Join Our Telegram channel to stay up to date on breaking news coverage

Terra 2.0: The Reinvention of a Blockchain Ecosystem

LUNA 2.0 is Do Kwon’s upgraded version of Terra (LUNA), created to recover from the recent downturn. Crypto investors will get free tokens and a new version of the Terra blockchain.

The Terra 2.0 policy includes occasional LUNA token distributions to investors who owned more than 10,000 LUNA before the market crash. Terra 2.0 gets more trust and stability this way. Initially, 30% of investors’ LUNA tokens will be unlocked, and the rest will be released in 2 years. Terra 2.0 tokens will be available after six months.

Terra 2.0: Exploring Proof-of-Stake Consensus and Delegation

Terra 2.0 uses a consensus mechanism called proof-of-stake (PoS). The tokens they have connected to their nodes determine their vote. Gas fees and a 7% inflation rate reward LUNA 2.0 tokens.

By delegating their tokens to a validator of their choice, LUNA 2.0 token holders can participate in consensus. Validators have their own stake in the network too. Validators keep a commission before delegators get their rewards.

Terra 2.0 delegators get incentives based on validators’ voting power. A larger pool of delegators must share higher rewards with validators with more voting power.

Terra Station has an interface for delegation, but you should note that there are risks. Staked LUNA 2.0 tokens could be reduced if validators get penalized. Even if validators are offline for a short while, slashing can happen.

The Vision of Terra: Merging Stability and Speed in Global Transactions

Terra was founded in 2018 by Do Kwon and Daniel Shin. The founders wanted to give users the stability of traditional currencies while leveraging blockchain technology for faster and cheaper transactions. These advantages would promote blockchain adoption, they thought.

Terra Alliance, a coalition of e-commerce businesses and platforms worldwide, supports Terra. Terra Alliance is actively promoting Terra adoption. Together, the businesses in the alliance serve more than 45 million customers and are worth tens of billions of dollars.

Terra’s Dual Chains: Understanding LUNA 2.0 and Terra Classic

LUNA Classic and LUNA 2.0 look similar, but they’re different. According to a new governance plan, Terra is now divided into two chains. A new chain called Terra with LUNA tokens, also called LUNA 2.0, replaces Terra Classic with Luna Classic tokens (LUNC).

LUNA 2.0 won’t completely replace the old tokens but coexist with them. Terra Luna decentralized applications (DApps) will focus on LUNA 2.0, and the development community will start building DApps and providing utility for the new token. LUNA 2.0 doesn’t have an algorithmic stablecoin, though.

Some investors and traders may disagree with Do Kwon’s restoration plan and the new chain, so the Terra Classic community might shrink. However, Terra Classic still has a big following, and the community has agreed to burn as many LUNC tokens as possible to reduce the coin supply.

LUNA 2.0: Learning from Past Challenges and Building Trust

The Terra LUNA 2.0 is protected by 130 active Proof of Stake validators. Crypto investors are understandably worried about LUNA’s stability after previous issues. LUNA 2.0 hasn’t been hacked or scammed since its launch, but investors should know the risks before investing.

Cryptocurrencies are known for their high volatility, and the lack of regulations makes them riskier than traditional stocks. To make informed decisions and protect your money, you must research blockchain projects before investing thoroughly.

Luna was a successful player in the DeFi space until the Terra ecosystem collapsed. In December 2021, Terra overtook BNB Smart Chain as the second-largest DeFi protocol, with over $20 billion locked into its applications.

The algorithmic stablecoin UST and its counterpart, LUNA, crashed during the Terra ecosystem crash, significantly dropping their prices. As a result, investors lost trust in algorithm-based cryptocurrencies and smart contracts.

The decision to invest in LUNA 2.0 is a personal one. Every investor has their own goals and risk preferences when it comes to investing. To make informed decisions, investors should research digital assets thoroughly before investing.

Price Prediction: Is Luna Set to Dominate the Crypto Market?

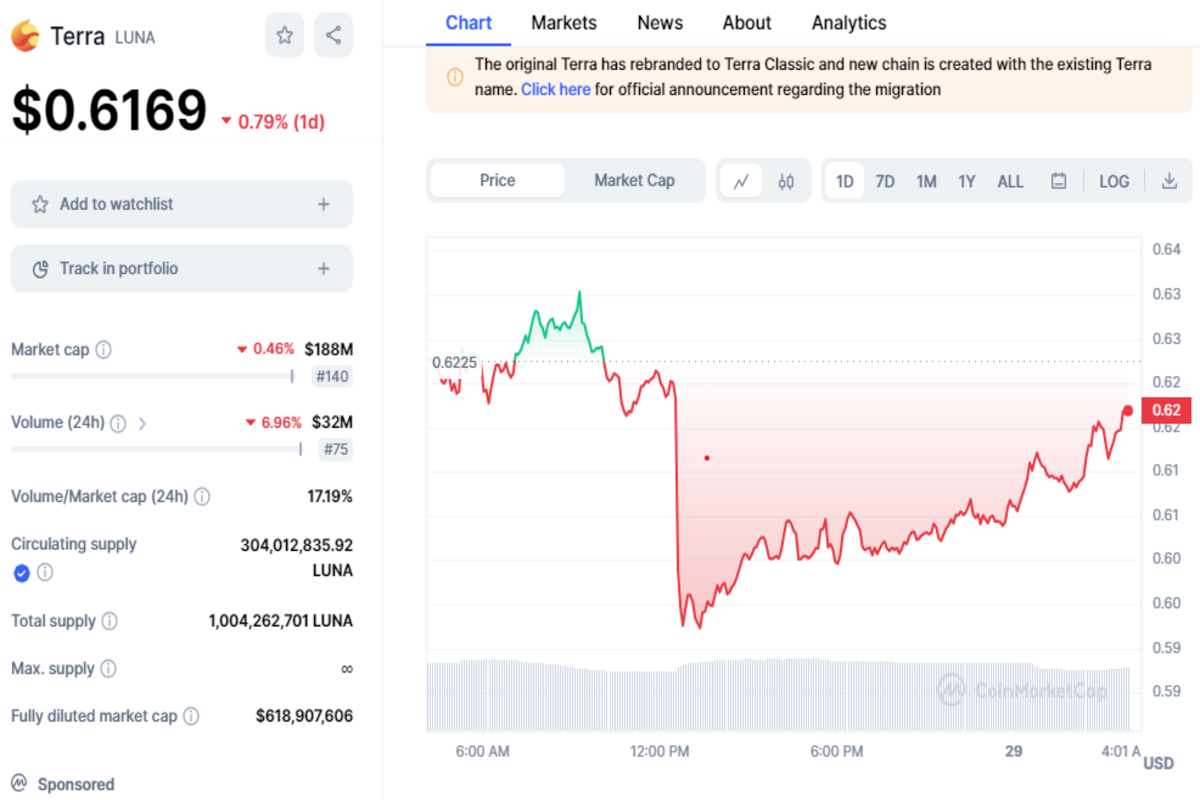

Terra is currently valued at $0.6169 and ranks 140th among all cryptocurrencies. It has a total of 303 million tokens in circulation and a market cap of $188 million.

Over the past 24 hours, the price of Terra has decreased by 0.46%.

The LUNA token, part of Terra, has experienced a significant loss of 28.90% in value over the last 30 days. Its price has dropped from $0.99 to $0.4732. This indicates that Terra is currently in a dip.

Over the past 3 months, the price of Terra has dropped by 63%, erasing $0.6623 from its previous value of $1.79.

The lack of recovery in the token’s price over the past few months is worrisome for LUNA investors. Some investors are looking for opportunities to profit from the current dip, while others are waiting for a potential rebound.

Some analysts predict this is the right time to invest in LUNA. It has 10x potential growth from here

Despite the downturn, optimistic investors still believe the token will recover and reach new highs. On the other hand, pessimists see the dip as a sign of a long-term decline. Only time will tell if LUNA can bounce back from its current situation.

LUNA Statistics Data:

- LUNA price now – $0.6169

- LUNA market cap – $188 Million

- LUNA circulating supply – $304,012,835.92 LUNA

- LUNA total supply – $1,004,262,701 LUNA

- LUNA Coinmarketcap ranking – 140

Introducing ‘Wall Street Memes’ ($WSM): A Revolutionary Meme Coin with Unprecedented Investor Interest!

‘Wall Street Memes’ ($WSM) is an exciting meme coin that’s been getting much attention. During its presale, the coin raised nearly $9.871 million. A great example is its Wall Street Bulls NFT collection, which sold out in 30 minutes.

‘Wall Street Memes‘ has a successful history in Ethereum NFTs, so it’s worth checking out. Wall Street Memes emerge as a groundbreaking force as the digital landscape evolves.

Find out how Wall Street Memes ($WSM) fuses finance, technology, and creativity into a thrilling new paradigm.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage