Join Our Telegram channel to stay up to date on breaking news coverage

The Monetary Authority of Singapore banned for nine years two founders of the failed crypto hedge fund Three Arrows Capital (3AC)

Former CEO Zhu Su and Chairman Kyle Davies were given prohibition orders that prevent them managing, directing or becoming shareholders of any capital market services firms in the city state for the period.

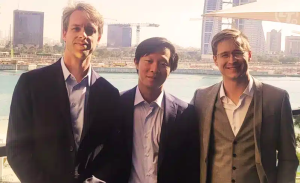

Kyle Davies, Su Zhu, Mark Lamb

Three Arrows Capital Was Once One Of The Largest Crypto Hedge Funds

Three Arrows, once one of the biggest crypto hedge funds with some $10 billion in assets under management, filed for bankruptcy in July last year after hitting financial difficulties following the implosion of the Terra ecosystem. It imploded with debts of some $3.5 billion.

After the MAS had previously reprimanded 3AC for providing it with false information, it conducted further investigations that uncovered new breaches. These included failing to notify it in a timely fashion of a new hire, providing it with false information in connection with that hire’s responsibilities, and failing to have in place an appropriate risk management framework, the MAS said.

“MAS takes a grave view of Mr. Zhu’s and Mr. Davies’ blatant disregard for MAS’ regulatory requirements and their neglect of their duties as directors,” said assistant managing director Loo Siew Yee. “ MAS will take measures to remove senior managers who engage in such misconduct.”

After the company emerged from bankruptcy, it was rebranded as 3AC Ventures.

We are excited to announce OPNX's ecosystem partner— 3AC Ventures.

The partnership will invest in projects building in the OPNX ecosystem and working towards a decentralized future.

🐂🐂🐂

🏹🏹🏹 https://t.co/EUi5bejTlH— OPNX (LAMB) 🐑 (@OPNX_Official) June 21, 2023

Dubai’s VARA Slaps Fine On Reborn Three Arrows Capital

In August, OPNX and its founders were fined about $2.7 million by Dubai’s Virtual Assets Regulatory Authority (VARA) for violating market regulations introduced earlier this year, the regulator said in a notice.

Separate fines of $54,000 each were imposed on OPNX founders Davies, Zhu, and Mark Lamb, as well as CEO Leslie Lamb.

Related Articles

- Best DeFi Coins

- Coinbase CEO Brian Armstrong Urges DeFi Companies to Sue CFTC

- Phisher who stole $24.2 Million Worth of Ethereum Transfers Funds to Tornado Cash, Peckshield Says

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage