Currently trading at $21,424, the world’s leading crypto is up by 5.51% in the last 24 hours and has garnered an impressive trading volume of $66.3 billion.

A similar action was also witnessed for the Ethereum price, as the world’s leading altcoin also painted a bullish engulfing candle and, at the time of writing, is trading at $1635 – which is closer to its mid-September levels.

While much of this price action has to do with the anticipation of a change of wording in the FOMC statement, in which James Powell indicated continued hawkishness, the investor ecosystem was also waiting for the US jobs report. And now that the report has arrived, where would the general crypto market be heading?

US jobs Report Better than Expected – The Crypto Prices for Leading Assets are high

“Better than expected” is the term used to describe the latest Job report by the US. A quick read suggests that nothing will massively trickle down the labor market even as the federal reserve push to stabilize the economy.

The labor force participation and employment-population rates have remained stable this year, staying at 62.2% and 60.0%, respectively.

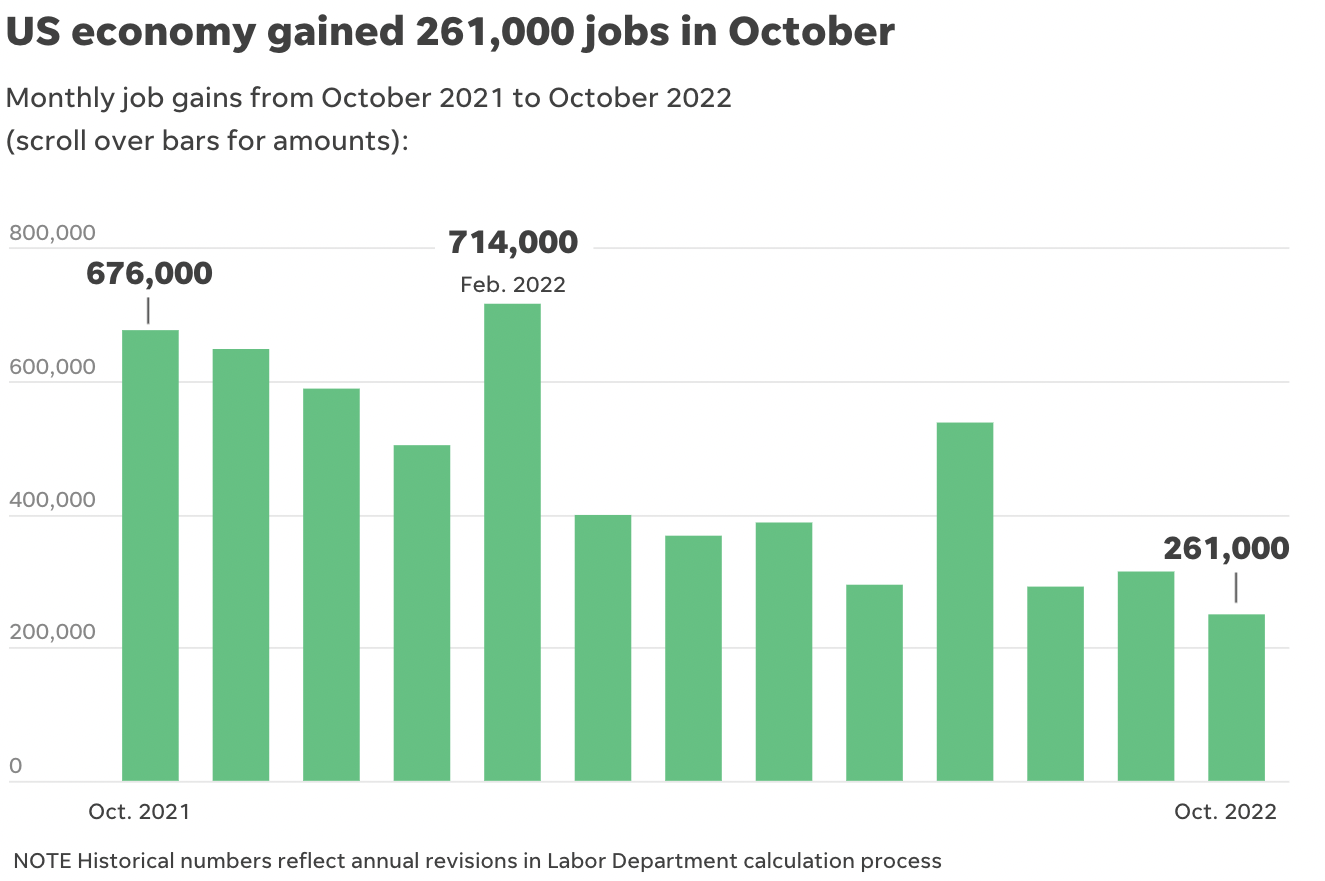

More than previously anticipated 200,000, over 261,000 jobs were added in October. Health care was the leading job-providing sector, followed by professional and business services, leisure and hospitality, hotels account, and manufacturing.

On the flip side, however, the unemployment rate has increased from 3.5% to 3.7%, inflating the number of people without jobs in the US from 5.81 million to 6.01 million, which is higher than the previously anticipated 0.1% increase.

Dartmouth Professor Danny Blanchflower has noted a decline of 325,000 jobs in the household survey and stated that the “labor market is set to crash”. Emphasizing that the rate cuts are coming, he has tweeted:

We are now in a position based on the rising unempt rate to expect the fed to go into full reverse gear as the labor market is set to crash most important probably is that empt on the household account fell 325k two of those in a row equals recession lmkt not tight loosening fast

— Professor Danny Blanchflower economist & fisherman (@D_Blanchflower) November 4, 2022

This tweet is in contention with James Powell stating that the interest rates have to go higher to put the reins on the current inflation rates.

These contending statements have given an air to further volatility to Bitcoin’s price, and it has performed better than the experts previously estimated. Seasoned investors have said earlier that going past $21k might be difficult due to an increase in sell orders and a drought in the buying regions. However, the latest price charts following the Job reports show that the bitcoin price is well above the $21k level – with some believing that there is a new psychological resistance level in the making.

However, this increase might be the result of what was foreseen in the Bitcoin yardstick that suggested that positive ramifications of the crypto are on the way.

On Ethereum’s front, the price has risen sharply past the $1.6k mark.

Other Reasons Behind the Recent Upsurge in Crypto Prices

The US jobs report and the FOMC’s recent meeting have created a chain reaction of moves by institutional and retail investors.

Bitcoin’s official Twitter channel recently tweeted how Microstrategy, the first public company to buy Bitcoin, has outperformed all major competitors.

The first public company to buy #bitcoin has outperformed all major assets, indices, tech stocks, and competitors pic.twitter.com/LpL61nTYt9

— Documenting ₿itcoin 📄 (@DocumentingBTC) November 3, 2022

And earlier this week, a 2022 institutional investor digital assets study showed that six of 10 institutional investors are ready and willing to invest in cryptocurrencies, including bitcoin. Many don’t believe in the bitcoin-traditional asset coupling – crypto’s correlation with the stock market – and thus are bullish on cryptocurrencies. And seeing the bullish green candle Bitcoin painted yesterday, it seems that many investors came through and rallied behind BTC.

Another reason behind Bitcoin’s recent uptick can be the retailer’s bottom-fishing Bitcoin, which many experts counted as an undervalued crypto after the Terra blockchain debacle. And since the recent Bitcoin yardstick reinforces the community’s collective belief that bitcoin is being sold cheaply, many retailers are bottom fishing, leading to a small buying frenzy that turned into a recent price increase.

Crypto Prices Are Too volatile – Invest in these Presale Cryptos Instead

The recent developments have once again revealed the incessant volatility of the crypto market. And while the market signals are showing positive signs, some contentions make long-term price predictions irrelevant at this moment.

Therefore, your best bet is to invest in cryptos with an early-mover advantage. These assets are being sold at a predetermined price, and their cost increases with each presale stage – giving you a chance to make guaranteed gains for the time being.

The first is IMPT, a green cryptocurrency set to redefine the carbon credits trading system by making it more transparent and inclusive. Currently, in stage 2 of its presale, IMPT has raised upwards of $12.2 million and can be bought at $0.023 per token. You can check out our buying IMPT guide to join this green presale movement.

For those looking for utility-based cryptos with major upsides, Dash 2 Trade is an interesting asset. It powers a crypto analytics platform that makes social trading and presale cryptanalysis accessible to all. The token has raised upwards of $5 million. Our team has assessed this token and have made some price predictions based on its current utility the market’ need for the same.

P2E cryptos are many, but the likes of Calvaria are few. This battle-card game is designed to incite crypto and non-crypto gamers. This attribute has engendered positive sentiment in its community, leading to Calvaria raising upwards of $1.4 million in its presale.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage